eclipse_images

Investment Thesis: I take the view that Duluth Holdings (NASDAQ:DLTH) does not have a compelling case for upside at this time and could face more competition against larger rivals in the current macroeconomic environment.

In a previous article back in August, I made the argument that Duluth Holdings could see modest growth in the short-term, as a result of downward pressure on sales due to supply chain issues.

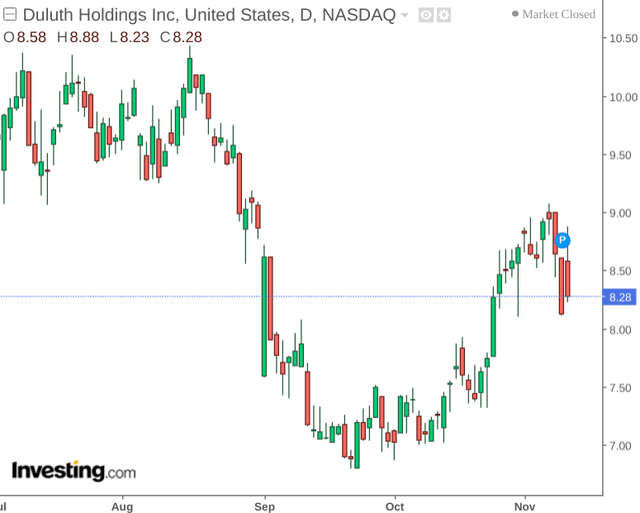

Since August, the stock is down by just over 12%:

The purpose of this article is to assess whether the stock has the capacity to rebound on the basis of its most recent earnings results.

Performance

When looking at the company’s latest balance sheet, we can see that the quick ratio (current assets less inventory less prepaid expenses all over current liabilities) has decreased significantly from 0.71 in January to 0.21 in July.

| January 2022 | July 2022 | |

| Current assets | 222,521 | 202,508 |

| Inventory | 122,672 | 164,499 |

| Prepaid expenses and other current assets | 17,333 | 16,841 |

| Current Liabilities | 115,996 | 100,062 |

| Quick ratio | 0.71 | 0.21 |

Source: Figures sourced from Duluth Holdings Inc Second Quarter 2022 Financial Results. Figures provided in thousands of US dollars, except for the quick ratio. Quick ratio calculated by author.

This indicates that Duluth Holdings is in a less favourable position to be able to fund its current liabilities as compared to the beginning of the year.

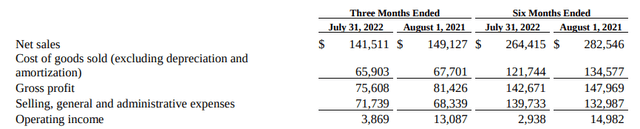

Additionally, net sales and gross profits were also down on that of last year:

Duluth Holdings: Second Quarter 2022 Financial Results

While sales have seen a decline in part due to inflationary pressures and supply chain issues – the company cited that the recent launch of the AKHG Women’s collection will allow the company to expand its offerings of outdoor apparel offerings to cater to this segment of the market.

With that being said, I do not see compelling evidence to suggest that this will necessarily result in a significant recovery in net sales growth. The outdoor clothing market as a whole is expected to expand at a compound annual growth rate of 5.6% from 2022 to 2031. However, this segment of the market is dominated by larger companies such as Nike (NKE), adidas AG (OTCQX:ADDYY) and Hugo Boss AG (OTCQX:BOSSY), among others.

With materials prices continuing to rise, Duluth Holdings could possibly face a significant challenge in remaining price competitive with such bigger companies – as rising costs start to force prices higher. While the company could still retain its competitive edge with respect to consumers who are looking for apparel specifically tailored to outdoor work environments, the company might face increased competition across the casual segment of the market.

Looking Forward

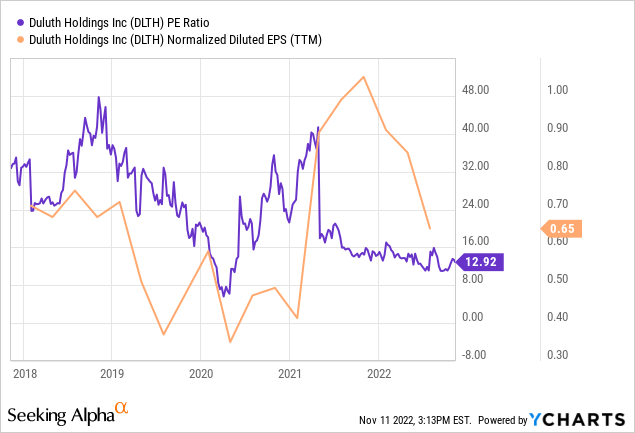

From an earnings standpoint, we can see that while Duluth Holdings saw a strong recovery in earnings per share last year – this has been followed by a significant decline given the decline in net sales resulting from inflationary and supply chain pressures:

ycharts.com

In this regard, the stock does not seem undervalued on an earnings basis in spite of the recent price drop.

Going forward, inflationary pressures and supply chain issues may continue to be an issue across the apparel industry as a whole. However, at a company level I do not see any particular growth drivers for Duluth Holdings at this time. While the company continues to be recognised for its work-wear and accessories offerings, competition against larger rivals is likely to intensify and I fail to see a compelling differentiation strategy for the company’s offerings at this time.

Conclusion

To conclude, Duluth Holdings has seen pressure on sales growth which in part has been influenced by inflationary and supply chain pressures. However, competition against larger rivals could intensify under such an environment and the company’s short-term cash position appears to have worsened. As such, I do not see any particular growth drivers to take Duluth Holdings higher at this time.

Be the first to comment