Diego Thomazini/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 18th, 2022.

DoubleLine Income Solutions Fund (NYSE:DSL) has posted their latest Semi-Annual Report. It shows that the distribution coverage is still quite strong, though it has slipped a bit. Interest expenses have increased a bit as we would have expected. This was partially offset by a small reduction in investment advisory fees. The largest contributor was a decline in total investment income.

DSL remains an interesting name in the fixed-income space due to its strong distribution coverage and attractive discount. The fund is managed by Jeffrey Gundlach, a rather popular fixed-income manager. It has been a challenging year across the board for almost all investments, with fixed-income being hit by higher interest rates. The fund’s tilt towards lower credit quality holdings also plays a role in the 2022 declines.

The Basics

- 1-Year Z-score: -2.47

- Discount: 13.01%

- Distribution Yield: 10.96%

- Expense Ratio: 1.51%

- Leverage: 28%

- Managed Assets: $2.162 billion

- Structure: Perpetual

DSL has an investment objective to “provide a high level of current income, and its secondary objective is to seek capital appreciation.” The fund is invested “in a portfolio of investments selected for their potential to provide high current income, growth of capital, or both. The fund may invest in debt securities and other income-producing investments anywhere in the world, including in emerging markets.”

The fund’s expense ratio comes to 1.51%. When including the leverage expenses, it comes to 1.88%. In fiscal 2019, the expense ratio touched 3%. That reflects the higher interest expenses the fund was paying at that time. With rates set to head higher, that has put uncertainty not only on the underlying portfolio but also on the rising interest expense of the fund.

The fund had decreased its borrowings in the period by $140 million. This seemed to be a smart move to reduce further downside from the declines we are seeing in the fixed-income space this year. It had total borrowings of $770 million at the end of September 30th, 2021. Now, when the fund reported at the end of March 31st, 2022, it had $630 million. The interest that is charged is at a rate of one-month LIBOR plus 0.70%. Since this is in the process of being discontinued, an alternate rate will be established at some point.

Performance – Challenging 2022

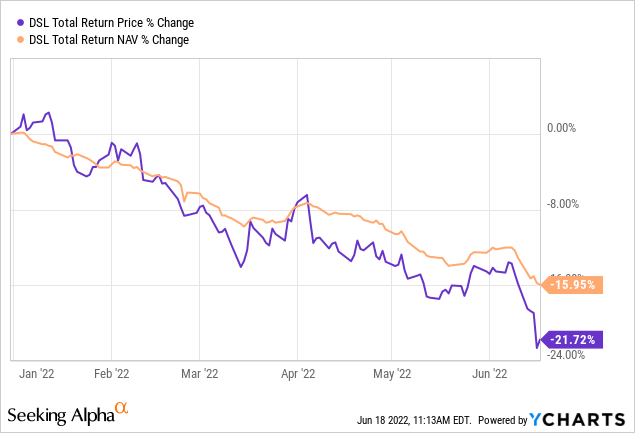

Like so many other investments, the fund has been having a rough 2022.

YCharts

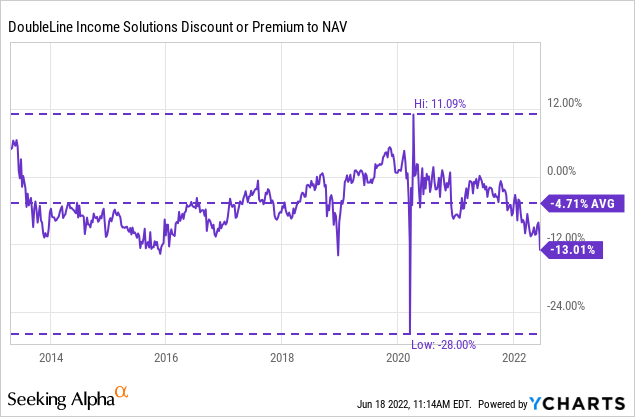

However, from what we can see, a meaningful decline has come from discount expansion. When we last covered the fund, it was at less than a 6% discount. Now it has jumped up to around 13%, more than a double from the previous level. That is quite a meaningful jump. This is also significantly below the fund’s longer-term average.

YCharts

That all makes this a fairly attractive time to consider DSL due to its attractive valuation. The price of the underlying portfolio is declining, but as we will discuss in the next section, a good portion of the income generation is still there.

Distribution – Regular Distribution Coverage Is Strong

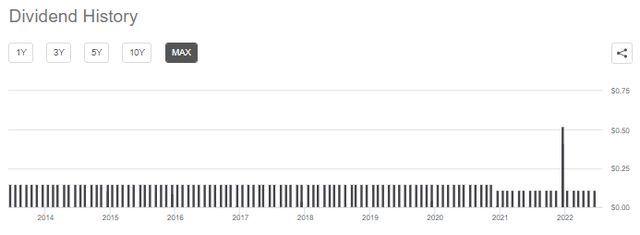

The fund had cut its monthly distribution in 2020. It had been paying out $0.15 for years before making this adjustment.

DSL Distribution History (Seeking Alpha)

Interestingly, the fund followed up that distribution cut with a year-end special that negated most of the cut. Based on today’s regular monthly distribution of $0.11, the distribution yield works out to a heightened 10.96%. On an NAV basis, it works out to 9.54%. This is also pushing near the red flag level of 10%.

The fixed-income space has been in a strong sell-off through 2022 – along with most of the market. However, the coverage of the fund’s distribution still remains encouraging that a cut might not be needed. In fact, given the level of coverage, another special could be in the cards from the numbers that are reported.

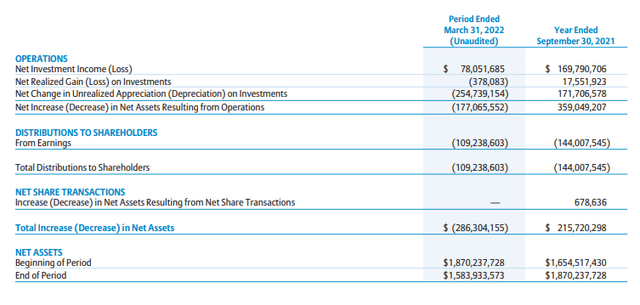

DSL Semi-Annual Report (DoubleLine)

At first glance, it would appear that the distribution is no longer being covered according to its latest Semi-Annual Report. However, that isn’t true since it factored in the special year-end of $0.411 they paid in December.

There are 101,996,828 shares outstanding. The current monthly dividend works out to $0.11 or $1.32 annually. That should be around $134.636 million needed to fund the annual distribution. Given the first six months of the fiscal year, if we annualized that figure, it would come to $156.103 million. In other words, it is running at about 116% distribution coverage through NII.

That’s only a small decline from the 118% coverage we saw in the previous fiscal year. This is encouraging that there is a buffer since the costs of its leverage will continue to rise as rates rise. That put some pressure on the fund in the last six-month period, but we will see even more going forward. The primary driver of the decrease in coverage is the total investment income that the portfolio generated. Since the fund deleveraged its portfolio, this makes sense.

The fund’s distribution is classified as ordinary income in both years 2020 and 2021. This is generally the case with fixed-income funds, making it more appropriate for tax-sheltered accounts.

DSL’s Portfolio

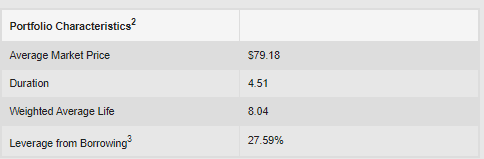

Here is where DSL gets even more interesting in terms of not only its discount, but its underlying portfolio is also heavily discounted. The average life of the bonds is 8.04 years. The duration comes to 4.51 years, meaning that for every 1% change in interest rates, the portfolio should decline by around 4.51%.

A lot of this has already taken place, as reflected by the average market price of the underlying portfolio being $79.18. An over 20% discount to the par value of $100.

DSL Portfolio Characteristics (DoubleLine)

In our previous update, this was $93.24. So it’s been a substantial move just since that time too. They have also increased their maturity, and that has translated into a higher duration with this latest update. Given the declines already experienced, it would seem that adding duration at this time might not be the worst idea. If the declines are mostly priced in, then further declines could or should be limited. Of course, there is no way of knowing that except until we get through it.

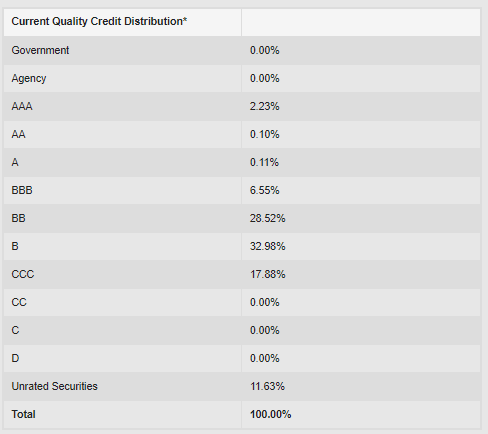

The next question would then be, why is DSL continuing to trade significantly lower? Besides the increasing interest rates, they are invested in mostly below-investment-grade bonds. Fears of a recession potentially around the corner put significant credit risk on the table. That would be in combination with the higher interest rates. Both of these factors are working against the portfolio.

DSL Portfolio Credit Rating (DoubleLine)

Being a leveraged fund means that the losses are going to be exaggerated too. It certainly isn’t a fund for risk-averse investors.

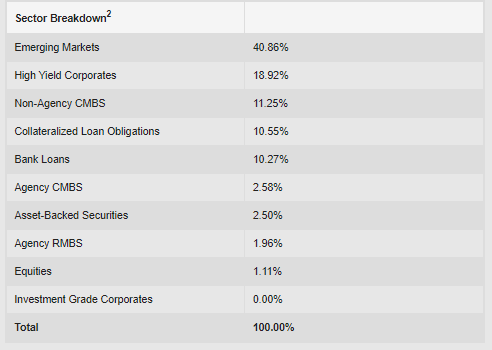

In general, this portfolio has a significant weighting in emerging market debt. This is then followed by high-yield corporates. Non-agency CMBS, CLOs and bank loans also make up meaningful allocations.

DSL Sector Breakdown (DoubleLine)

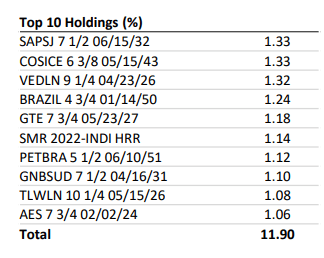

The overweight to emerging markets has been a recurring theme since I’ve been following the fund. The other recurring characteristic of this fund is holding hundreds of positions. That makes the weightings to any one position relatively small.

DSL Top Ten (DoubleLine)

The top ten positions are less than 12% of the fund. For junk-rated portfolios, this is often the best approach. They diversify across industries and issuers to reduce the risk that a handful of collapses would cause significant damage to the fund. Instead, it takes a recession that would impact the entire portfolio rather than certain individual company risks.

Conclusion

DSL is a higher-risk fund due to its leverage and lower-rated credit quality. There is interest rate risk not only on its underlying portfolio that will negatively impact the fund, but also the leverage the fund utilizes will also be more expensive. Being in lower-quality holdings means the fund is more susceptible to economic slowdowns impacting the fund negatively too.

That’s a lot of risks to consider. However, much of this seems to be priced in at this point. Both through the fund’s own discount and the underlying bonds running at a deep discount to their par value. The distribution coverage has remained strong but did slip a bit due primarily to a reduction in leverage from the prior period. This definitely isn’t for a conservative investor, but for those that might be lacking some emerging market exposure and have a higher tolerance for volatility this could be an interesting idea.

Be the first to comment