Vukasin Stanojlovic/iStock via Getty Images

Overview

I believe Driven Brands (NASDAQ:DRVN) is just slightly undervalued with 13% upside. The automotive care industry in the US is large and fragmented, and Driven Brands is positioned to benefit from the increasing complexity and age of cars, which leads to higher repair costs and a shift towards do-it-for-me [DIFM] service providers.

Business description

Driven Brands Holdings Inc. is a business that provides services for cars. Services offered by the company include auto body repair, windshield replacement, windshield repair, oil changes, maintenance, and car washes. Driven Brands Holdings serves people in the United States.

Large and fragmented industry

The highly dispersed aftermarket automotive care industry in the United States supplies vehicle owners with essential needs-based services, as well as replacement components, accessories, and equipment, long after the initial sale of a vehicle. Over 250 million automobiles are considered vehicles in operations [VIO] in the US, and this number is steadily rising (the average age of these vehicles is 12 years).

The DRVN VIO focus for servicing and repairs is the large population of vehicles that are six years old or older and therefore no longer covered by manufacturers’ warranties. I believe there’s going to be an increasing number of older cars, and they’re going to need constant maintenance. Since most consumers have a daily need for automobiles, I expect the industry to continue experiencing long-term growth trends that are stable and predictable.

In my opinion, the industry’s long-term growth is stable and predictable thanks to a number of secular tailwinds. The primary one is the average age of vehicles in use will increase, so too will the demand for servicing and repairs for those vehicles. Due to the growing complexity of modern vehicles, repair costs are rising and more people are turning to DIFM service providers who have the necessary expertise, resources, and equipment to complete the work for them. The premiumization of some products, such as more expensive motor oils to maintain performance, and the rise in the average repair order are both results of these developments.

A growing number of cars and a shift in consumer preferences toward [DIFM] are both good for the car wash business, but it also benefits from the fact that its services are cheap and people use them often. Since August 2020, Driven Brands has been a part of the automated car wash industry, which constitutes a sizable portion of the total U.S. car wash industry (70% according to DRVN S-1).

Vehicles are getting more and more complex these days, which increases average repair order

As manufacturers strive to set themselves apart from one another technologically, particularly in areas like safety features and engine advancements, vehicle designs have become increasingly intricate in recent years.

Advanced Driver Assistance Systems [ADAS] are an excellent illustration of this principle because they employ multiple sensing modalities and electronics to fully automate various safety features. Improved road safety is motivating both automakers and consumers to adopt ADAS at a rapid pace. The complexity of ADAS necessitates expert DIFM services, as well as calibration procedures to guarantee optimal performance. As such, large, well-resourced chains are best suited to provide ADAS sensor calibration because of the specialized knowledge and equipment they can afford to invest in.

Fortunately, this pattern has led to higher average repair costs in the collision repair sector. Also, carmakers are adding new engine technology to new cars. To keep up with the demands of these cutting-edge engines, the oil change industry as a whole has had to premiumize its offerings in order to compete. The premiumization of products and the growing complexity of automobiles are leading consumers to spend more money during each service visit.

DRVN provide a wide range of services and is a highly recognized brand

In my opinion, DRVN is the only enterprise-level automotive services platform that provides its customers with a full range of options. Its diversified platform allows it to offer a wide variety of services for all makes and models of vehicles, as well as in a number of different fields. More importantly, the majority of services are necessities that customers must have regardless of the state of the economy, and DRVN offers a wide range of pricing options to accommodate their budgetary needs. To better serve its customers, DRVN has a global network of more than 4,000 offices, each of which provides a unique set of services. The convenience of being able to take care of all of a business’ automotive service needs in a single location is a major selling point for the “one-stop-shop” model.

In addition, the S-1 states that DRVN is the most diversified automotive services platform in North America, and that for over 350 years, its brands have provided quality services to retail and commercial customers all over the world. A large number of people seem to be fans of DRVN because of the company’s well-known brands, the dedication of its franchisees, and the reasonable prices and excellent value of its goods and services. Franchises like Maaco and Meineke, which provide auto repairs, have been around since 1972 and have become household names.

Over 250 skilled operations professionals back these brands by providing trainings to franchisees, company-operated, and independently-operated locations to help them provide customers with service that is unmatched in the industry. To meet the demands of both retail and commercial customers, DRVN has made significant investments in training, operations, and marketing, which I believe has kept their brands competitive in an ever-evolving market.

Attractive franchise model

The franchise model is one of my favorite parts of DRVN. Financially, I think the DRVN business model is a hybrid of franchises, independent businesses, and company-owned enterprises. With a large percentage of their units being franchised and independently operated, as well as the high-growth and high-margin characteristics of our company-operated units, Driven Brands enjoys dependable sources of cash flow. DRVN’s brands enjoys strong customer loyalty, and as a result, DRVN’s stores consistently see an increase in same-store sales while generating attractive cash-on-cash returns.

Due to its asset-light business model and geographical and service category diversification, Driven Brands has consistently generated high operating margins and stable cash flow regardless of economic conditions. With an average of over ten years under their belts, DRVN’s diverse base of over a thousand franchisees are heavily invested in their businesses, their employees, and their customers.

Independent operators outside of North America run DRVN car washes and are paid a percentage of revenue. Moreover, both DRVN’s domestic car wash business and its company-operated stores have positive unit economics.

Overall, Driven Brands’ mix of franchised and high-growth company-operated stores bodes well for the company’s ability to sustain high operating margins, rapid expansion, and reliable cash flow generation over the long term.

Forecast

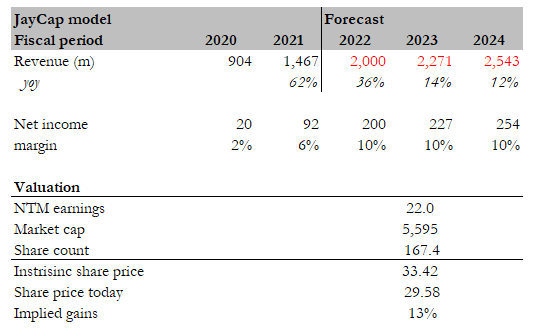

According to my investment thesis, I expect DRVN to grow as planned in FY22, reaching $2 billion in revenue and $200 million in earnings. Given the above-mentioned strong secular trend, I believe DRVN can continue to grow even in this weak macro environment. DRVN should also be able to maintain its guided margin. I believe DRVN can maintain its market share. Overall, I anticipate $2.5 billion in revenue and $254 million in earnings for DRVN in FY24.

If DRVN does this and trades at the same forward earnings multiple as it does now, it should be worth $33.42 in FY23. This is about 13% higher than the current share price, implying that it is only slightly undervalued.

Author’s estimates

Key risks

Not an easy industry with many competitors

Competition is fierce in the auto parts aftermarket. In my opinion, the market is highly competitive because of the wide range of businesses competing for customers’ attention. Furthermore, some rivals have merged previously separate automotive service brands and shops to increase efficiency and take advantage of economies of scale.

Quality assurance is not easy to manage as DRVN scales bigger

The health of DRVN is tied to that of its franchisees. Employees of franchisees are not DRVN workers. While DRVN does its best to help its franchisees succeed, it cannot guarantee that their stores will always run smoothly.

Conclusion

DRVN is slightly undervalued based on my model. The company serves people in the United States and operates in the highly dispersed aftermarket automotive care industry. The industry is expected to continue experiencing long-term growth due to the increasing number of older cars and the shift in consumer preferences towards “do-it-for-me” service providers.

Be the first to comment