Seth Love/iStock via Getty Images

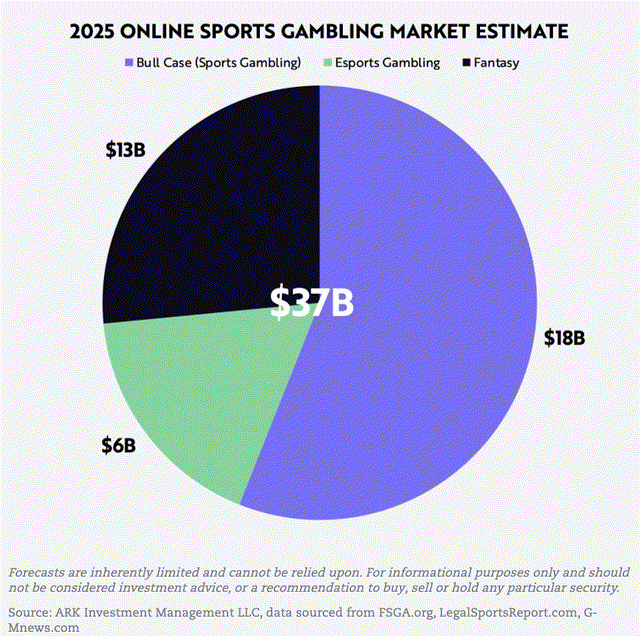

Virtually since its debut SPAC deal, shares of DraftKings Inc. (NASDAQ:DKNG) have punched way above their weight as eager investors believed a few delusional analysts who were forecasting about the sports betting sector, which by 2025, they predicted, would soar to $200b. Not on this planet.

Above: Even wildly bullish Ark Investment has forecast an $18b business. We think its low, with $25b closer to the 2025 mark. But $200b was insane.

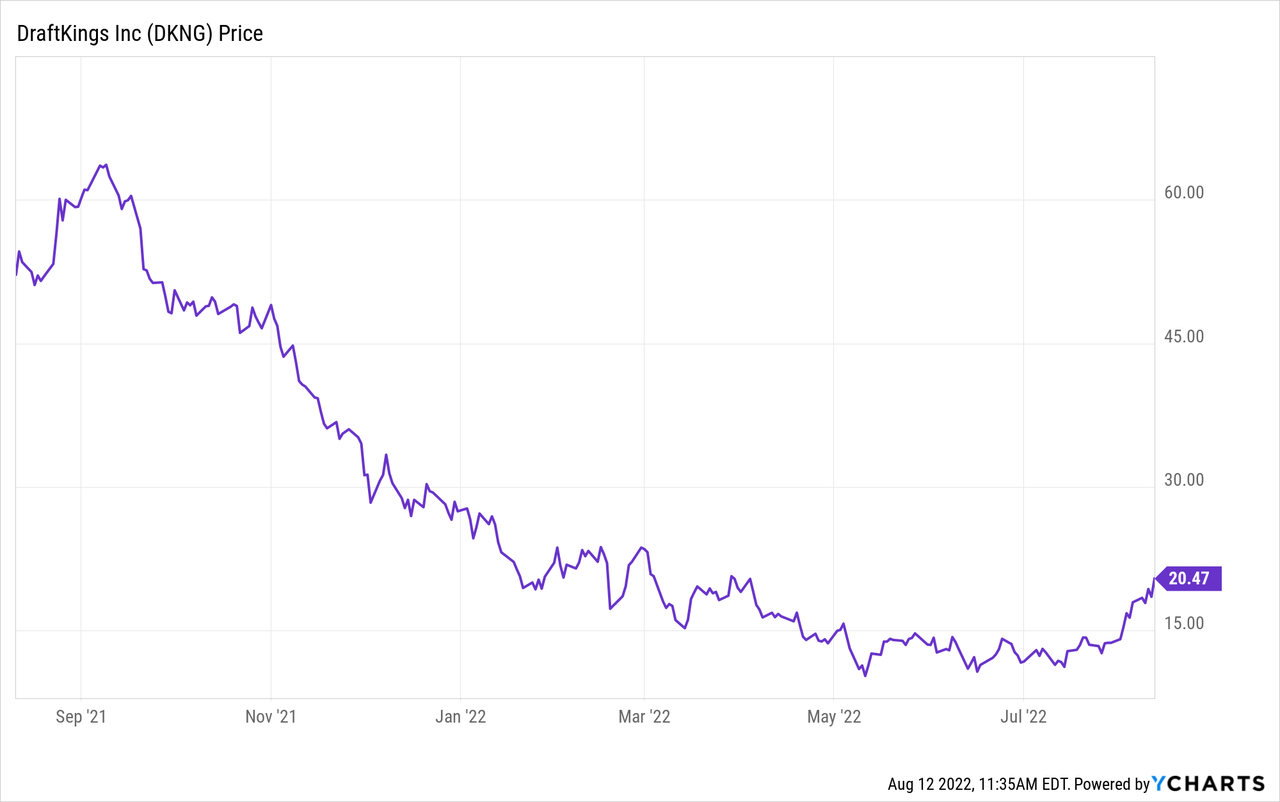

But the DKNG stock moved on bloated valuations:

5-year low August 2019: $9.85

All-time high: March 8, 2019: $71.75

Price just before current earnings release: $13.68

Price at writing: $18.54–$20.

The engine behind the debut surge was partially understandable. DKNG was, in effect, the first really pure play in the sector. It had no brick and mortar casinos. It had no UK or EU parent with existing multi-billion dollar revenues. And, above all, it had a legacy daily fantasy sports customer base that it deftly converted to sports betting customers.

Revenue soared both sequentially and annually. Bets on the stock at that point were almost always on the prospect that these exponential spikes in revenues and customer counts were far more telling than the growing billions of cash burn DKNG threw into the market share battle often without rhyme or reason.

Nothing has changed. In its recent 2Q release, DKNG’s mantra was: raised revenue guidance, higher average per customer spend ($103) and smaller losses. The company said its losses would be trimmed to ~($765m) to ($835m) vs. prior guidance of-($810m) to ($950m). ONLY ($765M) to ONLY ($835M)?

DKNG has always pointed to its cash position as being more than adequate to keep propelling its growth. But the actual numbers insert a grain of salt into the calculus:

Cash on hand as reported:

2020 $2.1b

2021: $2.83b

2022 ytd: $1.51b

Debt: (mrq) $1.33b.

Current ratio: 2.9624, clearly on the edge of a not-so-reassuring zone, but DKNG should be able to wade through the coming tides.

What didn’t fall into the neat logical paradigm for the surge was the simple fact that DKNG was far from alone in aggressively moving to establish a dominant market share in sports betting.

Almost from the get-go, DKNG had lots of company, around 14 entries in the race for customers from wannabes to big-time, resource-rich operators. Not much has changed since, except that we have seen the beginning of consolidation, as three of those early entrants have announced plans to wave the sector bye-bye. The reason: the marketing spend is enormous to build and retain share.

So much so that some actually doubt if a sports betting business will ever be profitable. The brick and mortar entrants are beginning to point with pride at the crossover from the sports betting customers into the casino floors. It’s a younger demo they so eagerly court. So to some, it’s less of a business, than a proven marketing tool. But at some time, the ad coffers are closing.

There is a useful analog to the DKNG story here. Also just released were the earnings for The Walt Disney Company (DIS). An overall fairly positive set of results were offset by the news that signups for Disney+ were slowing, as it’s added 14.4m, with only 100,000 coming out of the U.S.

Disney’s cumulated losses on its 137m subscriber streaming service have reached a staggering $7b-a ton, even for a legacy powerhouse content company which otherwise did well. The cure was clear: Disney, in effect, said the days of throwing endless money at customer acquisition were coming to an end.

From now on, the pivot was to offer users a choice at an upped standard price per month or an ad supported variable deal for 30% less. Beyond that, media spend would be curbed.

This decision and similar ones made by Hulu, Prime, and Discovery Warner was to shut down the money spigot on both media and content development and concentrate on getting profitable on their online product. The hard truth: multiple platforms chasing a customer base that does indeed seem to have a saturation point leads to a dead-end EBITDA street.

So question one is this: does the recent spike in DKNG shares auger happy days ahead? That meaning, continuing rapid shrinkage of losses while revenue jumps Q-on-Q run double digits with enough cash and if needed, borrowing power, to get to the promised land?

And question two is this: Mr. Market loved the report. But what’s going on with competitors? And three, what’s happening in the legalization front that would support the continuing vitality of revenue growth for the sector?

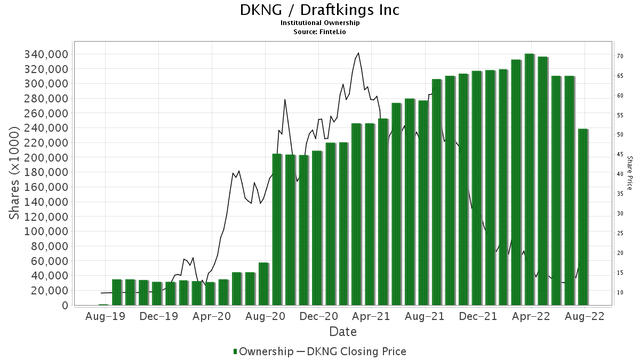

Above: Institutional ownership percentage has faded a bit, indicating there could be lots of sideline DKNG money around, but in all truth, DKNG is really a retail stock when earnings trigger instant spikes.

Revenue prospects

As the old wives tale goes, good cooks or bad cooks, everyone cooks with water. That’s the ground reality of the sports betting business. There basically are no product differences among the 14 active players in the space. They’ve all done a first-class job producing player-friendly sites. Nobody has breakthrough, proprietary tech stacks. Most are moving off outside tech stack suppliers and going internal, fully integrated. So this is a business without anyone having a moat of any kind-including DKNG. Its early moat without question, was its DFS business-but it was shared with Fan Duel.

Here comes the NFL: the best news for DKNG and its peers is the imminent opening of the pro football season, the most fertile quarter in the betting year with by far the biggest potential revenue floodtide. So the answer to question one above is, yes: revenue gains can be expected from a benevolent sports calendar in 3Q:

The NFL, the opening of the NBA, NHL and the MLC World Series. This is a tide that will lift all boats. So, we can expect, failing an unforeseen black swan, DKNG to follow up with a 3Q release that will beat 2Q.

New Markets: Recently legalized Massachusetts is historically persnickety when it comes to gaming enabling legislation and regulatory nitpicking. Legal Sport does not expect the state to be active this fall yet, and remain problematical even for Super Bowl.

WynnBet (WYNN), presumably still on the sale rack, has said it expects to be a leader in the Bay State sports betting sector because of its Encore property base. But at least 5 other platforms are already maneuvering to join the fray there as soon as it goes live.

So cross that off now. Industry lobbyists are pouring up to $50m, wetting the beaks of California legislators as the biggest kahuna population of all, continues to contemplate its navel, edging an inch- by-inch move to legalize. The tribal casinos there are having their say. Passage may not come for this year for certain and, in the view of some observers familiar with state politics, possibly not before early 2024. It’s all guesswork. Don’t count on it no matter what happy talk about California you may hear on the DKNG earnings calls and those of all market participants.

So, given the trading history of DKNG, we expect a strong 3Q, more or less showing what 2Q has done: nice revenue gain, total users up, only a modest shrink of losses. We can see the stock moving somewhere in the low to mid-twenties. But bear in mind, everyone else will share in the 3Q largesse of the sports calendar.

The next question: all platforms will benefit, but Fan Duel, leader of the pack by far, will retain, if not increase, its market share leadership.

The U.S. traded equity of Flutter Entertainment (OTCPK:PDYPF, PDYPY) is Fan Duel, which according to that company’s latest estimate, now controls near 50% market share of the U.S. sports betting/IGaming market. Its UK parent reported a single digit decline in its global business due to economic slowdowns in England particularly, but also because the growing apprehension of an expected White Paper Report that will recommend a powerful set of regulatory changes to curb problem gambling. Among the conclusions: advertising media spend could be legally curbed to protect the public from itself.

Fan Duel at writing traded at $57.30, up 2.25% since the DKNG release. It has also indicated it is moving into positive EBITDA territory with an estimated $22m. It’s small of course, but telling. It reflects its similar direction in curbing costs. And of course, the biggest joker in the PDYPY deck, yet to be played, is the still lingering possibility that the long-discussed spin off of Fan Duel as a U.S. equity may well happen. That prospect, dim or not, is a big plus not really baked into the stock price.

There will undoubtedly be some me-too political turmoil about these issues in the U.S., particularly those with a nanny state bent. Without any nudge from governments, top U.S. platforms are already curbing media spend. They finally recognize the mad chase of new users coupled with the need for retention deals winds up at a dead-end street of continuing losses.

Already on the record are BetMGM, Caesars Sports Book, Barstool The Score (PENN) telling the market they cut spend and aim at getting into profit by 2023 or before. PENN has already said it expects to show a small profit this calendar year.

Conclusion:

While we find the DKNG spike okay but nothing special, we understand that the stock still has many fans oblivious to the relative values of all players in the sector. And we agree that a pure play does attract a followership that results in an upside. Yet we continue to guide caution here. DKNG is still losing a ton of money. Its projected smaller losses are still far too high at this maturing stage of the sector.

Average estimated losses per share by analysts for 2023 are at -(-$2.29). We think that’s a big optimistic. It could run to -($4.00) in our view. We also believe as competitors begin to slowly emerge from massive losses to modest EBITDA gains, that by contrast DKNG will lose much of the allure it still retains.

Overall, we just guide a caution light here. There is just too much road ahead to profit, too little evidence that

DKNG can impose the self-discipline to speed its way to profitability and retain its second or third place in share of market to feel good about another big run up ahead.

Holders should stay long and enjoy the little ride now, hoping for another nice move when 3Q numbers are released this coming fall. But I recognize that non-pom-pom twirlers for the stock in at the low teens may want to cash out now, take a nice profit and wait.

A sideline strategy from now could make sense by keeping an eye peeled on monthly net revenues on sports betting in all states. The best barometer would be total win and win percentage increases in September and October, flush with NFL betting.

All that said, I continue to believe the best rationale to hold DKNG is the prospect of a big time buyer figuring out how they can make money and hold its top tier position and then swoop in.

Be the first to comment