Michal Czerwonka/Getty Images News

Stipulation: As of this writing, neither the author nor anyone else knows for certain what the possible deal between DraftKings (NASDAQ:DKNG) and ESPN (DIS) will bring to both companies. The deal could be great for investors, or just another set of brand swapping, empty content programming that does not address the fundamental problems underlying the sports betting sector at the moment. Time will answer that question. Our focus here remains this:

DKNG, a solid sports betting site among the market leaders, remains a puzzle going forward because it operates in a crowded, turbulent sector that is rapidly becoming a commodity play. Success in turning profitable without sacrificing market share by banking the out-of-control fires of marketing spend isn’t easy. Nor will a possible ESPN deal make it any easier. What is important here is whether the deal could end in a merger. That would be highly bullish for the stock.

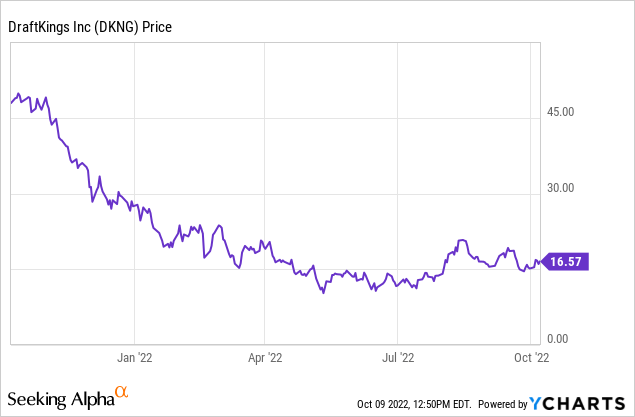

DKNG management says it expects to turn profitable late next year. That would be a big time plus for the stock without question. Yet, is Mr. Market buying that forecast? Apparently not yet. The stock continues to waddle in the mid-teens. The ESPN news did provide a nice little spike of over 8% to the stock, but nothing like a big time catalyst.

Yet, there is no sentiment anywhere yet that the rocket ride of DKNG that sent it soaring over $71 in March of 2021 is in the realistic crosshairs. Mr. Market has begun to understand just how brutally competitive the sector has become, even for a solid entrant like DKNG.

The deal, whatever it is, cannot solve the baseline problems for both companies, i.e. how to expand the customer base at a cost that ultimately contributes to a sustained, profitable business for DKNG and the Disney unit. There could remain some hesitancy at Disney as to just how making a deal in sports betting squares with its image as a provider of so-called family entertainment. It’s an understandable concern for certain.

But what is already clear is that these Disney guys are very close to the too little, too late entry point in sports betting at all. Had their vision been clearer, they’d had either long ago been in the business, or emphatically told the market they had taken a pass on sports betting because it wasn’t a good philosophical fit with its business model.

Instead, Disney has been bumping around, contemplating their navel for years now with lip service, hints, etc. No, it isn’t an easy decision for a company already facing multiple challenges in many of its core businesses. With last week’s news of a pending DKNG deal, at least the market now has clarity. Whether such a deal exponentially propels the stock to new highs downstream is problematical. We’ll wait and see.

The deal, whatever it is, bears a familiar conceptual idea: Blend a vast, sports viewing audience with excellent demos for betting and buy new customers on the cheap as it were. We have been to this rodeo before. PENN Entertainment (PENN) bought the privately held Barstool Sports site with just that idea. Its 55m “stoolies” were the database gold the deal mined for. Since then, PENN has moved its original ebullience for the deal into the real world. Barstool has brought business to the Penn site (Barstool Sports Book).

But the cost discipline of the company has been imposed. They are not chasing rainbows anymore. With Dave Portnoy and his stoolies, PENN has begun to dramatically cut its marketing spend, and more critically, come to understand that a profitable, single digit sports betting market share is a better place to be than the battle for share at too high a price. We suspect something similar to this kind of thinking may well form the basis of the DKNG/ESPN deal.

Also bear in mind the looming probability that privately-held Fanatics, the mass merchandiser of sports apparel and gear, has already announced its intentions to enter the sports betting fray. They assert their customer base is over 80m. They have staffed up with sports betting executives. CEO Mitchell Rubin is bragging that he expects their site to eventually rise to #1 in share. Fanatics is already valued at $27b.

Kudos to Rubin who has cobbled together a fortress of ecommerce in sports regalia out of mergers, deals with the NFL and other leagues to create this great merchandising machine.

It’s fairly certain that if and when its IPO debuts (probably in 2023/4), Mr. Market’s will pom pom twirlers be in hot pursuit of the new kid on the block. A quick round trip is what we see: Buy on the IPO, hold as some analysts build a dreamscape picture of its betting potential that ignites the stock. And finally run like hell once it becomes apparent that Fanatics will need more than Rubin’s bloviating to secure a market share anywhere near DKNG or FanDuel (OTCPK:PDYPY).

Amid the entry of that possible disrupter, would come the DKNG/ESPN deal, both in the teeth of a possible recession/stagflation macro economy and slowed pace of new legalizations. Armed with fresh cash, is there any doubt that Fanatics would soon find its buyers of team jerseys aren’t exactly producing massive market share in sports betting igniting a tsunami of marketing spend? And that in turn forcing DKNG and its co-leaders to start playing market share defense with their torrents of cash?

Let’s take a quick look first at what ESPN can and cannot bring to the DKNG party regardless of the deal that emerges:

ESPN is in a reported 76m homes, but trending downward for the past several years since its apogee of 100m a decade ago. It generates a reported $4b in revenue between its carriage fees and advertising. Parent Disney is on record as having targeted an additional $10.3b in developing more sports content as part of its $33b estimate of total content spend ahead.

- We presume that the DKNG deal will get some of that $10.3b as a foundational partnership investment in sports betting by the mouse kingdom. A drill down of the ESPN demos clearly show strength in the sports betting sweet spot of males 25-54. So far so good. What we must consider as well are these reality checks:

- ESPN’s 18-20 year old male audience is worthless at least for the next several years as that segment won’t be old enough to bet legally for several years.

- ESPN’s viewers outside the 29 states (and DC) now legal for sports betting is foreseeably useless as well. Tracking when the new states already passed will go live is guesswork. Beyond that, the big kahuna states not yet at the party remain problematical. Texas and California will take a lot more time if ever they join the team. The platforms are spending tons in lobbying the biggies.

- Overall, it would appear that the pace and intensity of new legalizations is clearly beginning to slow. What that means is that the platforms must generate new revenue from existing states until those pending go live. And that suggests keeping the marketing spend high. DKNG’s Q on Q sales growth hit 56.6% last quarter, solid but beginning to get tougher.

- DKNG stock has been a sales growth story for almost two years now. But the days of triple digit Q on Q sales growth could be well be past even if the ESPN deal meets all strategic goals.

Duplication

Duplication between a chunk of the ESPN audience and the customer base of DKNG and its competitors clearly will be a factor. So we presume the very savvy demo drillers of both companies are already at work figuring out just what percentage of the ESPN viewing demo already have sports betting accounts with DKNG or one of its competitors. Whatever it is this is a fact:

The mere adding of an ESPN escutcheon to the business doesn’t appear to be a singular, compelling reason for sports bettors to shift from other platforms.

Programming and content: For sure ESPN can infuse appropriate content of its regular sports programming with DKNG messaging. They would be de facto infomercial type blips of marginal but nice to have exposure.

ESPN could graft a branded betting site on one of its existing channels managed by DKNG. Its ESPNU, the site it runs covering big time college sports, has taken a bit of a hit but has the potential during the basketball and football seasons for an actual betting platform. Branding as ESPNU-BET, POWERED BY DKNG seems to us to have some potential among its 17m subscriber viewership. But its aim could only hit age approved college seniors. Yet the buzz factor would be a plus.

Visibility: ESPN linked to DKNG with promos, programming around betting can’t hurt and might in fact facilitate a lower average customer acquisition cost than the estimated $500 platforms pay these days. But there is always risk here of alienating your existing customers that ESPN will face.

Already there is considerable grumbling among viewers over the annoying squares, boxes and running lines of graphics and statistics that blot the screen during ESPN games. A push that could include in-game betting, great on the surface, but perhaps not really enhancing content value per se, would be a risk. You can do it easily enough on the DKNG site right now.

Overall: A DKNG/ESPN deal will undoubtedly have many attractive features on paper as it were. But at the same time it is fair to conjecture that it will also bring lots of programming to a subsector already crowded with blow dried sports hosts bellowing out fake controversies to generate eyeballs.

The demo math is a bit screwy

Do the math:

ESPN: 76m presumed sports fans.

Barstool: 55m presumed “stoolies”

Fanatics claims its database has 82m users of sports gear.

Total: 213m pairs of eyeballs – presumably.

Estimated population of US males 25-54: 55m

So that comes to four times as many potential customers for sports verticals of all kinds in the demo sweet spot. What’s wrong with this picture?

According to census demos, there are 106m people in the US who “indicate an interest” in sports betting.

So how is it possible for just three of the big time sports purveyors above actually exist in the population? Four sets of eyeballs per person?

What this tells is that clearly, there is considerable duplication between viewers of sports programming, buyers of sports gear and acolytes of Dave Portnoy. We then have to ask, where do these people get the time to watch ESPN, watch Barstool and linger over the latest Cowboys jersey on the Fanatics site? Huh? That doesn’t even count regional sports networks and the big kahunas of NFL games spread over a multiple of TV platforms? And what about the four-hour NFL games, the endless MLB games, NBA? NHL? And all of the college sports ESPN covers? It would appear that sports fans have precious little time to go to work, sleep, slam a few slices of pizza or watch other programming.

It’s clearly self-evident: they don’t:

The excess of sports related leisure activities, media and products way over the actual population sweet spot tells us there has to be considerable duplication. So then how can we value ESPN’s potential in sports betting assuming that part of its audience for games and shows is already engaged in sports betting on an existing platform? Or how many just want to watch games? We can also safely assume that a portion of Fanatics’ 82m users are already betting on sites they like, and other than more giveaway deals, what’s the incentive to bet on a Fanatics site? Here come more giveaways.

According to a Wall Street Journal report last year on the topic, they estimated that an ESPN imprimatur affixed to DKNG or any existing vertical in the space would command a $3b fee paid to the sports network. That appears wildly excessive to us since the entire value would be very tough to fix. It would likely take the logic that exposure to ESPN’s massive audience – even unduplicated – would reduce DKNG’s customer acquisition cost by more than half. But that assumes a very modest current percentage of sweet spot demos who are ESPN subscribers and large enough to justify at $3b fee to access no matter how much content fru fru accompanies the deal.

Buy DKNG itself: A better, smarter idea for Disney

Readers of this space may be starting to get the idea that I am a stealth investment banker for DKNG given my various articles laying out the proposition that someone, anyone with a real need in the sector, should buy DKNG rather than delve into twisted partnership deals. Its priced right for a takeover.

I am not of course, but I do believe that DKNG’s time as a standalone pure-play in sports betting is a trip to nowhere for investors at least until they turn profitable on a consistent basis. And that a merger makes a great deal of sense for the company, a buyer and shareholders because once and for all a re-ordering of marketing and business model priorities could turn the company into a first class money maker sooner than later. Consolidation will happen. There will not be 16 sports betting platforms fighting for market share by 2026.

DraftKings: A capsule glimpse by the numbers

Price at writing: $16.57

52- week range: $9.77-$51.30

Net income TTM – (1.58b). Not very pretty of course and not likely to get very glamorous anytime soon. But an ESPN deal will be seen as a catalyst by true believers.

Market cap at writing: $7.4B still a bit high given many macro factors just ahead, but not crazy. There is a comfort premium of ~$7 a share that could make investors happy. But waiting for an ESPN deal, or another state going live alone won’t move the shares anywhere near the all-time high. Yet we think the analyst PT of $26.42 could be approachable once the ESPN deal shows a pathway Mr. Market thinks will get DKNG to the promised land of black ink faster than anticipated.

EV/EBITDA: -(4.56)

Discounted cash flow value per Alpha Spread: $20 a share.

The balance sheet highlights are fine:

Cash on hand (MRQ) $1.51B

Total debt: $1.33B

Current ratio: 2.32

Our forward revenue/earnings estimates:

2022: $1.85b to $2b

Earnings: We’re looking for -($1.45) for 2022

2023: $2.5b

Earnings estimate: -($0.93)

Note: This estimate does not take into account what capex and/or impact an ESPN deal might have in 2023.

Conclusion

We are presently in the propulsive calendar of the NFL season. World Cup soccer at Qatar is due to explode next month. While betting interest here in the US is relatively chump change compared with the heating up NFL season, there is still enough passion out there for the games to have a positive impact on sports betting revenue in the last quarter.

We raise a cautionary flag to investors to take news of the ESPN/DKNG deal with eyes wide open before seeing it as a hot take catalyst for an entry point here. We think DKNG is trading a bit high as we mentioned, but within a reasonable range. The downside risk we see is common to the entire sector. That is the unknown impact that recession and slowing jobs growth could have on the betting demo sweet spot.

Also with the competitive heat high, we still see only marginal cutbacks in marketing spend. It’s going in the right direction but needs a lot more force to begin showing up in earnings power.

ESPN, on balance, will be a positive in the sense that shorn of duplication, its data sets could provide some fertile new marketing ground for DKNG. As for Disney, we see the deal as a toe in the pond to test the temperature of the waters, not anywhere near a possible game changer that a dive in the deep end of the pool with an ESPN-Bets branded actual betting site would be. Perhaps there will be more to this than what now appears. But most vibes we’re getting looks like a lot of programming around game content. Stay tuned.

Be the first to comment