Olivier Verriest/iStock via Getty Images

DoubleDown Interactive (NASDAQ:DDI) announced Q2 results on August 12th and from a glance they looked bad. Earnings per share was greater than the current stock price at a -$13.75 and revenue was down year-over-year by 13.5%. While the stock price took an immediate downturn after earnings since it’s come back up and is trading above levels when I first shared my bullish thesis about a month ago. I borrow a lot of context from this piece so it may be helpful to review that first.

Despite the look of earnings I still believe DDI is undervalued and maintain a price target of $18.00 within 1-2 years, an implied return of 81%. The top level picture of earnings distorts the overall reality as the cost booked in Q2 is related to a large reserve set aside in relation to the Benson case which is in the midst of negotiations this month. After sharing some of my thoughts regarding earnings I’ll share a bit about my research into the case and where things stand and why I think settlement might be coming soon. And why there might be a share buyback in the works as well.

DoubleDown Interactive Q2 Earnings Review

The key detail from their recent earnings is this:

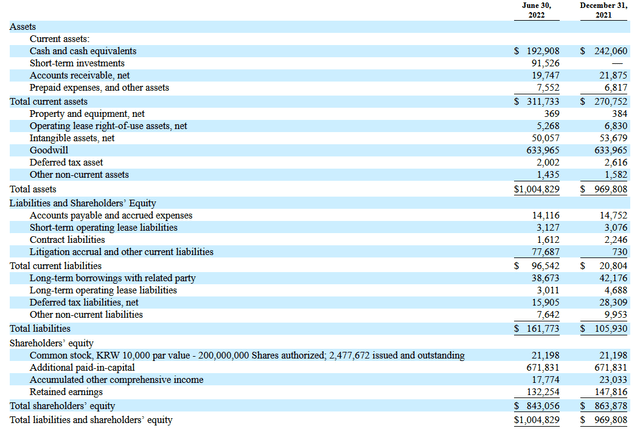

Operating costs increased from $71.5 million in the second quarter of 2021 to $128.6 million in the second quarter of 2022 due to a $71.5 million non-cash accrual which was included in General and Administrative expenses associated with previously announced legal proceedings related to the Benson class action complaint.” Essentially DDI is pre-booking some of the legal amount that they are expecting to pay out to Benson. With $284.434m in cash and short term investments the $71.5 million they are booking is already held in cash on their balance sheet.

In total they have $77.687m set aside on their balance sheet now for litigation accrual and other current liabilities. Even after that the company still maintains $284.434m in liquid assets as of the quarter end.

Total equity value comes in at $843.056m as compared to their $491.04m market cap today; this leaves them trading at a P/B of 0.58x. The operating component of the company generated $21.13m in free cash flow in Q2; for the first half the company has generated $49.512m. That leaves them at a P/FCF of 9.91x based on the first half alone . A conservative assumption is that this company should trade at least book value given it is profitable – and this ascribes no value to how profitable it is. Return on a reversion to book value would be 72%.

As noted in my previous article, the company is incredibly asset light. That cash flow number for the quarter was below their two year quarterly average of $28.03m which is due likely to their declining revenue base. The declining revenue is a problem and is consistent with results seen across the social casino category this quarter. Part of this is due to last year’s comps being difficult to maintain due to a tailwind from COVID and people being at home. The other piece is that the sector overall is considered to be quite mature at this point. This is partly why management has been investing in the hyper casual segment themselves and are looking to make a strategic acquisition likely outside of social casino.

While there is a risk of ongoing revenue decline causing profitability issues, the structure of the company allows them to decrease costs along with revenues. That should allow some margin of safety while the company explores their current pipeline of games and explores M&A opportunities. Management expects their new game Spinning Space to launch this quarter with multiple games slated for 2023. With each new game launch there is an optionality of success with very little ongoing costs associated with them as they maintain all of their games on the same code base.

While there are some initial marketing costs related to launches, from there it becomes a data science exercise where the company is evaluating the customer behavior and profitability in-game. They use that information to both adjust in-game mechanics and rewards to entice players as well as to adjust marketing spend on games.

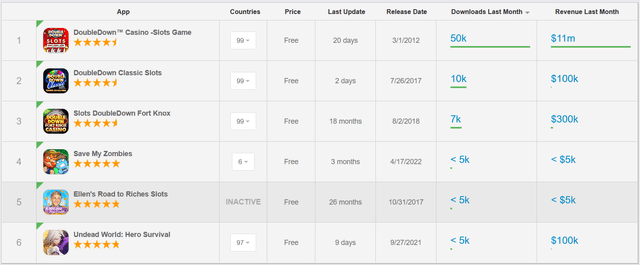

The last game they launched, Undead World: Hero Survival, was in September 2021. Management has indicated a six month payback period for new launches and with us nearing a year into launch of the game they indicated “continued minimal investment” in the name last quarter. Estimated revenue last month from the game was $100k according to Sensor Tower data.

From an efficiency perspective, average revenue per daily active user (ARPDAU) was $0.95 in Q2 versus $0.97 for the year last year. EBITDA margin was 32.4% with payer conversion at 5.2%.

DoubleDown Interactive M&A Update

CEO IK Kim had this to say in regards to M&A targeting in their conference call: “We definitely look — see our candidates around hyper-casual gaming industry including iGaming. Actually we are in mobile gaming space. So, we do into more wider gaming industry as well.“

This tracks with the idea that they are not going to invest further in social casino. Instead they seem to be leveraging their social casino assets as cash flow generators to fund new growth. Not a bad strategy given that last year that cash flow was $96m or 19.5% of their current market cap.

Management seems more optimistic and believe they are in “an optimal buying position given the overall pull back in valuations and associated tightening of capital market.” This compares with commentary from peer Playtika’s (PLTK) Chief Strategy Officer Eric Rapps regarding valuations in the market:

So what we can say is things have gotten more attractive. I would say that the disconnect that existed between the public and private markets, you know that disconnect started to bridge, but I wouldn’t yet say that everyone acknowledges the current economic backdrop, and I think where expectations do remain high, it’s largely the product of people thinking that this current trend may not be as long as some others think. So we’re starting to see it a little bit, but in other places it’s still elevated.

It’s possible as a result of more attractive valuations that an acquisition may occur. Though CFO Joe Sigrist seemed to suggest that this is early stages given his commentary that “Now obviously, there are some targets – well at least potential targets, I’ll be honest and say no one that we had really in our sights.“

The overhang of the legal proceedings is likely to create a bit more hesitation in making a move though if valuations are lowering some bolt-on acquisitions may become more attractive that could be done at a lower cost and still preserve capital for potential litigation payout.

But let’s turn to the legal proceedings more directly to analyze the risks.

An Update on Benson, et al. v. DoubleDown Interactive, LLC and International Game Technology

DDI has an outstanding legal case, the Benson case, related to allegations that the company is an illegal gambling operation. Given the precedent of settlements in these cases, which I outlined in my previous coverage, it’s likely that this will amount to an actual cost to the company. While some may believe this represents an existential issue for the company I would note that peer SciPlay (SCPL) faced a similar lawsuit, settled already, and is generating a profit for shareholders today.

This case relates back to the $71.5m they set aside this quarter for legal expenses. Prior to this the company estimated a range of between $3.5 million and $201.5 million as total expenses for the case. Negotiation has been ongoing between parties this month with a mediation session occurring on July 28th and another one scheduled for August 26th. It seems that in the midst of negotiations it became a bit more clear to the company what the actual cost may be as they updated their range to $75 million to $201.5 million in the last quarterly call.

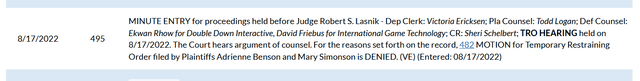

From accounts given by both DDI and co-defendant IGT negotiations have been engaged with in good faith and IGT noted they “made significant progress towards the resolution of this litigation in recent weeks.” Ironically these statements are given in response to plaintiff’s attempt to put a temporary restraining order on DDI, which was denied on August 17th.

Basically what happened is that the Benson plaintiffs noticed a July 21st filing from DDI announcing details regarding their extraordinary general meeting for August 26th. Included in that is a vote to “to approve the reduction of the Company’s capital reserve in the amount of KRW 70,000,000,000 pursuant to Article 461-2 of the Korean Commercial Code.” This is around $50m and the fear from the plaintiffs is that the company is intending to pay this out in the form of a dividend or share buybacks, enriching shareholders at the expense of the plaintiffs. Here’s the plaintiff’s perspective:

During the extraordinary meeting, DoubleDown intends to hold a vote on removing more than $50 million of cash from its “capital reserve,” apparently to pay overseas investors a first-ever (and “unanticipated”) dividend. In other words, while DoubleDown’s lawyers have represented that DoubleDown “has mediated in good faith and intends to continue to do so,” Dkt. #480, and while they ask the Court to refrain from making any rulings on pending motions, id., DoubleDown’s management appears to be stalling the litigation so that it can abscond with money that is owed to the Class.

They claim that total out of pocket damages is greater than $2b for DDI and that essentially all cash on hand is subject to the lawsuit. As a result they request the judge place a temporary restraining order against not just the company DDI preventing them from using their cash for anything other than day-to-day operations, but also a restraining order against CFO Joe Sigrist to prevent the vote from moving forward and as CFO to ensure no cash at DDI is moved.

It was a big stretch and as noted the motion has already been denied. I say it was a stretch because plaintiffs were trying to use Washington state law to enjoin the corporate actions of a Korean company. It seems pretty clear they didn’t expect this to work and so also targeted Joe Sigrist directly given he works out of Seattle.

DDI’s response to the temporary restraining order request frames the tactic in a different regard:

The timing of Plaintiffs’ Motion for a Temporary Restraining Order (“Motion”) is not coincidental. It comes in the midst of good faith settlement negotiations involving substantial monies, guided by Judge Layn Philips (Ret.), with one mediation session having been completed on July 28, 2022, and another set for August 26, 2022. As these negotiations are ongoing, Plaintiffs’ Motion is a transparent attempt to create artificial settlement leverage as their requested relief has no bearing on the actual merits of the underlying claims. Plaintiffs instead hope that by preventing DDI from conducting its business operations, DDI will be forced to pay a higher settlement amount than the facts and law require. The judicial process should not be an unwitting co-conspirator in Plaintiffs’ efforts.

Why does any of this matter if the order was ultimately rejected? Well I think amidst the noise of the back and forth here there is some real information that might be inferred. For one, DDI goes to great length to explain that even if they wanted to pay a dividend with this capital reduction they would not be able to do this until 2023. What they do not say is anything related to a share buyback which plaintiffs picked up on and highlighted as part of their fears.

What I take this to mean, and given the continued low stock price, it’s possible that a stock buyback could be in the works. As explained by a third party Korean tax expert in the case:

The “capital reserve” is an abstract accounting concept, rather than any specific asset or cash account. The “capital reserve” is a number that must be subtracted from the company’s total cash reserve, to arrive at the amount of cash that is deemed available to spend on certain categories of expenditures enumerated in Korean law, including as a source of dividends.

What I note is that DDI for one reason or another is looking to free up around $50m in cash to spend on something. It may be that it’s a share repurchase, it may be that they actually have an M&A target. I’m not sure on this part, but we can see given the vote that they are intending to do something with that money and plaintiffs in the Benson case do not want that to happen.

I suspect regardless we will have more information about negotiations in the case before we know anything about what the company hopes to do with that cash. August 26th is the next negotiation date and I believe it’s likely that they will come to settlement soon after that. I think this is likely because I tend to agree that the plaintiffs were seeking some kind of leverage through the restraining order going into negotiations. After the first round of negotiations we saw the $71.5m set aside at DDI and also analyst David Bain on the earnings call noted that co-defendant IGT took a $150m expense related to Benson as well. With both companies taking the expense already it seems likely to me that they are in the ballpark of what they expect final settlement to be or else why book the expense.

Time will tell though and there’s a huge risk if you believe the plaintiff’s $2b claim has any merit. I think it’s notable that while DDI updated the bottom of their expected expense range for the case, the high end estimate remained at $201.5m. If we assume the high end cost for DDI then in addition to the $71.5m set aside they’d need to use $130m in cash to cover the expense. This would leave total equity value at $713.056m and would still leave the company trading below book value at a P/B of 0.69x.

Summary

While headline results of the recent quarter were bad, I believe the news overall was not nearly as bad as it seems and the company remains undervalued at today’s prices. With the company booking an expense related to the Benson case this quarter and continued negotiations scheduled for August 26th I think it’s plausible that the case may be coming to settlement soon. Additionally, management has made a move to free up around $50m on their balance sheet for something that is not clear just yet though is not without purpose. It could be that they are seeking to do a repurchase given low valuation of shares, it could also be that they have an acquisition target in mind. Either would serve as a catalyst for the name.

I maintain that fair value is likely around $18.00 suggesting an 82% margin of safety. A base level rerating for a profitable company to P/B of 1x would imply a 72% return.

Risks

-

Even with a $71.5m pre-booked as an expense for pending Benson litigation there’s still the risk that the payout could be higher than that. Plaintiff’s say $2b, DDI maintains an upper estimate of $201.5m.

-

The large cash position may be used in an M&A transaction which actually destroys value. Details of any transaction should be monitored.

-

Revenue is highly concentrated in DoubleDown Casino. Any impact to the performance of this game would be materially significant to the thesis.

-

95% of shares are held by insiders and related parties. As a controlled company, this may represent risk depending on your opinion of the majority owners.

-

I estimate only 5% or 2.18m shares available for trading. Given a 30-day average volume of 11,400 shares a day there’s potential for illiquidity risk.

-

Geopolitical risk given that DDI is based in Seoul, Korea. Increased tensions in the Pacific region could impact the stock price and the company.

Be the first to comment