Co-produced with “Hidden Opportunities”

onurdongel/iStock via Getty Images

Introduction

Dorchester Minerals, L.P. (NASDAQ:DMLP) is a pure-play crude oil and natural gas royalty opportunity backed by a shareholder-friendly operating structure and management. This MLP owns mineral rights and net profit interests in key geographies across the U.S. and distributes virtually all net cash from operations to shareholders. In this inflation-ridden economy, energy commodity prices are fueling price hikes across the board. Hence, an investment correlating with commodity prices gives you the ultimate inflation protection.

DMLP’s distributions are variable based on the volume of hydrocarbons produced and their corresponding price. We expect crude and natural gas prices to remain elevated for the foreseeable future, and we project even higher yields from DMLP in the upcoming quarters. In short, if you like commodities, and can tolerate variable distributions, this 10.7% yielding MLP is a fantastic addition to your income portfolio and ideal for dividend reinvestments.

DMLP is a partnership that issues a Schedule K-1.

Ultimate Inflation Protection, 10.7% Yield

You have heard of book and music royalties. J.K. Rowling earned $60 million from the Harry Potter franchise in 2020. Ed Sheeran earns about $5 million annually from his song “Shape of You.” Warren Buffett compares a royalty to owning a tollbooth; after you make an initial investment to build the toll road, the upkeep is minimal, but the cash flow is almost perpetual. In that spirit, we bring a royalty investment in the energy sector.

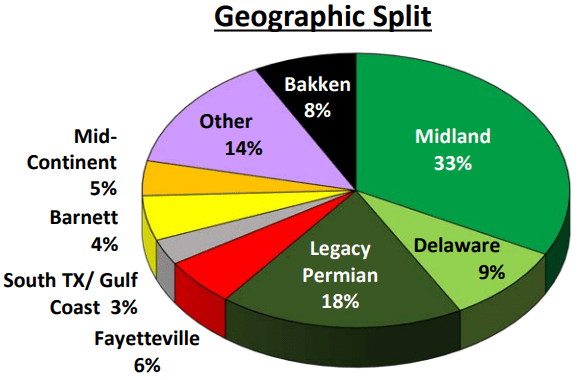

Dorchester Minerals, L.P. owns land and mineral rights in strategically important oil and gas fields located in 27 states. (Source: 2021 Investor Presentation)

2021 Investor Presentation

Being the owner of royalty and net profit interests, DMLP does not spend money or resources to explore, produce (upstream), transport (midstream), or process and transform (downstream) the hydrocarbon output. They simply collect a fee from E & P companies that drill on their land, and the proceeds vary by the volume extracted and the price of the commodity. 80% of the partnership’s revenues come from oil sales, 10% from natural gas, and 10% from other sources. Investors should expect DMLP distributions to track movements in the price of crude oil and natural gas.

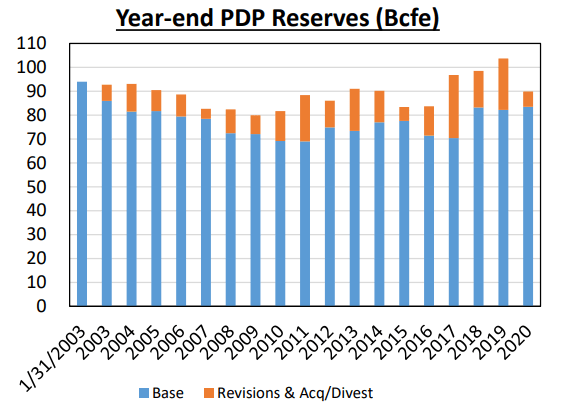

Most often, royalties dry out when the reserves are depleted. This is where DMLP stands out as built to last. Management has been making strategic acquisitions over the years, and current reserves are almost at the same level as when the partnership commenced its operations in 2003. Hence, DMLP will be a perpetual cash cow for your portfolio for decades.

2021 Investor Presentation

So, if you are concerned about higher prices at the pump, we have a way for you to get your cut through mineral royalties. Keep reading to understand more.

DMLP is a master limited partnership that issues a schedule K-1 for tax purposes.

Tailwinds For The Sector

Energy security is a growing priority following the war between Russia and Ukraine. As energy prices are soaring, there are supply concerns for many commodities such as oil, natural gas, and coal. And suddenly, Germany is firing up its coal plants and investing in LNG terminals, and leading economies are well short of their Paris Agreement targets.

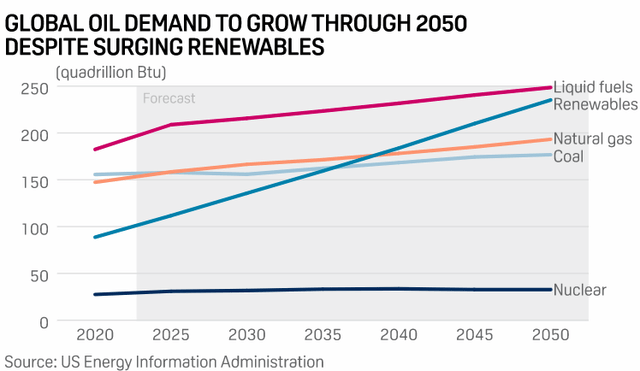

According to the International Energy Agency (“IEA”), global crude oil demand is expected to increase for decades.

Booming U.S. shale oil production played a significant role in the oil price plunge from mid-2014 to early 2016. But in the past five years, Big Oil companies spent very little CapEx on exploration and production enhancements. In 2021, upstream investment was 23% below pre-pandemic levels despite a strong demand rebound. The industry succumbed to Wall Street pressures and began using profits for debt paydown, share buybacks, and dividends. There is tremendous demand for hydrocarbons, but the supply is significantly constrained due to CapEx starvation.

Oil and gas will be around for a lot longer than people think, and it is time to take advantage of dirt-cheap valuations in the energy sector. While these commodity prices are already elevated, leading analysts such as Moody’s are expecting these levels to persist for a while.

“Restrained supply will keep prices high over the next 12-18 months, but without significant fundamental enhancement in operating conditions as growth in demand starts to ease” – Elena Nadtotchi, a senior vice president at Moody’s

The U.S. is the largest oil producer, and since hydrocarbon prices are projected to remain elevated for the foreseeable future, we would like to invest in U.S.-based mineral royalty companies to collect our share from the soaring demand amidst constrained supplies. DMLP directly benefits from higher production and higher prices and its structure passes the benefits along to investors.

No Debt, High Margin Business

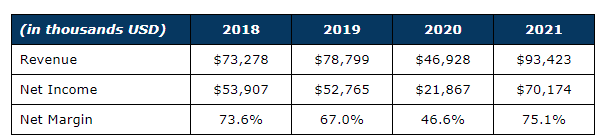

Being an entity designed for royalty income, DMLP has relatively flat costs and expenses. You can see that the difference between revenue and net income is consistently $20-$25 million. Any additional revenue has a negligible impact on expenses and net margin increases.

DMLP 10-K filings

Energy is an attractive sector, but many companies in the industry have debt on the higher side. This is where we like DMLP’s structure -the firm’s partnership agreement prohibits it from incurring indebtedness in excess of $50,000. Also, the partnership does not have a credit facility, and they aren’t permitted to incur indebtedness to make acquisitions.

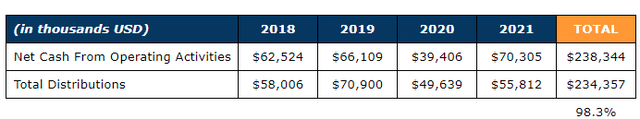

The company distributes virtually all cash generated from operating activities. DMLP’s distributions come from the royalty income and NPI (net profits interest) from previous quarters. Hence, for better insight into net operating cash flow and distributions, it is best to look at the combined data for a few years. We can see that the partnership has distributed ~98% of the cash from operating activities over the past four years.

Let us now look at the income potential for DMLP.

High Yield Royalty Income Opportunity

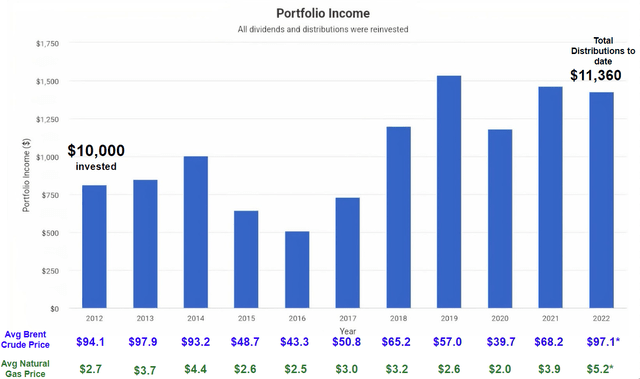

DMLP’s distributions vary based on the production volume and price of oil and gas. The higher the price of underlying commodities, the greater the distributions. Similarly, when the commodity prices drop, subsequent distributions are smaller. This is one of the reasons DMLP is an ideal candidate for the Dividend Reinvestment Program (‘DRIP’)

We understand you will ask this question – Is it worth buying DMLP when commodity prices are at historic high levels? Allow me to answer this by analyzing DMLP’s income for the past ten years. In 2012-13, oil prices were similar to today. $10,000 invested in DMLP in 2012 (with dividend reinvestments) would have produced $11,360 in distributions to date, and you would be sitting on ~21% capital gains. (Source: PortfolioVisualizer)

Note: Without DRIP enabled, this investment would have produced a handsome 7% annually.

DMLP’s recent distribution of $0.754/share came from the operations when crude prices were below $90. Due to elevated prices in the past two months, we expect its subsequent distribution to be larger, in the $0.80-$0.85 range (assuming no acquisitions are made). Annualizing the recent distribution provides us with an estimated 10.7% yield.

Shareholder Friendly by Design

Generally, one of the most significant drawbacks of an MLP structure is a greedy general partner. Some MLPs have the general partner drawing an increasing portion of the cash available for distribution, leaving regular investors high and dry.

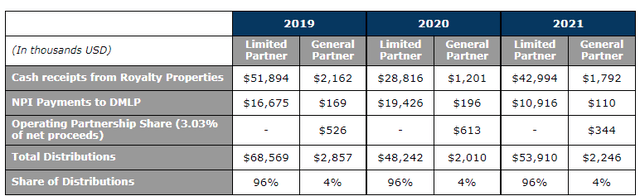

With DMLP, we have a very shareholder-friendly operating model. The General Partner is allocated no more than 4% and 1% of the firm’s Royalty Properties’ net revenues and NPI, respectively. Due to these fixed percentages, the General Partner does not have any incentive distribution rights (‘IDR’) or other arrangements to increase its percentage share of net cash generated from DMLP’s operating activities. Over the past three years, the General Partner has received no more than 4% of the total distributable cash flow.

MLP is a shareholder-friendly company by design and checks almost every box in Warren Buffett’s criteria sheet. However, with a market cap shy of $1 billion, this partnership is relatively tiny for Mr. Buffett’s consideration. That doesn’t have to stop you from collecting handsome paychecks from this mineral royalty stock.

Dreamstime

Conclusion

Big Oil has been forced to invest less and less in upstream operations to expand supply for the past few years. In “Are We Entering A Commodity Supercycle?” we said that a near-term hydrocarbon price surge was in the cards. This Russo-Ukraine war became the straw that broke the camel’s back.

The war has shined a light on the global dependence on hydrocarbons and the catastrophic impact its shortage would have on leading economies. Despite all the political talks about net-zero, clean energy, and renewables, it is clear that we will be increasingly dependent on crude oil and natural gas for the foreseeable future. We expect oil and gas prices to remain elevated for several years, and DMLP is the income method of riding the commodity wave.

DMLP is a pure royalty play in crude oil and natural gas, with a partnership structure and management that uphold the distribution stewardship we expect from a quality investment. This MLP distributes almost all cash from operations to shareholders, fluctuating with the price of underlying commodities. This structural high yielder is a Buffett-quality investment that will pay large sustainable dividends for years while safeguarding your portfolio against the perils of inflation. Buy and DRIP, as this cash cow is built to last.

Be the first to comment