arlutz73

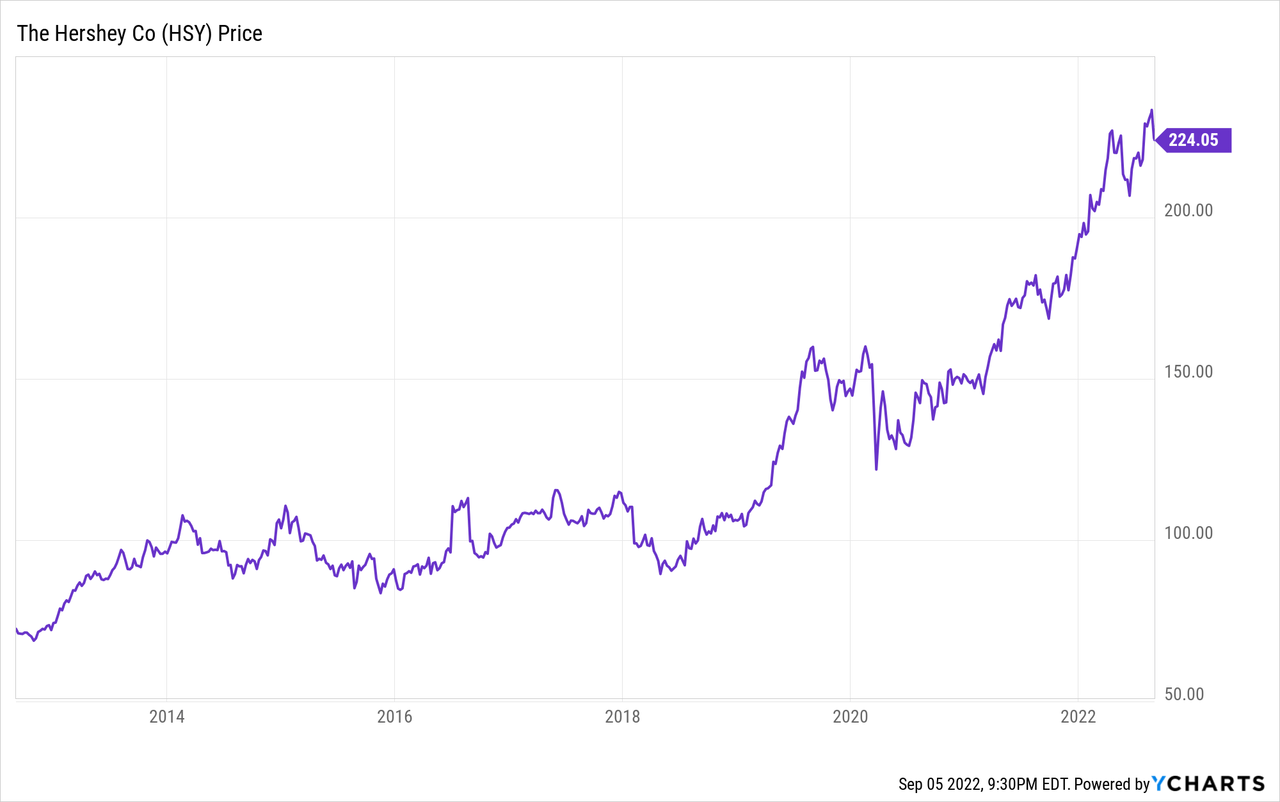

Confectionary giant The Hershey Company (NYSE:HSY) is on a role. After years of stagnation in the company’s shares, Hershey has become a surprising high-flier. On the back of double-digit revenue growth and a boom in profits, Hershey stock has blasted off to a new all-time high stock price.

Many people are looking at Hershey stock doubling in recent years and saying the stock must be overvalued and a sell. By contrast, I’ll argue here that Hershey is only modestly overvalued, if that. Rather, investors underappreciated the company’s strengths in the 2010s, including a stretch between 2014 and 2018 where the stock price didn’t go up at all. Instead, the rally we’ve seen over the past few years is more about Hershey catching up to its earnings growth over the years rather than any irrational behavior today.

To put it another way, Hershey stock is up a lot. That’s true. But the stock is hardly a sell simply due to its recent momentum. If anything, I still see Hershey as a sleep well at night stock that is easy to hold with a decent total return outlook from here going forward.

But Hershey Is Overvalued, Right?

My fellow Seeking Alpha authors tend to hold a fairly cautious view toward HSY stock. Of focus articles written about Hershey this year up until now, we’ve seen four hold ratings, two sell ratings, and just one buy rating on this site. Various authors have suggested taking profits or have warned about a sour valuation after Hershey’s big run-up in share price over the past year.

However, the valuation isn’t nearly as egregious as you might think. It starts with earnings:

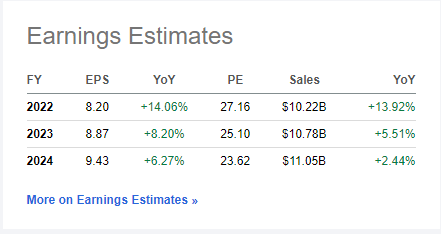

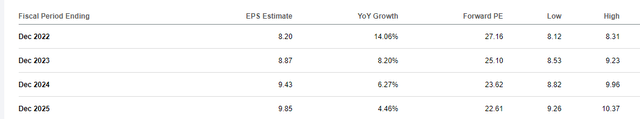

HSY earnings outlook (Seeking Alpha)

Even after the big run-up in Hershey’s share price, the stock is going for 27x this year’s earnings, 25x 2023 earnings, and so on. For comparison’s sake, consider that Coca-Cola (KO) and PepsiCo (PEP) are trading at 25 and 26x earnings, respectively, even though they are growing earnings significantly slower than Hershey has been as of late.

You can say 27x earnings might be a touch high for Hershey stock, but it’s hardly out of line with either Hershey’s past valuation metrics or in comparison with direct consumer staples peers. 27x earnings simply isn’t an outlandish price for a defensive company with a huge moat that is currently growing its earnings and dividend at a double-digit rate.

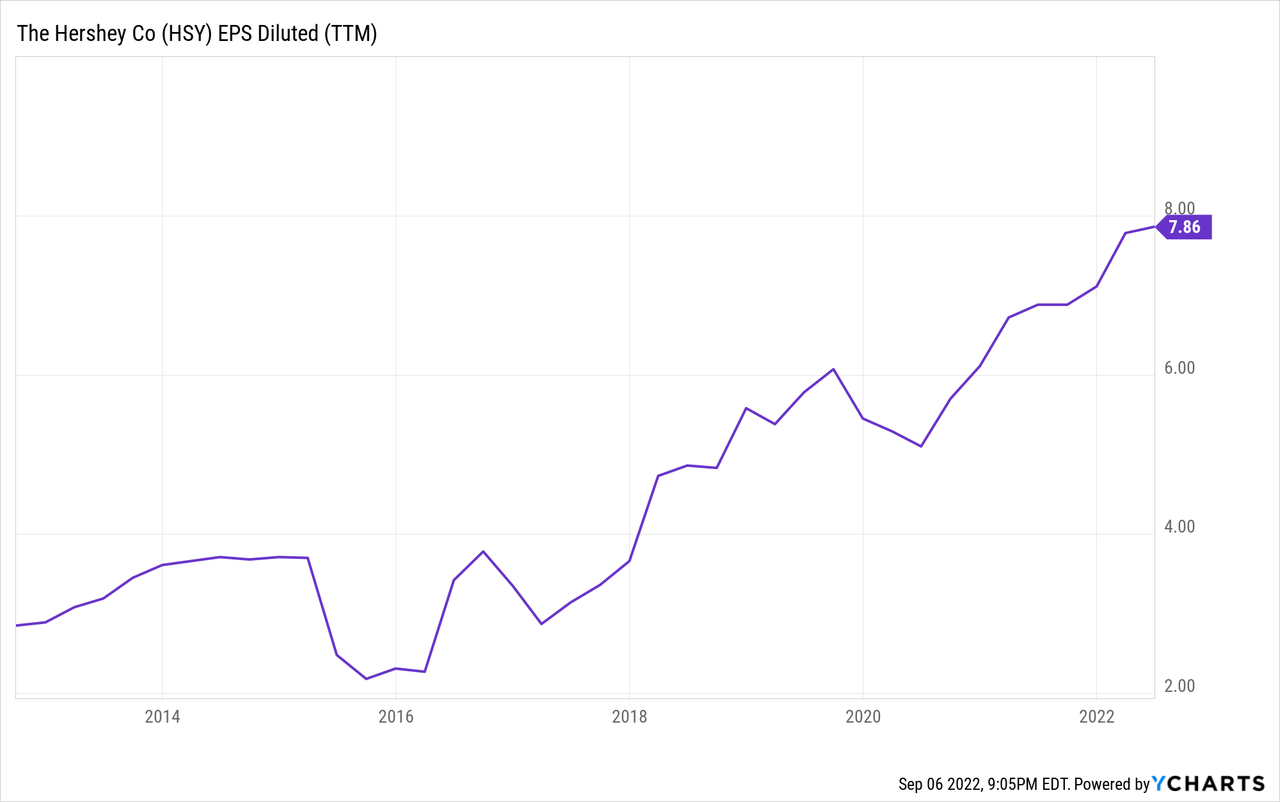

Stop to consider that Hershey has doubled earnings since 2017:

A consumer staples company that can post this sort of growth is going to be able to support a mid-to-high 20s P/E multiple.

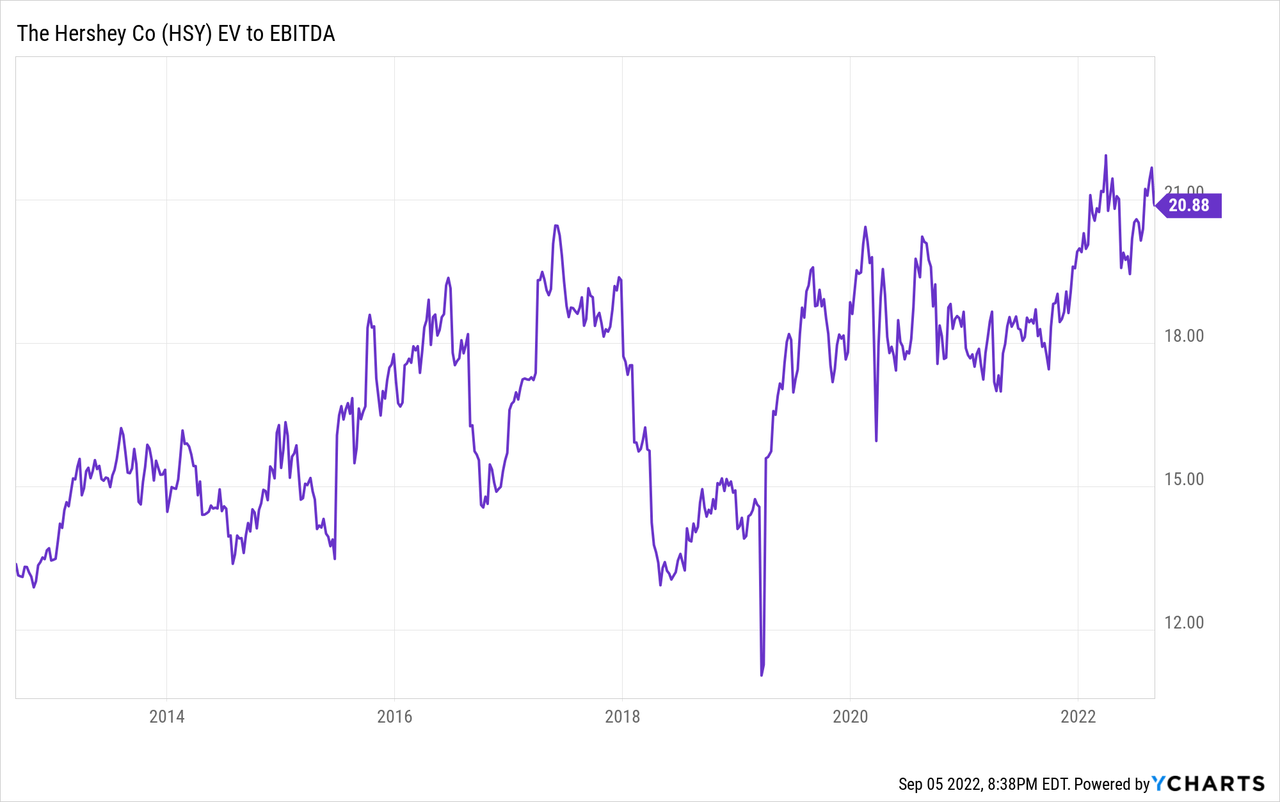

It’s not just earnings, either. On an enterprise value to EBITDA basis, Hershey is going for 21x at the moment. Here’s a 10-year chart of that valuation metric:

Hershey is at the high end of its 10-year range, to be sure. The stock is at a full price today based on its past trading history. But, it’s far from a bubble or untenable price. Hershey shares traded up to 19x EV/EBITDA on various occasions over the past six years.

The best time recently to buy Hershey stock was in 2018, there’s little dispute there. But the valuation hasn’t run up nearly as far as you might think at first glance. A mere 10% drop in Hershey’s stock price would put it back to 18x EBITDA, which would be right in line with where the stock has traded on average since 2016.

The bearish views around Hershey come from a failure to realize just how quickly Hershey has been able and is continuing to grow its business.

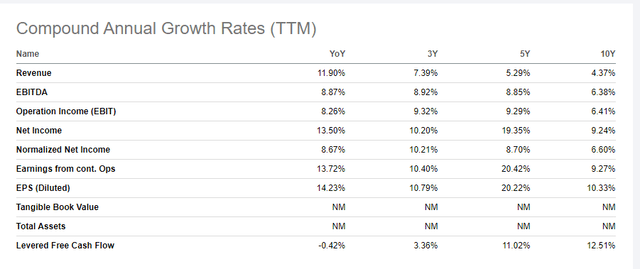

Hershey growth rates (Seeking Alpha)

Hershey has grown earnings per share at a double-digit annualized rate over the past year, three years, five years, and ten years, respectively. Read that again. The staid old confectionary company has posted a rather impressive 10.3%/year EPS growth rate over the past decade. The company has also grown levered free cash flow at a double-digit annualized rate over the past decade, which has given Hershey plenty of money for both acquisitions and sizable dividend hikes.

Speaking of dividend hikes, Hershey just gave investors a delicious 15% dividend hike in July. This is a reflection of Hershey’s dominance during this inflationary period. We’ve seen so many consumer staples companies struggle to deliver decent-sized dividend hikes given the profit margin pressure and slumping profitability during these shifting economic times.

By contrast, Hershey is running like a well-oiled machine. The company has been able to push through double-digit price hikes on its goods without much retailer or customer pushback. Supply chain concerns have caused some cost pressure and limited inventory shortages, sure. But on the whole, Hershey has been able to manage better than most of its peers.

The lack of meaningful private label competition in chocolate is also a plus for Hershey compared to rivals; not many people will defect to store brand chocolate even if Hershey raises prices aggressively. It’s a unique perk of the sweets category. By contrast, other products like condiments, cereal, and canned goods are facing much harsher private label competition.

Hershey’s success isn’t just a factor of the current economic conditions, either. Analysts see Hershey’s earnings growth continuing along a reasonable upward trajectory, rising from $8.20 per share this year to nearly $10 per share in 2025:

Hershey forward earnings estimates (Seeking Alpha)

This isn’t an earth-shattering growth rate, to be sure, but it is quite a respectable rate of increase.

HSY Stock Verdict

Hershey has tended to trade at about a 25x P/E ratio on average over the past decade. 25 times projected 2025 earnings would put the stock price at $247. That works out to a roughly 3% annualized upside on the stock from today’s starting point. Throw in the 2% dividend yield, and that’s a 5% annualized total return forecast through 2025. And, after that point, Hershey should be able to post closer to 8-10% total returns once it is done working off its slightly elevated starting P/E ratio.

Am I going to say that 5% total returns through 2025 is a particularly attractive return outlook? No, no I’m not. But it’s hardly a disaster either. Many investment grade bonds are yielding in the 5% range lately. Hershey works well as a bond alternative given its exceptionally durable brand, market positioning and robust cash flows and dividend. I’m not buying more HSY stock today. But shares aren’t remotely near a price high enough to tempt me to sell my existing Hershey position based on valuation.

Be the first to comment