Spencer Platt/Getty Images News

Investment Thesis

In my last article on the Vanguard Mid-Cap ETF (NYSEARCA:VO), I pointed out that investors were facing significant downside risk if they were considering purchasing this fund due to lofty valuations across the portfolio. Since then, VO has lost ~16% and provided similar returns when compared to the S&P 500.

While my fears related to the negative price action have materialized, I believe we’re nowhere near a bottom given the state of the economy. Inflation and higher rates were the main drivers of lower equity prices over the last couple of months but I suspect the next leg down will come from earnings revisions. Economic activity in the US is rapidly declining as estimated by numerous data providers and investors should expect further negative surprises in the months ahead. For this reason, I believe investing in equities is risky for now, particularly in VO which is more volatile than the market given its allocation to mid-cap stocks.

What Has Happened Since My Last Article

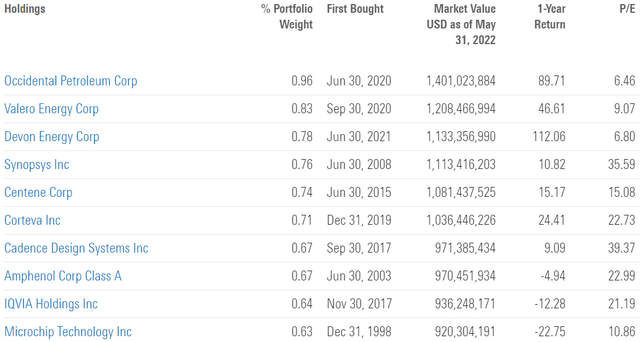

As a reminder, the Vanguard Mid-Cap ETF invests in a broadly diversified index composed of mid-size U.S. stocks. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

I concluded my previous article with the following statement:

VO provided good absolute returns in the past and I expect this trend to continue going forward. However, VO is not cheap at the moment, and I would personally prefer to wait for a 15-20% pullback before buying this ETF.

The subsequent price action proved my worries have materialized. I have compared below VO’s price performance against the SPDR S&P 500 Trust ETF (SPY) and the iShares Core S&P MidCap ETF (IJH) over the last 5 months to assess which one was a better investment. Since my previous article, VO lost nearly 16% compared to a loss of ~15.8% and ~13% for SPY and IJH, respectively.

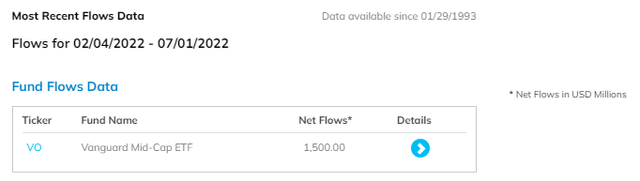

Despite the poor year-to-date performance, investors haven’t capitulated and have added to their existing position throughout the year. As a result, VO registered $1.5 billion worth of inflows since early February 2022, which represents nearly 3% of the fund’s latest assets under management. This market behavior leads me to believe that investors haven’t yet switched from the buy-the-dip mentality to a risk-off approach, which would be much more adequate in this treacherous market environment.

It’s Not Yet The Time To Be Greedy

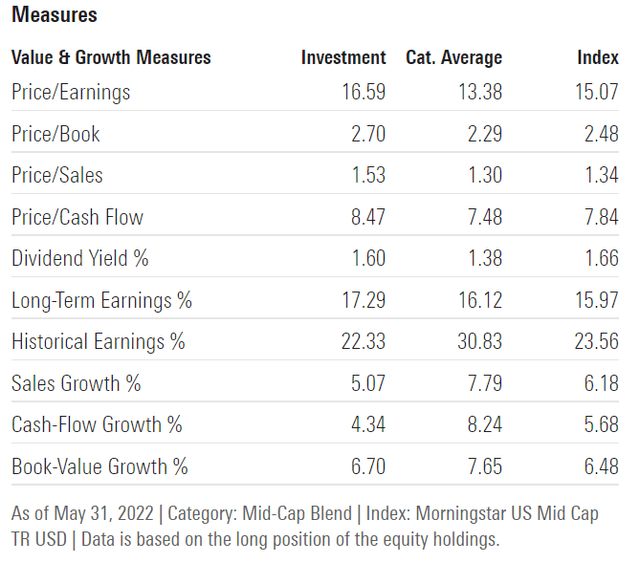

Be greedy when others are fearful. Everyone knows this famous quote from Warren Buffett, yet very few investors actually turn bullish in moments of maximum pessimism. If we look at VO, I believe we are nowhere near capitulation as illustrated by fund flows as well as valuations, hence the reason why it’s not the right moment to get greedy and chase every dip. While the fund is now cheaper than a few months ago, I still believe valuations are stretched across the portfolio. VO is trading at ~17x earnings and has a price-to-book ratio of 2.7. Valuations remain a main concern here since analysts haven’t yet started downgrading EPS despite numerous warning signs in the economic data, which leads me to believe that the time to be greedy is still ahead of us.

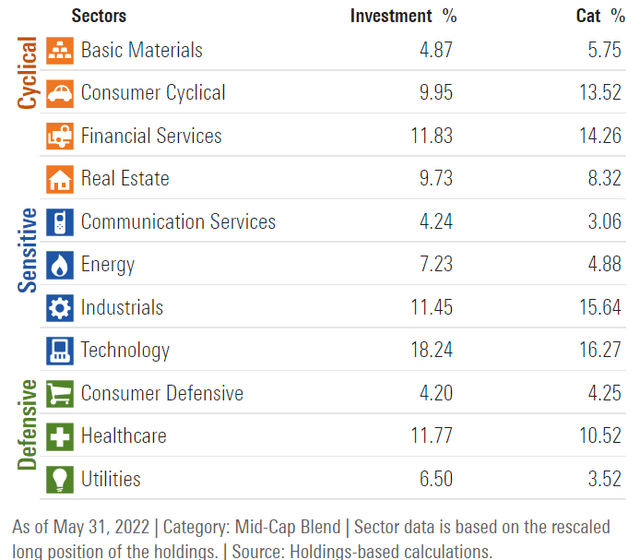

The risk of an economic downturn puts VO in a difficult position. Over 36% of total assets are invested in cyclical sectors, and less than 23% are invested in defensive stocks. In other words, the portfolio is very sensitive to changes in economic activity and therefore vulnerable to a recession. The fact that VO invests in mid-cap stocks doesn’t help in this context as this category is generally more volatile compared to large caps.

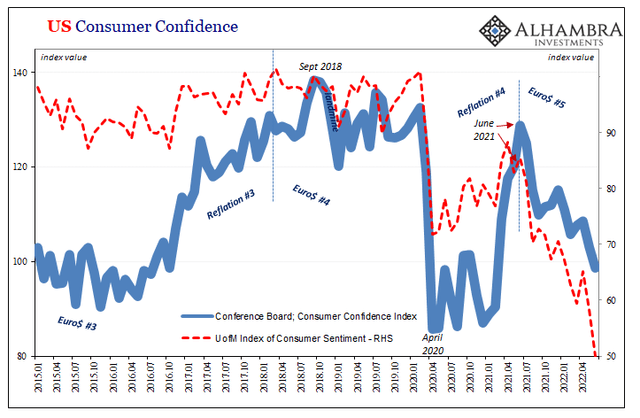

I believe there are many reasons why a recession is now highly likely over the next couple of months. In my opinion, one of the best leading indicators is consumer sentiment, which reached a multi-decade low last month. Pessimism amongst consumers is the main driver that pushes demand lower, creating a bullwhip effect in the economy. I expect this trend to continue over the next quarters. Publicly listed businesses are directly impacted by weaker demand, and I assume analysts will have to slash their EPS estimates at some point in time to reflect this new economic reality.

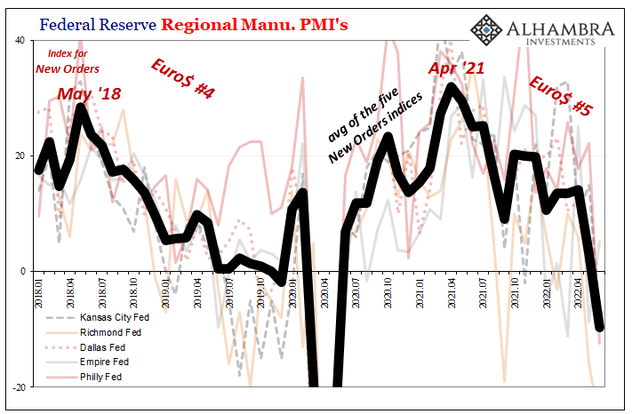

We are already seeing signs of demand destruction in the manufacturing data. PMI’s new orders are now at the lowest level since Q1 2020 which coincided with the COVID-19 lockdown and stock market crash.

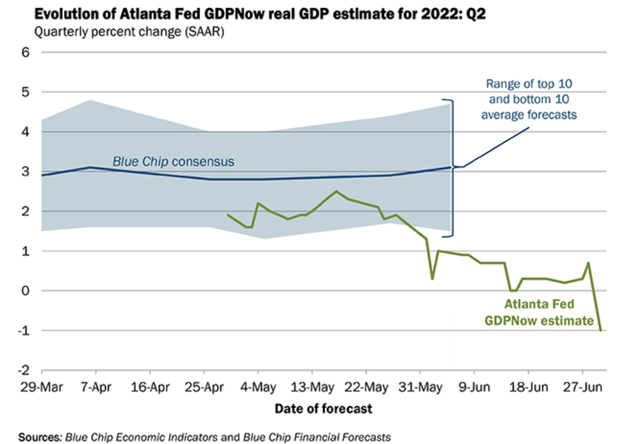

The recent GDPNow figures provided by the Atlanta Fed also corroborate the recession hypothesis. You can read more about how the model works here. The main takeaway from the data is that GDP growth expectations have been gradually declining for the last two months, and their model estimates Q2 GDP growth to be close to -1%. Owning stocks in an environment where the economy is crashing isn’t the wisest choice in my opinion, and I believe it is better to be fearful at the moment until clear capitulation signs emerge.

Key Takeaways

While my concerns about the negative price action have come true following my previous article on VO, I believe we are still far from a bottom given the state of the economy. Lower equity prices have been driven primarily by inflation and higher interest rates in recent months, but I believe the next leg down will be driven by earnings revisions. According to numerous data providers, economic activity in the United States is rapidly declining, and investors should expect more negative surprises in the data in the months ahead. As a result, I believe that investing in equities is risky for the time being, particularly in VO, which is more volatile than the market due to its exposure to mid-cap stocks.

Be the first to comment