Scott Olson/Getty Images News

Enterprise Products Partners (NYSE:EPD) has dropped almost 20% since the start of the month, pushing the company’s dividend yield back towards 8%. The company has a unique, nearly impossible to replicate, portfolio of assets, which we expect will help the company to generate market leading returns, making it a valuable investment.

Enterprise Products Partners Overview

Enterprise Products Partners is one of the largest midstream companies on the market.

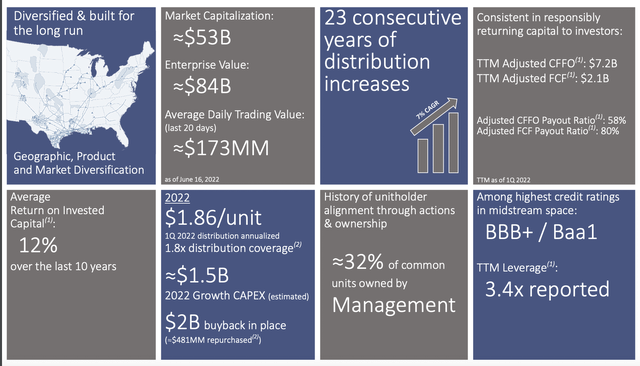

Enterprise Products Partners Overview – Enterprise Products Partners Investor Presentation

Enterprise Products Partners has an enterprise value of more than $80 billion with roughly $31 billion in net debt. The company has had 23 years of consecutive dividend increases to generate its almost 8% dividend yield, showing its commitment to shareholders. The company expects a 1.8x dividend coverage for the year with a substantial $1.5 billion in growth capex.

The company has a $2 billion buyback in place of which its only utilized $481 million. The company’s buyback enables it to repurchase another 3% of its shares, although we’d like to see it ramp up its buyback. The company has 32% common unit management ownership, and manageable leverage at 3.4x.

Overall, the company’s strong financial positioning and unique assets, along with ability for additional shareholder rewards, making it a valuable investment.

Enterprise Products Partners Growth Capital

Enterprise Products Partners has a substantial and manageable growth program.

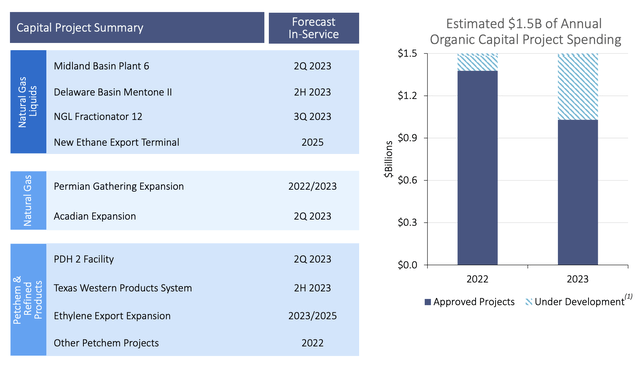

Enterprise Products Partners Growth Capital – Enterprise Products Partners Investor Presentation

The company has $4.6 billion in growth projects under construction, amounting to almost 10% of its market capitalization. Roughly 65% of this will come into fruition from 2022-2023, or 3% of its market capitalization each year. These are spread across the natural gas, natural gas liquids, and petrochemical businesses.

Most approved projects will come into fruition in 2022/2023, although some export / terminal expansion projects won’t come to fruition until 2025. There’s a few unique growth advantages the company has.

1. The company has a massive Gulf Coast asset portfolio and a strong portfolio throughout the rest of the country. That gives the company numerous add-on opportunities at lower than average market prices.

2. The company has some of the strongest refined assets in the market. The company is adding natural gas takeaway capacity with growing NGL assets, and other refined product transportation. These products have stronger margins for the company.

Enterprise Products Partners Financials

These assets and the company’s growth potential are supported by the company’s strong financial positioning.

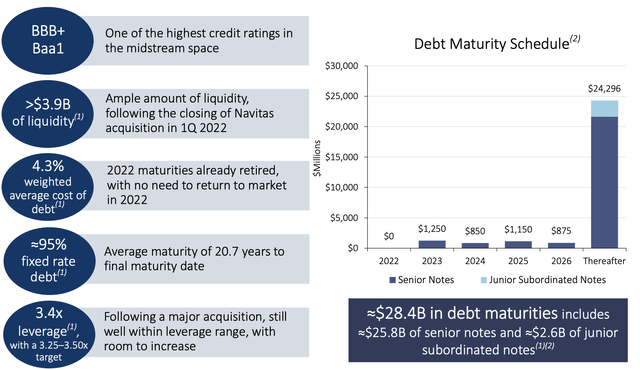

Enterprise Products Partners Financials – Enterprise Products Partners Investor Presentation

The company has one of the strongest credit ratings in the midstream space and almost $4 billion in liquidity after the multibillion dollar Navitas acquisition. The company retired all 2022 maturities without needing to return to the debt markets and 3.4x overall leverage following a major acquisition. The company can increase its leverage range, but we expect it to minimize focus on paying down debt.

The company has 95% fixed rate debt with an average maturity of 20.7 years. Up until 2027, the company has roughly $1 billion in annual debt due. After that, the company has a more distributed longer term debt portfolio. The company can afford to pay down the debt as it comes due, avoiding needing to reissue it at a higher interest rate.

The company’s annualized interest costs are roughly $1.1 billion annualized, a low number it can comfortably afford.

Enterprise Products Partners Returns

Putting this all together, Enterprise Products Partners has the ability to generate market-leading shareholder returns.

The company has roughly $7.5 billion in DCF, or a ~9% enterprise value DCF yield and ~15% market cap DCF yield. The company’s dividend consumes roughly $4 billion in this and the company is expecting a 1.8x coverage ratio for the year. That highlights the company’s financial strength and security of its dividend.

From the remaining $3.5 billion, the company is spending roughly $1.5 billion on growth each year. This growth will help the company’s financials to continue improving. After all of this, the company has $2 billion. The company can use this to both buyback shares and pay down debt as it comes through. However it spends this we expect the company to generate double-digit returns.

Thesis Risk

In our view, the risk to the thesis is minimal. The company has a near impossible portfolio of assets to replicate, each generating reliable fees. Multiple COVID-19 related black swan events could decrease long-term demand and hurt volumes, but in the immediate-to-medium term we expect the company’s assets to outperform.

Conclusion

Enterprise Products Partners has put substantial effort into building an asset portfolio that investors can be proud of. The company has increased its dividend for 23 consecutive years and now has an almost 8% dividend yield. The company’s DCF still has a 1.8x coverage ratio for the company’s portfolio leaving $3.5 billion.

The company is continuing to invest in growth capital, and using $1.5 billion for that, improving cash flow. That leaves the company with roughly $2 billion. That’s enough to pay down debt as it comes due and while also buying shares. That enables the company to generate strong shareholder rewards from a variety of sources making the company a valuable investment.

Be the first to comment