Power lines TebNad/iStock via Getty Images

Dividend-paying stocks tend to outperform non-dividend-paying stocks. Dividend-paying stocks averaged nearly 8% annual total returns from 1973 to 2021. This is much more than the 5% annual total returns non-dividend-paying stocks have delivered over that time.

Dominion Energy (NYSE:D) is a dividend stock within my portfolio. Since I last covered Dominion Energy in January, the stock’s price has surged 7%. This is double the 3% return that the S&P 500 has generated since that time.

But I’d argue that Dominion Energy is currently a hold. Let’s delve into the reasons for my hold rating.

Moderate Dividend Growth Prospects Remain Intact

Dominion Energy’s dividend appears to be safe and positioned for decent growth in the years ahead. This is supported by looking at two different elements.

First, the stock’s 3.14% dividend yield is slightly lower than the 3.38% diversified utilities industry average dividend yield. This signals that Dominion Energy’s dividend could be as safe as its industry peers.

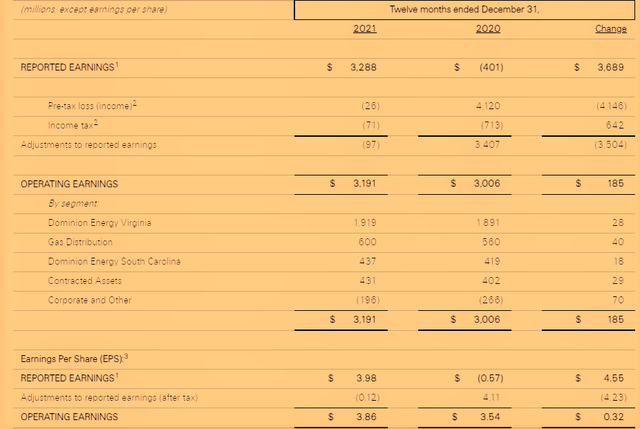

Next, the stock generated $3.86 in operating EPS in 2021. Against the $2.52 in dividends per share that were paid during that time, this is equivalent to a 65.3% operating EPS payout ratio.

And this reasonable payout ratio for a utility looks like it will slightly decrease in 2022.

Dominion Energy’s midpoint operating EPS guidance for 2022 is $4.10 (according to Dominion Energy’s Q4 2021 earnings press release). Compared to the $2.67 in dividends per share that are slated to be paid this year, that equates to a 65.1% operating EPS payout ratio.

Since these payout ratios are essentially in line with Dominion Energy’s 65% target payout ratio, the stock should be able to raise its dividend in line with earnings growth. That’s why I’m confident that Dominion Energy will be able to deliver 6.5% annual dividend growth over the long haul (target payout ratio per slide 3 of Dominion Energy’s Q4 2021 Earnings Call Presentation).

Dominion Energy Had A Solid 2021

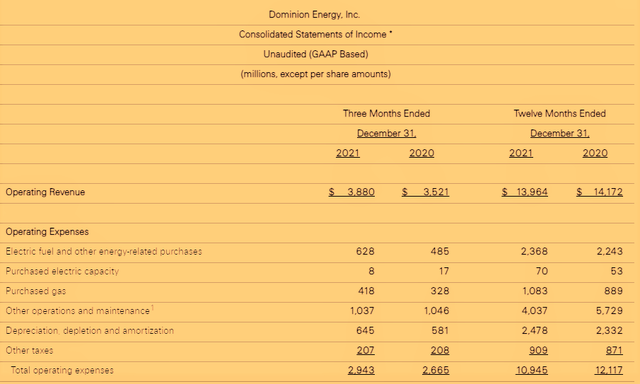

Dominion Energy Q4 2021 Earnings Press Release

Dominion Energy reported $14 billion in operating revenue during 2021, which represents a 0.1% decline over 2020 (details sourced from Dominion Energy’s Q4 2021 earnings press release). As I pointed out in my previous article on the stock, it requires a bit more discernment than simply stating that revenue decreased.

The reason behind Dominion Energy’s operating revenue decline has to do with the sale of the majority of its gas transmission and storage assets to Berkshire Hathaway (BRK.A) (BRK.B) in late 2020. While the amount of operating revenue this generated for Dominion Energy in 2020 is unclear, 2021 was the first full year without the business. Thus, the operating revenue dropped.

But Dominion Energy seems to be better off without its gas transmission and storage assets. That’s because the company’s operating ratio (defined as total operating expenses divided by operating revenue) improved by 710 basis points to 78.4% in 2021 (info according to Dominion Energy’s Q4 2021 earnings press release).

Dominion Energy Q4 2021 Earnings Press Release

The essentially unchanged operating revenue base and improved efficiency allowed Dominion Energy’s operating income to jump 6.2% higher year-over-year to $3.2 billion in 2021. Along with the 2.7% decline in its average diluted outstanding share balance, this explains how Dominion Energy’s operating EPS surged 9% higher to $3.86 in 2021 (all data points per Dominion Energy’s Q4 2021 earnings press release).

The stock’s growth will drop off a bit in 2022. But using the $4.10 midpoint operating EPS guidance for this year, Dominion Energy will still post a respectable 6.2% growth rate (figure sourced from Dominion Energy’s Q4 2021 earnings press release).

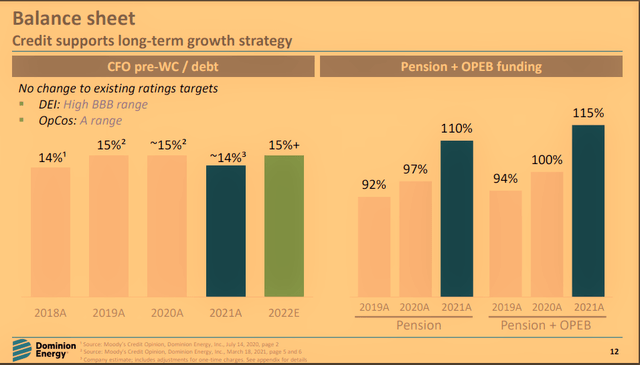

Dominion Energy Q4 2021 Earnings Call Presentation

In addition to its robust results in 2021 and healthy growth outlook, Dominion Energy also possesses a secure balance sheet. The stock’s pension is more than covered, with a 110% funding rate (info according to slide 12 of Dominion Energy’s Q4 2021 Earnings Call Presentation).

For these reasons, Dominion Energy could be a nice wealth-building stock for the long haul.

Risks To Consider:

Dominion Energy’s fundamentals seem to be encouraging. But there are two risks that investors should especially pay attention to as the year unfolds. These could potentially lead to some downside from the current share price.

The first risk to Dominion Energy is the accelerating inflation rate. The 7.9% year-over-year increase in the Consumer Price Index in February 2022 is the highest in 40 years.

This could cause a meaningful increase in the company’s operating expenses. Unless Dominion Energy can offset these increased expenses through improved efficiency or secure rate case increases with state utility commissions, this would hurt its profitability.

The second risk is that the Federal Reserve will need to strike a balance between large enough interest rate hikes to tame inflation. But the Federal Reserve will need to avoid raising rates too much to prevent an economic downturn.

Rising rates from less risky investment vehicles like Treasuries could lead investors to demand more yield from equities as compensation for taking on more risk. This could cause some downward pressure in Dominion Energy’s stock price.

A Fully Priced Stock

Dominion Energy is a fine utility stock. But since utilities typically don’t grow at a very fast clip, it’s critical to not significantly overpay.

This is why I will be using two valuation models to assess the fair value of Dominion Energy’s shares.

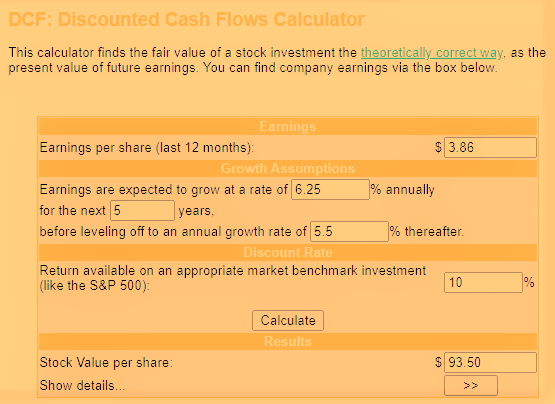

Money Chimp

The first valuation model that I’ll employ to appraise shares of Dominion Energy is the discounted cash flows model, which involves three inputs.

The first input into the DCF model is the trailing twelve months of operating EPS. In the case of Dominion Energy, this amount is $3.86.

The second input for the DCF model is growth assumptions.

I’ll assume that Dominion Energy falls just a bit short of the analyst outlook of 6.4% annual earnings growth through the next five years, and generates 6.25% annual earnings growth for that period. I will then estimate a drop-off in annual earnings growth to 5.5% in the years that follow.

The third input into the DCF model is the discount rate, which is another term for the required annual total return rate. I prefer 10% annual total returns.

Based on the considerations above, I come out at a fair value output of $93.50 a share. This points to Dominion Energy’s shares being undervalued by 9.1% and offering a 10% upside from the current price of $84.97 a share (as of March 31, 2022).

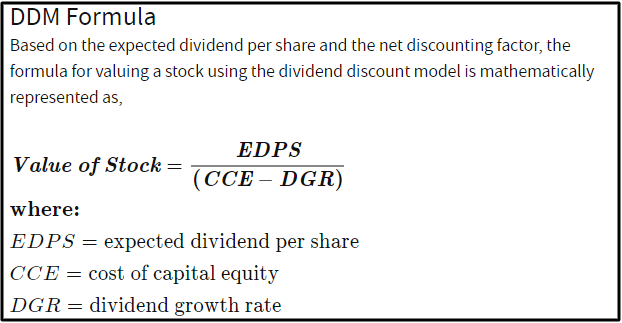

Investopedia

The second valuation model that I will utilize to value shares of Dominion Energy is the dividend discount model, which is also made up of three inputs.

The first input into the DDM is the expected dividend per share, which is a stock’s annualized dividend per share. Dominion Energy’s current annualized dividend per share is $2.67.

The next input for the DDM is the cost of capital equity, which is the annual total return rate that an investor requires from their investments. Like I did above, I’ll use 10% for this input.

The last input into the DDM is the annual dividend growth rate or DGR over the long run.

While the first two inputs into the DDM require minimal effort to find and set, correctly predicting the long-term DGR requires an investor to consider numerous factors: These include a stock’s payout ratios (and whether those payout ratios are set to expand, contract, or remain unchanged in the future), annual earnings growth potential, industry fundamentals, and the state of a stock’s balance sheet.

I will use 6.5% as the final input into the DDM.

Using these inputs, I arrive at a fair value of $76.29 a share. This indicates that Dominion Energy’s shares are priced at an 11.4% premium to fair value and pose a 10.2% capital depreciation from the current share price.

Averaging these two fair values together, I compute a fair value of $84.90 a share. This means that shares of Dominion Energy are trading at a 0.1% premium to fair value and pose a 0.1% downside from the current share price.

Summary: Holding My Shares And Waiting For A Better Price

Dominion Energy’s operating EPS payout ratio is right around its long-term target of 65%. This gives the stock the flexibility for dividend growth to track its earnings growth. And with Dominion Energy set to deliver annual earnings growth of around 6.5%, the dividend should grow at a similar rate.

The stock also boasts a relatively strong balance sheet. Dominion Energy appears to be fairly valued here. But with some uncertainty over inflation and how aggressive the Federal Reserve’s interest rate hikes will be in the months ahead, some downside could be ahead.

If the stock experienced a 5% downturn from current levels, this would be a large enough margin of safety for me to add to my position. Until then, I will be on the sidelines.

Be the first to comment