traffic_analyzer/iStock via Getty Images

There it is at the top of the front page of the Wall Street Journal,

“Dollar’s Rise Spells Trouble For Global Economies“:

“The U.S. Dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown and amplify inflation headaches for global central banks.”

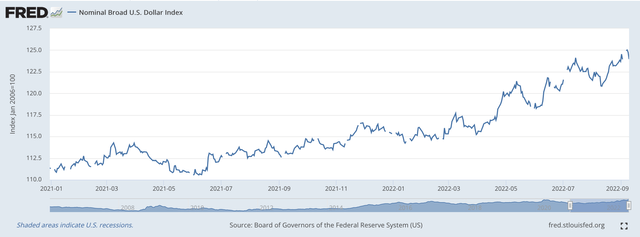

The latest phase of this is only relatively recent.

Dollar Index (Federal Reserve)

In this chart, we only go back to the beginning of 2021.

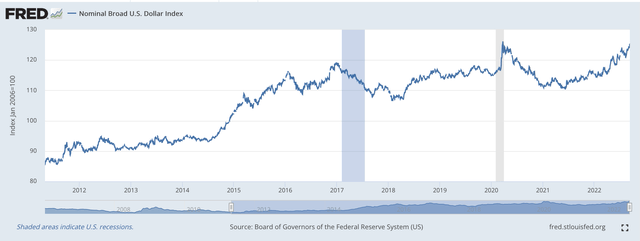

But, over the past year or so, I have been arguing that the current rise in the value of the U.S. dollar goes back a lot further than that.

Take a look. To me, the current rise in the value of the U.S. dollar goes back to the Spring of 2011.

Dollar Index (Federal Reserve)

From this chart, it appears as if the rising value of the U.S. dollar has been going on for quite a while.

This is what makes me think that this result was not unwanted by the Federal Reserve. The stronger dollar not only keeps the U.S. dollar at the top of the list in terms of reserve currencies in the world.

The stronger dollar also places lots and lots of pressure on other countries to get their economies in order, otherwise, they suffer more from inflation and from slower economic growth.

And, especially in the emerging economies in the world, there is less willingness to discipline their economies and focus on issues like the growth of labor productivity and financial control.

Even in more advanced economies, the governments emphasize aggressive budgetary programs and monetary looseness.

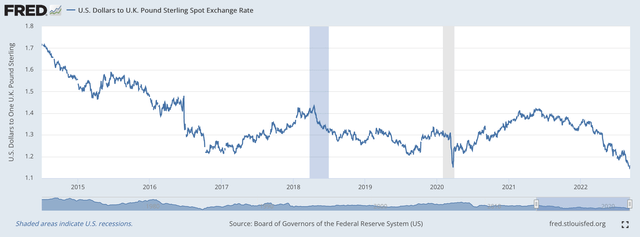

Take a look, for example, at the performance of the British Pound since May of 2014. Again, the downward trend dominates the picture.

U.S. Dollar versus the British Pound (Federal Reserve)

Again, the downward trend is not a straight line, but the downward movement predominates the picture.

Since the Spring of 2014, the British Pound has gotten weaker and weaker relative to the U.S. dollar.

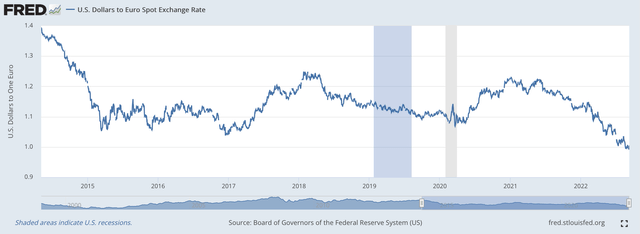

And, what about the Euro?

U.S. Dollar versus the Euro (Federal Reserve)

Again, we get a picture that is very much the same.

The U.S dollar gets stronger with time.

And, many other charts show exactly the same thing.

The value of the U.S. dollar, against other currencies in the world gets stronger beginning in 2012.

In the spring of 2014, however, the upward movement of the U.S. dollar becomes even stronger.

Major Reserve Currency

There is no question that the United States dollar is the primary reserve currency in the world.

To me, during the time period under review, against the Euro and against the British Pound, there was no question about how the U.S. dollar compared against these other currencies in the world in terms of currency reserve status.

The U.S. dollar was on top!

And, now, one Euro can be acquired for a little less than $1.00.

Furthermore, the British Pound can be obtained for less than $1.1400.

Will they stay there or go a little bit lower? I think that they will.

The real issue to me is how the value of the U.S. dollar will compare with the Chinese Yuan.

To me, as far as the U.S. government and the Federal Reserve are concerned, this is the major issue.

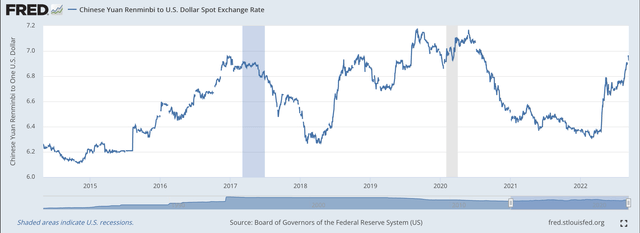

Note what has happened to the dollar value of the Yuan since May 2014.

Since that date, the U.S. dollar has gotten stronger against the Chinese Yuan, although the trip has been somewhat bumpy. This “bumpiness” has occurred because the Chinese central bank has entered the market and tried to keep the exchange rate from rising.

Chinese Yuan versus the U.S. Dollar (Federal Reserve)

This, however, is what the U.S government and the Federal Reserve are trying to achieve. Since the spring of 2014, the pressure, it appears, is for the value of the U.S. dollar to rise against the Chinese Yuan.

From the Wall Street Journal article cited above:

“China’s central bank has attempted to shore up the Yuan by releasing more dollar liquidity into the market. It has cut the amount of reserves banks need to hole against their foreign-exchange deposits and has consistently set the daily fixing–a benchmark point for the currency–stronger than market expectations.”

Neither the government nor the Fed talks about this relationship, but I believe that this is one thing that officials do not want to see happen. That is, the U.S. does not want the Chinese Yuan to get strong enough to really challenge the position of the U.S. dollar as the primary reserve currency of the world.

Neither government officials, nor Federal Reserve officials talk much, if at all, about the relationship between the dollar and the Yuan.

This, I believe, is policy.

But, when one studies the data over the past ten years or so, I think that one must draw the conclusion that the U.S. government and the Federal Reserve are working to keep the value of the U.S. dollar strong against the Chinese Yuan so that the dollar’s role as the primary reserve currency in the world is not challenged.

There is little question that a strong U.S. dollar must be achieved for the United States to maintain its position as the primary economy in the world that has the primary reserve currency in the world.

As the world becomes more and more connected and globalization becomes more effective and more efficient, the leading reserve currency in the world will only become more dominant.

This gets into the story of how the global financial system evolves. But, that story is for another day.

Be the first to comment