Michael Vi

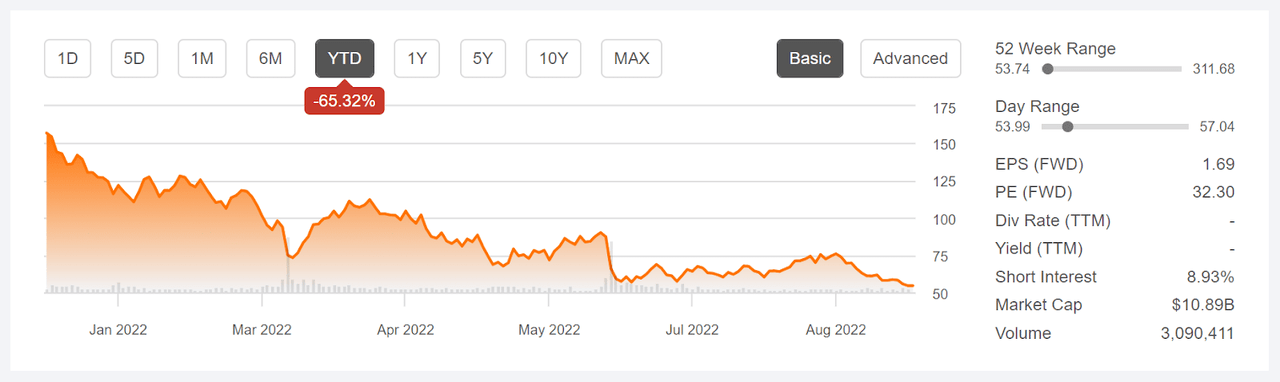

Despite having a well-regarded and widely-adopted platform for digital signatures and contract management, DocuSign (NASDAQ:DOCU) has sold off in dramatic fashion so far in 2022. The shares have fallen about 65% for the YTD, as compared to decline of about 45% for Adobe (ADBE), the other big name in this space. The primary problem for the company was that the valuation got too high as the company grew rapidly during the COVID-19 lockdowns. In addition, rising interest rates disproportionately reduce the net present value of future earnings for companies like DOCU, for which the valuation depends heavily on rapid earnings growth. The company reports FY Q2 earnings after the market closes on September 8th.

DOCU was downgraded by RBC Capital Markets in August and by Piper Sandler in July. The analysts have tended to criticize management, but the simple reality is that expectations provided by management and supported by the analysts were too optimistic that growth rates from the last couple of years were somewhat sustainable. CEO Dan Springer resigned in June as a result of weakening growth and earnings that fell below expectations for FY Q1.

Seeking Alpha

Price history for the YTD and basic statistics for DOCU above.

DOCU’s earnings rocketed up in the COVID-driven lockdowns and the extended work-from-home period in 2021, with quarterly EPS increasing by a factor of more than 10X over less than 3 years, before starting to decline over the last several quarters. Earnings are expected to grow at an annualized rate of 20% per year over the next 3 to 5 years, but full-year 2023 and 2024 earnings are expected to be below those for 2022 (Source: ETrade). DOCU’s forward P/E is now 32.3, as compared to 27.2 for ADBE.

ETrade

Historical (3 years) and estimated future quarterly earnings per share for DOCU above. The green (red) values are amounts by which EPS beat (missed) the consensus estimate.

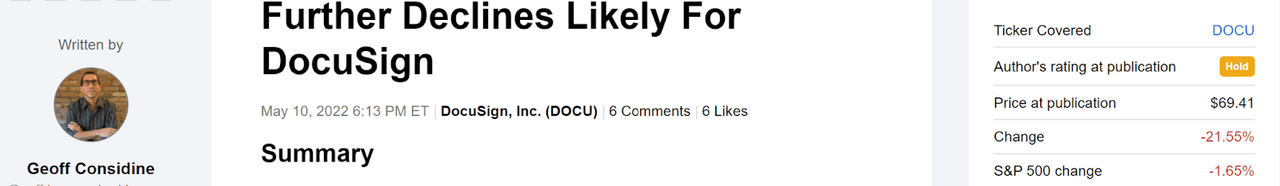

I last wrote about DOCU on May 10, 2022, at which time I maintained a hold rating on the shares, even though, as the article title states, I saw a high probability of additional declines. The Wall Street consensus 12-month price targets were more than 50% above the share price at that time, consistent with the analysts buying into a high-growth narrative. There was high dispersion among the individual analyst price targets, however, which reduces the meaningfulness of the consensus as a predictor. By contrast to the Wall Street consensus, the options market was signaling a bearish outlook on DOCU. The market-implied outlook, a probabilistic price return forecast derived from the prices of call and put options on DOCU, indicated that the most-probable outcome was for the shares to decline by 39% from mid-May of 2022 until mid-January of 2023. It is not especially uncommon to see this kind of major disconnect between the Wall Street analyst consensus and the consensus view implied by options prices, but this is a cause for concern. I compromised between the bullish Wall Street view and the bearish market-implied outlook by maintaining a neutral / hold rating on the stock.

Seeking Alpha

Previous analysis of DOCU and subsequent performance vs. the S&P 500 above.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With almost 4 months since my last analysis and with earnings reported on September 8th, I have calculated updated market-implied outlooks for DOCU and I have compared these with the Wall Street consensus outlook in revisiting my rating.

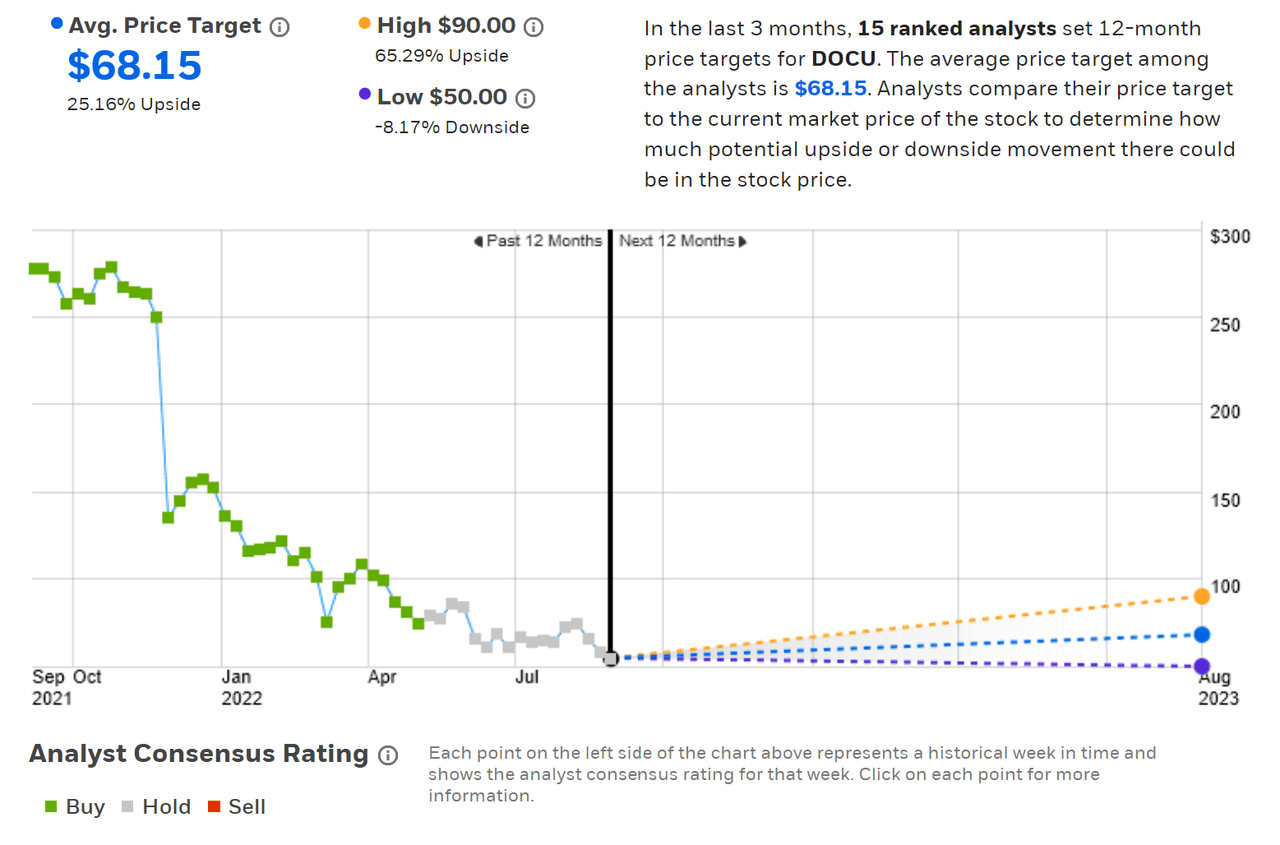

Wall Street Analyst Consensus for DOCU

ETrade calculates the Wall Street consensus outlook for DOCU by combining the views of 15 ranked analysts who have published ratings and price targets over the past 3 months. The consensus rating is neutral, down from a buy rating in May, and the consensus 12-month price target is $68.15, as compared to $101.14 in my analysis in May. The consensus 12-month price target is 25.2% above the current share price. The dispersion among the individual price targets is high, but is less dramatic than it was in May. The highest price target is 1.8 times the lowest price target. As a rule of thumb, I largely discount the consensus price target when the highest price target is 2X or more times the lowest. DOCU does not quite reach this level.

ETrade

Wall Street analyst consensus rating and 12-month price target for DOCU above.

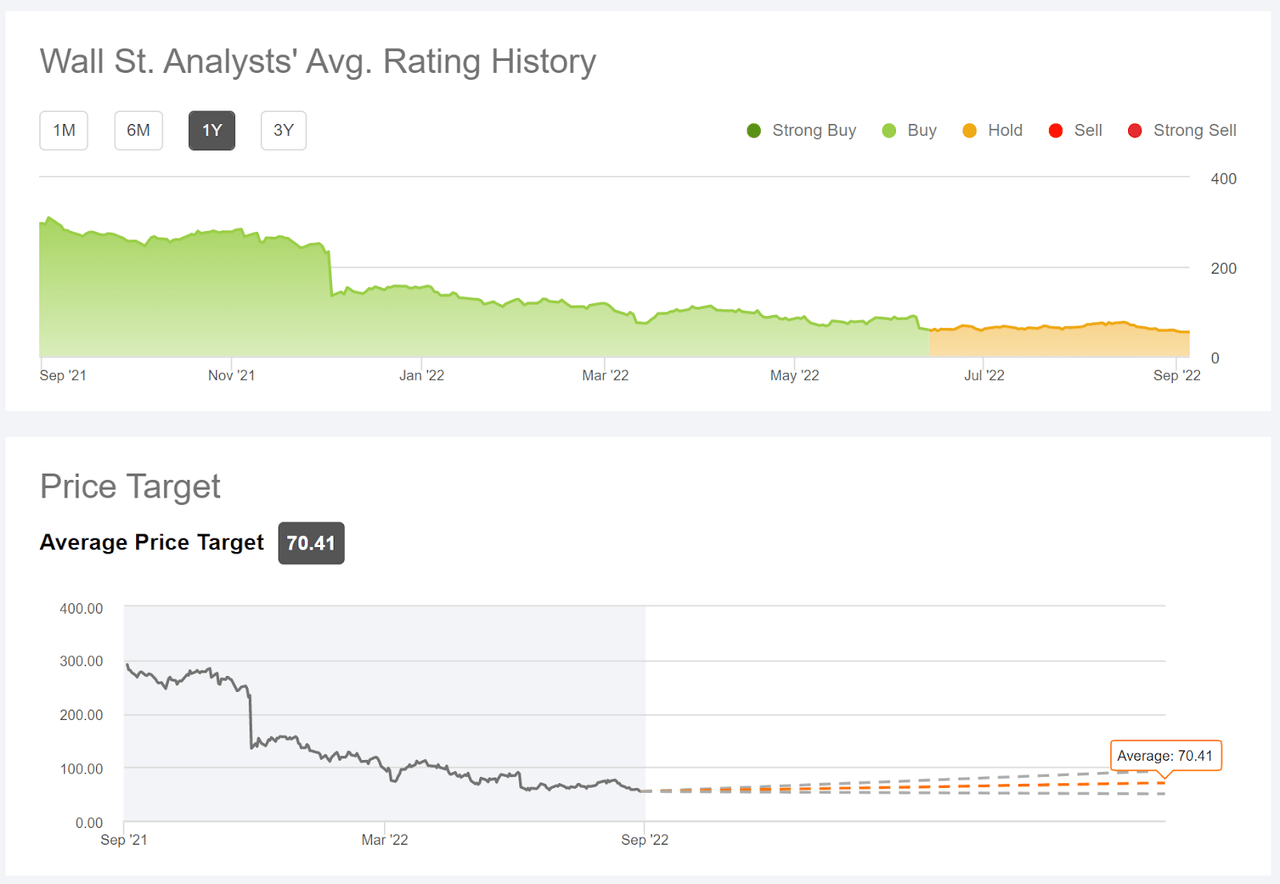

Seeking Alpha’s version of the Wall Street consensus outlook uses ratings and price targets from 19 analysts who have published their views over the past 90 days. The consensus rating has changed from a buy in May to a neutral rating today. The consensus 12-month price target, $70.41, is 29.3% above the current share price and 33.3% below the consensus 12-month price target in my analysis in May.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for DOCU above.

The consensus rating on DOCU has changed from a buy to a hold since my previous analysis in May and the consensus 12-month price target has fallen by 1/3rd. Even though the current consensus price target implies a 25-29% gain over the next year, I discount this outlook because of the fairly high spread among the individual price targets.

Market-Implied Outlook for DOCU

I have calculated the market-implied outlook for DOCU for the 1.5-month period from now until October 21, 2022 and for the 4.5-month period from now until January 20, 2023, using the prices of call and put options that expire on these two dates.

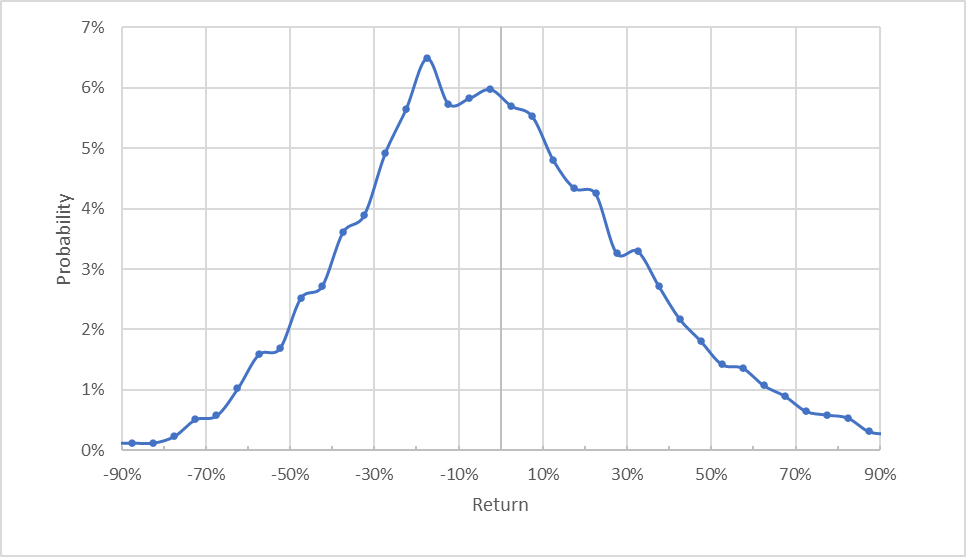

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for DOCU for the 1.5-month period from now until October 21, 2022, above.

The market-implied outlook to October 21 is substantially skewed, with the maximum probability corresponding to a price return of -17.5% over this 1.5-month period. The expected volatility calculated from this distribution is 36% (not annualized). This is a substantially bearish tilt for DOCU, with very high volatility.

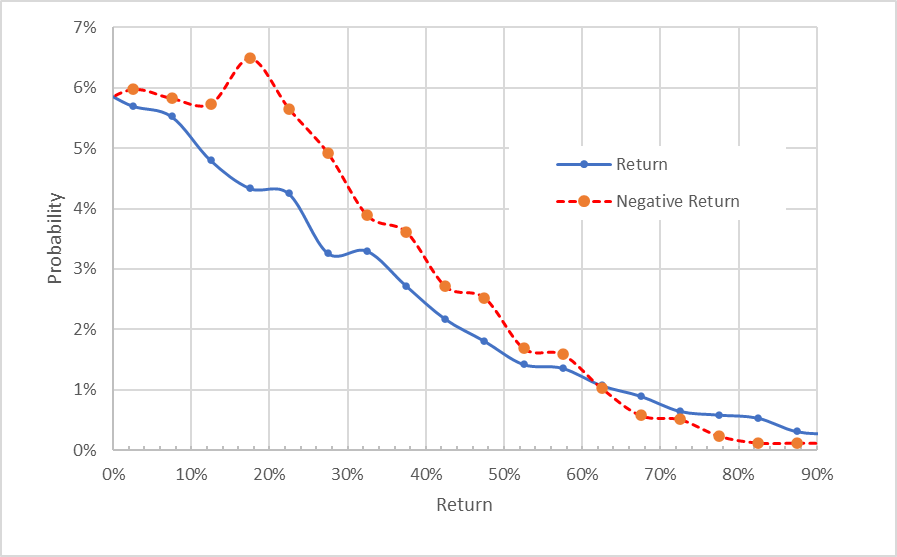

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for DOCU for the 1.5-month period from now until October 21, 2022. The negative return side of the distribution has been rotated about the vertical axis above.

This view shows that the probabilities of negative returns are substantially higher than for positive returns of the same magnitude, across a wide range of the most-probable outcomes (the dashed red line is well above the solid blue line over the left ⅔ of the chart above). The probabilities of large-magnitude positive returns are elevated, but the overall probabilities of these outcomes are small.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Even with the potential for this negative bias, I interpret the market-implied outlook to October 21st to be negative, based on the range of analyses that I have run.

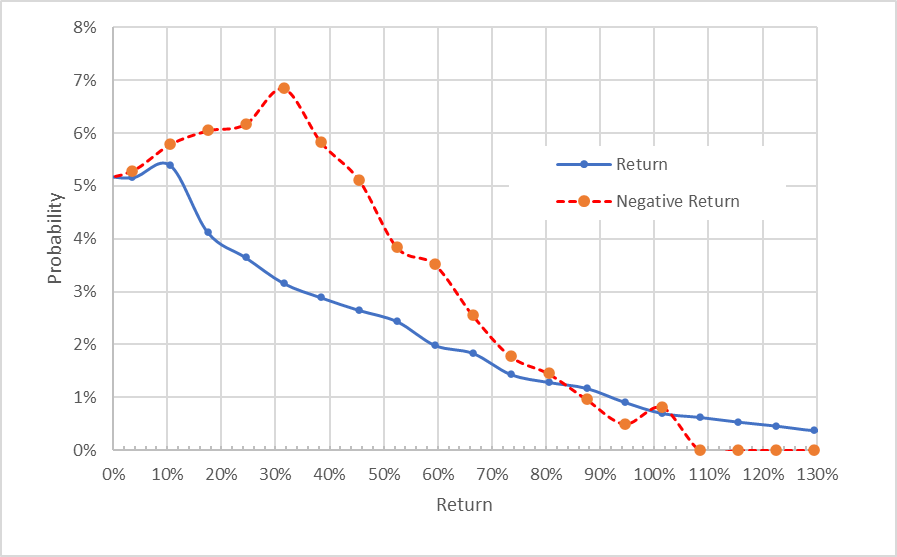

The market-implied outlook over the 4.5-month period from now until January 20, 2023 is similarly bearish to the shorter-term outlook. The maximum-probability outcome corresponds to a price return of -31.5%. The expected volatility is 55.2% (not annualized).

Geoff Considine

Market-implied price return probabilities for DOCU for the 4.5-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis above.

The market-implied outlooks to October 21, 2022 and to January 20, 2023 are consistently bearish, with very high volatility. It is definitely not rational to bet on the peak-probability outcomes occurring because the range of possible outcomes is so large. For the outlook to October 21st, the 20th percentile return is -29% and the 80th percentile return is +28%. This means that the options prices suggest that there is a 1-in-5 chance of having a return of -29% or worse and a 1-in-5 chance of having a return of +28% or better between now and October 21st. This is a very high level of uncertainty and investors should understand that they are taking on an extremely risky position here, albeit also with a high degree of potential upside.

Summary

DocuSign has a well-regarded product platform, but the company’s growth trajectory and valuation are extremely uncertain. The Wall Street analysts have overestimated the degree to which the rapid growth rates achieved during COVID were sustainable. The Wall Street consensus rating on DOCU is neutral / hold and the consensus 12-month price target is 25% to 29% above the current share price. I do not place much faith in the predictive value of the consensus price target because there is a high degree of disagreement among the individual analysts. The market-implied outlooks for DOCU to October 21, 2022 and to January 20, 2023 are bearish, with very high volatility. I am downgrading DOCU from a hold to a sell, although I would be afraid to take a short position because of the massive expected volatility.

Be the first to comment