hapabapa

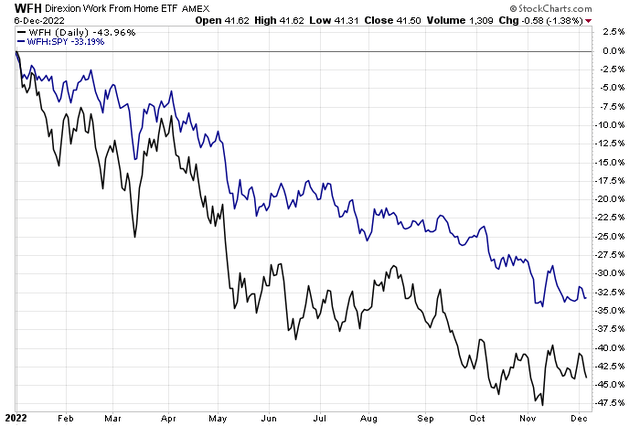

A big pain trade this year has, not surprisingly, been the work-from-home theme. The Direxion Work From Home ETF (WFH) is down 44% in 2022, greatly underperforming this year’s relative strength in blue-chip stocks.

One of the fund’s holdings, DocuSign, reports quarterly results Thursday evening. Are shares cheap enough? Is the downtrend over? Let’s draw the lines on this eSignature stock.

Work From Home Continues To Be A Losing Trade

Stockcharts.com

According to Bank of America Global Research, DocuSign, founded in 2003, is a market leader in providing electronic signature technology and automation of the agreement process through its cloud platform. DocuSign’s solution addresses the core of every business transaction – the agreement – and makes the process much more efficient, resulting in lower processing costs and time.

The California-based $8.5 billion market cap Application Software industry company within the Information Technology sector does not have positive GAAP earnings over the last 12 months and does not pay a dividend, according to The Wall Street Journal. Ahead of Q3 earnings Thursday night, there is just a 6.5% short interest on the stock.

Earlier in 2022, DocuSign announced a CEO transition before issuing a solid Q2 earnings report in which total billings were strong. The incoming chief executive, formerly at Google, has experience in managing high-growth businesses, but shares of DocuSign remain mired in a steep downtrend amid a challenging macro environment for non-profitable tech (though DocuSign has positive non-GAAP earnings). Back in September, the stock rose following news of a 9% workforce reduction, but that was just a temporary reprieve for the bulls. Just recently, an analyst at Jefferies set a $50 price target and a neutral rating on the stock.

Enterprise spending among medium and large-sized corporations is a key risk for DOCU. With a possible tech-led recession in the first half of next year, there are obvious macro headwinds in place. Other downside risks include increased competition from Adobe which could threaten market share and margins and a broader slow adoption of eSignature products in key end markets. Upside potential stems from simply a lower valuation today, a growing total addressable market, and the potential for lower interest and borrowing rates.

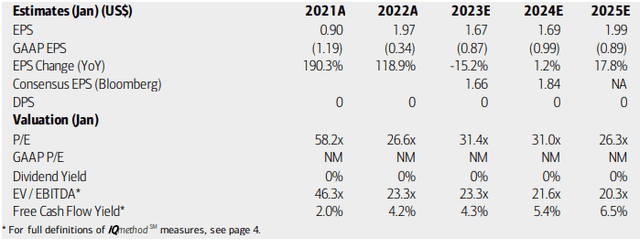

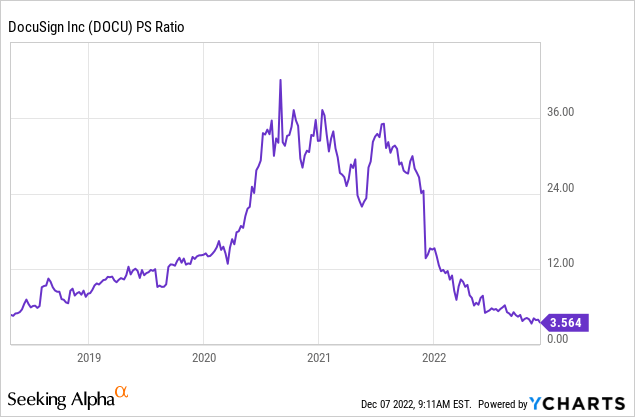

On valuation, analysts at BofA see operating earnings falling sharply in DocuSign’s FY 2023 (which is already underway) while GAAP per-share profits are seen as continuing in the red through 2025. The Bloomberg consensus operating EPS forecast is a bit more optimistic than what BofA has. With earnings growth that should be restored after the coming several quarters, a non-GAAP P/E near 30 would imply a PEG ratio of about 1.3. That valuation seems quite reasonable. Moreover, DOCU’s trailing price/sales ratio of 3.6 is way below its five-year average of a whopping 16.7. I also like that the firm is free cash flow positive, so this is not a total spec name.

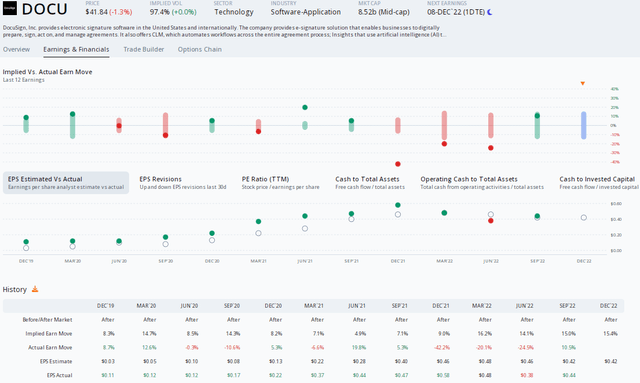

DocuSign: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

DOCU: Price/Sales Ratio Near All-Time Lows

YCharts

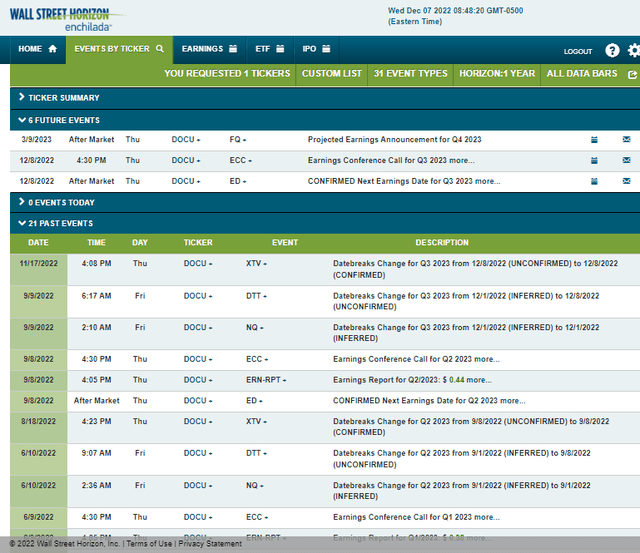

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2023 earnings date of Thursday, Dec. 8, after market close with a conference call immediately after results cross the wires. You can listen live here.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus operating EPS forecast of $0.42 versus $0.58 earned in the same quarter a year ago. The company has topped analysts’ estimates in 11 of the last 12 quarters but the share price has traded lower following three of the past four quarterly reports.

Options traders have priced in a high 15.4% post-earnings stock price swing when analyzing the nearest-expiring at-the-money straddle. Considering some wild reactions over the previous five reports, don’t be so fast to sell that straddle.

ORATS

The Technical Take

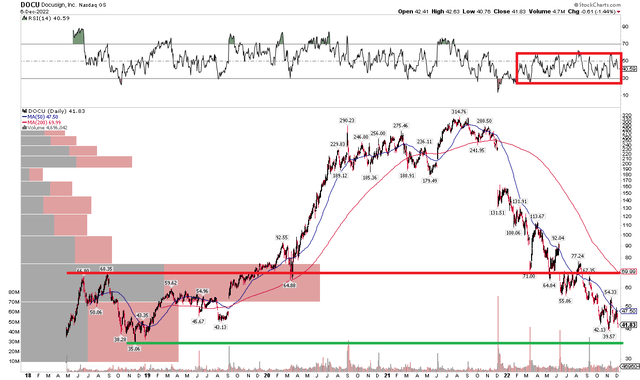

DOCU has a much better valuation now, but I still see downside risks in the technical chart. Notice below that the stock has shown few signs of reversing higher. I see support at the all-time low near $35 while upside resistance is way up near where the falling 200-day moving average comes into play around $70. Buying on a dip into the upper $30s with a stop under the late 2019 low could be a bullish trade, but I’d like to see a capitulation event on high volume to mark a solid low – maybe the Q3 earnings report will deliver that. I would also be encouraged if the RSI broke out from the bearish 20 to 60 range.

In all, with generally lower lows and lower highs in the last 18 months, the onus is on the bulls to prove a reversal. Otherwise, you are just trying to pick a bottom.

DOCU: Support Perhaps At Its All-Time Low, Bearish Momentum Persists

Stockcharts.com

The Bottom Line

I like the longer-term valuation on DOCU now that some multiples have retreated to all-time cheap levels. Options traders see more volatility to come after its earnings report Thursday night, while I see a pronounced downtrend in place. I’m a seller for now and would prefer to wait until shares show some upside momentum or a capitulation event.

Be the first to comment