snapinadil/iStock Editorial via Getty Images

Diversification And Pricing Power To Counter Weaknesses

The positive momentum in the energy indicators and the recent price hikes will increase DMC Global Inc.’s (NASDAQ:BOOM) DynaEnergetics segment revenues sharply in Q1. The Arcadia acquisition in late-2021 has added a new line of service – the commercial and residential buildings framing systems market – to its portfolio. The company has an edge in the legacy integrated perforating gun business, where it holds a significant market share.

However, global supply chain bottlenecks, higher reserve costs, and delivery delays can affect the NobelClad business adversely. Management now targets to bring down EV/EBITDA, although cash flows turning negative could place obstacles in front of that goal. The stock is relatively overvalued at the current level. Nonetheless, I think investors might want to hold the stock to reap the rewards of its medium-term growth drivers.

The Arcadia Acquisition Values

In December 2021, BOOM acquired 60% equity interest in Arcadia Inc. – a supplier of architectural building products – for $282.5 million. With DMC diversifying away from oilfield services products, Arcadia sells exterior and interior framing systems for the commercial buildings and residential real estate market.

The acquisition is expected to double DMC’s sales, expand gross margins and provide exposure to more cyclical energy and industrial infrastructure markets. The addressable architectural products industry amounts to $4.5 billion, per the company’s estimates. From 2010 through 2020, Arcadia’s top line increased by 13% annually, while its EBITDA increased by 23%. So, the acquisition is expected to be earnings accretive within a year.

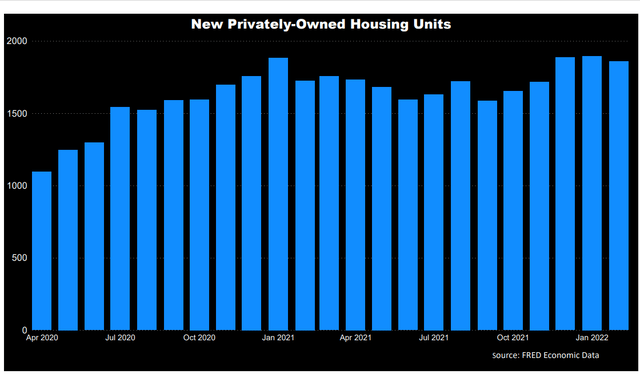

However, according to recent economic data, new privately-owned housing units authorized by building permits decreased by 1.9% in February 2022 compared to a month ago. The pandemic slowed down non-residential construction spending, which may spill over to 2022 and 2023.

Pricing Outlook And Cost Challenges

You may read more in my previous article on BOOM’s strategies and its integrated perforating gun systems here. In November 2021, DMC Global initiated a 5% price increase on all products, although the outcome was suboptimal due to low activity in the industry at that time. The Q4 margin decline, despite the price rise, was due to the inventory reserve and the effect of the CARES Act withdrawal. Still, it mitigated higher labor and input costs partially. Overall, inventory reserve, the CARES Act, and commodity price inflation shaved the margin by six percentage points.

BOOM is set to increase prices by another round in Q1, and I think investors can expect a net positive impact of the price rise in Q2. It can still suffer from costs higher than some of its peers because the company is not vertically integrated. A more integrated company absorbs cost hikes better. In the event of tightness in the traditional oilfield services, BOOM has stressed improving its digital presence. Its digital app, which helps customers configure and purchase products, can help enhance margin significantly from Q2, according to management.

Industry Indicators And Guidance

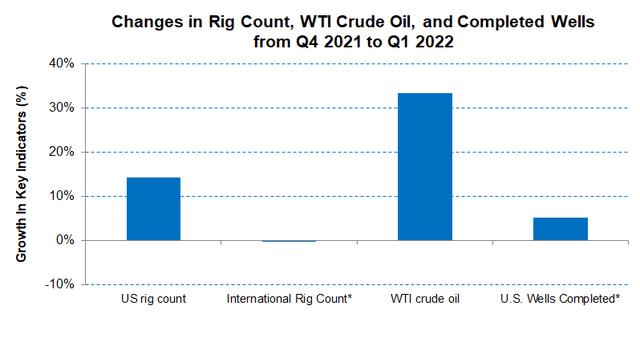

EIA and Baker Hughes’s rig count data

The energy industry indicators gathered tremendous momentum in the first couple of months in Q1 but looked to fizzle a bit in the past couple of weeks. Since the start of the year, the crude oil price has gone up by 31%. The US rig count went up by 17.5% in 2022 so far. In Q1, however, the completed well count in the key US shales is still firm. Per Primary Vision, the frac spread count seems steady, moving in tandem with the US rig count in this period.

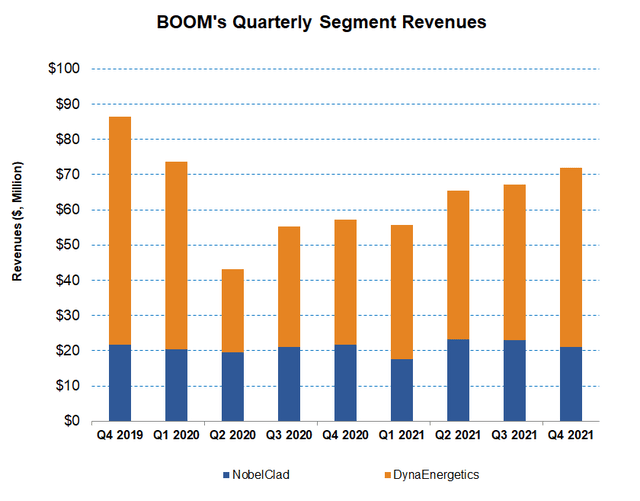

The company’s management expects the top line to improve in Q4. DynaEnergetics segment revenues are expected to increase (at the guidance midpoint) sharply (13% projected growth), while the NobelClad segment’s revenue is expected to decline (by 11%).

How Did The Segments Perform In Q4?

Improved demand for energy products business led to DynaEnergetics segment revenue rising by 14.6% in Q4 2021 compared to Q3 2021. While North American sales increased by 7% quarter-over-quarter, international sales outgrew, rising by 75%.

In contrast, the NobelClad segment revenues declined by 8% in Q3 2021 because of delays in receiving metals at the US and European manufacturing plants. In Q4, the company’s gross margin shrank by 700 basis points compared to a quarter ago. Material cost inflation, adverse changes in project mix at NobelClad, and expenses related to inventory reserve at DynaEnergetics contributed to the margin fall. The other influencing driver in reducing the margin was the expiration of the CARES Act during the quarter. As a result of these charges, in Q4, it recorded a $3.56 million net loss compared to a marginal net profit a quarter ago.

Cash Flows And Balance Sheet

In FY2021, BOOM’s cash flow from operations (or CFO) turned negative compared to a positive CFO a year ago. Although revenues increased during this period, higher accounts receivable and higher inventory levels to mitigate supply chain bottlenecks led to the CFO decline. So, the free cash flow (or FCF) also turned significantly negative in FY2021.

BOOM had total debt of $137 million as of December 31, 2021. While the total debt-to-adjusted EBITDA leverage ratio was 2.79x at the time of acquisition (December 2021), it now targets to bring it down to below 2x, following expected growth in EBITDA and debt repayment. Although its leverage (debt-to-equity) is much lower than many of its peers, the cash and marketable securities balance ($31 million) decreased steeply (83% down) since a quarter ago. So, financial risks have surfaced in the past quarter following the acquisition of the 60% controlling interest in Arcadia.

Linear Regression-Based Revenue Forecast

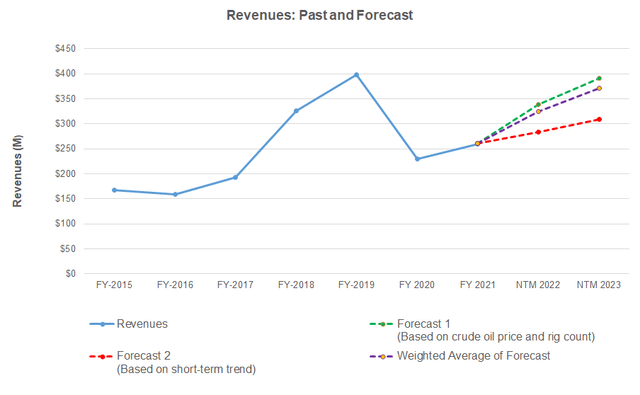

Author created, Seeking Alpha, Baker Hughes rig count, and EIA

Based on a regression equation consisting of key industry indicators (crude oil price and rig count) and BOOM’s reported revenues for the past seven years and eight quarters, I expect revenues to increase in the next twelve months (or NTM) 2022. The growth rate can decelerate in NTM 2023.

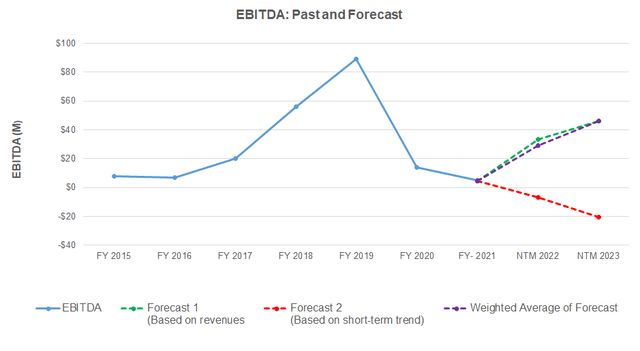

Author created and Seeking Alpha

Based on a linear regression model using the forecast revenues, I expect its EBITDA to increase sharply in NTM 2022. The growth can normalize in NTM 2023 and remain steady in the following year.

Relative Valuation And Target Price

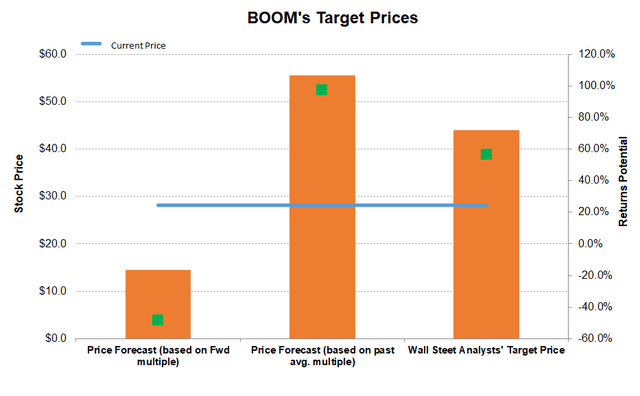

Author created and Seeking Alpha

The stock’s returns potential using the forward EV/EBITDA multiple (13.4x) is much lower (48% downside) compared to the returns potential using the past average multiple (97% upside). The Wall Street analysts also expect positive returns (56% upside).

BOOM’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than the peers, typically reflecting a higher EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (193x) is significantly higher than peers’ (CLB, HAL, and OIS) average of 22.7x. So, the stock can be relatively overvalued at the current price.

What’s The Take On BOOM?

The Arcadia acquisition included the commercial buildings and residential exterior and interior framing systems market. The acquisition is expected to double its sales and expand gross margins. I think the acquisition will provide exposure to the cyclical energy and industrial infrastructure markets for DMC in 2022. After effecting a 5% price increase on all products in November last year, it once again increased prices in Q1. Although the inventory accumulation helped mitigate higher labor and input costs partially, higher reserve and the effect of the CARES Act withdrawal reduced net earnings. Because the energy indicators have been positive, I expect the DynaEnergetics segment revenues to increase sharply in Q1.

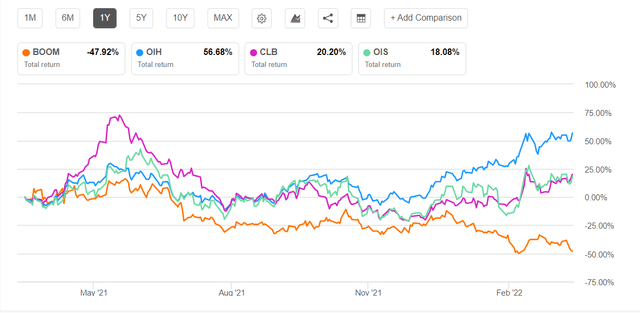

On the other hand, global supply chain bottlenecks and delivery delays can affect the NobleClad business adversely. Cash flows turned negative in FY2021. The management now targets to bring down debt-to-EBITDA, following expected growth in EBITDA and debt repayment. So, the stock price significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. The culmination of various factors would prompt investors to hold the stock.

Be the first to comment