When we last covered Diversified Healthcare Trust (DHC), we suggested that the time to be bearish was over but investors should play the long side cautiously via selling puts. Specifically, we recommended selling the June 2020 puts for $0.70. That in hindsight, turned out to be a better call versus going long directly as the stock moved much lower. With fourth-quarter results out and the stock more than 10% below where we were initially seeing the merits of a bullish bet, we decided to take a fresh look and examine if we could maintain our bullish perspective.

Q4-2019

DHC reported Q4-2019 normalized funds from operations (FFO) that were actually up from 2018.

Source : Company Press Release

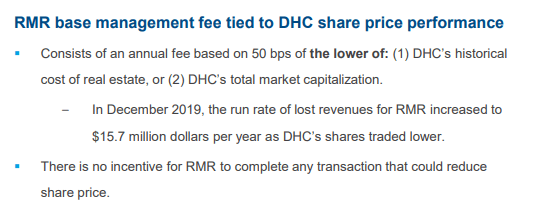

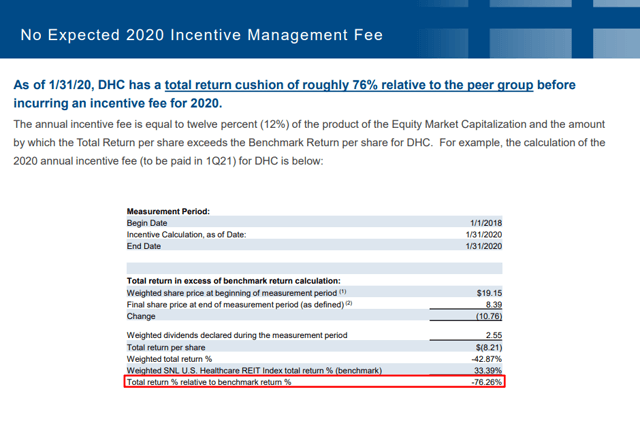

This increase is the result of the curious way in which DHC books its management incentive fees. These are all done in the fourth quarter of the year and as a result, Q4 FFO generally appears a lot lower than that of previous quarters. This time around, however, with the stock going substantially lower, its contract with RMR (RMR) management actually resulted in zero incentive fees being paid. This was a very large delta versus the previous year where it paid $40.6 million in these fees. Additionally, paying nothing to RMR in 2019 offset the big loss in rents from asset sales and restructuring with Five Star Senior Living Inc. (FVE). The FFO comfortably covered the dividends of 15 cents/share.

Asset Sales

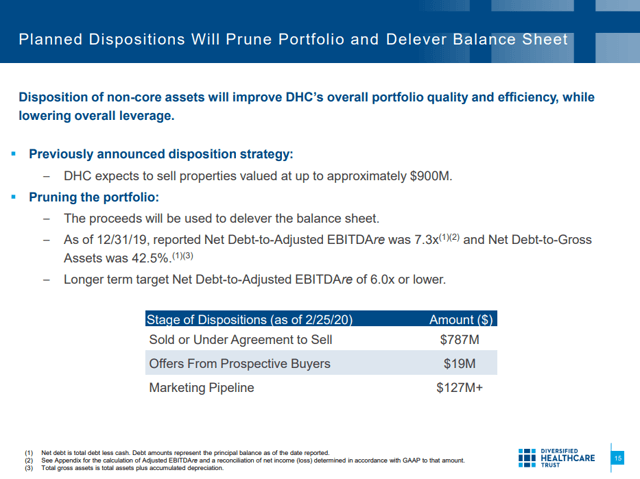

DHC continued asset sales at a furious pace and exceeded our expectations.

Source: Company Presentation

At current pace, DHC will be done with its deleveraging program by the middle of this year and it will have substantially reduced the risk inherent in the portfolio.

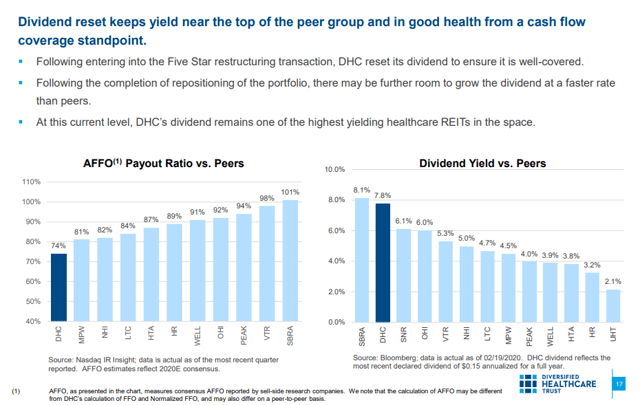

Dividend yield

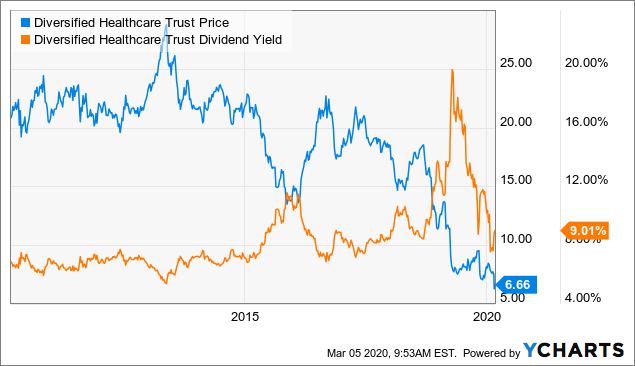

DHC now sports a rather hefty yield and one that is very well covered by its FFO and adjusted FFO (AFFO). The stock has actually fallen since this presentation and DHC now sports a yield of over 9%.

Source: Company Presentation

At 9%, this is a big stand-out for the healthcare group and offers a big cushion to buy this name.

Data by YCharts

Data by YCharts

Net Asset Value

We estimate that DHC’s property portfolio could liquidate for $12-14 a share. This is also close to analyst consensus NAV of $12/share. We have not adjusted this higher to account for the likely cap rate compression post the Fed rate cut. On the flip side, many in the healthcare space, including Physicians Realty Trust (DOC), trade at a substantial premium to NAV. Our view here is that a bidder is likely to emerge for these assets at some point and we don’t believe the bid will be in the single-digits.

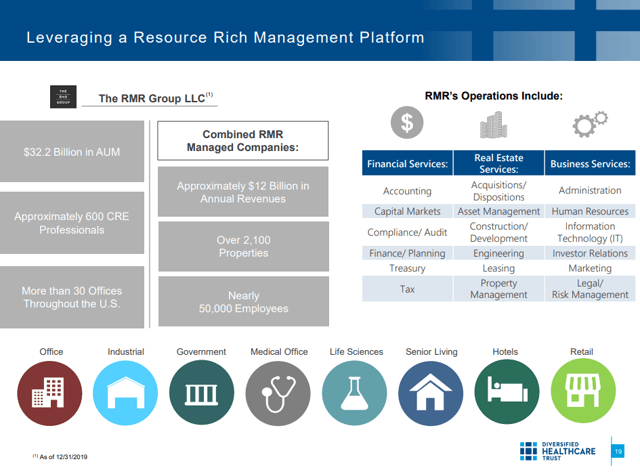

The External Manager Hurdle

When things go wrong everyone loves to blame the external management. In this case, however, we do believe that RMR messed up by letting FVE get so big as a percentage of DHC revenues.

Source: Company Presentation

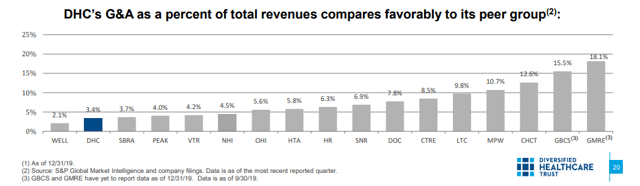

That said, DHC’s current shareholders are not paying RMR much in the way of expense reimbursements and fees.

Source: Company Presentation

As the chart above shows, G&A expenses are close to the lowest in the peer group. Furthermore, RMR’s interests are rather firmly attached to that of DHC shareholders.

Source: Company Presentation

The aligned structure prevents RMR earning anything in the way of incentive fees, unless DHC moves up substantially from here.

Source: Company Presentation

Based on this information, we believe that RMR has every vested interest to sell the company and remove this bad performing REIT from the exchanges.

Conclusion

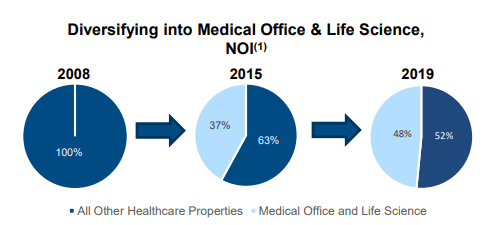

DHC now trades at close to 7X 2020 FFO. By comparison, New Senior Investment Group Inc. (SNR) trades at 15X 2020 FFO estimates and does not have a single medical office property. DHC derived about half of its 2019 Net Operating Income (NOI) from medical office and life sciences.

Source: Company Presentation

This is an astounding divergence in valuations. We would add that SNR’s portfolio is also fully an operating portfolio, unlike DHC’s which will be about evenly split between triple net and operating portfolios. There is no doubt in our minds that investors picking this up under $6.75 will do well over the next few years as DHC reshuffles the portfolio. The yield is a good solace as one waits for the inevitable sale.

If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

TIPRANKS: Buy.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with 4,400 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don’t miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long DHC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Trapping Value is long DHC.

HDO portfolio is not long DHC.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment