Michael M. Santiago/Getty Images News

Our view

In our recent in-depth analysis of The Walt Disney Company (NYSE:DIS) (“Disney”), we rated the stock as a “hold”. Since then, the company has released its earnings report for the final quarter of FY22 and the stock has fallen by a further 15%.

In recent years, Disney has experienced a period of significant disruption and change, with the traditional broadcasting business being the only source of stability and dependability. The earnings report for the final quarter of FY22 confirms that the temporary disruptions caused by the pandemic are gone. The Parks and Experiences business is booming once again, while content investment is uninterrupted and growing in line with pre-pandemic levels.

While the temporary disruptions are over, there are some changes which are fundamental in nature and remain ongoing. The launch of Disney+ has been a success with the company overtaking Netflix in terms of subscribers, however it continues to be loss-making and is yet to prove its ability to generate long-term shareholder value.

The recovery of Parks and Experiences business and the growth of Disney+, have helped drive revenues almost 20% higher than pre-pandemic levels. However, margins remain depressed and reported net earnings are still more than 70% below where they were three years ago. Free cash flow remains lower by an ever greater percentage margin, meaning the dividend remains on hold without any obvious near-term indication that it will resume.

Since we rated it as a “hold” back in September, we have sold our entire position. Our decision to do so was not driven by any change in our assessment of the business fundamentals, but rather by the relative value on offer following recent declines in other offerings which we considered to be better for our aggressive, contrarian style. However, we reiterate our longer-term “hold” rating.

After recounting Warren Buffett’s decision to sell Disney after only a 12-month holding period and warning investors about the risks of doing so, we inadvertently find ourselves in the same situation. If our overall performance turns out to be anything like Buffett’s, missing out on Disney is a mistake we are willing to make.

Business review

Since 2021, Disney has reported its performance across two major segments:

-

Disney Media and Entertainment Distribution (“DMED”) which is the company’s famous content creation and distribution business; and

-

Parks, Products and Experiences (“PEP”) which monetises the company’s content through physical experiences and products including its theme parks and cruise line.

A detailed overview of the segments is included in our recent in-depth analysis.

Disney Media and Entertainment Distribution

Content

Prepared by author. Data from company reports.

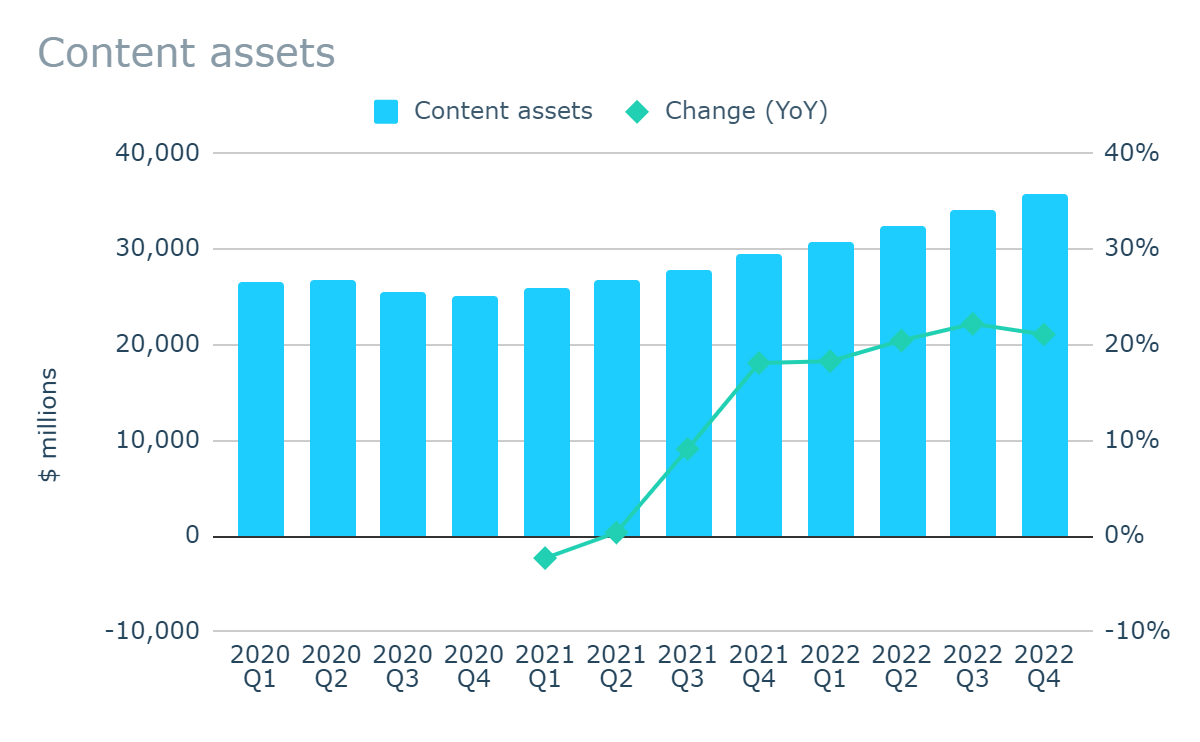

Content spending is the key driver of Disney’s business. While the company doesn’t provide disclosure on its level of content spending as part of its quarterly reporting, the value of content assets on its balance sheet provide an indication of whether overall content investment is increasing or decreasing.

Following a period of decline during the disruptions caused by the pandemic through FY20-FY21, the latest results confirm that Disney has returned to a period of increasing content investment. Investment has been accelerating through FY22, with year-over-year growth in content assets of over 20% in the final quarter of the year.

Whether this increased investment is positive or negative will ultimately depend on the ability of the company to monetize the content. Disney has a long history of doing so with great success, but the monetization model is changing with more content being created for the company’s direct-to-consumer streaming options. Converting content into shareholder value in a sustainable way is the challenge facing Disney and other players, as we reported in our recent analysis of Netflix (NASDAQ:NFLX).

Linear Networks

The Linear Networks segment includes the company’s traditional domestic and international television channels.

Prepared by author. Data from company reports.

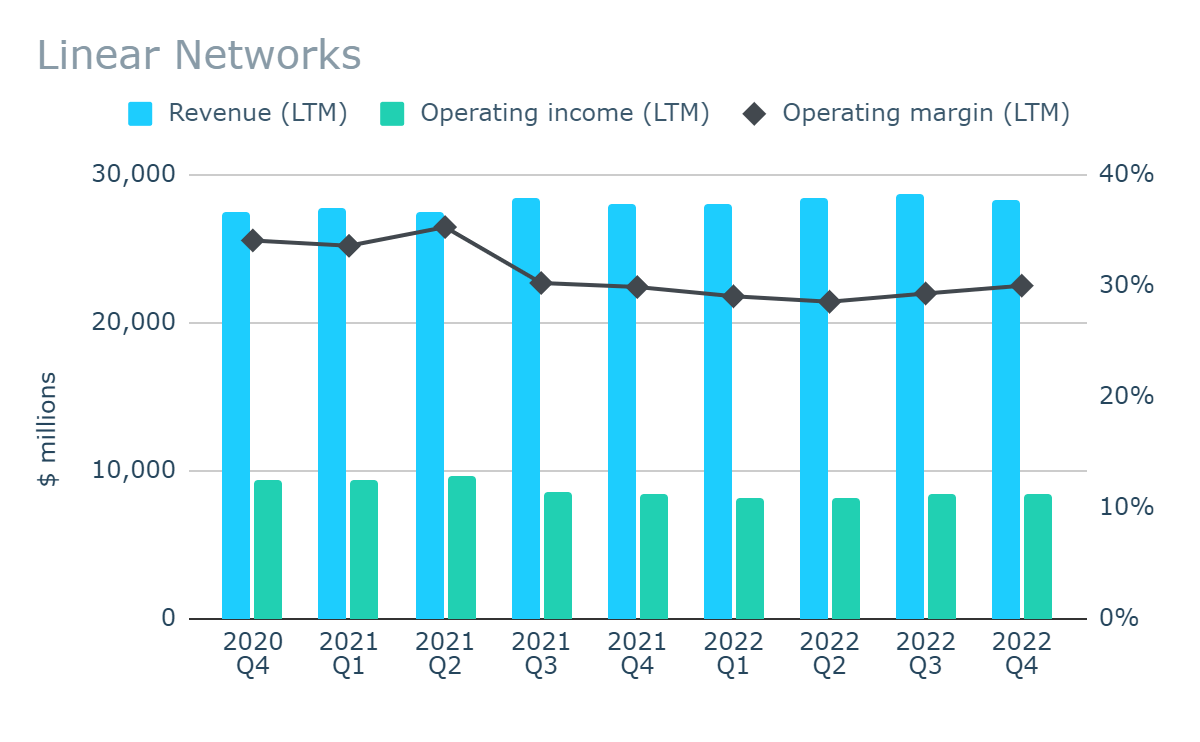

Due to the resilient nature of its revenues, Linear Networks continue to be a source of stability and resilience amidst a period of volatile times for the rest of Disney’s businesses. With revenues effectively flat in the past 12 months and margins holding steady at or near 30%, in-line with long-term averages, the business has provided some welcome stability for investors.

As we reported in our in-depth analysis of Disney, there has been a general downtrend in subscribers to Disney’s linear channels. In its quarterly earnings, the company reports only limited supplemental information meaning investors will need to await the company’s annual report to see if these trends continue. In the meantime, the fact that revenues and margins are holding steady are a positive sign that the segment is not in any significant decline.

Direct-to-Consumer (“DTC”)

The DTC segment includes the company’s streaming services Disney+, ESPN+ and Hulu. The company currently owns a 67% interest in Hulu, but has full operational control.

Prepared by author. Data from company reports.

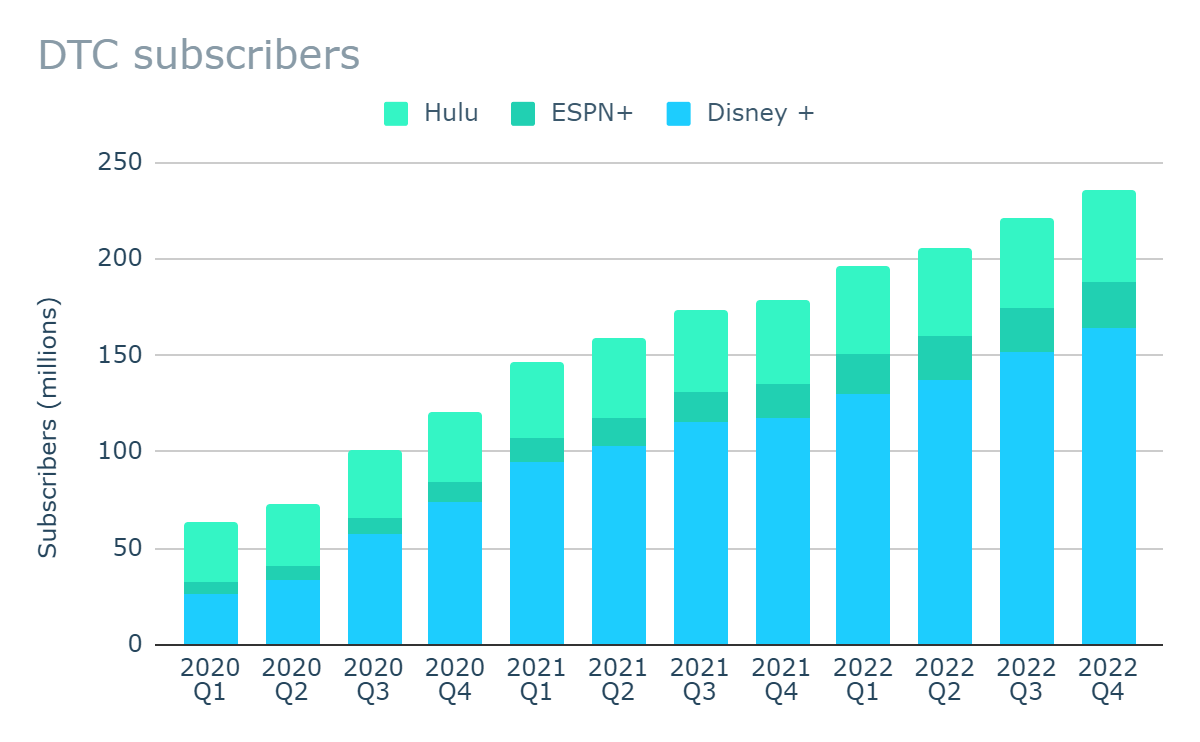

The company’s flagship streaming service, Disney +, continues to achieve meaningful growth. In the most recent quarter alone, subscriber count grew by 8% taking the total additions for the past year to 57 million, while subscriber growth for FY22 as a whole was 30%.

With more than 235 million active subscribers, Disney+ has now overtaken Netflix in terms of total subscribers. Growth is naturally slowing as the subscriber base expands. However, it continues to grow at an annual rate more than 5x its rival.

The company’s other, more mature streaming offerings also continue to grow but at a much lower rate than Disney+. ESPN+ added a further 7% in the final quarter taking total subscribers to over 24 million. However, there are signs that user growth is slowing from well in excess of 30% annually last year, to 14% as of the latest quarter.

Meanwhile, Hulu does continue to grow but at only a marginal rate. In the final quarter of the year, Hulu added only 2% in the final quarter of the year, taking total subscriber growth for the year to just 4%. At these rates, Hulu’s growth has slowed significantly from last year when it was growing at double-digits on an annual basis.

Prepared by author. Data from company reports.

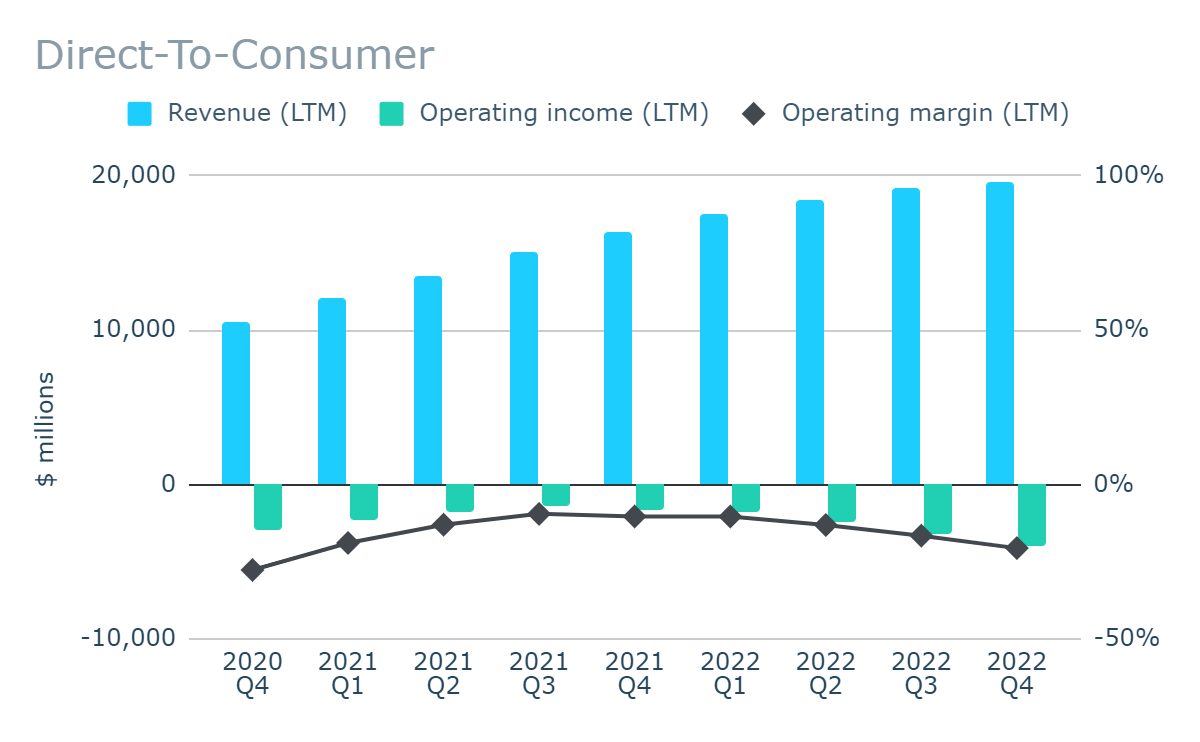

In spite of continued growth across all streaming offerings, the DTC segment not only continues to be loss-making, but has seen its margins continually worsen through FY22. A key driver of this is increased content costs, including an increased mix of original content, while the strength of the dollar is also having a negative effect on revenues and profits.

The cost of producing content for the streaming service not only affects the results of the DTC business, it is also negatively impacting revenues of Content Sales/Licencing segment as content is released directly to consumers through streaming platforms as opposed to being licensed to third parties (see Content Sales & Licencing section below).

Increasing losses against a backdrop of strong subscriber growth is disappointing, especially in the current macroeconomic environment which has the potential to put further pressure on household budgets, subscriptions, and corporate advertising budgets. Management does expect losses to narrow and for the segment to achieve profitability in FY24, though this is assuming no meaningful changes in economic climate. As things stand, that could turn out to be an optimistic assumption.

The introduction of an ad-supported tier is one of the drivers management hopes will move the business towards profitability. As we reported in our recent analysis, Disney will introduce its first ad-supported subscription tier on Disney+ on 8 December 2022. The ad-supported plan is being offered at around 30% less than the ad-free plan, with the hope being it will attract new subscribers and be more profitable than paid-for subscriptions when advertising revenue is included.

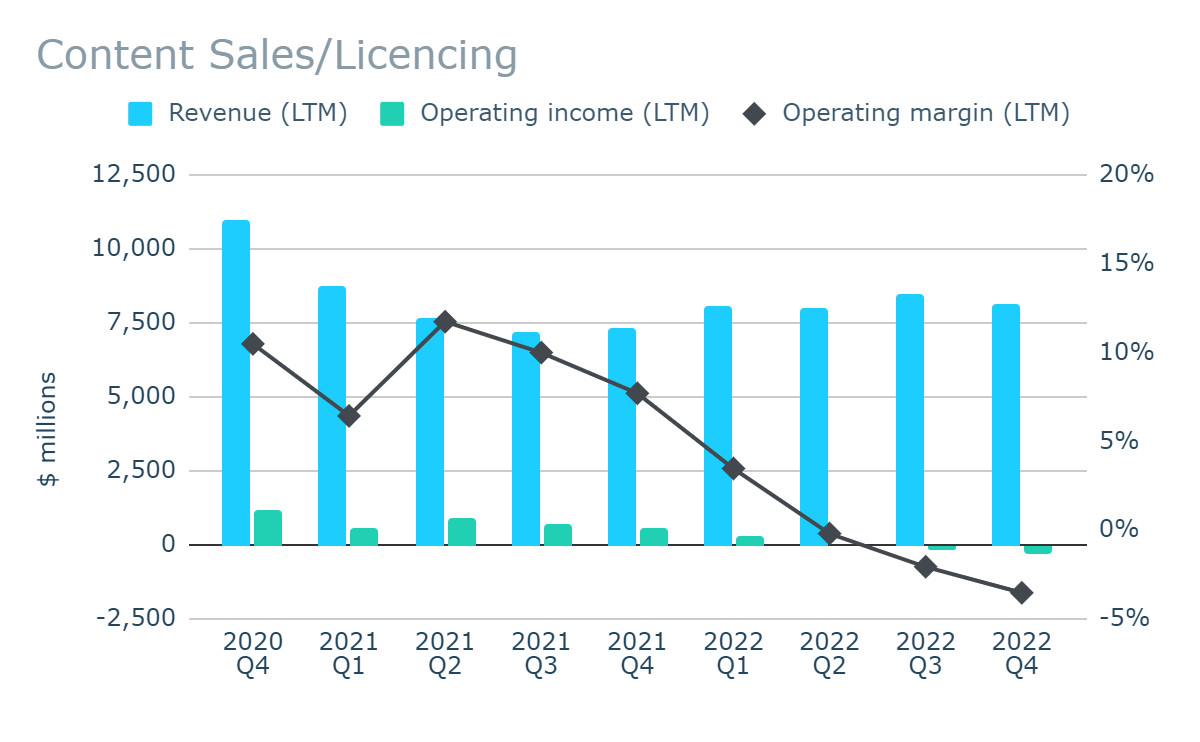

Content Sales & Licencing (“CSL”)

The rights to content which is not exclusively broadcast on Disney’s own linear channels or streaming services is sold or licensed to third party distributors including TV networks, streaming providers and movie theaters.

Prepared by author. Data from company reports.

While revenues have been growing through FY22, profit margins have been completely eroded and the segment is currently loss-making. These results are in stark contrast to the performance of the segment prior to the pandemic, where revenues had been consistently growing and margins were around 30%. The main drivers for the turnaround in fortunes include reduced sales from episodic TV and theatrical film content, as well as a shift from licensing to third parties to distribution on the company’s own DTC services.

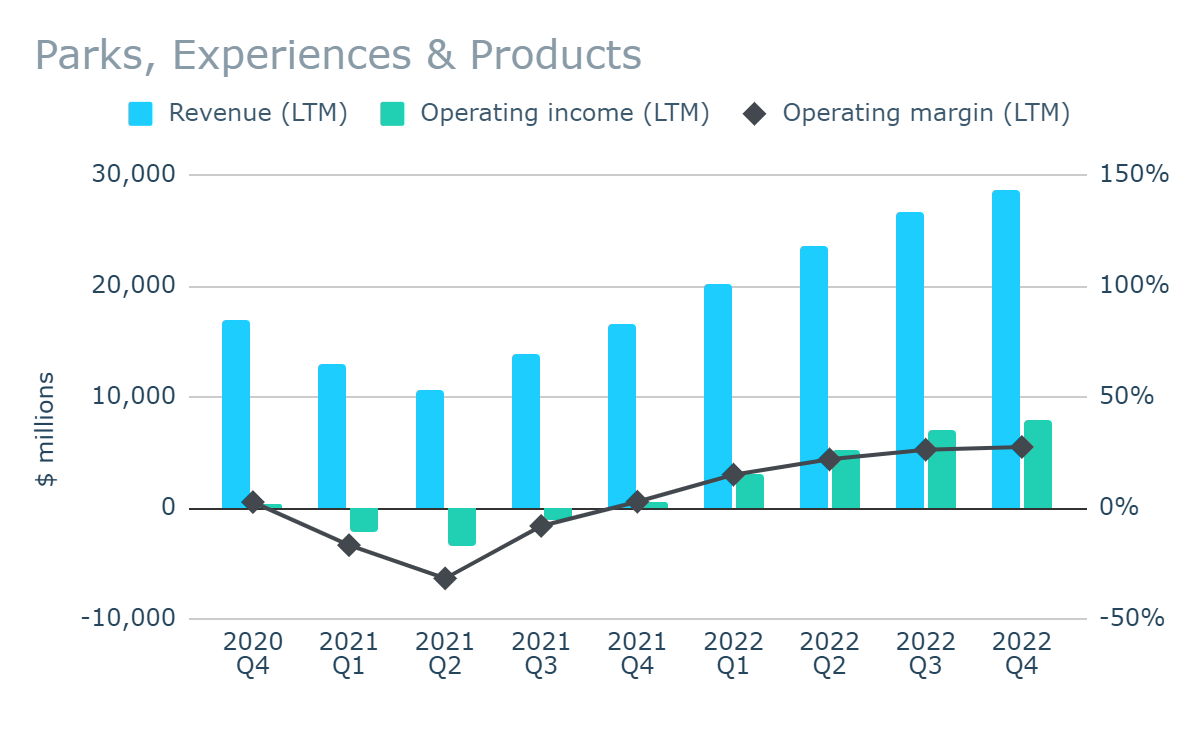

Parks, Experiences & Products (“PEP”)

The PEP segment includes the company’s domestic and international theme parks and resorts, Disney Cruise Line, and Disney Vacation Club, as well as consumer products which it sells directly or licenses to third parties.

Prepared by author. Data from company reports.

The PEP business has recovered strongly post-pandemic and has continually strengthened through FY22. Revenue in the final quarter of the year was up 36% on the same period last year, while operating profits more than doubled to $1.5 billion resulting in a record quarter for the business. Looking at the last 12 months, revenues are up over 70% and with operating margins at 28%, it has not only recovered from the pandemic but now exceeds pre-pandemic levels.

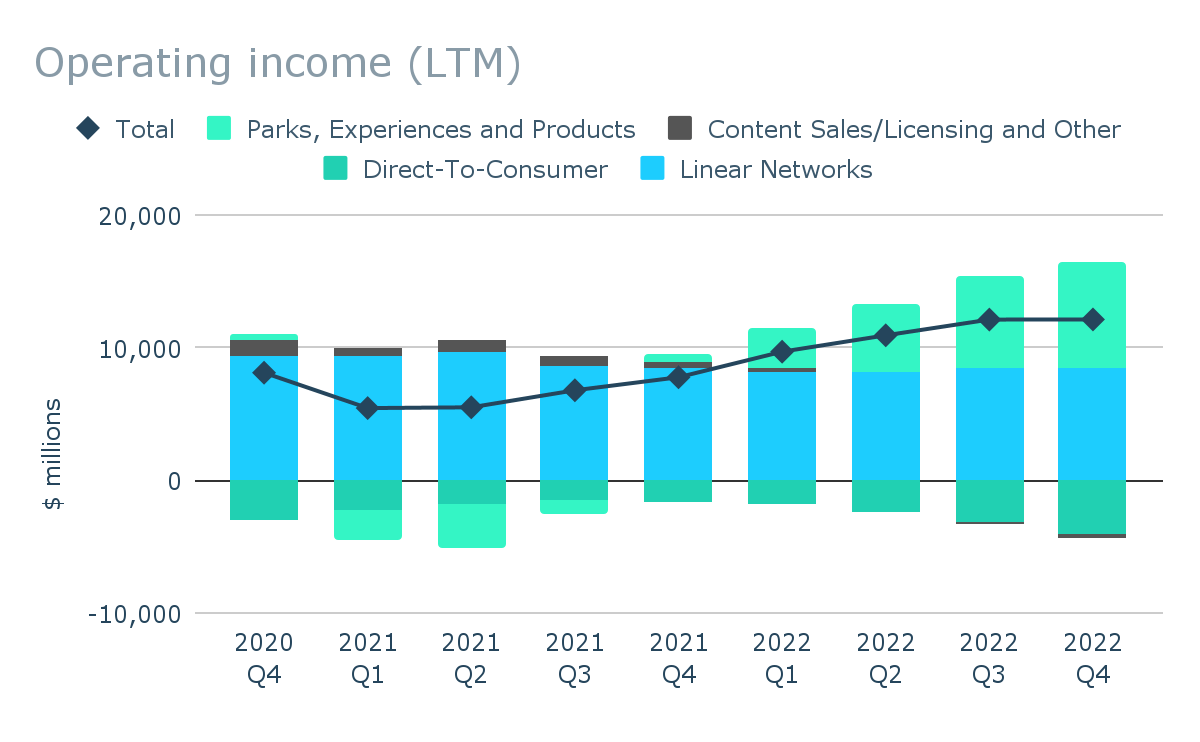

Overall profitability

Prepared by author. Data from company reports.

The mixed performance of the various segments means that overall profitability and margins remain well below pre-pandemic levels. While revenues beat pre-pandemic levels by 20%, total operating profit for the year is still lower by more than 30% as margins have fallen from 30% to 6% in the same period.

Linear Networks, though not exciting and receiving little fanfare, continues to be the foundation of Disney’s earnings. However, as a business which has limited growth prospects at best, Disney cannot rely on this to continue indefinitely and certainly needs another area to drive future growth.

The most obvious candidate for this is Disney+. While the service is achieving great success in attracting subscribers, it is yet to prove the model can deliver long-term shareholder value. As we covered in our recent analysis, Netflix is in a similar situation where it is yet to demonstrate that it can transform from a high-growth investment intensive business into one which generates significant free cash flow, though it is making initial steps in that direction. Subscribers and revenue growth count ultimately for nothing if cash is continually absorbed by increasing content costs.

Away from Disney+, the PEP business is fundamentally solid with good long-term prospects. The recent decline was purely due to COVID factors and is no reflection on its fundamentals. However, as a business with premium prices, there is potential it could see pressure on profits in the short-term amidst a challenging economic environment.

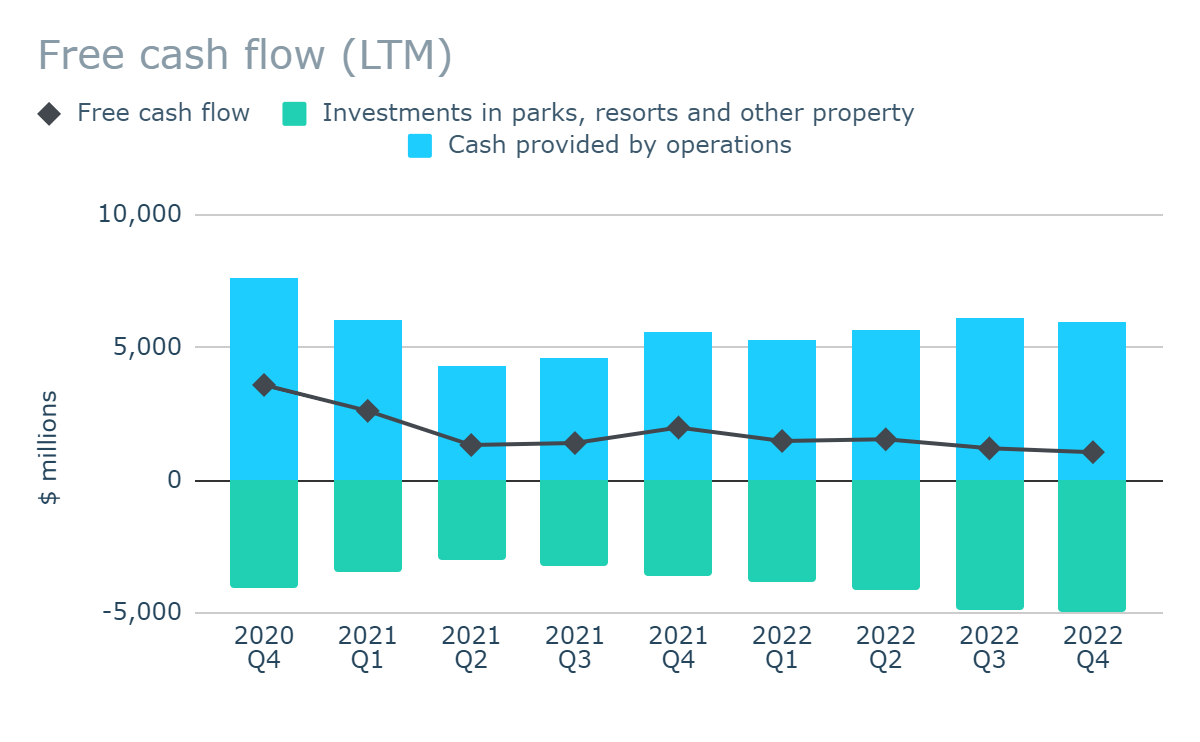

Cash Flow

Prepared by author. Data from company reports.

The disappointing profitability is translating into equally disappointing free cash flows. With capital investment also increasing, the company converted only 20% of its FY22 net income into free cash flow, compared to free cash flow conversion in excess of 70% pre-pandemic.

With cash flow under pressure, it is no surprise that the dividend remains on hold and that there has been no share repurchase activity despite the decline in share price. Disney is also still carrying the debt burden following acquisition of Twenty-First Century Fox Corporation (“TFCF”) of $70 billion, half of which was financed through debt. While net debt is gradually reducing, it still stands at $49 billion, equivalent to 3.4x EBITDA at FY22 levels.

Risks

The key risks are consistent with those set out in our in-depth analysis. A summary of these is included below:

-

TFCF acquisition – At $70 billion, the acquisition of TFCF was a significant investment. Since the acquisition, the company has experienced a period of challenging trading conditions which has made it difficult to assess the impact of the TFCF acquisition and it is unclear to what extent the acquisition can be considered a success at this point.

-

Disney+ – Disney+ was launched in 2019 and has attracted more than 150 million subscribers to date. While we expect the service to be a long-term success, it continues to be loss making and it has yet to be proven whether the model can be profitable.

Valuation

As of 11 November 2022, the company’s shares trade at around $90, giving a total market capitalization of $164 billion. Excluding the company’s significant cash reserves of $12 billion and investments of $3 billion, this implies a valuation of around $150 billion for the operating businesses.

Our approach to valuing operating businesses centers around determining the true underlying earnings power of the business or “owner earnings.” The recent disruptions and changes which have taken place at Disney make determining the true underlying earnings power of the company difficult.

Adjusted net income – net income excluding restructuring/impairment costs, goodwill amortization, and non-trading income – for the last 12 months was $5 billion. At this level, the operating businesses are valued at around 30 times earnings. Based on adjusted net income in FY19 (prior to the pandemic but following the acquisition of TFCF) of just over $16 billion, the operating businesses are valued at a much more attractive price-to-earnings ratio of 11 times.

It is reasonable to argue that Disney’s current true underlying earnings power is actually higher than current earnings. The mature businesses such as Linear Networks remain resilient, the company has had more time to integrate and extract value from TFCF, and it has successfully launched its own streaming platform which was only in its infancy prior to the pandemic. However, we do recognize that this has introduced additional risk and uncertainty.

For the purpose of our valuation analysis we have used pre-pandemic adjusted net income as our basis, but remain aware of the context in assessing the outcome. As always, we do not attempt to estimate an exact intrinsic value of the business, but consider the implied returns to investors under various scenarios:

| Valuation assumptions | Lower | Mid | Upper |

| Earnings growth | 3% | 5% | 7% |

| Re-investment rate | 25% | 25% | 25% |

| Price-to-earnings ratio | 17.5 | 20.0 | 22.5 |

| Total return (10Y) | 243% | 344% | 473% |

| Implied compound annual return (10Y) | 13% | 16% | 19% |

Our scenarios assume only modest growth in earnings of between 3% – 7% p.a. over the next decade. At these modest growth rates, the implied compound annual return is 13% at the lower end, increasing to 19% at the upper end.

Bearing in mind that this is based on pre-pandemic earnings, which are far above current earnings, and that the company is still in the stages of establishing the profitability of its streaming offerings, we assign an uncertainty rating of “moderate” to the outlook.

Conclusion

Opportunity cost means that every investment we hold is continually competing against all other opportunities in the market. The recent declines, particularly in tech, convinced us that there were opportunities which were better suited to our aggressive, contrarian approach and were more aligned to the risk/return profile we seek from our investments. For that reason, we sold our entire Disney holdings.

The key question for current and would-be investors is whether Disney is a better or worse business than it was pre-pandemic. There are reasons to believe it is, but there are also risks and uncertainties. Even so, we expect that long-term investors will do just fine and the price relative to the business fundamentals and opportunities, especially long-term, make it a “hold”.

Be the first to comment