FelixCatana

Investment thesis

Although Disney (NYSE:DIS) is 50% far from its all-time high it might be wise to wait for a further drop before opening a position. Since the outbreak of the pandemic Disney has not yet been able to fully recover, and new problems have been incurred in 2022. The company often emphasizes the growth of Disney+ users but does not make explicit the increasing losses related to this segment. Recently, there has also been a souring of relations with the Florida Senate (Disney has 60,000 employees in Florida) and the LGBTQIA+ community, and all of this will lead to the repeal of the Reedy Creek Improvement Act. The problems do not end there, however, as the price of Disney theme parks is rising higher and higher, effectively becoming an increasingly expensive destination. Based on my assumptions, Disney’s fair value is between $75 and $90 per share, so the company is currently overvalued. Disney’s competitive advantage could be challenged if these issues are not resolved in the next few years.

The problems that plague Disney

Since Bob Chapek became CEO of Disney in February 2020, the company has made a series of changes that currently seem to be leading to less than positive results. In his defense, however, it must be pointed out that Chapek began his tenure in a very complicated time, which was during the outbreak of the pandemic. Running Disney when the parks were forcibly closed and film production was at a standstill would have challenged any CEO. I will now analyze the three main problems that Disney will have to solve and finally there will be a more quantitative approach that will contextualize what has been said.

Disney+ is still not profitable

Focusing efforts on the development of the Disney+ platform was an almost unavoidable choice on Bob Chapek’s part because of forced closures. The main problem regarding Disney+ is not the platform itself, which has by the way been a great success among fans, but it is how much the company earns through it.

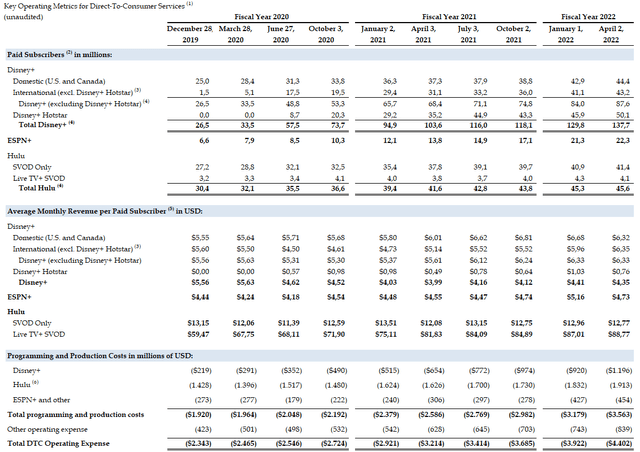

The segment related to Disney+ is still unprofitable as programming and production costs exceed total revenues. Since Disney+ features 137.7 million users it is rather curious how the company fails to generate profits, which is why it announced that by this year it will also provide in the US a subscription in which advertising will be featured. The subscription with advertising will also be available internationally in 2023. How this change will affect future revenues is not yet clear, but the company expects Disney+ to be profitable by 2024. The problem with this forecast is that it considers that users may become between 230 million and 260 million, about 100 million more in 2 years. Honestly, this forecast seems too rosy to me, considering also that user growth will not be able to follow the same trend as in the past since there are already many subscribers. Assuming that by 2024 it can become profitable and that new subscribers will not reach 230 million, the only way to achieve this goal would be to raise prices or insert a lot of advertising, but at that point we need to realize whether consumers will be okay with this. Finally, I would like to point out that the Q2 2022 loss regarding Disney+ was $597 million, far higher than previous losses. Going backwards we can see that operating losses decrease, bringing to the surface a puzzling reality: the more subscribers increase, the higher the losses. Disney’s reports did not specify the composition of Disney+ operating costs, but their upward trend is worrisome. It is true that every business needs time before it becomes profitable, but here it seems that as time goes on, the loss gets bigger and bigger. Bob Chapek is betting a lot on this line of business, so I am rather surprised at this negative result. Things may change with the inclusion of advertising, but it is too early to predict that.

Disney disputed between the Senate and the LGBTQIA+ community

In early 2022, Disney had to prepare for a bitter controversy involving the Florida Senate and the LGBTQIA+ community. But what happened? In March 2022, a new law was promoted by the Republican Party and Florida Governor Ron DeSantis called “Don’t Say Gay.” The main purpose of this law is to exclude the possibility of talking about topics related to sexual orientation in public schools until the third grade. Obviously this law has not been well received by the LGBTQIA+ community, especially in Florida. Since in the U.S. one of the ways to oppose bills is public opposition from large corporations, it was expected that Disney would release a statement on the matter, which did not happen. The reasons why public opposition from Disney was expected are essentially two:

- Disney employs about 60,000 people in Florida, making it the largest employer in the state.

- Disney over the past few years has increasingly included themes related to the LGBTQIA+ community in its products. Its support in this respect has been sound, but when there was to be opposed against the Senate, silence was preferred.

The choice of silence can be attributed primarily to Bob Chapek, who preferred not to take a position on political matters that do not directly involve Disney. Here are his words on the matter:

“We were opposed to the bill from the outset, but we chose not to take a public position on it because we thought we could be more effective working behind the scenes engaging directly with lawmakers on both sides of the aisle. I understand our original approach, no matter how well-intended, didn’t quite get the job done. But we’re committed to supporting the community going forward.”

Following these statements, LGBTQIA+ employees at Pixar decided to take a public stand against Bob Chapek, expressing all their disappointment and concern about Disney’s lack of public opposition. At that point, Bob Chapek realized that he had made a mistake and first publicly apologized and then opposed the new Republican Party law. In spite of this, it was already too late, however, and the trust of some LGBTQIA+ employees was broken. However, Disney’s problems related to this matter unfortunately do not end there. In fact, shortly thereafter Disney was also notified that its special rights granted by the Reedy Creek Improvement Act will be repealed in 2023. The consequences of this decision will heavily affect Disney’s future and are worth devoting a separate paragraph to.

Reedy Creek Improvement Act

To understand how much this decision will affect Disney’s future, it is necessary to understand the dynamics that led to the construction of Walt Disney World. Walt Disney’s primary goal was not to create a theme park, but to create a real city that would be independent of government and autonomous in its decisions. In 1967, the Florida legislature passed the Reedy Creek Improvement Act and gave Disney full autonomy over the land where today’s Walt Disney World is built. But what is meant by autonomy? Disney must cover all costs related to municipal services such as police, garbage disposal, fire department and more, just as if it were an autonomous city. In this case, the advantage of the state is twofold: on the one hand, the citizens of Orlando do not pay taxes to finance the work or services carried out in the theme park, and on the other hand, Disney guarantees a significant influx of tourists to the Orlando area and tens of thousands of jobs. But what, on the other hand, is the advantage of Disney? The main advantage is the freedom to build within Walt Disney World, thus reducing bureaucratic problems. The autonomy to build what Disney wants within this special area has been the reason the park has received substantial investment and has grown larger and larger. By removing the Reedy Creek Improvement Act, Disney would have to submit to the rules of local districts to carry out new construction and expansion, thus limiting their operations. This is quite a problem because it could push Disney to direct its investments to other theme parks and cause the park in Orlando to stall on improvements.

Former CEO Bob Iger, who led Disney for 15 years, also recently spoke out on the issue regarding the ” Don’t say gay” law. For Bob Iger, Disney should have taken immediate action by publicly opposing this bill. These are his words on the matter, “A lot of these issues are not necessarily political. It’s about right and wrong.”

Parks raise prices but do not improve efficiency

If we judged the efficiency of the parks by the revenues of the last quarterly Disney has certainly done a very good job, however, I think the situation is more complex than it may seem. Since the park reopened after the pandemic something has changed in the atmosphere of the Disney parks, and the problem stems from less attention to customers and a general increase in the cost of the park. It is true that due to current Covid-19 regulations the park has been restricted since reopening, but as of now the situation does not seem to have improved, quite the contrary. Since pre-pandemic there have been many changes, but I think these three are the most important: The removal of the Magical Express, the introduction of fast lines (lightning lanes), and the increase in the price of tickets and lodging.

- The Magical Express was a bus that transported visitors for free from the Orlando airport to Disney-owned hotels. In January 2022, however, this service was cancelled, and the Magical Express was replaced with the Mears Connect, a similar but paid service. This change obviously did not sit well with visitors, who will now have to shell out $30 to $60 per person to reach Disney-owned hotels. For a family of four, this is no small additional expense because it could exceed $200.

- The introduction of lightning lanes was perhaps the biggest mistake, as it creates inequality among visitors. To understand why the lightning lanes are making Disney World a more élite experience, we need to understand how the lines worked before. Initially Disney World included in the price of the ticket a service called a fast pass in which one could skip the line early for some of the visitor’s favorite rides as long as he or she followed set times. This service which today take the name Genie plus is still available but is no longer included in the ticket price and one has to pay $15 in Florida and $20 in California. The problem related to Genie plus is that in addition to charging about $60-$80 more for a family of 4 is that it does not include the ability to skip the line early for popular attractions. If you want to skip in advance the line of even the most famous attractions you have to buy an additional pass called lightning lanes. This pass costs $10-$15 per visitor per ride, and it tends to greatly enhance the park experience for anyone who purchases it. The main problem with lightning lanes is that it creates frustration with those who may be waiting hours for an attraction and have to see a line of people belonging to the lightning lanes pass by. This new system created by Disney tends to greatly favor those with greater economic possibilities, while forgetting that in this way the vast majority of park visitors may have a negative experience and not return.

- The price of park tickets has continued to increase for years and will continue to do so in 2023. The 2023 price range will always vary between $109 and $159 per ticket, however, the annual average per ticket has increased: you will hardly find a ticket at $109 compared to 2022. The price increase, however, affects not only tickets, but the entire Disney experience. While it is true that with such high inflation an increase was inevitable, however, the situation seems to be getting out of hand. To understand the nature of this phenomenon I suggest you read this article I have just attached: it takes inspiration from some data posted in the UK DailyMail. It would seem that an average American family cannot afford a vacation to Disney World since the cost of 5 days is around $8,480.

At the moment looking at the latest quarterly report there is no doubt that this strategy adopted by Bob Chapek is having very positive results on the company’s profitability through its theme parks, but I personally do not think it can last for long. The Disney theme parks have been closed for many months and obviously families have postponed their trip; therefore, the huge turnout seen now is also due to people who would have liked to visit the park in the past but could not. However, travelers visiting the park today will have a different experience than they would have had visiting it before the pandemic, and this may affect the possibility of their eventual return. The fact that to date there is a large turnout in the parks is certainly positive, but I think it is more important to understand whether this turnout is only momentary or may continue in the coming years.

In my opinion, it seems that Disney is completely changing the values that have distinguished this company over the years and made it one of the best in the world. Walt Disney’s goal was to involve all families, but with the new policies adopted in the parks it seems that the real fun is reserved for those who are willing to spend more. Universal Studios is just a stone’s throw away from Disney World : once you lose the customer, it is not enough to lower prices again to change his mind.

Disney from a quantitative standpoint

Profitability

In the first part we looked in detail at Disney’s operating problems, but now it is time to analyze the numbers of this company.

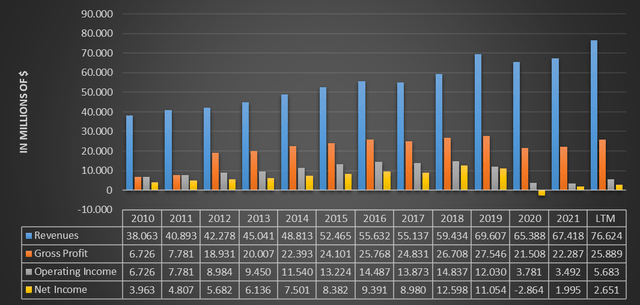

The company’s revenues and profits until 2019 were on an upward trend, however, the situation completely changed with the arrival of Covid-19. In fiscal year 2020 Disney even went into a loss, while in 2021 there was an initial recovery. Within Disney’s recent quarterly reports, the company often points out that the difficulties related to the pandemic are still present, and in addition to negatively affecting revenues they also affect the increase in costs to cope with the restrictions due to Covid. The biggest problems affect parks located in China and Japan, two countries that are still maintaining high health security. In all this, also negatively affecting earnings from 2019 onward is Disney+ (with increasing losses) and the greater weight of depreciation and amortization following the $71.3 billion acquisition of 21st Century Fox.

Looking at Disney’s LTM revenues have exceeded 2019 results, which is positive, but earnings still remain very low, which is why the current P/E is well above the historical average.

Discounted cash flow

Having gotten to this point we have seen Disney’s main problems and how much money this company generates, but what is it worth? To answer this question I will use a discounted cash flow, so as to provide a present value for future cash flows. I will consider 2 different scenarios:

In the first scenario there will be free cash flow that will take several years to regain pre-pandemic values due to the unprofitability of Disney+ and restrictions in the Disney parks. Once past levels are reached, the growth rate will be 7% until 2031.

In the second scenario, free cash flow will increase faster because we consider that Disney+ can be profitable by 2024 and the parks will continue to get the same crowds if not higher. I personally find this scenario less likely than the first.

First scenario

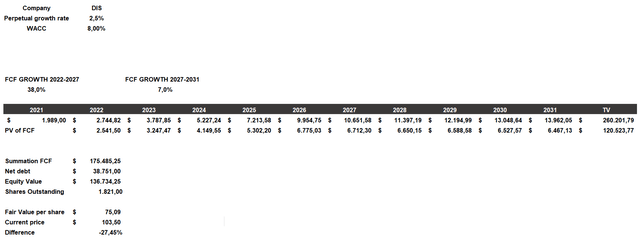

This scenario will be constructed as follows:

- The cost of equity will be 9.75% and will take into consideration a beta of 1.24, country market risk premium of 4.20%, a risk-free rate of 3.50% and additional risks of 1%. The cost of debt will be 4.32%.

- The capital structure considered is 70% equity and 30% debt, and the resulting WACC is 8%.

- Free cash flow will grow a lot in the coming years but only because it has had a drastic drop from the past. In 2026 it will reach 2018 values and from there on the growth will be 7%, a figure I consider reasonable.

According to these assumptions the fair value is $75.09 per share, suggesting the company is overvalued. Certainly, this is not a particularly positive scenario, but it is the one that I personally find most plausible.

Second scenario

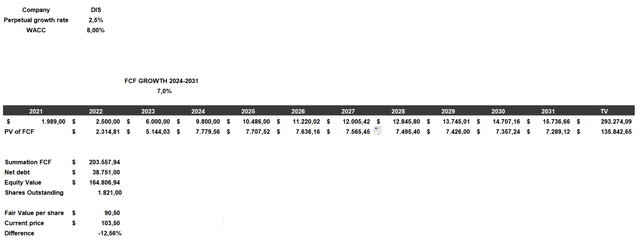

In this second scenario the WACC will be the same, what changes is how quickly the company will be able to generate free cash flow as high as in the past. In this scenario we consider Disney+ profitable by 2024 and strong revenues from theme parks. Basically by 2024 free cash flow will reach all-time highs, and then it will always grow by 7%.

Following these assumptions of a quick recovery, Disney’s fair value is estimated at $90.50 per share, basically the price reached a few days ago. In this scenario I think I am being overly positive but I do not consider it entirely unlikely. Personally, if I were to invest in Disney, I think I would open an initial position at an intermediate price between $75 and $90, with the understanding that I would have to average it down in case of further falls. Since it has recently exceeded $100 per share, I believe the company is overvalued by 15 to 20%, so my opinion is a sell.

Be the first to comment