aureliefrance

Thesis

We urged investors to be wary about buying into the surge in The Walt Disney Company (NYSE:DIS) stock in August, even though we highlighted it has likely bottomed out in July.

Notably, DIS has given back most of its summer gains, falling more than 25% from its August highs through its September lows. The magnitude of the decline has likely stunned investors who bought its momentum surge toward its August highs.

Our analysis suggests that the pullback has proffered investors who missed its July bottom another opportunity to add exposure to its recovery. Furthermore, management is confident that Disney remains well-positioned to overcome the worsening macroeconomic headwinds. Notwithstanding, we believe the market justifiably digested DIS’s summer gains to de-risk its execution risks in the near term, given the uncertain impact of the coming global recession on consumer discretionary spending.

Furthermore, Disney’s forward profitability estimates remain well below its pre-COVID highs. Therefore, Disney’s performance in its upcoming ad-supported version for Disney+ would be keenly watched. While the company is considering a gambling expansion in its ESPN+ product, we believe it’s still too early for investors to factor in meaningful adjustments to Disney’s profitability at this juncture.

Still, we like the extent and speed of the recent pullback, as we postulate it has likely shaken out weak hands adequately, offering investors less aggressive entry levels to add exposure.

As such, we revise our rating on DIS from Hold to Buy, with a medium-term price target (PT) of $120 (implying a potential upside of 25%).

DIS’ Valuation Is More Well-Balanced After The Pullback

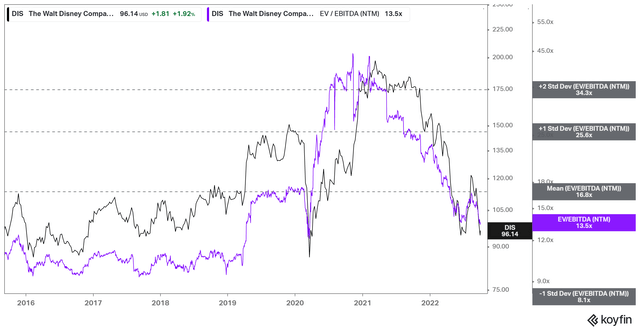

DIS NTM EBITDA multiples valuation trend (koyfin)

We believe investors can glean that DIS is no longer overvalued from its early 2021 days, as the pandemic-induced stay-at-home bubble lifted DIS’ valuations to unsustainable levels.

It’s also important to consider that DIS has consistently traded well below its 10Y NTM EBITDA multiples mean (16.8x) before the onset of the pandemic.

Therefore, the rejection at its August highs as its valuation recovered to its 10Y mean should not be surprising. We believe it indicates that the market remains tentative over CEO Bob Chapek & team’s execution to lift its weakened profitability through the cycle. As a result, we deduce that the de-rating is justified to mitigate the risks emanating from the worsening macro challenges.

Disney Remains In Recovery Mode

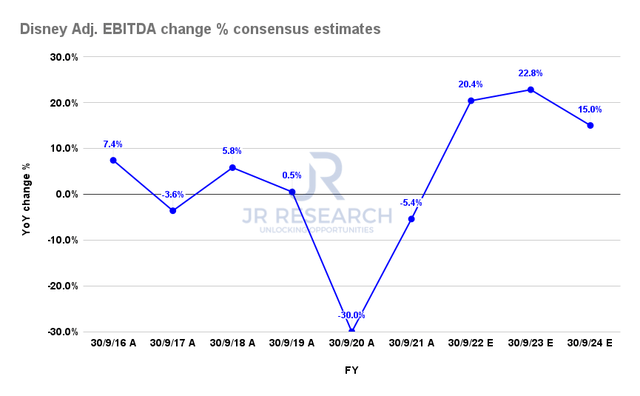

Disney Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

We gleaned that the consensus estimates (bullish) suggest that Disney’s adjusted EBITDA recovery remains on track, despite worsening macroeconomic headwinds.

Management is also confident that the recovery in its studio and parks business is resilient. Notwithstanding, we urge investors to parse management’s commentary at its upcoming earnings release for Q4 to assess the potential impact moving ahead.

However, we believe the market has de-risked its entry levels, given the battering from its August highs. Hence, we remain cautiously optimistic that Chapek & team can continue its recovery momentum from the current levels even with some near-term uncertainties.

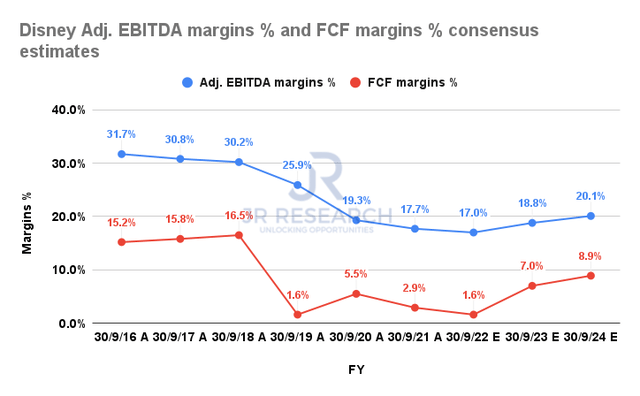

Disney Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

Consequently, we expect the improvement in Disney’s margins profile to underpin its current valuation.

However, an unexpected delay in its recovery cadence could impact DIS’ valuations further if management’s execution is subpar. Therefore, investors need to be highly convinced of Disney’s execution through the cycle, as we don’t think DIS is undervalued.

Is DIS Stock A Buy, Sell, Or Hold?

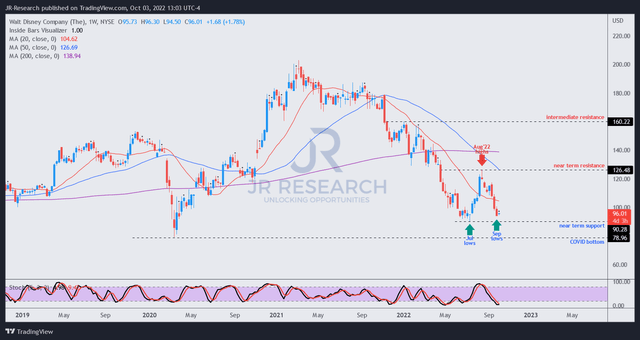

DIS price chart (weekly) (TradingView)

As seen above, the selling from its August highs sent DIS spiraling down close to its July lows through September.

However, we assess that its July bottom seems robust, in line with our thesis of its medium-term bottom. Moreover, coupled with oversold technicals, its price action should support a constructive consolidation phase and underpin its recovery from here.

Therefore, we believe revising our rating on DIS from Hold to Buy is appropriate.

Be the first to comment