aureliefrance/iStock Editorial via Getty Images

Since we first recommended The Walt Disney Company (NYSE:DIS) in late February, the stock has been down some 32%, primarily due to multiple compression across the market. Disney remains one of our favorite stocks to own in the media and entertainment industry. Disney remains the global leader for its high-quality family-oriented entertainment franchise. We continue to remain bullish on Disney and its multiple growth drivers. Disney stock will likely be driven higher and outperform its peers by the ongoing recovery in its theme parks business and subscriber growth for its Disney+, Hulu, and ESPN+ franchises. Theme parks in Asia have reopened recently, are still recovering from the pandemic lows, and are yet to see visitors at pre-pandemic levels. We also expect DIS studio business to recover with new film releases driving robust attendance. Overall, we expect attendance at various Disney properties to rise as capacity restrictions are eased all over the globe. In addition, we also expect Disney+ to add subscribers at a rapid clip as they launch the services in more countries in the coming quarters. Disney+ is a must-have for many families.

Disney reported a solid 3Q22 quarter, beating expectations. We expect Disney to beat and raise expectations over the coming year, driven by the pent-up demand as the pandemic eases around the globe. The DIS stock trades at a discount to Netflix (NFLX), despite having more total subscribers for its properties. Therefore, we recommend investors buy Disney shares on any weakness.

Beats Netflix for the first time, but not the last.

Disney+ beat Wall Street expectations last quarter by adding 14.4M subscribers. Disney+ signed up 4.6M subscribers, more than expected. In contrast, competitor Netflix lost around 1M subscribers last quarter. The added subscribers boosted Disney’s total portfolio of streaming services to 221M subscribers (including Hulu, ESPN+, Hotstar), edging ahead of Netflix. We believe Disney is at the top of its game in media and entertainment. The company is adding new content to its streaming services. Simultaneously, Disney is entering the ad adoption industry before Netflix. Disney announced plans to launch a new ad-supported subscription of $7.99 in December. We expect Disney+ to continue gaining market share to become the world’s largest video streaming subscription platform.

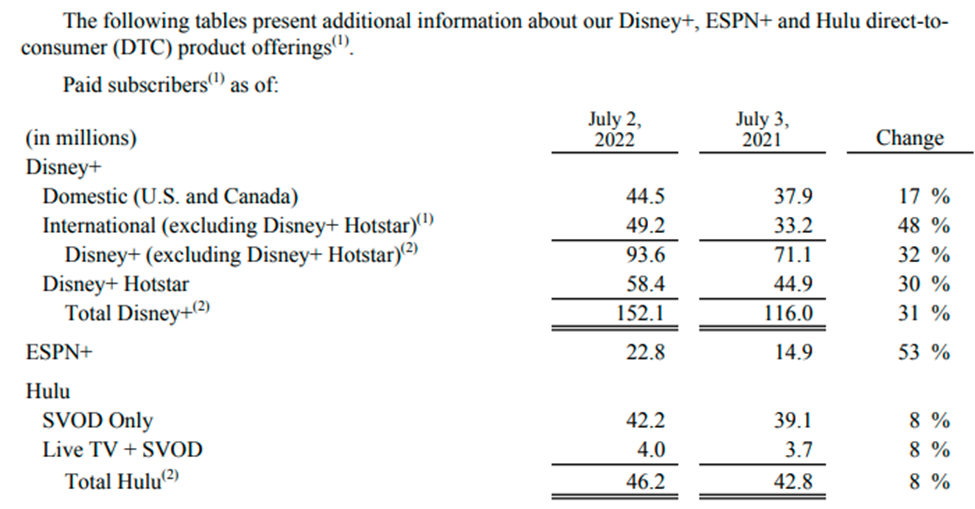

The following table shows Disney’s revenue from its media and entertainment division.

Disney presentation

Regional expansion is another growth catalyst

Disney+ has expanded its service to 42 new countries and 11 new territories in Central Europe, the Middle East, South Africa, and North Africa. Expansion into new territories will be a significant catalyst to drive subscriber growth. Disney+ is now available in 60 countries across EMEA. Disney+ continues to offer high-quality and family-friendly programming and is becoming an alternative to Netflix in many countries.

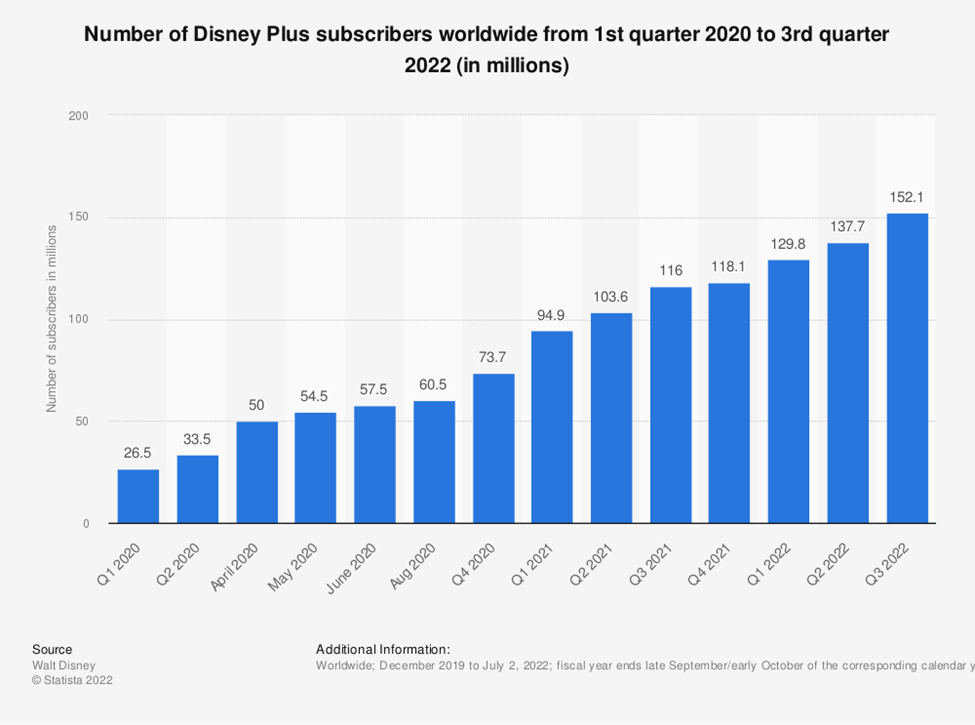

The following graph highlights the increasing number of Disney+ subscriptions from 1Q20 until 3Q22.

Statista

Disney+ is quickly gaining the spotlight as the new “Netflix” with more affordable subscriptions, new content, and, as of recently, global accessibility. We expect Disney+ to be a significant growth driver in the future for revenue, earnings, and cash flow and recommend investors buy the growth.

Parks remain a primary revenue driver

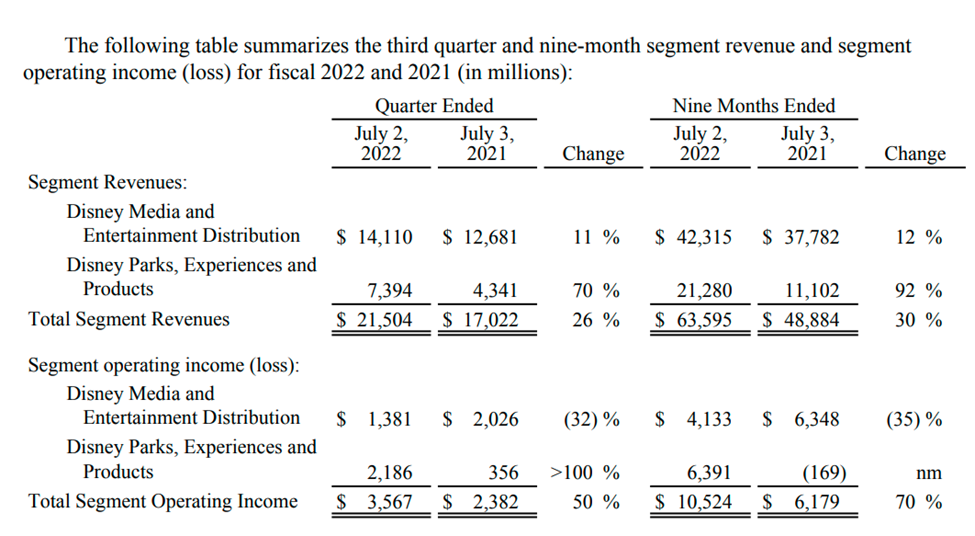

During F3Q, Disney’s Parks division drove most of the upside to revenue and earnings and remains a key growth driver for the company. The Parks division made a considerable comeback last quarter even though Asian parks remained closed for most of the quarter.

Park revenue increased to $7.4B compared to $4.3B a year prior, achieving a 70% growth year-over-year. The Parks business is recovering from its pandemic low due to pent-up demand. We continue to expect a recovery in the theme parks business for the rest of the year and into 2023, driven by a recovery in international parks, increased cruise ship occupancy, and international visitors returning to domestic parks in the U.S. at pre-pandemic levels. In addition, the domestic parks are yet to reach the level of pre-pandemic attendance from domestic customers. Finally, the company recently launched the Disney Wish cruise ship with healthy demand and much fanfare. We expect Disney Parks continue to generate more revenue in coming quarters, despite inflationary pressures.

The following table outlines Disney’s revenue by segment.

Disney presentation

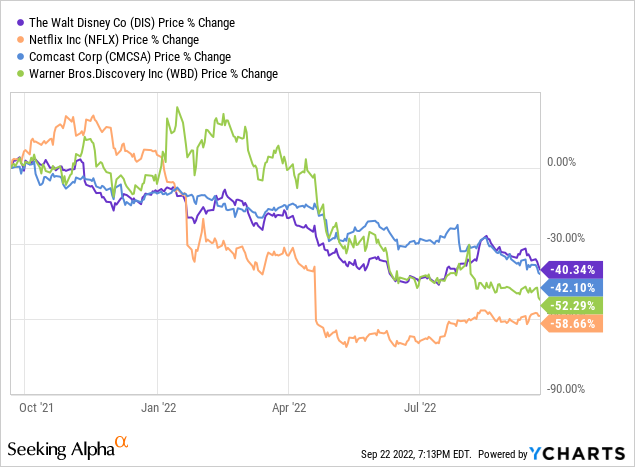

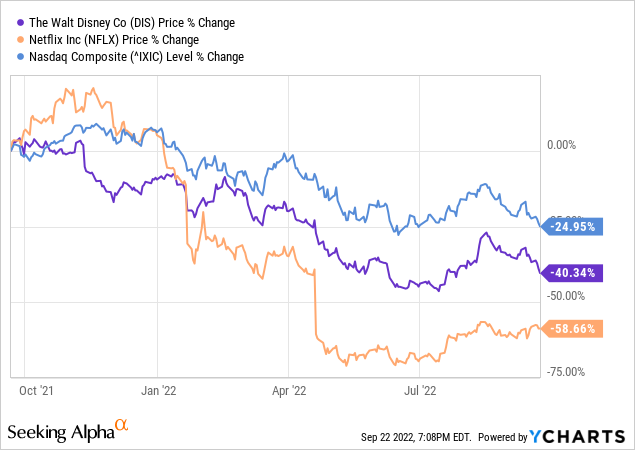

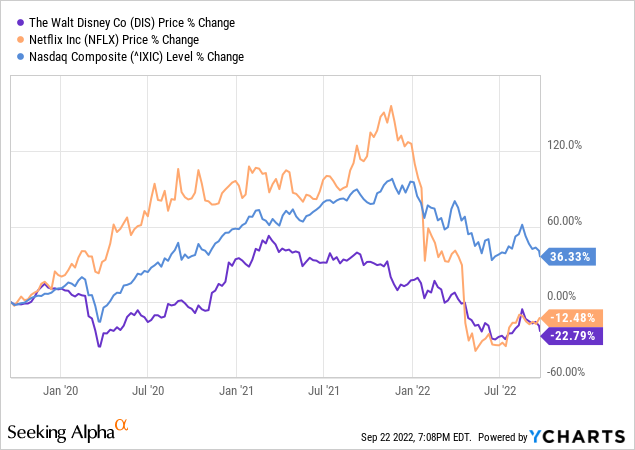

Stock Performance

Disney stock has been in a downward trend, declining 40% over the last twelve months, while Nasdaq declined 25%. Over the past three years, Disney declined about 23%, while Nasdaq grew 36%. However, we are not worried about Disney stock over the next several years. We believe the company’s worst days are behind it as Disney+ grows its subscription business while expanding globally. The downward trend is not specific to Disney but has also taken a toll on Netflix. YTD, Disney’s main competitors, have dropped lower than Disney; Netflix by about 59%; Comcast (CMCSA) by 42%; and Warner Bros. (WBD) by about 52%.

The following chart shows Disney’s performance YTD among competitors.

Ycharts Ycharts Ycharts

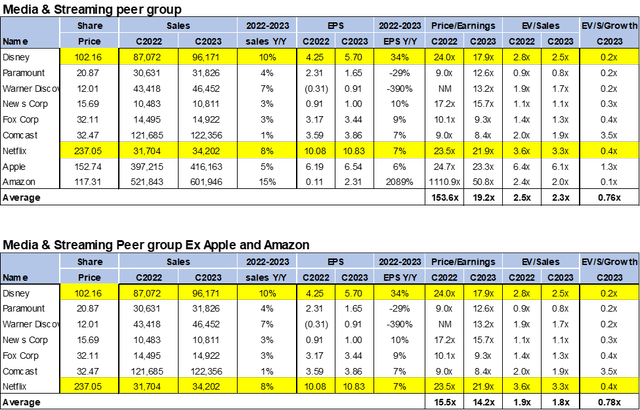

Valuation

Disney is relatively inexpensive when compared to Netflix. Disney is trading at a discount to Netflix on both P/E and EV/sales basis. Disney is growing its revenue faster than Netflix, despite being almost 3x larger than Netflix. Disney EPS is also growing faster than Netflix’s, as the company has a lot more leverage due to its multiple revenue streams – theme parks, movies, and now streaming. On a P/E basis, Disney is trading at 17.9x C2023 EPS of $5.70 compared to the media and streaming content peer group trading at 19.2x C2023. On an EV/Sales, Disney is trading 2.5x C2023 sales versus the peer group average of 2.3x. We believe Disney provides a good entry point to invest in the consumer-focused media and entertainment industry. The following chart illustrates Disney’s valuation relative to its peer group.

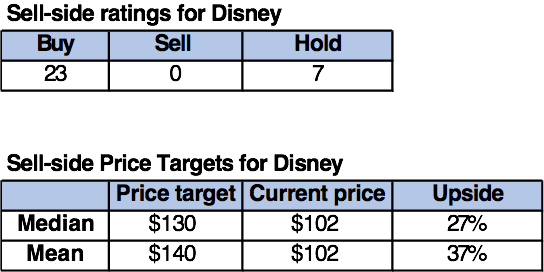

Word on Wall Street

Wall Street is overwhelmingly bullish on the stock, and we agree with this assessment. Of the 30 analysts, 23 are buy-rated, and the remaining are hold-rated. Disney is currently trading around $100. The median price target is $130, and the mean price target is $140, with a high upside of 27-37%. The following chart indicates Disney’s sell-side ratings and price targets.

Refinitiv & Techstockpros

Risks to our bull thesis:

Disney operates in a highly competitive market. Companies in the video streaming market are under more pressure than ever to maintain low pricing while creating great content. Disney is no exception, and we expect the entertainment giant will probably come under pressure to increase the cost of its streaming services due to inflationary pressures. Disney announced it would increase the cost of the standard ad-free Disney+ subscription from $8 to $11 in December. However, Disney+ remains cheaper than Netflix’s standard subscription, which charges $15.49. Despite being well-positioned, we expect the churn to increase due to the price increase. In addition, we see risks to execution as the company roles out Disney+ in new countries and executes well on its major movie releases. Other significant risk factors include new lockdown measures on the emergence of new Covid-19 strains in various geographies.

What to do with the stock

Disney, in our opinion, is the best-in-class franchise with industry-leading content/IP leveraged across multiple distribution platforms. Its theme parks business has bounced back from its Covid-19 lows faster than many had anticipated. Disney studio continues to churn out hits at an above-average clip, and the company continues to monetize it across traditional distribution channels and streaming platforms. We expect subscription numbers to continue growing across Disney+, Hulu, and ESPN+, specifically as Disney+ expands globally. Disney stock is trading at a discount to Netflix, and we believe it is a better stock to own for longer-term investors due to multiple revenue streams and a well-liked brand.

Be the first to comment