bymuratdeniz

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares ETF (NYSEARCA:GUSH), or the Fund, seeks daily investment results, before fees and expenses, of 200% of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index (“the Index”). I previously reviewed the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2x Shares ETF (DRIP) in a prior article, DRIP: A Very High Risk Double Oil Short.

The Index is described by the Fund below:

Target Index

The S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOPTR) is provided by Standard & Poor’s Index Provider and includes domestic companies from the oil and gas exploration and production sub-industry. The Index is a modified equal-weighted index that is designed to measure the performance of a sub-industry or group of sub-industries determined based on the Global Industry Classification Standards (GICS). One cannot directly invest in an index.

There is no guarantee the Fund will meet its stated investment objectives and the return will almost certainly vary from its objective of the holding period is less than, or more than, one day. The Fund should not be expected to provide two times the return of the benchmark’s cumulative return for periods greater than a day.

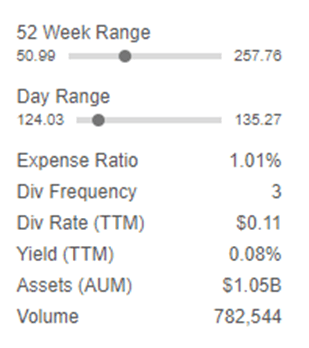

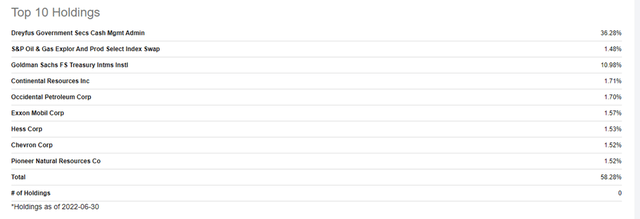

The largest holdings of the Fund as of the end of June were as follows:

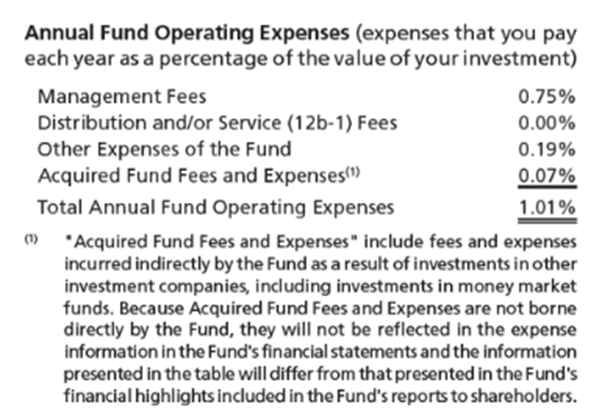

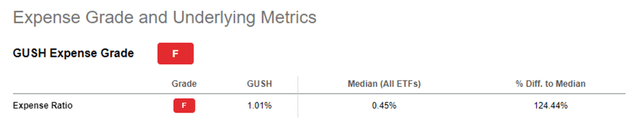

The Fund has an Expense Ratio of 1.01% and Assets Under Management (“AUM”) of about $1.05 billion.

Seeking Alpha

The breakdown of expenses is detailed below and includes a 0.75% management fee.

Direxion

Seeking Alpha gives GUSH an “F” grade on expenses.

The total return of the Fund over the past year was 79.55 %, as compared to the return of the SP500TR of -8.8 %.

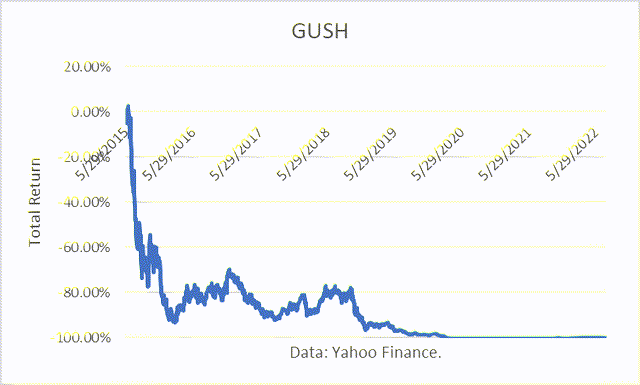

However, since inception in May 2015, the Fund has had a total return of -99.98%. The performance prior to April 1, 2020, reflects the Fund’s previous daily leveraged investment objectives, before fees and expenses, of 300% of the performance of the Index.

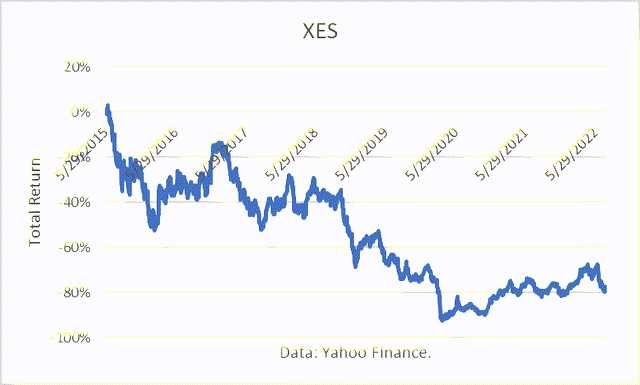

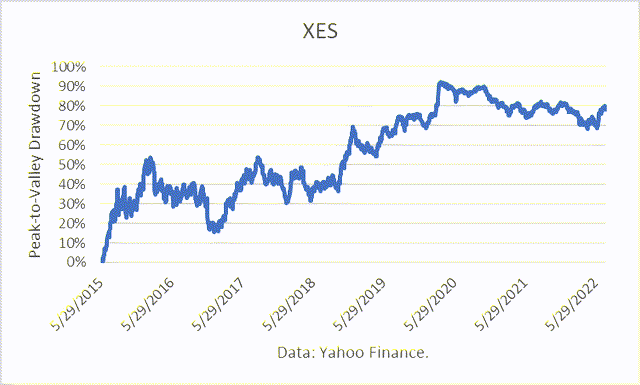

Comparing that to another oil services ETF, XES, which I recently reviewed in an article, XES – Oilfield Services ETF A ‘Dry Hole’ Long-Term, XES lost 78.55 % over the same period.

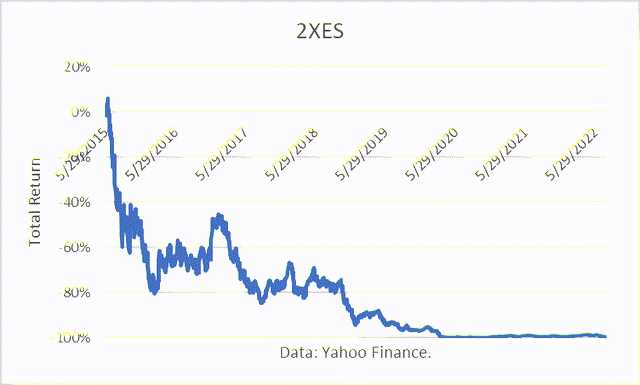

A double position in XES (“2XES”) would have lost 99.34 %.

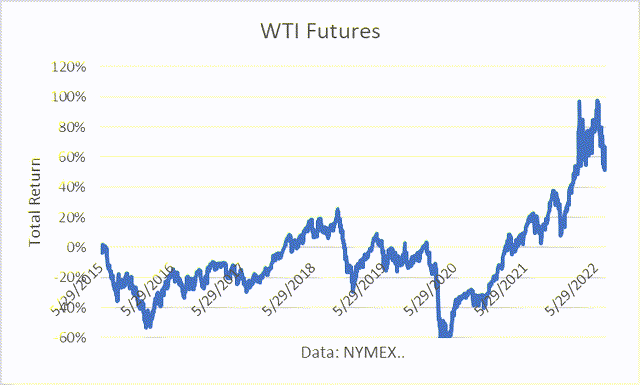

The continuous NYMEX WTI second nearby crude oil futures contract (“WTI Futures”) actually gained 52.34 % over the same period.

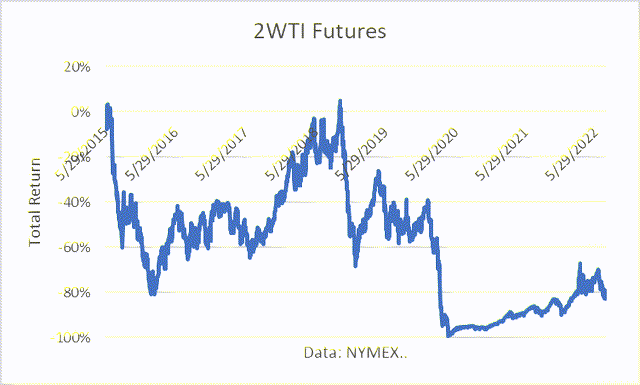

A double exposure of the same contract (“2WTI”) would have lost 82.54% over the same period. Those statistics illustrate the precarious nature of double exposures, given the asymmetric requirement to recover from a large loss.

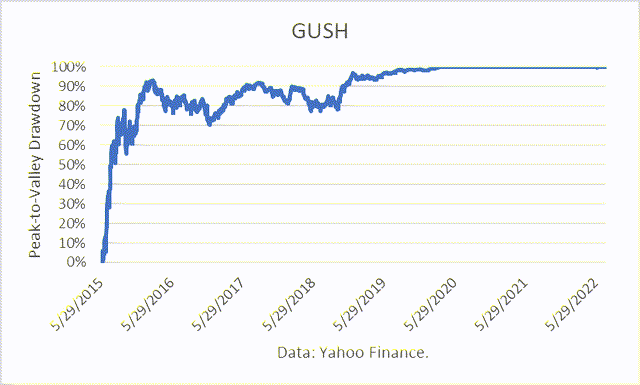

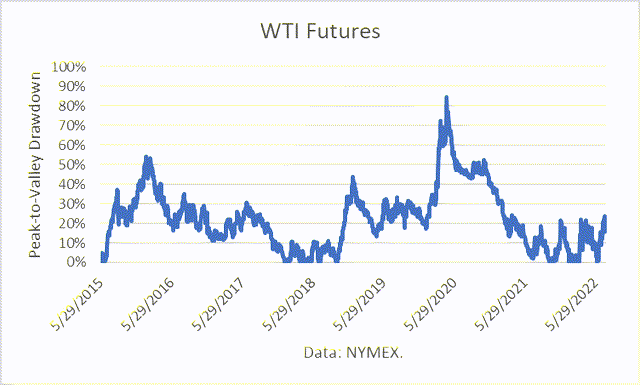

In addition, the risk of the Fund was massive. Typically, downside risk is measured as Peak-to-Valley (“P2V”) and the maximum drawdown (“MD”) over a period is the largest P2V experienced. For more about P2V calculations, read here. I take the opposite sign of the drawdown, so that it is a positive number.

According to my calculations, GUSH’s MD was 99.84 %. In other words, from the Fund’s highest peak, it lost 99+% of its investment value. The Fund is still down 99+% from its peak at its inception. I also noted in my DRIP article that DRIP had lost 99+% of its investment value. The fact that both long and short positions suffered almost total losses may appear to be illogical, but it demonstrates the problem that major losses cause for investment accounts; e.g., to recover from a 50% loss requires a 100% gain, and larger losses require even greater outsized gains for recovery.

XES’s MD was 78 % over the same period.

By contrast, the WTI Futures contract’s MD was 85%.

Needless to say, such a massive loss in GUSH would (or should) exceed the risk tolerance of any investor. And investors typically exit investments once losses exceed their risk tolerances, locking in the loss.

The Adverse Effect of Volatility and Leverage

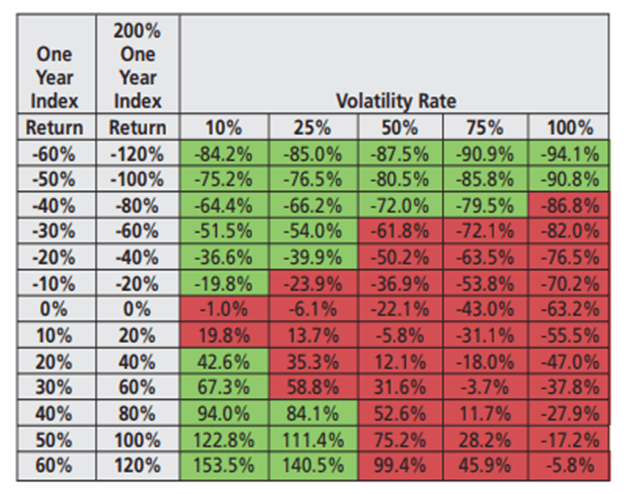

In addition to losing value if the Index goes negative, volatility and leverage can affect have a large effect on the Fund’s return. According to the Prospectus,

As shown in the chart below, the Fund would be expected to lose 6.1% if the Index provided no return over a one-year period during which the Index experienced annualized volatility of 25%. At higher ranges of volatility, there is a chance of a significant loss of value in the Fund, even if the Index’s return s flat. For instance, if the Index’s annualized volatility is 100%, the Fund would be expected to lose 63.2% of its value, even if the cumulative Index return for the year was 0%.

Direxion

With respect to leverage,

The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. An investment in the Fund is exposed to the risk that a decline in the daily performance of the Index will be magnified. This means that an investment in the Fund will be reduced by an amount equal to 2% for every 1% daily decline in the Index, not including the costs of financing leverage and other operating expenses, which would further reduce its value. The Fund could theoretically lose an amount greater than its net assets in the event of an Index decline of more than 50%. This would result in a total loss of a shareholder’s investment in one day even if the Index subsequently moves in the opposite direction and eliminates all or a portion of its earlier daily change. A total loss may occur in a single day even if the Index does not lose all of its value. Leverage will also have the effect of magnifying any differences in the Fund’s correlation with the Index and may increase the volatility of the Fund.

Key Wins

Notwithstanding the risks and historical returns discussed above, GUSH recently provided an outsized return. Specifically, from late September through June 8th, GUSH surged 263%. However, since then, GUSH has given up much of the gain with the pull-back in crude oil prices.

Potential Future Opportunities

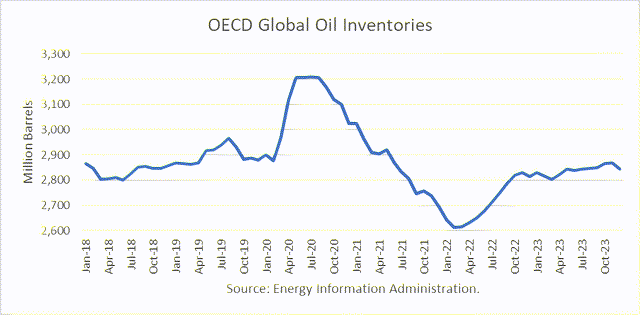

Though WTI futures prices have weakened since early June, there are uncertainties in the future supply/demand outlook that could result in at least short-term surges in crude oil prices, likely resulting in rises in the price of GUSH. Using the EIA’s July Short-Term Energy Outlook (“STEO”) as a base case, OECD oil inventories are projected to rise, having bottomed out in February.

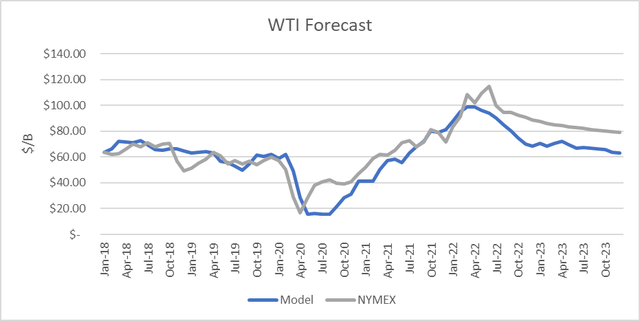

According to my model, EIA’s forecast of inventories would result in lower oil prices over the forecast horizon, as shown below. NYMEX futures prices are as of July 22, 2022.

However, the inventory projections are based on the assumptions of supply that may not materialize as projected, due to lower Russian production as a result of its invasion of Ukraine and resulting sanctions, lower OPEC production or an interruption in U.S. Gulf of Mexico crude production resulting from hurricanes.

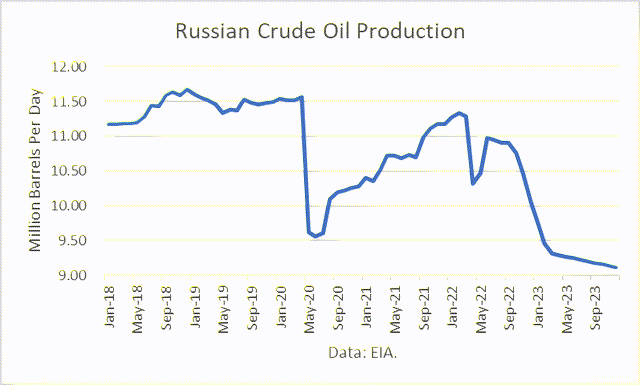

Russian Oil Production

The EIA projects that Russia will increase its output from April in the short-term, but the sanctions on Russian crude oil imports from the EU are scheduled to tighten as 2022 progresses. According to the Center for Strategic and International Studies,

On June 3, the European Union adopted a sixth package of sanctions, including a partial embargo on Russian oil. The sanctions will seaborne imports of Russian crude oil as of December 5, 2022, and ban petroleum product imports as of February 5, 2023… the EU claims that the ban on seaborne imports-as well as Germany and Poland’s voluntary move to halt pipeline imports-will allow it to cut oil imports from Russia by 90 percent.

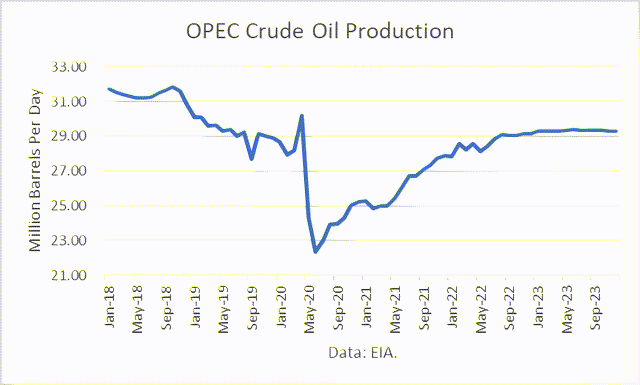

OPEC Oil Production

President Biden met with Crown Prince Mohammed bin Salman (“MbS”) in Saudi Arabia in mid-July, but the production increase he sought was not announced. Instead, the Saudis have said they will work within OPEC+ to make joint production decisions. It had been reported that the Saudis have little spare capacity to increase production.

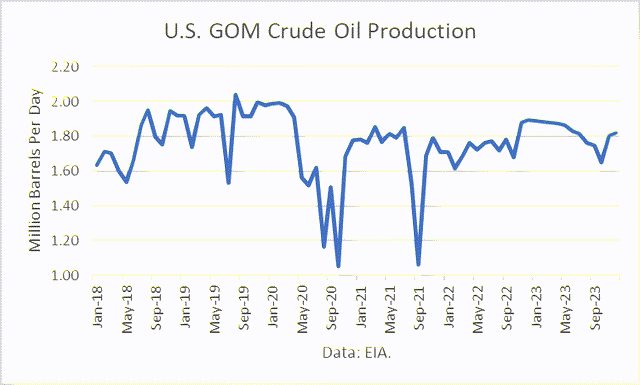

U.S. Gulf of Mexico (“GOM”)

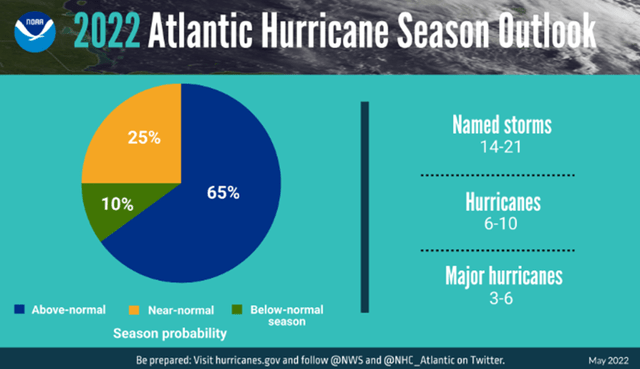

NOAA’s Climate Prediction Center has predicted above-average hurricane activity this year, ” a 65% chance of an above-normal season, a 25% chance of a near-normal season and a 10% chance of a below-normal season.” NOAA has predicted three to six major hurricanes this year.

Hurricanes have temporarily caused monthly disruptions of 800,000 b/d or more in recent years. Hurricane Katrina had a more massive impact back in 2006.

Conclusions

GUSH is a high-risk financial product and should only be used by sophisticated traders. A continuous long position over time has produced an almost 100% loss.

However, there have been short periods where it provided massive gains. And it is possible there will be opportunities for huge returns at times in the months ahead, if any of the unexpected events mentioned above come to fruition.

Be the first to comment