Brett_Hondow/iStock Editorial via Getty Images

Two very iconic restaurant chains that exist in the US today are Applebee’s Neighborhood Grill + Bar and International House of Pancakes (aka IHOP). At the center of these two firms is a company called Dine Brands Global (NYSE:DIN). This operator, which owns, franchises, and operates these restaurant concepts, is a rather large player in the food space. However, financial performance achieved by the company has been quite lumpy in recent years. On the positive side, the company is trading at levels that should be considered attractive. But when you consider that there are other players on the market that are likely in better condition than it is, I cannot get all that excited. At the end of the day, I have decided to rate the business a ‘hold’ because while I do not think it is a bad opportunity, I certainly don’t think it’s great.

A play on dining out

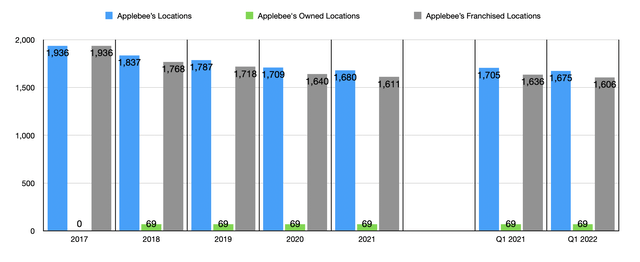

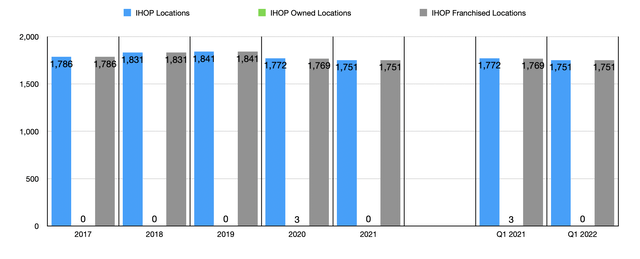

As I mentioned already, Dine Brands Global serves as an owner, franchisor, and operator of both the Applebee’s and IHOP restaurant concepts. All combined, the system that the company has consists of 3,426 locations, with most of them located in the domestic market. The vast majority of these locations are currently franchised out. For instance, as of the end of the latest quarter, the company had 1,675 Applebee’s restaurants, with only 69 of these being company-owned and operated. Meanwhile, the company’s system includes 1,751 IHOP locations, none of which are company-owned and operated. Most of these are franchised, while others are listed under licenses.

These days, Dine Brands Global generates revenue from four key sources. A big portion of its revenue comes from franchise fees associated with the thousands of restaurants in its network. The company also generates rental income derived from lease or sublease agreements covering 598 IHOP franchised restaurants and two Applebee’s franchise restaurants. A modest amount of revenue, mostly in the form of interest income, comes from receivables for equipment leases and franchise fee notes. And the company also generates some revenue from the 69 Applebee’s company-operated restaurants in its system.

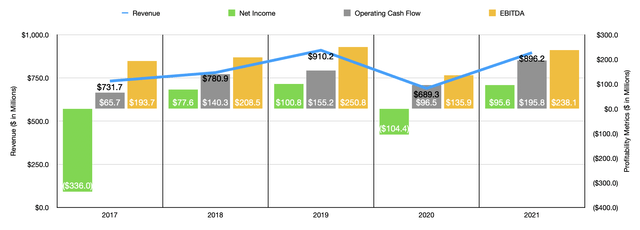

Recent financial performance achieved by Dine Brands Global has been rather mixed. If you were to look at the overall trend from a revenue perspective, the picture would generally be positive. Revenue rose consistently year over year, climbing from $731.7 million in 2017 to $910.2 million in 2019. The COVID-19 pandemic really stung, tanking revenue to $689.3 million in 2020. However, the company did see drastic improvement in 2021, with revenue mostly recovering to $896.2 million for that year. Much of the improvement in sales over the years has been as a result of positive comparable store sales. Under the IHOP brand, comparable store sales were positive in two of the three years leading up to the COVID-19 pandemic. Then, in 2020, these sales plummeted by 32.8%. The good news for investors is that this decline was short-lived. In 2021, comparable-store sales under this brand jumped by 40.2%. The picture has been less kind when it comes to the Applebee’s brand. In two of the three years leading up to the pandemic, comparable store sales in its system were negative, with the COVID-19 pandemic then pushing sales down a further 22.4%. But just as was the case with IHOP, comparable-store sales improved significantly in 2021, jumping by 38.2% year over year.

What has been disconcerting is the fact that the number of locations the company has in its system has only dropped in recent years. For instance, the number of Applebee’s restaurants declined from 1,936 at the end of 2017 to 1,680 by the end of 2021 before dropping to the 1,675 that are open today. The picture for IHOP has been more favorable. The number of units in its system actually increased from 2017 through 2019, climbing from 1,786 to 1,841. But then, in 2020, the company saw the number of units drop to 1,772 before eventually falling to the 1,751 that are in operation today. Management has said that they expect to close between 5 and 15 net restaurants throughout this year. So although revenue might have risen in recent years, this has come off the back of fewer restaurants. Such a trend is unsustainable.

From a profitability perspective, the picture has been rather interesting. That income has been all over the map in recent years, ranging from a low point of negative $336 million to a high point of $100.8 million. Operating cash flow has generally increased, eventually rising from $65.7 million to $195.8 million. Over that same window of time, EBITDA has followed a similar trajectory. It ultimately rose from $193.7 million in 2017 to $250.8 million in 2019. In 2020, it came in at just $135.9 million, while in 2021 it mostly recovered to $238.1 million. Even though the number of restaurants the company has in its system decreased, comparable-store sales improved. For the Applebee’s brand, store sales grew by 14.3%. And under the IHOP brand name, we saw comparable-store sales increase by 18.1%.

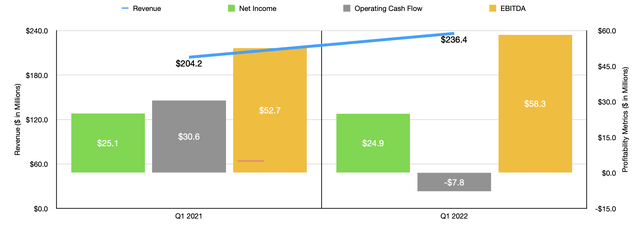

When it comes to the current fiscal year, the picture looks rather mixed. Revenue is higher in the first quarter of 2022, coming in at $236.4 million. That compares to the $204.2 million generated the same time one year earlier. On the other hand, net income for the company did tick down modestly, falling from $25.1 million to $24.9 million. Operating cash flow also worsened, plunging from $30.6 million to negative $7.8 million. Meanwhile, EBITDA is the only profitability metric that improved, ultimately rising from $52.7 million to $58.3 million.

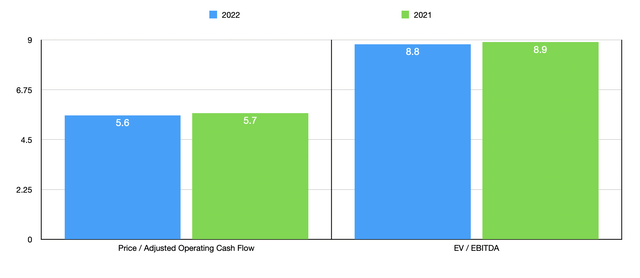

When it comes to the 2022 fiscal year, the only guidance that management gave involved EBITDA. They said that this should come in at between $235 million and $250 million. At the midpoint, it would translate to a reading of $242.5 million. If we apply that same year-over-year change to operating cash flow, then that metric should ultimately total about $199.4 million this year. Using this data, we can easily value the company. For the 2022 estimates, the price to operating cash flow multiple should be 5.6. This compares to the 5.7 reading that we get if we use 2021 results. Meanwhile, the EV to EBITDA multiple should be 8.8. That compares to the 8.9 that we get if we use the data from 2021. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 3.6 to a high of 10.1. And using the EV to EBITDA approach, the range was from 4.3 to 10.8. In both cases, three of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Dine Brands Global | 5.7 | 8.9 |

| Brinker International (EAT) | 3.6 | 5.2 |

| Jack in the Box (JACK) | 10.1 | 10.8 |

| Bloomin’ Brands (BLMN) | 4.3 | 4.3 |

| The Cheesecake Factory (CAKE) | 6.2 | 9.2 |

| Arcos Dorados Holdings (ARCO) | 8.3 | 7.5 |

Takeaway

Based on the data provided, I will say that I like how cheap shares of Dine Brands Global are on an absolute basis. At the same time, the stock looks to be more or less fairly valued compared to similar firms. Add on top of this the fact that the company has a difficult history from a restaurant count perspective and, under the Applebee’s brand, has experienced rather rocky comparable-store sales, and I find this to be a difficult opportunity to get behind. Although some profitability metrics have increased in recent years, that is not enough to make me a buyer. In fact, at this time, I have decided to rate the business a ‘hold’.

Be the first to comment