Olemedia/E+ via Getty Images

In the world of high-flying tech stocks, the norm has been to achieve growth at all costs. However, DigitalOcean Holdings Inc. (NYSE:DOCN) has proven that good companies don’t need to be reckless in order to achieve high growth.

Industry Overview

DigitalOcean operates in the cloud computing industry, which is expected to grow at a compound annual growth rate of 17.9% from 2021 to 2028. This would equate to a market size of $791 billion. Currently, the industry is dominated by the big tech giants – Amazon (AMZN), Microsoft (MSFT), and Google (GOOG).

DigitalOcean, on the other hand, has a much smaller market share, at 3.25%. However, the company focuses on small to medium-sized businesses by simplifying the steps required to use its platform. Alternatively, the big names focus on enterprises. As a result, their offerings aren’t always the right choice for small companies.

Some might believe that because the company is relatively small in the space, it will be taken out by larger competitors. However, the numbers don’t lie, and DigitalOcean’s strategy seems to be working. Until the growth disappears, then that belief is simply not true.

DigitalOcean is an Efficient Operator

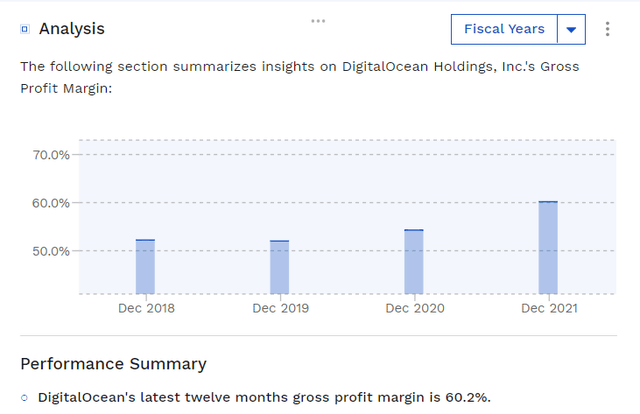

A simple yet effective way to measure if a company has a competitive advantage is by taking a look at gross profit margin trends. This is because it represents the premium customers are willing to pay above the cost of the product being offered.

Companies with competitive advantages will see profit margins expand as they grow. If there is no competitive advantage, a company would have to compete by lowering prices, which would lead to a declining gross margin.

Taking a look at DOCN, we can see that its gross margin has been increasing in the past few years.

Furthermore, the company expects to achieve 30%+ growth in 2022 while maintaining an 8-10% free cash flow margin. This means that it doesn’t have to rely on outside capital to fund growth.

Going forward, this will be extremely important. Thanks to inflation, interest rates will continue to rise and so will discount rates. As a result, the cost of borrowing and equity raises will increase substantially. This can spell big trouble for companies that spend aggressively and rely on outside capital to fund operations. Fortunately, this won’t be a problem for DOCN.

Valuation

To value DigitalOcean, we will use the H-Model, which is similar to a three-stage DCF model. The H-Model assumes that growth will decelerate linearly over a specified period of time. We believe this is a reasonable assumption as companies gradually slow down as they mature.

The formula is as follows:

Stock Value = (CF(1+tg))/(r-tg) + (CF*H*(hg-tg))/(r-tg)

Where:

- CF = LTM free cash flow per diluted share

- tg = terminal growth rate

- hg = high growth rate

- r = discount rate

- H = half-life of the forecast period

For DigitalOcean, we used the following assumptions:

- CF = $0.28 per share

- tg = 2.564% (used 30-year U.S. Treasury yield as a proxy)

- hg = 41.3% (based on the company’s guidance at the midpoint)

- r = 8.1%

- H = 10 years (we are assuming it will take 20 years to reach terminal growth)

As a result, we estimate that the fair value of DigitalOcean is approximately $24.78 under current market conditions.

Final Thoughts

We believe DigitalOcean is a very well-run company that has demonstrated it can grow revenue rapidly and profitably. Although we estimate the company to be overvalued at the moment, it’s possible that it may perform better than our expectations. If you are an investor who believes this, then you may want to hold on to the stock.

We are not implying that the stock price will be cut in half, but the valuation is just something to keep in mind. We rate the stock as a hold at the moment.

Be the first to comment