Just_Super/E+ via Getty Images

DigitalOcean (NYSE:DOCN) isn’t the cheapest stock in the tech sector, but as a cloud provider, it can sustain solid growth for many years. The company is already generating free cash flow and thanks to a well-timed capital raise, has $1.7 billion of cash which makes up 23% of the market cap. The strong profitability and large cash balance have enabled the company to embark on a $300 million share repurchase program – I expect this to be a sufficient catalyst to unlock further upside. I expect DOCN to perform strongly in any recovery in the tech sector, as the stock should sustain a material premium to tech peers. I rate shares a buy as the best pure-play cloud stock on the market.

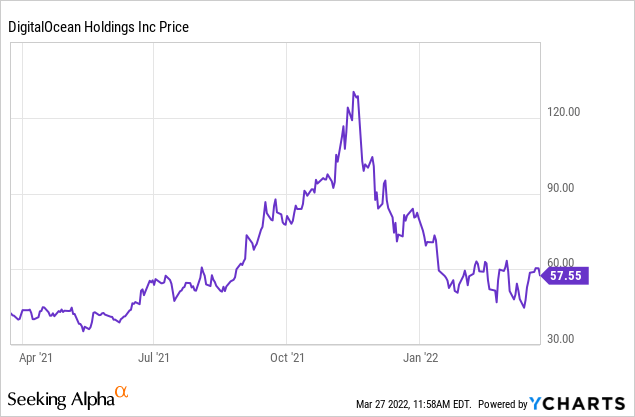

DOCN Stock Price

DOCN is up 12% since I last covered the company. There, I described the stock as offering a rare blend of high growth and positive free cash flow. The problem was that there was no immediate catalyst to send the stock higher. That has changed with the announcement of a share repurchase program. Management also issued long term guidance which, coupled with the share repurchase program, should provide the necessary ingredients for a sustained rally.

DOCN remains more than 50% lower than all time highs.

YCharts

I’m not necessarily projecting a quick return to those highs, but the stock looks highly compelling here with high visibility into forward growth rates and strong free cash flow even now. This is a rare opportunity to invest for high growth while enjoying free cash flow immediately.

What is DigitalOcean?

DOCN is a cloud provider similar to Amazon Web Services (AMZN) or Microsoft Azure (MSFT). Cloud providers are the companies which make the internet possible. Every website is in general hosted on the cloud – as the internet grows, cloud providers are positioned primely to benefit.

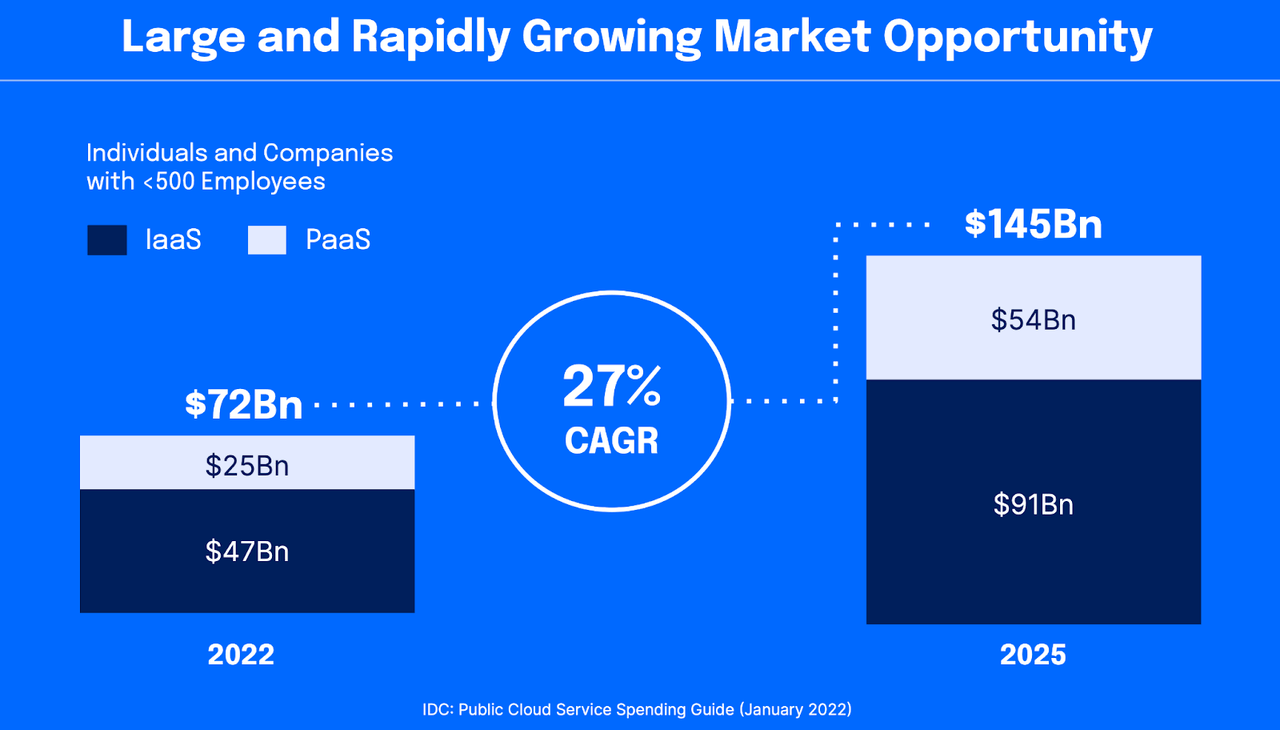

Clearly, DOCN may not be able to compete with the likes of AMZN or MSFT for the largest customers. That is why they have intentionally focused their efforts on small businesses. That narrower market is still quite sizable at $72 billion with a 27% projected compounded annual growth rate through 2025.

DigitalOcean 2021 Q4 Presentation

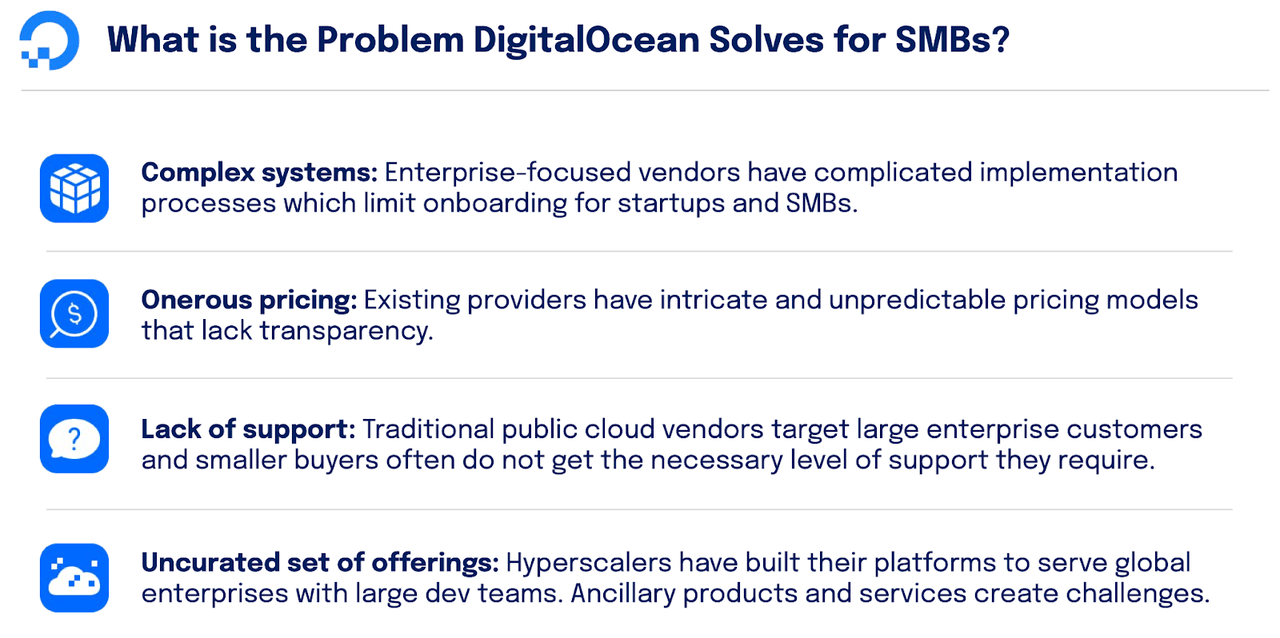

How does DOCN win the business of small businesses? The company emphasizes simplicity. Most of DOCN’s customers start using a self-onboard process and are attracted to DOCN’s competitive pricing, which can be 20% to 25% lower than that of AWS.

DigitalOcean 2021 Q4 Presentation

DOCN is by no means the best of breed operator in the cloud space, but it competes quite effectively in the small business market and is flowing cash due to its efficient sales model.

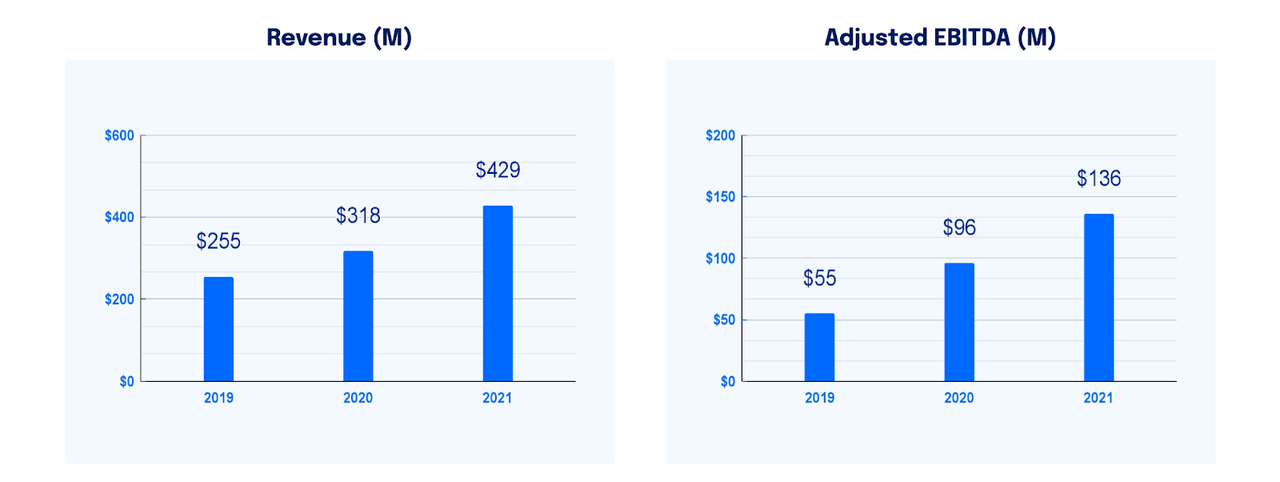

DOCN Stock Earnings

DOCN closed out 2021 with 37% revenue growth in the fourth quarter. The company delivered strong 31.7% adjusted EBITDA margin for the full year.

DigitalOcean 2021 Q4 Presentation

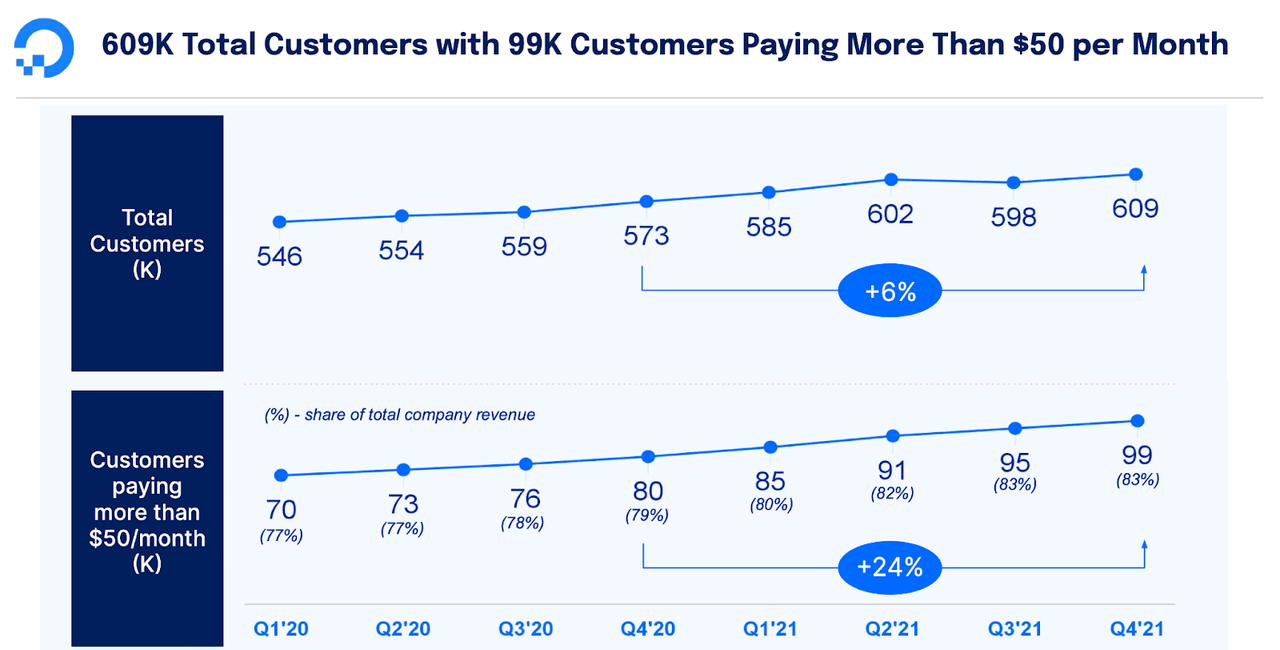

While DOCN has seen total customer growth of only 6% in the latest quarter, it was able to grow larger customers at a much faster 24% rate.

DigitalOcean 2021 Q4 Presentation

As stated on the conference call, DOCN expects total customer growth to improve to the “high single digits” after it works through some “bad actors” that have been falling off its platform. In the meantime, larger customers are driving the bulk of the company’s growth.

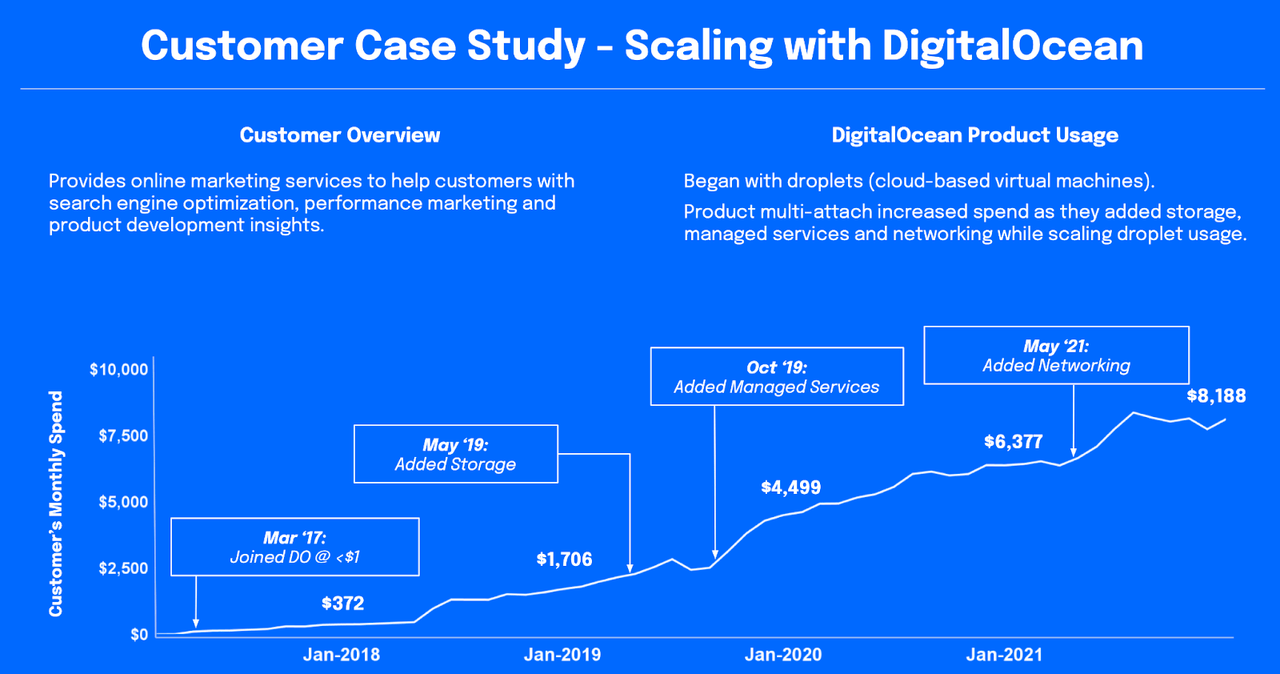

We can see below how the typical customer lifecycle looks like at DOCN. They might start with less than $1 in monthly spend but as they grow, their business with DOCN grows rapidly as well.

DigitalOcean 2021 Q4 Presentation

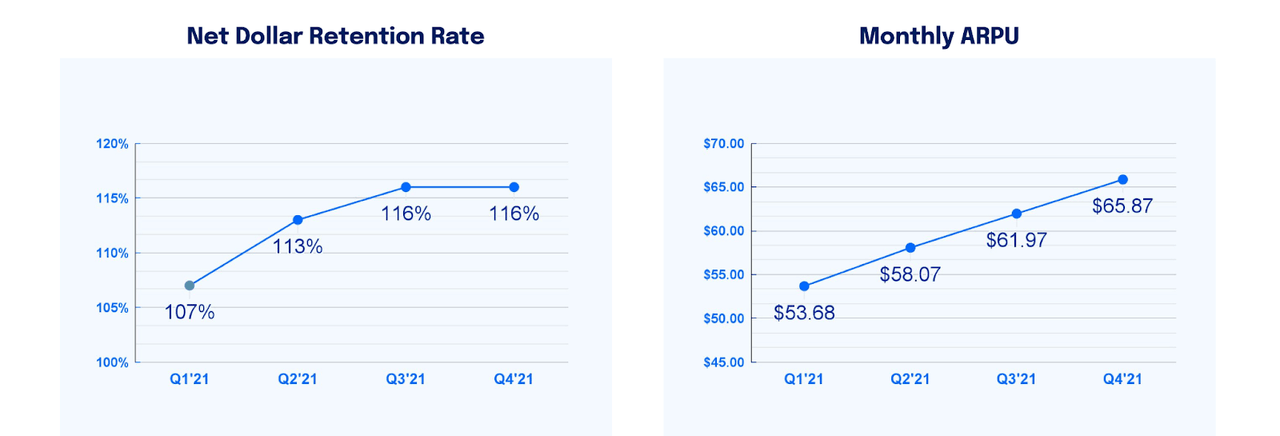

DOCN has seen a strong improvement in net dollar retention rate which stood at 116% in the latest quarter.

DigitalOcean 2021 Q4 Presentation

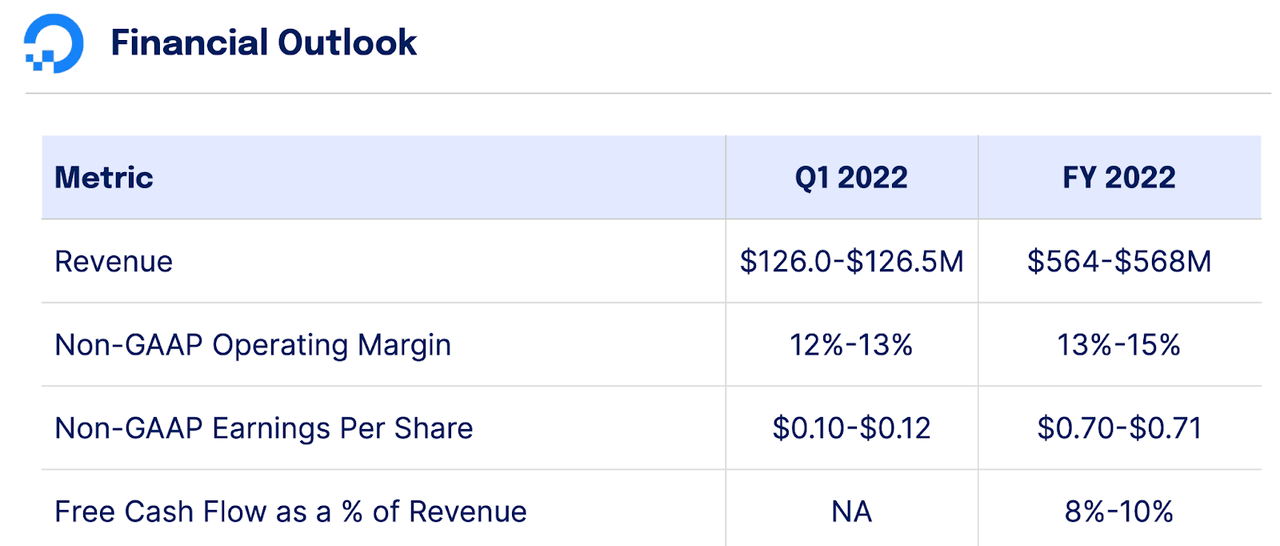

DOCN has guided for the next year to see revenue growth of around 32% with another year of solid free cash flow margins.

DigitalOcean 2021 Q4 Presentation

These results were a continuation of what the company has already delivered in the past. The big news was that DOCN has authorized a $300 million share repurchase program to help offset ongoing stock dilution. That share repurchase program makes sense considering that the company is flowing cash while it is generating solid growth. I note that the company had over $1.7 billion of cash on its balance sheet as of the latest quarter, making up over 22% of the current market cap. The large cash balance is due to a well-timed capital raise of convertible notes in November which carry a 0% interest rate and conversion price of $178.51 per share. These notes are effectively 0% yielding debt over the next 4 years, giving the company significant financial flexibility. Like many tech stocks nowadays, DOCN trades at very reasonable valuations with ample cash on its balance sheet. Unlike many tech stocks, DOCN has the financial capability to directly take advantage of the low stock prices through its share repurchase program.

Is DOCN Stock A Buy, Sell, or Hold?

At first glance, DOCN might not look so cheap with its stock trading at 86x forward earnings, and 32x 2024e earnings.

Seeking Alpha

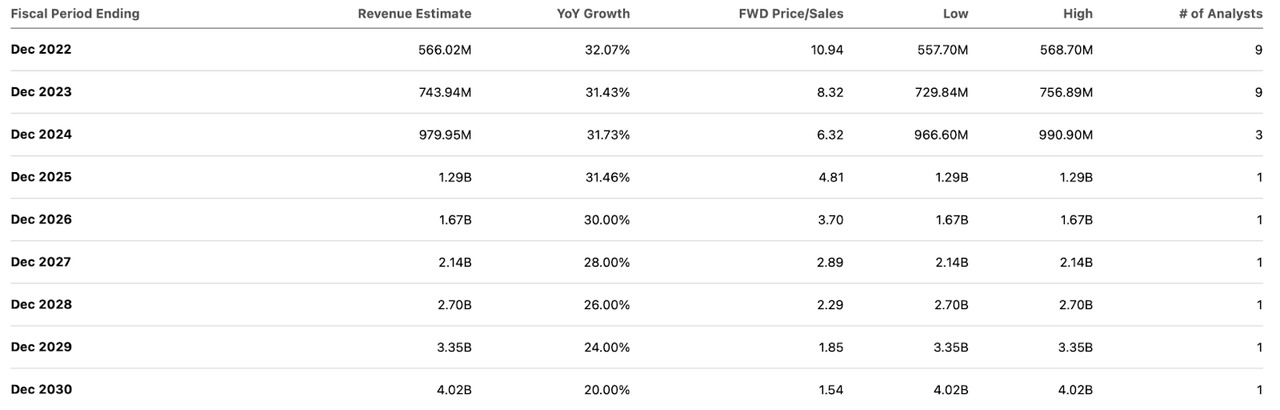

The key to the thesis is the company’s ability to sustain at least 30% growth for many, many years. The company has guided to $1 billion of revenues by 2024 (with 20% free cash flow margins by then) and consensus estimates call for $980 million of revenues by then.

Seeking Alpha

The company has stated its long-term goal of 40% revenue growth and 20% plus free cash flow margin in the near term, with 30% growth or better over the long term. That kind of growth profile makes the company look quite cheap after just several years, even if it doesn’t look obviously cheap at present day.

I assume the company can achieve 30% long term net margins, which is likely too conservative. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), DOCN might trade at 14x sales in 2025, representing a stock price of $162 per share. That suggests potential upside of 30% annualized over the next 4 years. I note that I have not given any value to the potential for aggressive share repurchases during this time period.

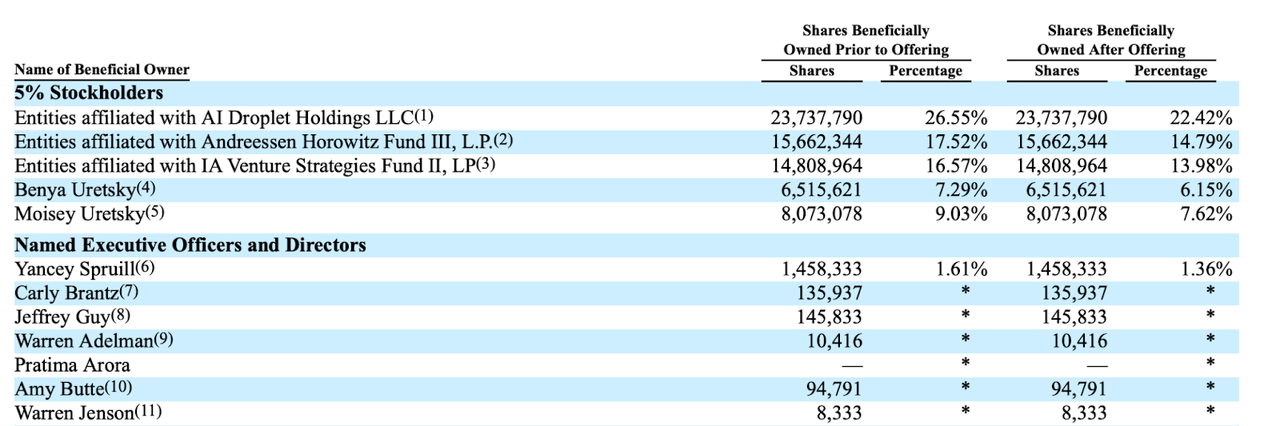

As we can see below, insiders CEO Spruill and co-founders Benya Uretsky and Moisey Uretsky all own sizable stakes in the business.

DigitalOcean S-1

The large insider ownership can prove to be a positive factor as it shows that management may be incentivized to drive long term shareholder value. This stock has all the ingredients that might spark a rally: strong long term growth guidance, solid free cash flow, share repurchases, and high insider ownership.

The key risk here is the fact that DOCN is not as high quality as the tech titans. It remains to be seen if DOCN will lose customers to the tech titans as its customers grow larger and larger – losing any of its large customers may lead to substantial volatility in its financials. For now, I am a believer in its low cost and simplicity-driven platform, but investors should watch out for any elevated churn rates. That may signal issues with the product and question the legitimacy of the bull thesis, which is predicated on strong long term growth rates.

I rate the stock a buy as the combination of high growth and solid free cash flow margins should enable the stock to sustain a premium multiple as the tech sector eventually rallies.

Be the first to comment