piranka

Digital Realty Trust, Inc. (NYSE:DLR) is a high-quality data center real estate investment trust. The trust is rapidly expanding its global footprint, and as demand for computing power grows, it has highly appealing long-term growth potential.

Furthermore, Digital Realty Trust covers its dividend with money from operations, and the pay-out ratio is so low that dividend investors are not concerned about dividend coverage.

While the stock is not cheap, Digital Realty Trust has significant long-term dividend growth potential.

A Data Center Trust You Would Want To Own

Digital Realty Trust is a premier real estate investment trust that is at the vanguard of the data revolution. The trust invests in data centers to assist businesses in expanding their operations and transforming digitally.

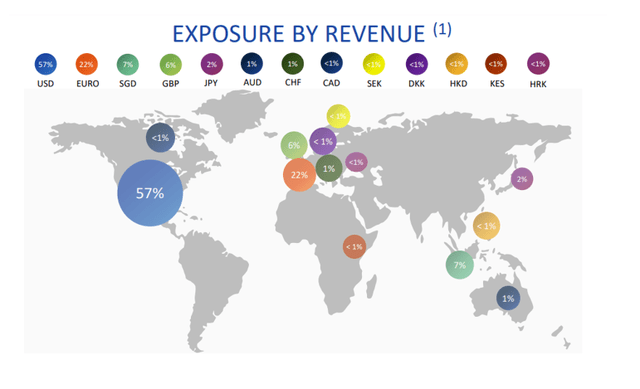

Digital Realty Trust remains primarily focused on the North American market, although it is attempting to expand its international presence.

The American market accounts for little under 60% of Digital Realty Trust’s annualized base rent. Other markets, which will become more significant for trust in the future, include EMEA (Europe, Middle East, and Africa) with a revenue contribution of 27% and the Asia-Pacific area, which accounts for roughly 10% of rental revenues. As of June 30, 2022, the trust held 297 data centers and 36.8 million rentable square feet.

Exposure By Revenue (Digital Realty Trust)

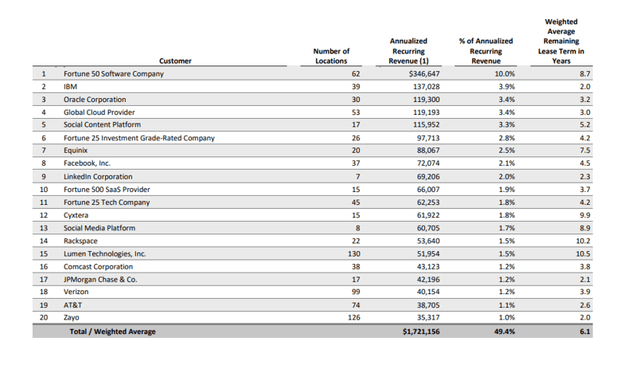

Top Clients Rely On Digital Realty Trust

The trust rents out its data centers to some of the world’s leading technology corporations, including IBM (IBM), Oracle (ORCL), Facebook (META), AT&T (T), and Lumen Technologies (LUMN). As of June 30, 2022, the weighted average lease duration for Digital Realty Trust’s leases was 6.1 years.

Top 20 Clients (Digital Realty Trust)

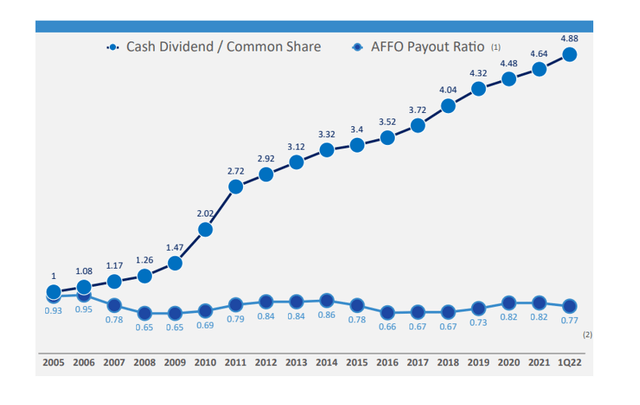

Transform Cash Flow Into Dividends

Digital Realty Trust has a long track record of increasing shareholder dividends, which is, of course, what investors are looking for when purchasing DLR. The trust’s payout has grown significantly over time.

The annual dividend growth rate from 2005 to 2022 was 9.8%, making Digital Realty Trust an appealing option for income investors seeking passive income.

Cash Dividend And AFFO Pay-Out Ratio (Digital Realty Trust)

What is especially noteworthy about Digital Realty Trust is that, despite its strong dividend growth, the company has continually maintained a low pay-out ratio.

A low pay-out ratio, which I define as less than 80%, is a good indicator that a real estate investment trust can continue to pay out dividends in the future.

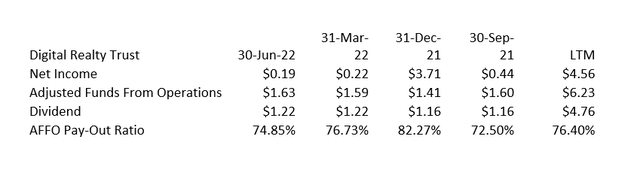

Digital Realty Trust distributed 75% of its adjusted funds from operations in the second quarter and 76% of its AFFO over the previous year.

AFFO (Author Created Table Using Trust Information)

FFO Outlook For 2022 And Multiple

Because the U.S. dollar has risen against the Euro and the British Pound in 2022, and Digital Realty Trust has a developing international reputation, the trust’s funds from operations will be slightly lower this year.

Due to rising currency concerns, Digital Realty Trust reduced its (core) funds from operations guidance from $6.80 to $6.90 per share to $6.75 to $6.85 per share.

The stock of Digital Realty Trust closed yesterday at $126.75, implying that DLR’s effective FFO multiple is 18.6x.

Data center trusts, such as Digital Realty Trust, are not cheap, owing to the high AFFO and dividend growth rates associated with the fast-growing data center business.

Why Digital Realty Trust Could See A Lower Valuation

I’m having difficulty envisioning a situation in which the data center market’s growth slows in the future. Companies invest extensively in their IT systems and require data centers to securely store data, and this demand will not go away. In this regard, I believe Digital Realty Trust works in a very appealing market that is poised to grow at both a resilient and above-average rate. Having said that, a recession may cause some market and data center disruption.

My Conclusion

In the data center business, Digital Realty Trust is a must-own real estate investment trust. The trust has promising long-term growth potential because businesses will continue to require data centers to store their data.

Furthermore, Digital Realty Trust’s fast-growing dividend pay-out is easily covered by adjusted funds from operations, and the company trades at a reasonable FFO multiple.

While the strong U.S. dollar is a difficulty for Digital Realty Trust, the 2022 estimate was only slightly changed.

DLR has a 3.9% yield and is appealing to income investors.

Be the first to comment