alvarez/E+ via Getty Images

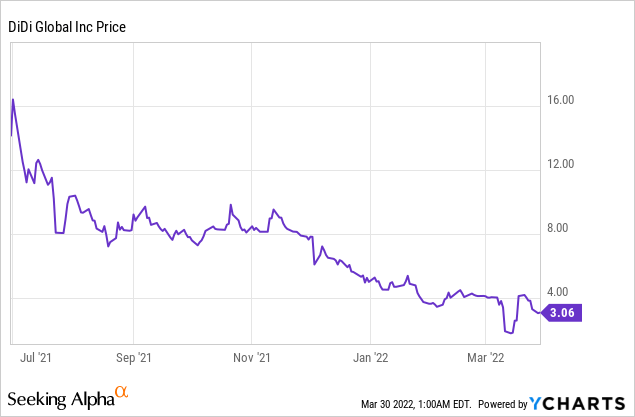

DiDi Global’s (NYSE:DIDI) dirt-cheap stock price is a value trap that we should avoid. Aside from the regulatory and geopolitical risks and the threat of delisting, my main concern with the stock is that the company’s market share is rapidly being taken away by new entrants. Alongside stagnant revenue growth and a negative net income for the last few financial years, it’s now clearly time to sell DIDI.

Company Overview

DIDI is China’s Uber (UBER) or Lyft (LYFT), and also has a presence in 15 other countries including Japan, Australia, and South America. The company claims to have 15 million drivers worldwide compared to Uber’s 5 million.

A large reason for DIDI’s price slide along with other Chinese tech stocks is the disagreement of accounting practices of Chinese stocks listed on US exchanges. The US made a law change named the Holding Foreign Companies Accountable Act, which necessitates that Chinese companies listed on US exchanges must allow their books to be audited by US regulators; if the company does not meet this requirement, then they will be delisted. It should be noted that the Chinese government previously said that they were happy to work with regulators on this issue, which led to a short rally. This optimism was short-lived, however, as US regulators recently announced that such cooperation between both sides is “premature.”

Unfortunately for DIDI, its problems don’t stop with a potential delisting from US exchanges either. China suspended the download of its apps in the country, citing cybersecurity issues. Its apps remain suspended today, but existing users can still use them.

Other aspects of the business are also affected, such as rising gas prices eating into driver’s profits and unsuccessful expansions into new international markets.

Industry Analysis

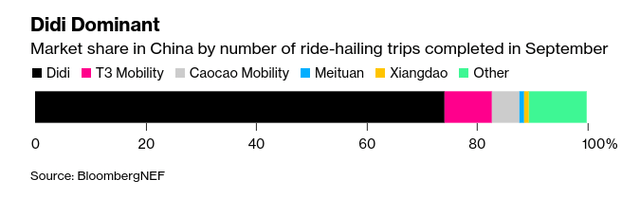

In my opinion, the biggest threat that DIDI faces is from new entrants in the Chinese market, and this is central to my thesis. In China, DIDI is clearly the dominant player, but there are rivals that are snapping at the company’s heels to secure market share.

DIDI’s main competitor that it will need to contend with is T3 Mobility. T3 is was founded by Chinese state-owned enterprise automakers Changan Automobile, FAW Group, and DongFeng Motor Corp. as well as tech giants Tencent (OTCPK:TCEHY) (OTCPK:TCTZF), Alibaba (BABA) (OTCPK:BABAF), and Suning. It has been suggested that part of the reason for China’s clampdown on private ride-sharing companies is because they compete with the state’s public transportation system. Unlike DIDI, which is privately owned, T3 is backed by the Chinese government through its state-owned enterprises, which should not be understated. The Chinese government has shown in the past that it is apparently willing to put the interests of the state ahead of the private enterprises. One can look at the blocking of Ant’s IPO as an example of this behavior.

T3 is also pursuing expansion plans in what I see as an attempt to take advantage of DIDI’s weakened position. The company unveiled plans to expand into 15 cities in China and recently raised $1.2bn in funds. Late last year, T3 stated that it had more than 54 million users on its platform and that its orders for rides exceeded more than 2 million in September 2021.

For evidence that DIDI’s market share is quickly diminishing, Bloomberg reported that it lost 5% of its market from July to September in 2021, reducing its share from 80% to 75%. I believe it’s likely that this trend will continue as new entrants such as Caocao Mobility, which raised $600 million in funding in September last year, will compete with DIDI.

COVID-19

Then there is the ongoing coronavirus pandemic and the emergence of more virulent strains. Not only are more people choosing to use their own vehicles due to the risk of infection, but in some countries, certain businesses are locked down to curb the spread, so there is less demand than usual, according to Statista.

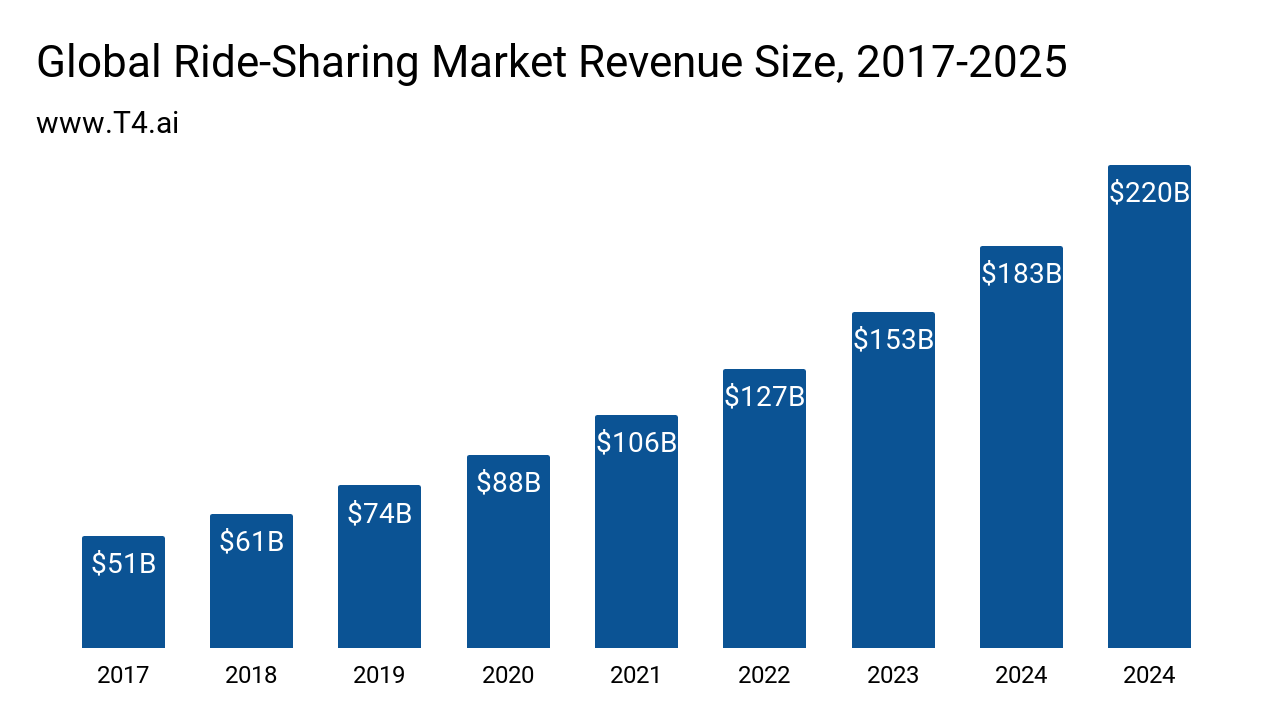

Still, regardless of COVID-19, the ride-share market as a whole is still experiencing strong growth. It is expected to reach $220B by 2024, which is up from an expected $127B near the end of 2022 as reported by T4.

T4

Financials

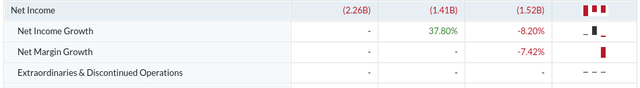

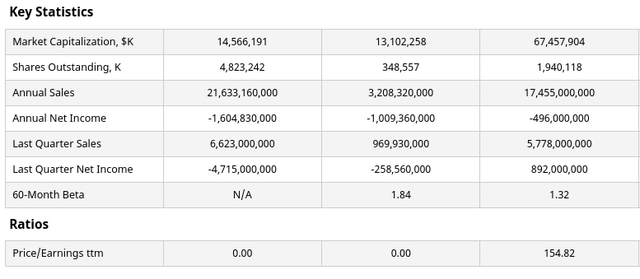

Like other ride-sharing companies like Uber and Lyft, DIDI is also struggling to turn a profit and suffers from stagnant growth in its revenues. The company had an 8.33% decrease in its sales from 2019 to 2020, reaching $20.5B in the end of that year.

DIDI also had strong profitability woes as the company lost $1.52B in 2020 and $1.41B in 2019. It is a common theme among ride-sharing apps is that they struggle to turn a profit for their shareholders.

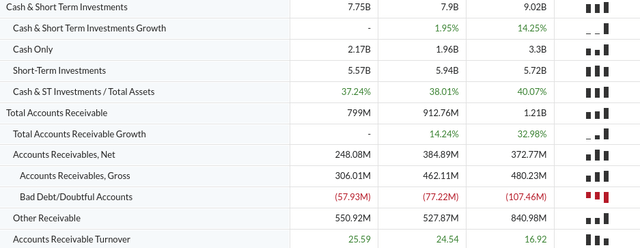

One favorable aspect of DIDI’s financial position is that it holds a reasonable amount of cash and short-term investments and has a current ratio of 2.9, which is one of the most important financial ratios for technology stocks. This may help the company buy some runway in order to reach profitability.

Another red flag for DIDI is the growth of its bad debt and doubtful accounts. This figure has doubled since 2018, growing from $57.93 million to $107.46 million. It’s important to note that this figure is not growing linearly with its accounts receivables either as they only grew from $462.1 million to $480.23 million in 2020.

Competitive Analysis

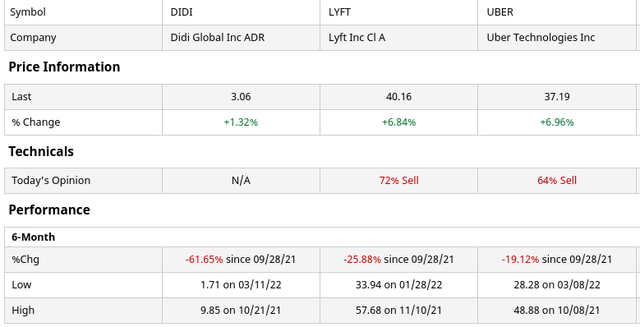

The most obvious difference that DIDI has from its competitors Uber and Lyft is that either of those companies is not at risk of being delisted in the United States. Then there’s also the political and regulatory environment that DIDI operates in which is another cause for concern.

Another obvious difference is that DIDI’s app continues to be blocked in its most important geographic location, while Uber and Lyft do not have such restrictions. Speaking of the difference between the apps, DIDI’s competitors continue to innovate and add additional features to their applications such as Uber Explore, which allows users to book experiences such as concerts and restaurant reservations. By comparison, DIDI is lacking in terms of value-added features to keep its users engaged and using their platform.

Valuation

When comparing DIDI to its competitors LYFT and UBER, I think its current price is a value trap for the reasons I outlined earlier in this article. This is despite the fact that DIDI has superior revenues and trades at a fraction of the price of its competitors.

For most investors, I believe DIDI is in fact too expensive considering the risks involved. But for those who are more adventurous and don’t expect their money back, speculating on DIDI could earn a nice return if the company manages to work through its handful of serious problems.

Risks

It’s possible that DIDI will be able to turn the company around. If this happens, investors would miss out on a great opportunity to pick up a very profitable short-term trade or investment.

In terms of regulatory risk, China may also soften its stance on companies that are listed in the US, especially if the current head of the Chinese communist party is replaced with one who is more liberal as opposed to authoritarian.

Finally, there is the chance that the market believes this stock to be oversold, and it may bounce back to higher levels.

Conclusion

DIDI has some serious problems it needs to work through I could consider a feasible investment. The rising competition and already diminishing market share is a serious issue on its own. Even if we were to take out the regulatory and geopolitical risk, its business model is struggling overseas while its competitors continue to take market share from its primary market in China. For these reasons, I am giving this stock a strong sell recommendation.

Be the first to comment