Roman Tiraspolsky/iStock Editorial via Getty Images

DICK’s Sporting Goods (NYSE:DKS) has had an incredible year as shares are still up 41.89% despite declining -25.15% from their previous high of $142.78 in 2021. Shares of DKS have been cooling off, but the stock looks like it could heat up again. One thing I never understood is why short sellers go after hard targets? According to MarketBeat 20.4% of DKS total shares were sold short as of 2/28/22, while Seeking Alpha is showing the short interest has increased to 22.38%. When I look at the most shorted companies in the market, some of them don’t make sense, and DKS is at the top of that list for me.

Contrary to what some may believe, physical retail isn’t going to disappear completely. While it may seem as if e-commerce has completely dominated the retail sector, it only accounts for roughly 20% of retail sales. I can’t figure out why the short sellers are attracted to DKS as the financials are stellar. DKS has a rock bottom P/E with increasing revenue, net income, Free Cash Flow (FCF), and EPS while buying back tremendous shares. DKS has enough cash on hand to repay its long-term debt obligations. Shares of DKS may have cooled off during the market downturn, but this isn’t a company I would want to be short as the financials are bulletproof.

DICK’S Sporting Goods Has Great Financials And I am Not Sure Why Short Sellers Are Betting Against It

Let me start with this preface, I am a shareholder of Amazon (AMZN), but I am not a shareholder of DKS. The phenomenon of e-Commerce has revolutionized the shopping experience, but I still believe there is a place for physical retail as it serves as an experience.

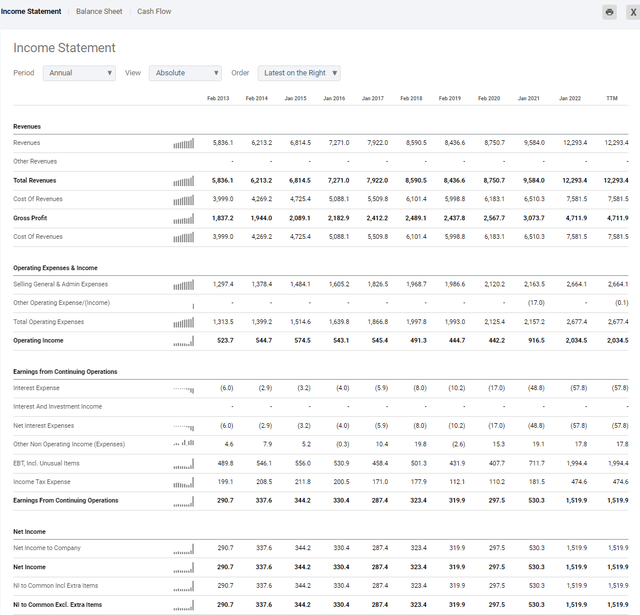

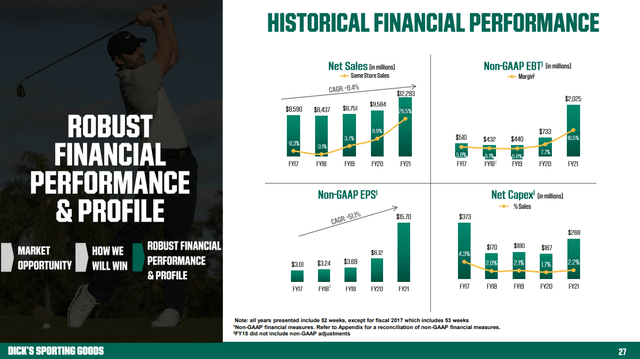

Let’s start with the income statement. DKS has increased its revenue by $4.37 billion (55.18%) over the last 5-years as its revenue has grown from $7.92 billion to $12.29 billion. Gross profit and net income have also increased significantly along with the revenue. Gross profit has increased by $2.3 billion (95.34%) over the past 5-years, while DKS net income increased by $1.23 billion (428.84%). As DKS has grown its revenue, gross profit, and net income, they have also increased their margins. Their gross profit margin has increased by 7.88% to 38.33%, while their profit margins have increased by 8.74% to 12.36% over the previous 5-years.

DKS has been able to achieve these metrics by evolving with the times. DKS has embraced the digital experience, unlike other retailers, by creating a world-class omnichannel operating model. DKS has the largest database in youth sports as they added 16.5 million new athletes in their database over the previous 2 years. DKS has become a data-driven company by delivering enhanced athlete experiences through multiple in-store technology experiences from running to golf. DKS is an important retail outlet with many partnerships among leading brands. Even though companies such as Nike (NKE) have their own stores, pulling their products isn’t a viable option due to the level of traffic DKS produces. DKS is changing the athletic experience and has become a top destination for equipment and sporting gear.

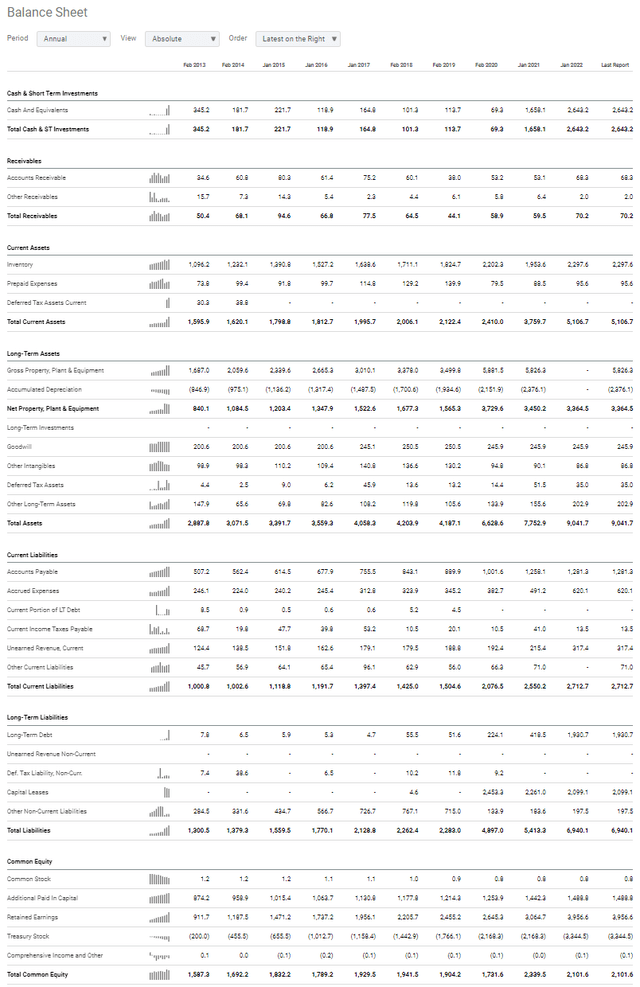

The best part is DKS has overhauled the customer experience and grown without destroying its balance sheet. DKS has $2.64 billion in cash on the books with $1.93 billion in long-term debt, of which $0 is due in 2022. DKS could write a check tomorrow and eliminate its debt. DKS has $2.1 billion in total equity on the books with only $245.9 million of goodwill from its $9.04 billion in assets. DKS has a fortress balance sheet and is rewarding shareholders by giving them a bigger slice of the pie through share repurchases.

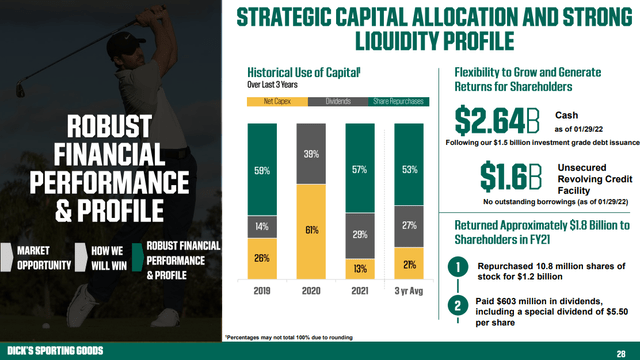

Over the past decade, DKS has decreased its share count sequentially YoY. At the end of the fiscal year 2012, DKS had 123 million shares outstanding. Over the decade, DKS has been able to fuel its growth without issuing shares and killing shareholders through dilution. Over the past decade, DKS has repurchased 43.1 million shares, a reduction of 35.04% as it reduced its total shares outstanding to 79.9 million. Not many companies have been in this position, which is a testament to management’s ability to grow responsibly and in a way that benefits shareholders.

DICK’S Sporting Goods is trading at a rock bottom valuation

The financials look great, but how about the valuation? After looking at some metrics, there is nothing not to like. In 2021 DKS generated $147.79 in revenue per share, placing their P/S ratio at .72 as the market isn’t even valuing DKS on a 1:1 ratio, yet Mr. Market will gladly place a huge P/S multiple on unprofitable technology companies. In 2021 DKS generated $18.27 in EPS placing its P/E ratio at 8.09. Today you’re paying less than 1x sales and 8.09x earnings.

DKS has been increasing its FCF, and in 2021 they generated $1.31 billion in FCF. DKS has a market cap of $9.45 billion. A valuation metric that many don’t take into consideration is the price of FCF. I want to look at what I am buying a company’s cash flow at. Today you are paying 7.22x DKS FCF. Think about it like this, if you were to buy the entire company, it would take 7.22 years to generate your original investment in FCF. This is an incredibly low price point considering how expensive other companies trade at. For instance, Block Inc (SQ) has a market cap of $82.20 billion and generates $713.5 million in FCF. SQ trades at a price to FCF ratio of 115.21x its FCF. DKS generates almost double SQ’s FCF, yet SQ trades at 115.21x FCF while DKS trades at 7.22x FCF. Many would argue that SQ has much more potential, but potential shouldn’t matter. Companies are set up to generate profits, and when you invest in a company, you’re paying the present value of future cash flow. $1 in FCF is still $1 in FCF regardless if you’re a tech or retail company. The Coca-Cola Company (KO) generated $11.26 billion in FCF for 2021 and trades at 23.41x its FCF as its market cap is $263.6 billion.

DICK’S Sporting Goods is also becoming a dividend growth company

To be completely honest, I didn’t even know DKS paid a dividend. DKS currently pays $1.95 per share for a forward yield of 1.81%. DKS has a rock bottom payout ratio of 10.19% and has provided 8 years of dividend growth to its shareholders. Over the past 5-years, DKS has had a 22.56% growth rate on its dividend. In addition to providing a solid dividend that wasn’t distributed throughout the pandemic, DKS paid a large special dividend in 2021 of an additional $5.50.

I think management has shown its commitment to shareholders that the dividend is an integral part of DKS stock and can be relied on. Companies need to be financially strong to pay a dividend and must accurately forecast their future financials to implement a dividend growth plan. DKS has provided 8 years of dividend growth with an especially large special dividend. This is a company that has the ability to provide many future increases as its payout ratio is 10.19%.

Conclusion

I would love to know what the short-sellers see in DKS? This isn’t a company that’s struggling, there isn’t a debt issue, and every financial metric has sequentially increased. DKS has a strong balance sheet, can repay its long-term debt by writing a check as its cash on hand more than covers the balance, and DKS is generating over $1 billion in pure profits. Today you can buy shares of DKS at a P/S ratio of 0.72, a P/E of 8.09, and at 7.22x its price to FCF. Not to mention, DKS pays a dividend with 8 years of dividend growth and a 1.81% forward yield. I am not saying there will be a short squeeze, but there is no reason why more than 20% of the shares are sold short. DKS looks very undervalued, has a strong balance sheet, and is a cash cow. I think the perception of DKS is misinterpreted, and shares are primed for a rebound. I plan on starting a position and adding to the position in the future if it continues to decline.

Be the first to comment