ssuaphoto

Energy prices have tumbled after rising dramatically during the first half of 2022. Crude oil is currently below $100 per barrel, down ~17% from its $122 June peak. U.S. retail gasoline prices are also down to an average of $4.44, ~15% below the $5.10 peak. The moderate correction in energy prices has caused many oil and gas producing stocks to tumble, with the oil exploration and production ETF (XOP) declining around 30% from its June peak to its recent trough. Popular E&P stocks, such as Diamondback Energy (NASDAQ:FANG), have seen similar losses.

I believe the recent decline in energy prices may be a substantial buying opportunity for energy producers such as Diamondback. High energy prices, driven by lasting production shortfalls, are the primary direct driver of U.S. inflation. The U.S. economy is now technically in a recession, mainly due to the negative impact of growing inflation on real wages and personal savings. Many investors and analysts believe high energy prices are now leading to increasing demand destruction for energy products. That factor has had the most significant impact on energy prices over the past six weeks.

Historically, recessions are bearish for energy prices because the demand for crude oil declines typically with the economy. However, the U.S. economy is beginning the recession with a significant oil output shortfall. Secondly, the current recession has considerably impacted the services sector (such as technology) more than the goods sector. Despite demand destruction fears, refinery capacity utilization remains extremely high while total crude oil storage levels continue to decline rapidly. In my view, as the U.S. government slows the release of SPR reserves, the energy markets will rapidly return to a shortage dynamic due to the ongoing lack of supply growth. Even with some demand destruction, crude oil may be on the verge of new all-time highs as storage levels reach critical lows.

Energy producers with low valuations, strong balance sheets, and steady cash flows, such as Diamondback, may offer investors a means for significant returns on the back of higher energy prices. While I believe the macroeconomic backdrop behind crude oil is quite strong, Diamondback’s value potential may compound returns. Of course, as with its peers, Diamondback is not without risks, and crude oil prices may continue to slip. However, until the fundamental energy shortage issues are solved, Diamondback’s cash flows should remain strong or grow further.

Crude Oil Potentially Headed Much Higher

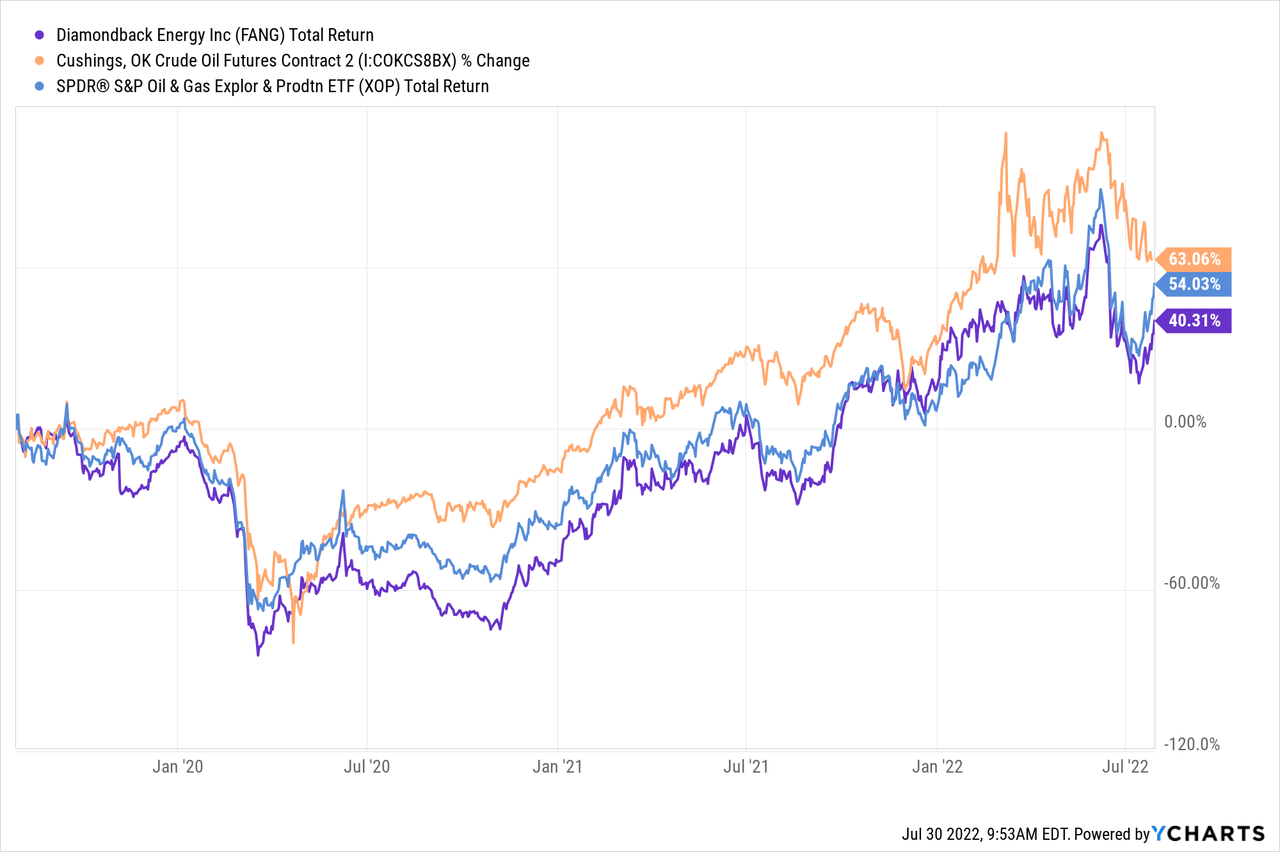

The price of FANG is closely correlated to the price of crude oil, as the company generates slightly over half of its sales from petroleum. FANG, crude oil, and other E&Ps have risen steadily since the 2020 crash with numerous moderate corrections. While FANG has seen high volatility over the past two months, it has recovered from multiple corrections since 2020. See below:

The current energy market correction seems more significant because energy prices were at ~14-year high levels in June. Crude oil at $100 per barrel and natural gas at $8.30/MMBTU are expensive compared to recent history, but oil surpassed $145 per barrel in 2008 while natural gas reached $13/MMBTU. Crude oil was closer to $200 per barrel in 2008 using 2022 inflation-adjusted dollars (given ~40% in inflation since 2008). Oil is not necessarily expensive today from that perspective.

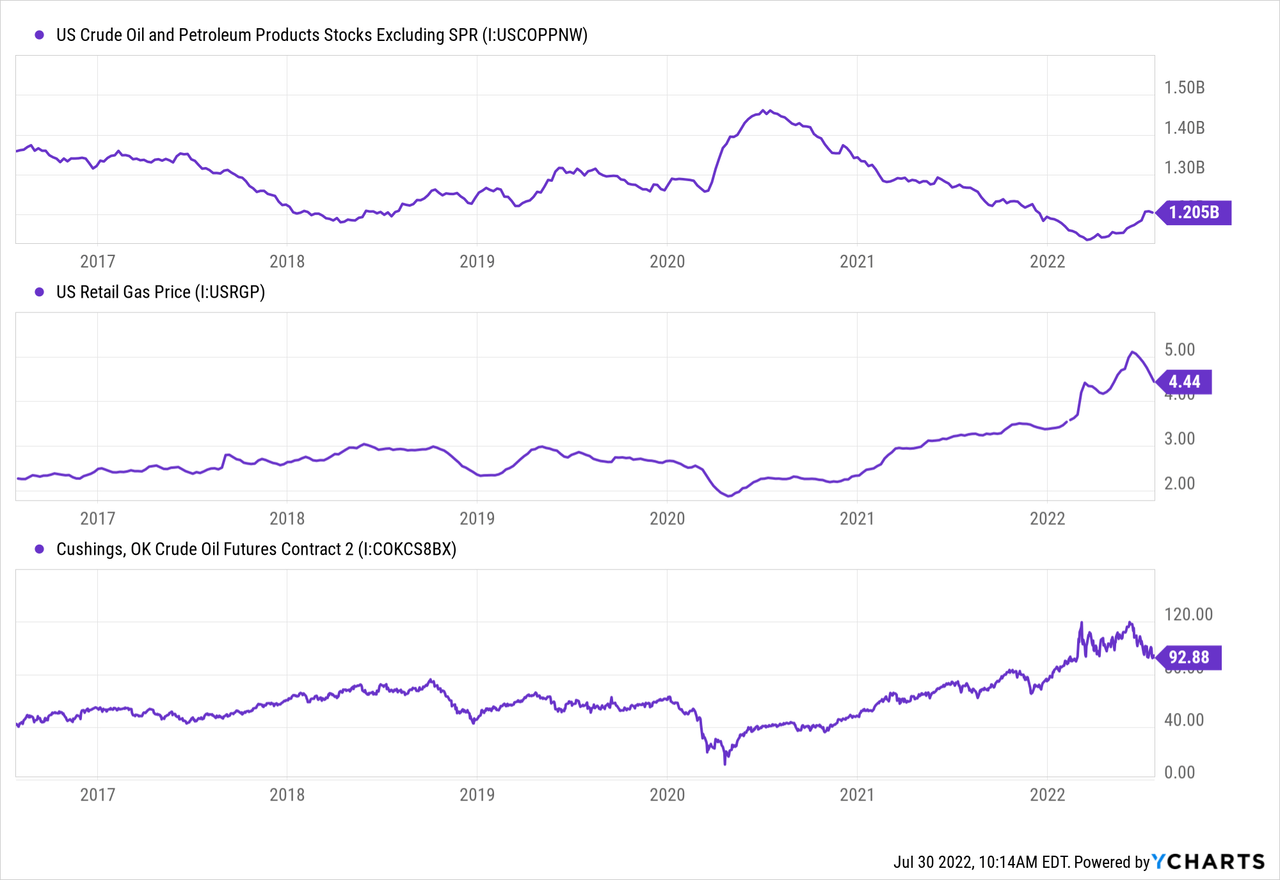

Commercial energy inventory levels most directly influence the price of crude oil and retail gasoline. Prices decline when inventories rise and rise when storage levels fall. Today, commercial storage levels are low but have increased dramatically over the past two months, pushing oil prices (and FANG) lower. See below:

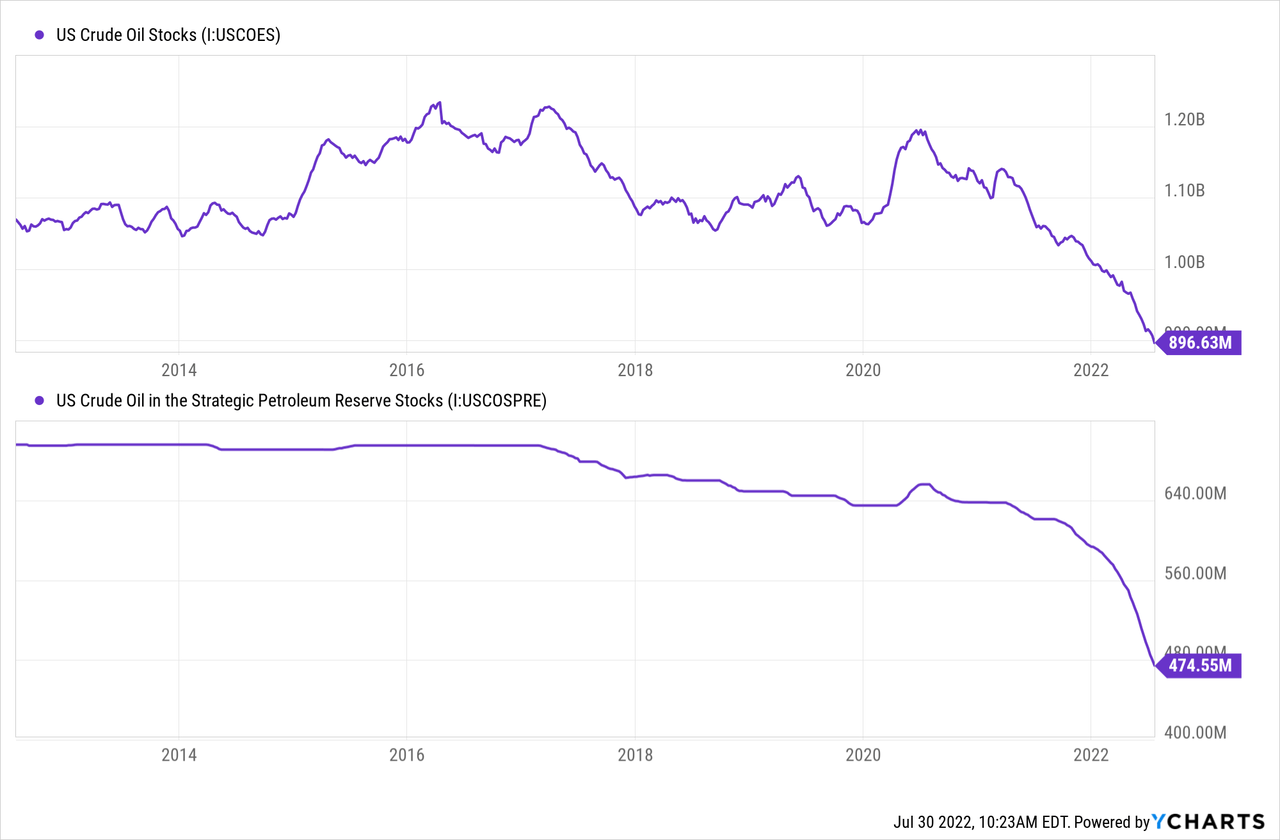

On the surface, this inventory data, tracked by many energy-market watchers, may imply the oil shortage has ended. Commercial inventories are rising, allowing more gasoline to flow to pumps and aiding prices. Indeed, in the short run, this factor may cause July’s inflation numbers to be lower than June’s. However, if we account for the impact of massive strategic petroleum reserve declines, it is apparent the crude oil shortage is worsening, not improving. See total oil inventories, including SPR reserves, below:

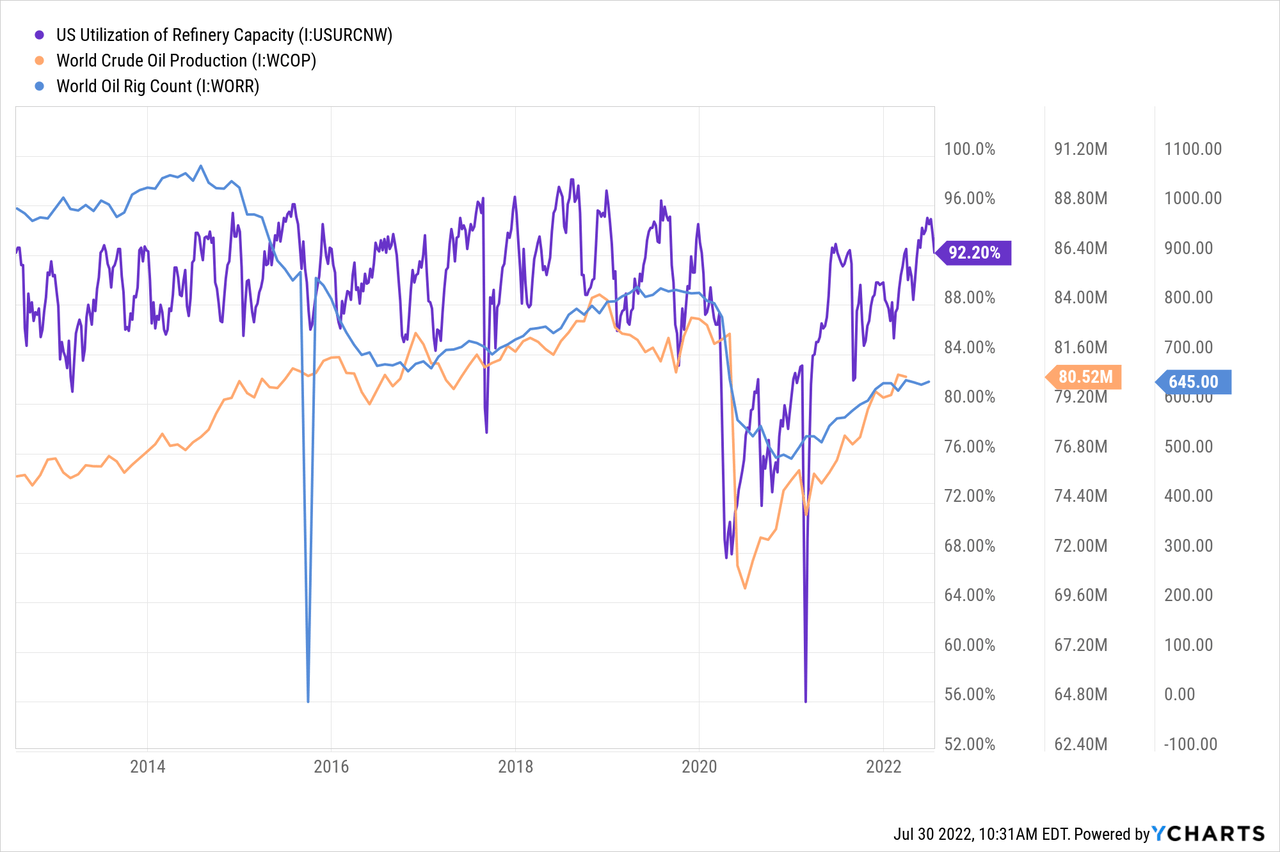

Commercial oil storage levels would be significantly lower if not for the rapid decline in U.S. government SPR reserves. Total oil storage has declined faster in recent months and is now the lowest it’s been in nearly two decades. There are few signs this trend will abate any time soon. U.S. total crude oil production has slowly risen, but is still moderately below its pre-COVID levels. Global oil production remains well-below pre-COVID levels, as the world oil rig count has stagnated (signaling a growth plateau). At the same time, U.S. refinery capacity utilization (a demand indicator) remains near moderately high levels. See below:

U.S. crude oil exports have surged, rising 40-60% this year. Higher exports have met growth in domestic oil production due to the lack of overseas output growth. Even much of the strategic petroleum reserve release has been directly exported abroad. Crude oil is a global commodity, so higher U.S. exports and a lack of overseas production growth benefit domestic prices. While there is minimal useful global data on refinery utilization, U.S. oil demand remains high despite fears of demand destruction.

Overall, I believe this situation points to higher global crude oil prices over the coming months. While commercial oil storage levels have improved, that is only due to a dramatic decline in SPR reserves. Demand has not waned this year despite the slowing economy, while global crude oil production is unlikely to rise higher due to the plateau in the oil rig count. Lastly, even if the U.S. economic recession results in lower oil demand, it will likely be met with dovish stimulative Federal Reserve policies (or direct stimulus bills) that artificially boost economic demand. I believe this would further promote an oil shortage, as last seen in 2020.

The situation in natural gas and NGLs is similar to that of crude oil. Diamondback generates nearly half of its sales from natural gas and NGL, and the prices of both gas and NGL’s have risen markedly. U.S. natural gas production has recovered faster than oil. Still, production has slipped recently due to environmental factors and, more importantly, a lower potential plateau in the natural gas rig count. This segment is also benefiting from higher export demand due to severe shortages in Europe; however, the importance of this factor may be overestimated since LNG production has reached capacity.

Value Opportunity In FANG

Like most oil and gas producers, Diamondback was in a difficult period before 2020 as the energy market was stuck in a glut dynamic, and prices were often below profitable levels. Diamondback’s valuation is still priced as if the company is struggling with insolvency, given its forward “P/E” ratio of 5X and similar price-to-cash flow. Before 2020, the company expanded operations rapidly, creating immense leverage buildup during low profitability. The “shale boom” end could not have come at a better time, as it was verging on insolvency before 2020.

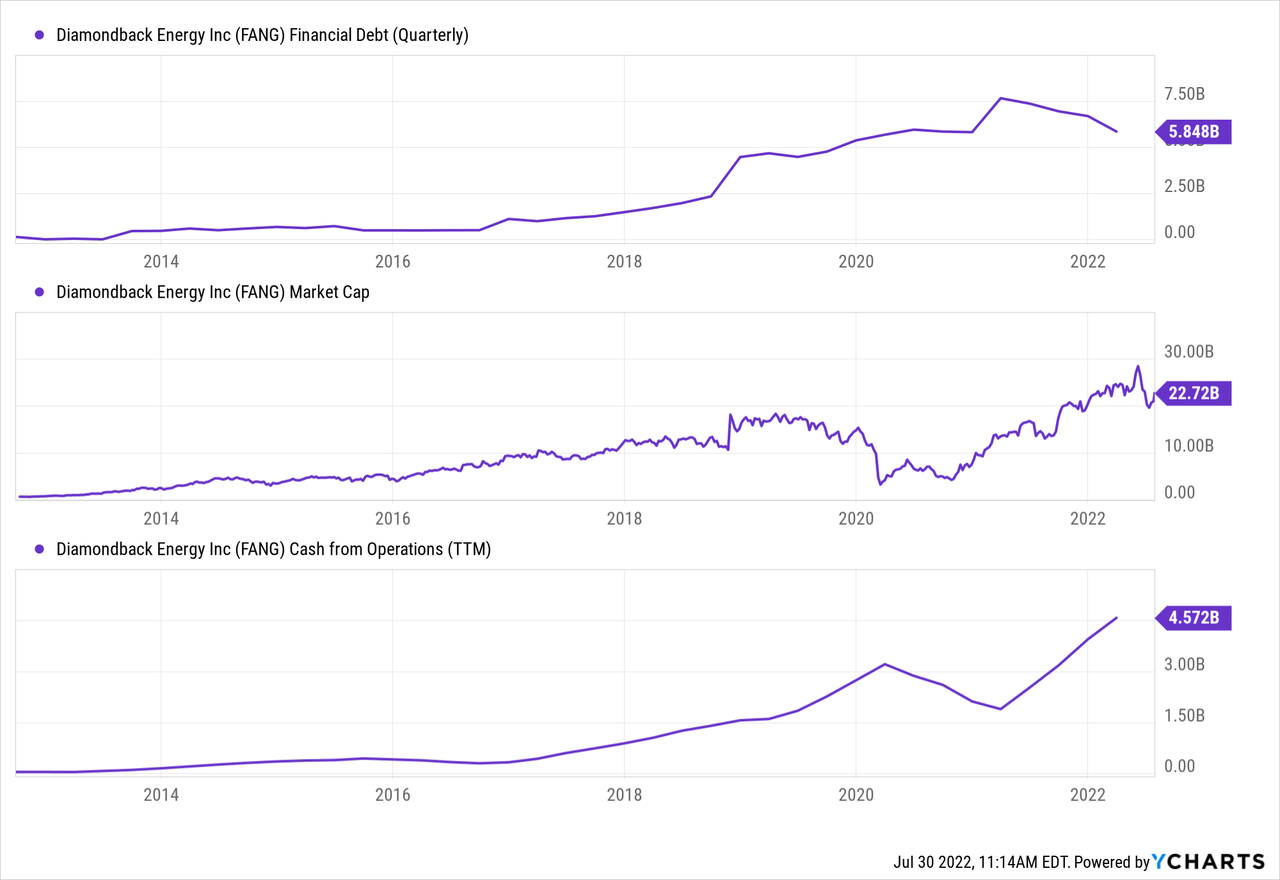

The company has used some of its current cash flows to reduce its financial debt and has begun to pay dividends. Its dividend has grown, giving it a forward yield of 1.7%. As Diamondback continues to clean its balance sheet and reach maturity with constant production, I suspect its dividend may rise significantly higher. The company still has $5.8B in financial debt, which is relatively low compared to its ~$23B market capitalization and ~$4.6B annual operating cash flow. See below:

I believe FANG would rise even if oil prices remain flat. The company’s operating cash-flow yield is around 20%, and, as it reaches maturity, it is paying far less into CapEx, so most of its cash flow is now “free.” As detailed in its last investor presentation, Diamondback aims to keep production flat and reduce its total debt, making it an excellent dividend growth target as its FCF expands. Further, if crude oil or natural gas continues to rise, as I suspect, the company could earn significantly higher cash flows.

The Bottom Line

In my view, crude oil and natural gas are in a long-term bullish super-cycle as global producers struggle to increase production, meaning high-cash flows may be sustained for many years. At its current valuation, FANG seems like a stellar long-term investment as the company reaches a more mature stage and its dividend expands. In the short-run, I believe it may be a great way to generate indirectly levered returns from another large wave higher in energy commodity prices, driven by growing storage deficits.

Biden’s administration aims to refill the SPR in 2023, meaning releases must end or slow over the coming six months. This factor may catalyze a more significant move higher in crude oil as commercial inventories would likely rapidly deteriorate as global production continues to be weak. Of course, other nations may race to increase energy production, or the Russian conflict may end, potentially aiding energy shortages. These are potential risks to my bullish thesis on FANG. However, I believe its valuation is low enough that its cash-flow yield would be high today, even with lower oil prices. Overall, I am bullish on FANG and believe it may reach new highs over the coming months.

Be the first to comment