Eoneren/E+ via Getty Images

The iShares Core Dividend Growth ETF (NYSEARCA:DGRO) is a simple, cheap, strong, dividend growth index ETF. The fund’s diversified holdings and strong dividend growth track-record make it a reasonable investment opportunity, and one which is particularly appropriate for dividend growth investors.

On the other hand, the Schwab U.S. Dividend Equity ETF (SCHD) seems like a similar, but broadly superior fund. SCHP has a higher 2.9% yield, and a stronger dividend growth and performance track-record. Although the differences are quite small, it does seem like SCHD is the broadly superior investment.

DGRO Basics

- Investment Manager: Invesco

- Dividend Yield: 2.0%

- Expense Ratio: 0.08%

- Underlying Index: Morningstar US Dividend Growth Index

- Total Returns 5Y CAGR: 14.48%

DGRO Overview

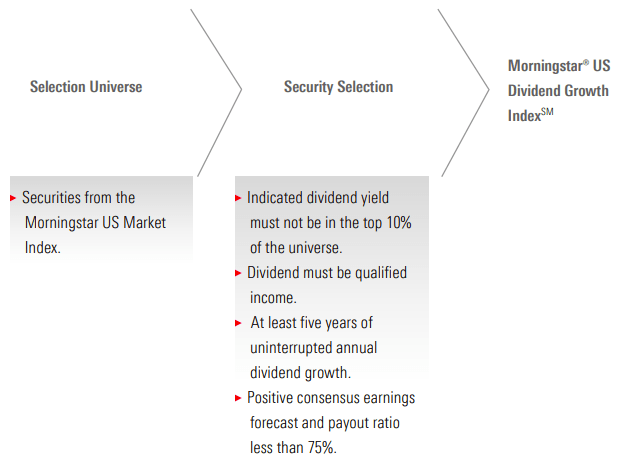

DGRO is an equity index ETF focusing on U.S. equities with strong dividend growth track-records. The fund tracks the Morningstar US Dividend Growth Index, an index of these same securities. It is a relatively simple index, including all relevant U.S. equities that meet a series of yield, dividend growth, and payout ratio criteria. The index construction process is as follows.

Morningstar

Excluding the top 10% yielding stocks as well as those with high payout ratios is meant to exclude excessively risky yield traps. I think these two exclusion criteria to be positives, although they do serve to decrease the fund’s yield.

Focusing on securities with qualified income means excluding REITs, MLPs, and other niche securities. Although there is nothing necessarily wrong with this, it does mean that investors looking for exposure to these asset classes need to consider other funds, or complement their investment in DGRO with another fund.

Finally, the fund does invest in stocks which failed to raise their dividends in the preceding year, if the company increased their buybacks instead. Although I see the logic behind doing so, you don’t want to penalize companies which chose to prioritize buybacks over dividend growth, it does go against the purpose of the fund. DGRO is a dividend growth fund, and a clearer focus on that would be ideal.

In my opinion, DGRO’s underlying index is reasonable enough, although there are several other dividend growth ETFs without the issues above. Still, these are very minor issues, and do not materially impact the fund’s investment thesis, expected performance, or expected dividend growth.

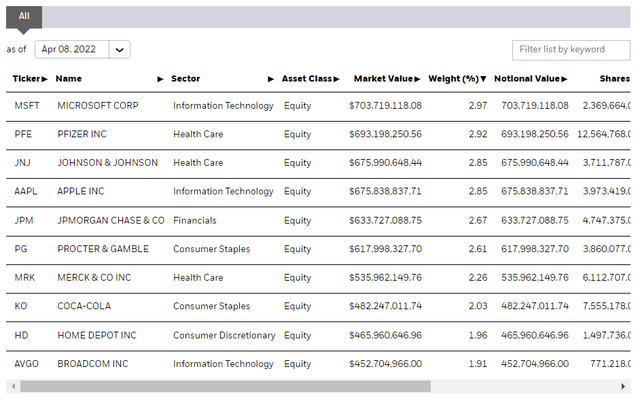

DGRO’s underlying index is quite broad, which results in a well-diversified fund. DGRO invests in 418 different stocks, with the top ten of these accounting for just 25% of its value. The fund’s diversification is comparable to that of most broad-based equity indexes, including the S&P 500.

DGRO Corporate Website

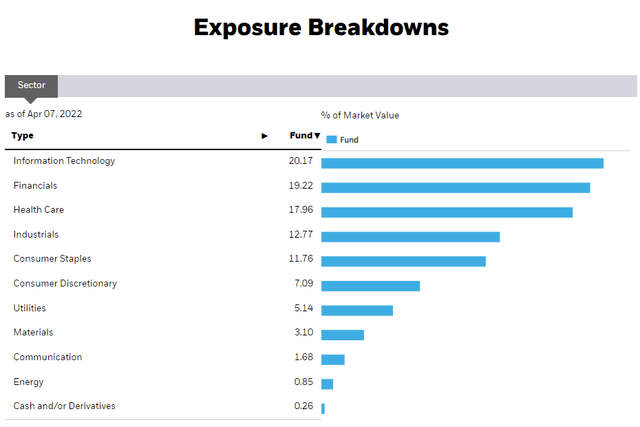

DGRO also provides investors with exposure to most relevant industry segments. The fund’s diversified holdings reduce portfolio risk and volatility, and are a significant benefit for the fund and its shareholders. In my opinion, DGRO is diversified enough that the fund could function as a core portfolio holding.

DGRO Corporate Website

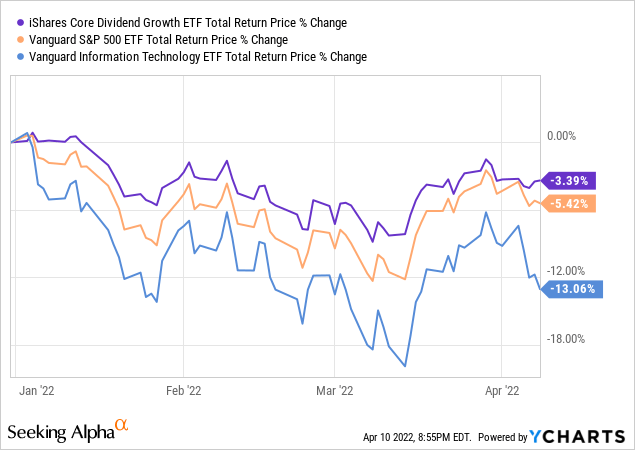

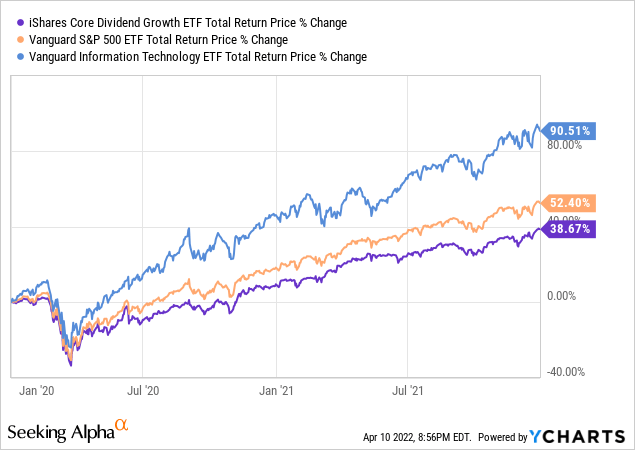

As with most dividend equity ETFs, the fund is somewhat overweight the old-economy financials and industrials sectors, while being underweight tech. As such, DGRO’s relative performance is strongly dependent on the relative performance of the tech industry. The fund performs comparatively well when tech underperforms, as has been the case YTD.

On the flipside, the fund underperforms when tech outperforms, as was the case during 2020, in the midst of the coronavirus pandemic.

In my opinion, and considering frothy tech valuations and prevailing market sentiment, DGRO’s comparatively low tech exposure is a benefit for the fund and its shareholders.

Besides the above, nothing else stands out about the fund and its index. It is a reasonably diversified U.S. equity index fund, focusing on companies with strong dividend growth track-records. With this in mind, let’s have a look at the fund’s dividends.

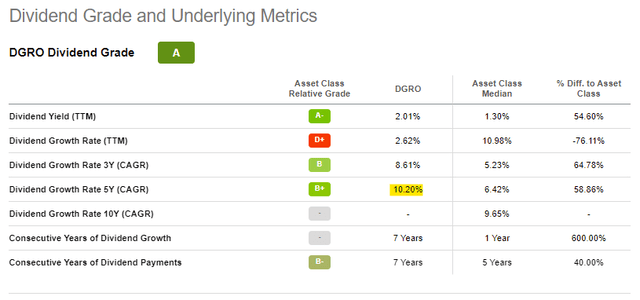

DGRO – Dividend Analysis

DGRO focuses on stocks with at least five years of uninterrupted dividend growth, which results in a fund with a strong dividend growth track-record. DGRO’s dividends have grown at a 10% CAGR since inception, and for most relevant time periods. Growth was quite slow from 2020 to 2021, but this seems to be mostly an artifact of dividend volatility plus an unfavorable cutoff period. Dividend growth during 2021 was quite strong, with the fund’s quarterly dividends growing by 14% from early 2021 to late 2021.

Seeking Alpha

DGRO’s strong dividend growth track record is a significant benefit for the fund and its shareholders, and the fund’s core investment thesis. This is a dividend growth fund, for dividend growth investors.

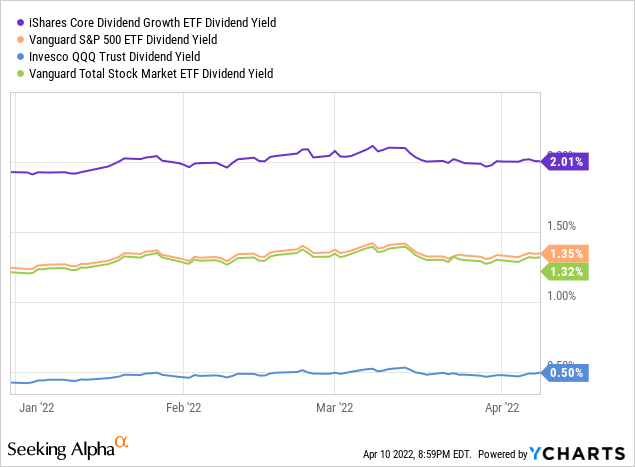

DGRO’s 2.0% yield is slightly higher than that of most broad-based U.S. equity indexes, but the difference is quite small, and not particularly material.

As a final note, as DGRO’s starting yield is quite low, yield on cost figures are not particularly strong. The fund boasts a 5Y yield on cost of 3.9%, and an 8Y yield on cost of 4.9%. Investors would have to wait about a decade before seeing +5% yield on costs. These are not terrible figures, but not particularly good either.

Seeking Alpha

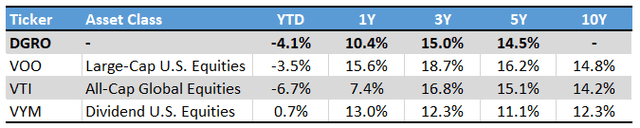

DGRO – Performance Analysis

DGRO’s performance track-record is about average. The fund has slightly underperformed relative to most broad-based U.S. equity indexes since inception, due to a lower allocation to the booming tech industry. On the flipside, the fund has moderately outperformed this past year, as tech valuations normalize. Relative to other dividend equity index ETFs, including the Vanguard High Dividend Yield ETF (VYM), the situation is mirrored, with DGRO outperforming since inception, but underperforming as of late.

ETF.com – Chart by author

As mentioned previously, DGRO’s performance track-record is about average, and so it does not materially impact the fund’s investment thesis.

DGRO – Valuation Analysis

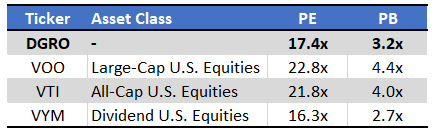

DGRO being underweight tech leads to a competitive valuation. The fund sports a PE ratio of 17.4x with a PB ratio of 3.2x, both slightly lower figures than those of most broad-based U.S. equity indexes. As with the fund’s performance track-record, the situation is mirrored relative to most dividend-focused ETFs.

ETF.com – Chart by author

DGRO’s competitive valuation could lead to strong, market-beating returns if valuations continue to normalize. I think this is the likeliest scenario, taking into consideration performance YTD, and prevailing market sentiment.

DGRO – SCHD Comparison

Finally, wanted to do a quick comparison between DGRO and one of the most popular dividend growth ETFs in the market, SCHD.

DGRO compares unfavorably to SCHD in most key metrics, although only slightly so.

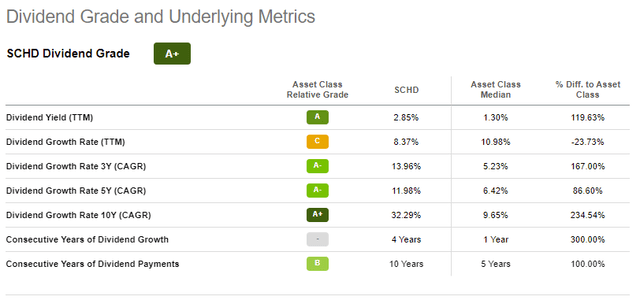

SCHD currently yields 2.9%, a bit higher than DGRO’s 2.0% yield. It is a small difference, but a difference nonetheless.

SCHD’s dividend growth track-record is also slightly stronger, with the fund more consistently growing its dividend at a double-digit rate. DGRO’s dividend also mostly grows at a similar rate, but growth is a bit more uneven, and a bit lower too.

Seeking Alpha

SCHD’s stronger yield and dividend growth are particularly impactful for long-term dividend growth investors. As an example, SCHD boasts an 8Y yield on cost figure of 6.8%, versus 4.9% for DGRO. Higher yield on cost metrics are beneficial for all investors, and especially important for long-term dividend growth investors. Insofar as SCHD is able to sustain higher dividend growth rates in the future, the gap will grow wider.

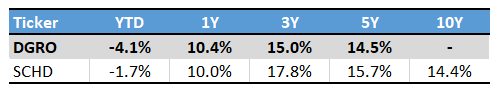

Finally, SCHD has outperformed DGRO for most relevant time periods, but only slightly so.

Seeking Alpha – Chart by author

In my opinion, SCHD is clearly an overall stronger fund than DGRO, but the differences are relatively small, all things considered.

Conclusion – Buy

DGRO’s diversified holdings and strong dividend growth track-record make the fund a buy, and one which is particularly appropriate for dividend growth investors.

Be the first to comment