grandriver/iStock via Getty Images

Devon Energy Corporation (NYSE:DVN) is a large upstream energy company with a market capitalization of more than $40 billion. The company has a high single-digit yield supported by its fixed + variable dividend policy, a strong balance sheet, and the ability to generate continued double-digit shareholder rewards. That helps highlight the company as a valuable investment.

Devon Energy’s Business Model

Devon Energy has a unique business model with an aggressive focus on the shareholder.

The company is focused on growing production without over-investing in rapid production growth in a volatile industry. The company is targeting production growth of 5% annually to focus on FCF generation. It’ll cover maintenance capital at the minimum, while moderately investing opportunistically in growth, sensibly growing production.

The company has already a low leverage ratio (net-debt-to-EBITDAX < 0.5x) that it’s planning to continue. That means interest isn’t a substantial part of the company’s spending, and the company is remaining sensible here. The company’s dividend is already in the high single digits and we expect that to continue outperforming.

Devon Energy’s 2021 Returns

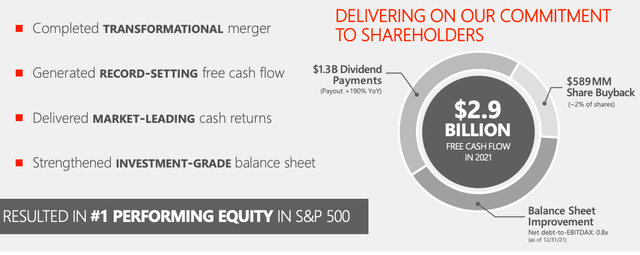

Devon had the #1 performing equity in the S&P 500 in 2021, a sign of its financial strength and commitment to shareholders.

The company completed a large merger through 2021 as a “merger of equals” and generated record-setting FCF with a strong investment-grade balance sheet. The company paid out $1.3 billion in dividends an almost tripling YoY with a dividend yield of >3%. The company’s variable dividend finished the year incredibly strong.

The company also managed to spend almost $1.5 billion in improving its balance sheet, cash that it’ll be less likely to need to spend going forward, with almost $600 million spent on share buybacks. That was enough for the company to repurchase ~2% of shares, saving it on future dividend expenses, and the company should be able to continue returns here.

Devon Energy’s 2022 Compelling Yield Potential

Devon has the ability to continue strong shareholder returns into 2022.

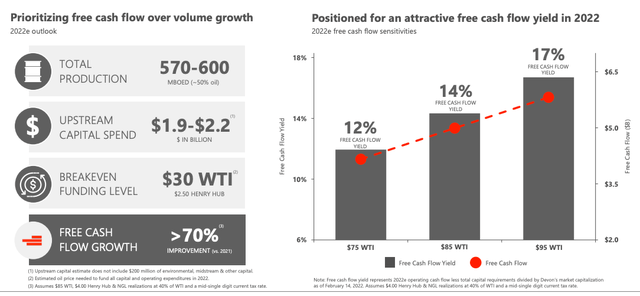

Devon Energy is planning to produce roughly 585 thousand barrels/day with ~$2-2.1 billion in capital spending. The company’s breakeven funding level is incredibly low at $30 WTI/$2.5 HH and the company expects to see 70% YoY FCF growth.

At current crude prices, the company expects to generate roughly $7 billion in FCF for the year or an almost 20% FCF yield. The company has expanded its buyback program to $1.6 billion, enough to repurchase ~5% of outstanding shares with current authorization. The company could do this this year alone with outstanding authorizations.

At $85 WTI the company also expects to generate an 8% dividend yield and opportunistically repay roughly $1 billion in debt to improve the company’s leverage ratio. This wide variety of strong shareholder returns shows the company’s compelling yield potential.

Devon Energy’s Asset Strength

Supporting it going forward, Devon Energy has the assets to continue this growth past 2022.

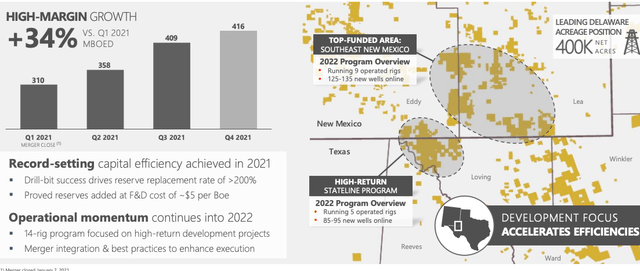

Devon Energy is planning to spend roughly $1.9-2.2 billion in capital spending for the year, a relatively significant amount. The company expects 34% of high margin YoY production growth and it has showed a continued ability to continue adding to its reserves at a mere cost of $5/barrel, supporting continued low costs.

The company has a substantial 14-rig program to focus on continued growth. The company is primarily operating in the Delaware Basin, where it has 400 thousand well-located acres with a plan to drill roughly 13 wells/rig throughout the year. Despite inflationary pressures, the company has continued to see strong cost reductions from growing efficiency.

The company’s unique and well-distributed assets have minimal risk and the ability to continue growing the company’s cash flow.

Thesis Risk

The risk to the thesis is oil prices. The company is a great investment at more than $70 WTI, a strong value in a market where WTI is at more than $100 WTI. However, prices have remained volatile and dropped significantly before, and that could always happen again. That could significantly hurt the company’s future shareholder returns.

Conclusion

Devon Energy was the best performing stock in the S&P 500 in 2021 for a good reason. The company has been rapidly increasing its shareholder rewards with share buybacks and provided investors with a high single-digit shareholder yield on the back of the company’s variable dividend policy. That should continue to grow.

The company has a low cost and incredibly strong asset position spread across several major basins in the United States. The company’s strongest is the Delaware Basin, which is expected to receive 75% of the company’s capital allocation. The company will continue generating double-digit shareholder rewards making it a valuable investment.

Be the first to comment