limpido

Background

Devon Energy (NYSE:DVN) is an independent energy company which explores, develops, and produces oil, natural gas, and NGLs (natural gas liquids). Its operations are concentrated in various onshore areas in the United States. The company’s main objective is to maximize cash flow and shareholder return. The ability to do this is determined by commodity prices, which can be volatile. The company strives to execute responsible investments, own a sustainable portfolio of premier assets, and maintain adequate liquidity and a strong balance sheet.

I originally bought Devon Energy at the end of 2020 for about $16 per share. I was going to write an article shortly after, but I left to go to Spring Training and didn’t have time (I play baseball in the pros). I regret not writing an article very much because even at that time I recognized that the stock was extremely mis-priced. However, I am writing an article now and better late than never, I suppose…

Thesis

Devon Energy is still an undervalued stock that has more room to escalate. I expect its stock price to exceed $100 per share in the long-term. The company is producing massive free cash flows and has been a leader in the industry for decades. With the price of oil near $100, investors will benefit from the variable dividend and growth in earnings. While impossible to predict, I believe oil prices will remain elevated, which translates into continued growth for Devon Energy.

Properties

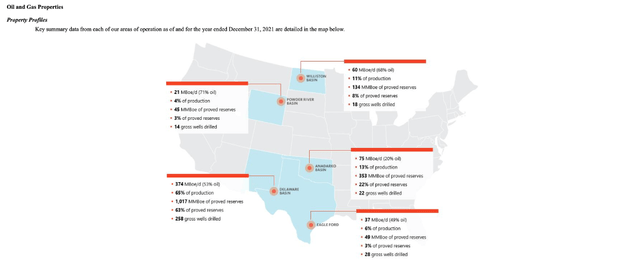

DVN’s Properties (10-K 2021)

If you read my previous article on Bank7, you will notice that I started off analyzing the stock by looking at its primary asset – its loan book. Likewise, let’s evaluate Devon Energy by examining its primary assets:

- The Delaware Basin: is the company’s most productive program and therefore the top funded asset, with about 75% of capital allocation directed towards it for 2022. It has a significant inventory of oil and liquid rich drilling opportunities and the company expects to deliver high margin drilling programs for years to come in this basin. There are 13 rigs developing this asset.

- The Anadarko Basin: is one of the largest in the industry and provides long term optionality and significant inventory. There are two rigs developing this asset.

- Williston Basin: is a high margin oil resource and contributed significant cash flow in 2021. There is one rig developing this asset.

- Powder River Basin: is an emerging oil opportunity. There is one rig developing this asset.

- Eagle Ford: provides strong operating margins due to its low-cost access to premium Gulf Coast pricing.

I will not pretend to be an expert in evaluating the quality of each basin Devon Energy owns; however, I will say that the overall earnings delivered by the basins indicates they are producing excellent returns. Sometimes logic can replace expertise.

Why Not Expand Production?

This is a common question that gets asked. Following the basic laws of supply and demand, why haven’t oil companies ramped up production as oil prices have gone up dramatically?

Answer: To produce more oil, capital investments have to be made. These investments are expensive, require lots of time, and are uncertain. There is no guarantee that oil is present in the exploration site or that the market price of the oil will be high, in the event that oil is discovered. A company making an investment has to be sure that it will reap profits 5-20 years into the future. Oil companies have doubts as to what the price, demand, and regulations will be, and as such, make drilling for new oil an extremely risky investment.

Oil Production, Price, and Cost

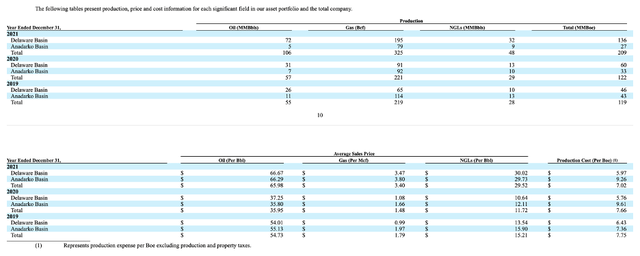

Oil Production, Price, and Cost (2021 10-K)

Despite the uncertainty and risk in making capital investments, we can see that the company has in fact significantly increased its production across the board. Furthermore, in Q4 2022, the company plans on investing a little under a billion dollars in capital expenditures. In the bottom half of the table, we can see the average sale price of each category of oil. For example, last year the average price of oil sold by Devon Energy was $65.98 per barrel.

The current price of WTI Crude and Natural Gas is $88.20 and $6.13, respectively. These are the two biggest pieces of Devon Energy’s asset portfolio and have the biggest impact on the company’s bottom line. In other words, the primary determinant in Devon Energy’s share price will be the price of oil, which is unfortunately impossible to predict. However, we can look at some facts and make an educated guess.

Demand for Oil

Oil demand is inelastic meaning no matter the price (excluding extremes), the same quantity is demanded. This is because the public has to get to work, run errands, visit family, etc. Therefore, they are forced to use oil no matter the price. However, demand is like a spigot – it can be turned on and off instantly at will.

Supply for Oil

Oil supply is not easy to increase on a whim. To increase output, massive capital investments have to be made, which require capital, resources, labor, and most of all, time. Therefore, supply is not like a spigot – oil supply cannot increase with a snap of a finger.

Oil Price

This timing difference is one of the reasons why the price of oil has risen so much. After the lockdowns, America had excess supply of oil because there was no demand for it. However, demand being a spigot, Americans all at once started to use oil again once the lockdowns ended. But oil supply, which was reduced due to COVID, takes time to readjust upwards. This lag creates a timing difference that results in the demand for oil being much higher than the supply, which pushes the price up.

Further escorting the price up is inflation, which is the expansion in the supply of money. The government has showered the economy with money and the Federal Reserve has kept interest rates artificially low. Both of these facts cause the general price level to rise as there are more dollars chasing the same amount of goods, therefore “bidding” up the price of each good.

Third, oil is a commodity and thus, even more sensitive to inflation than a good. Goods are typically non-fungible, whereas commodities are fungible by definition. For example, a lot of companies make cell phones. All these cell phones are different from one another (non-fungible), which means the price of each phone can vary because of its differentiating factors. Oil is a commodity which is non-fungible and therefore the price of one barrel cannot deviate from another. The implication being there is less competitive force keeping a lid on prices because all oil producers are selling the same non-fungible commodity.

Fourth, oil is priced in US dollars and the USDX is strong at 111 spot 35. The index has climbed almost 25% since January 2021, a time when WTI Crude oil was about $54 (it is now $88.20). This seems counterintuitive – why would the price of oil climb as the dollar strengthens? I believe the prior three factors (especially supply/demand and inflation) outweighed the effect of the strong dollar.

However, all four factors are intertwined. For example, I believe the scourge of inflation would be much worse had it not been subdued by the strong dollar. As the dollar weakens though, it will become more costly to import oil, since the US does not produce enough for itself. Therefore, the dollar weakening will be a huge catalyst to push the price of oil higher.

There are a few other catalysts which could send the price of oil higher which must be mentioned:

- OPEC+ agreed to cut oil output by 2 mln bpd (about 2% of the global supply) starting in November.

- The releases from USA’s strategic petroleum reserve will ultimately have to come to an end once when there is no oil left. President Joe Biden has reduced the reserve by 37% from 638 million barrels to 400 million. Once we run out of oil in the SPR, supply will be even less.

- Once the midterm elections end, politicians have less incentive to fiddle around with high gas prices as they are not trying to get reelected.

- At some point, China should end its lockdowns.

Note: There are other pressures on the price of oil derived from OPEC and geopolitical developments, but these are ongoing, ever-changing, and beyond the scope of this discussion. I have addressed the important determinants in the price of oil above.

Devon Energy Fast Facts

- $1.3 billion in cash, no major debt payments upcoming, 60% of debt matures after 2030.

- 4% reduction in share count TTM, stock retired at an average price of $50 per share.

- $5 or more dividend per share expected this year, up to 50% payout ratio still intact.

- $2.0 billion stock buyback program still in place.

- $6.3 billion free cash flow expected in 2022; FCF/share = $9.63.

Note: Some analysts are slashing their buy rating because DVN’s total dividend was $1.35 this quarter verse $1.55 last quarter. Investors must understand that a variable dividend, varies. Some quarters will be higher, some will be lower.

Free cash flow last quarter was $2.1 billion versus $1.47 billion this quarter. If management had earned slightly more FCF than last quarter, the adjusted Q3 2022 total dividend would have been around $1.70. You have to normalize FCF before you assess the dividend.

An Economic Fast Fact

The energy sector made up an abysmal 2% of the S&P 500 in 2020 and a slightly higher 6% today. If energy stocks continue to provide value, fund managers will have no choice but to increase their holdings in the energy sector. One strategist, Louis Navellier, believes the energy industry could hold a 30% weighting in the S&P 500 by 2025. This is an extreme claim, but his underlying point remains valid – money has been moving from growth to value and currently profitable oil stocks provide more value than potentially profitable tech stocks in an environment where interest rates are higher.

EPS Valuation

With those facts out of the way, let’s discuss valuation. So far this year, Devon Energy has earned $1.88 (Q1), $2.59 (Q2), and $2.18 (Q3) per share. We can expect FY 2022 EPS to be in the range of $8.50 – $9.00. If we apply a 12x P/E, then Devon’s fair share price will be between $102-108, representing a 52-61% gain from current levels.

The key here is what multiple (P/E ratio) will investors assign to Devon Energy’s earnings? The stock keeps banging its head against $80 and I believe it is because investors simply do not believe oil prices will remain high. I think there is pessimism in the air and investors believe oil prices are heading back into the $60s and that Devon Energy’s current spike in earnings will be short-lived.

FAST Graphs Valuation

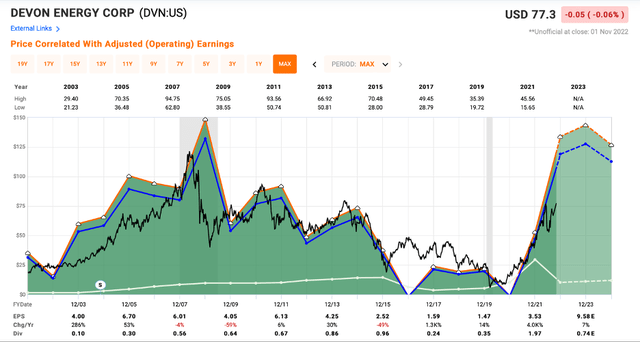

DVN Earnings Growth (FAST Graphs)

The first thing I want to point out is this is a cyclical stock as there are long periods of time where earnings rise and then fall. The period we are entering is similar to that from 2001 to 2008, except on a more rapid pace. Next, we can see that the company has produced consistent earnings over the long-term while paying a solid dividend over that time period.

Cyclical stocks are tricky. Investors have to buy when they are at the most expensive price relative to earnings because that is precisely when the earnings explode, leaving the P/E looking cheap in the aftermath. If an investor does the opposite (buy when the P/E is cheap thinking that the stock is steal), then he could be walking into a recession ready to dissolve the cyclical stock’s earnings, which will leave the investor holding a high P/E stock out of nowhere.

Devon was an expensive stock in 2020 and has been getting less and less expensive as the earnings have exploded. I believe we have more room to run in this bull cycle and investors are evaluating this cyclical stock at a good time still.

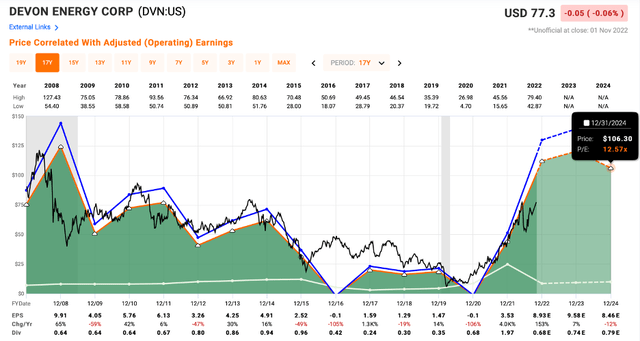

DVN’s Earnings (Shortened) (FAST Graphs)

If I change the time frame to 17 years, the graph displays something very important: how closely the stock price (black line) traces earnings (the green area). With this in mind, if the company earns $8.46 in 2024 as analysts predict, then the fair share price would be $106 at a historical normal P/E of 12.5x, representing a 58% return.

Since both of the above graphs have displayed the correlation between Devon Energy’s earnings and its stock price, we have to ask the obvious question: will the earnings increase? And again, the answer to that depends on the price of oil. So, will the price of oil increase?

To recap as I stated above, the four reasons why oil could increase are:

- Demand exceeds supply

- Inflation

- Enhanced sensitivity to inflation for commodities

- Weakening US Dollar

However, no one can predict the future. If oil prices remains elevated, the stock price should exceed $100, but if not, the stock price will crumble. And that leads us perfectly into the next section…

Risks

Oil companies carry lots of risk with them that investors need to be aware of in their evaluation process. I will list some important ones with my thoughts:

Government Regulation

The oil industry is subject to massive government regulations and as these companies continue to produce record profits, political pressure emerges to penalize them. There is sentiment in the US government that oil companies price gouge and should be subject to a windfall tax. If any proposed threats to the oil industry levied by the government materialize, profitability would suffer.

Commodity Price Volatility

If market forces recalibrate and assign a lower price to oil, then Devon Energy’s profits would disappear, leaving a lot of “bag holders.” A lack of demand based on alternative energy or a recession would be the primary two causes for oil prices to retreat.

My opinion: I truly do not believe demand destruction from a recession is going to lower oil prices. There are so many overwhelming catalysts for oil prices to increase (I listed eight earlier in the article). Plus, even if there was a recession, OPEC would cut production, which once again, puts upward pressure on the price of oil.

Cyclical Stock Risk

Buying stock in a cyclical industry requires timing; and since no one can time the market, investors could be buying this stock at the wrong time.

Negative Sentiment from Investors

Many investors, both retail and professional, lost a lot of money in oil companies during the last cycle. These retail investors, institutions, and asset managers are hesitant to jump back in as their previous losses are still fresh in their mind.

For a full set of risk factors, please click here.

Takeaway

Devon Energy is an industry leading producer, which deserves consideration in an investor’s portfolio given the inflationary landscape today. The company’s earnings solely depend on the price of oil, which is impossible to predict. There are four catalysts which could send the price of oil higher: demand exceeding supply, inflation, commodity price sensitivity, and a weakening dollar. However, nothing is guaranteed and if oil demand drops enough, then the oil price will follow suit and drag Devon Energy’s stock price down with it too.

However, given the company’s EPS and my outlook for higher oil prices, this is a stock which could trade hands at over $100 per share. Investors have an opportunity to make 50-60% on their money from current levels. To date, Devon Energy remains one of my largest positions, ever since I bought a huge block at $16 per share about two years ago.

Simply put, a bet on Devon Energy is a bet on oil prices.

Be the first to comment