ollo

Dear readers,

In this article, we’re going to take a look at Deutsche Post (OTCPK:DPSGY), one of the largest logistical companies on the planet. We’ll see what drives this company, and what we get when we invest in the company. Deutsche Post is today known as the Deutsche Post DHL Group, and there are, of course, reasons for this. I’ll show you what those reasons are as well.

This will be an initial deep-dive on Deutsche Post – so let’s get going and see what we have.

Deutsche Post – An introduction

The Deutsche Post AG, which is currently operating under the trade name Deutsche Post DHL Group, is a German, but multinational delivery and supply chain management company. Its headquarters are found in Bonn.

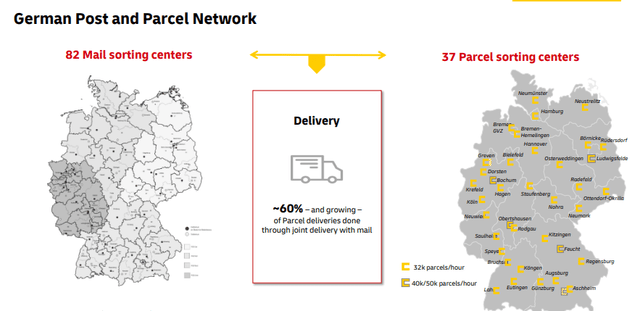

It is, quite simply, one of the world’s largest logistics and courier companies. The postal division alone delivers tens of millions of letters per day, making it, to date, the largest postal company/division in all of Europe.

Then we have the parcel division – DHL – which is a wholly-owned subsidiary with representation in well over 50% of the entire world, going by countries and territories.

The current organizational structure started to appear when the Deutsche Bundespost was privatized back in 1995. It became fully independent from the government 5 years later, and since that time, it has significantly expanded its operations through acquisitions – both inside and outside what one might consider “logistics” or even logical avenues – such as buying a manufacturer of electric vehicles. The company’s forays also included acquiring UK Mail, which became a division of the parcel network.

Deutsche post DHL IR (Deutsche post DHL IR)

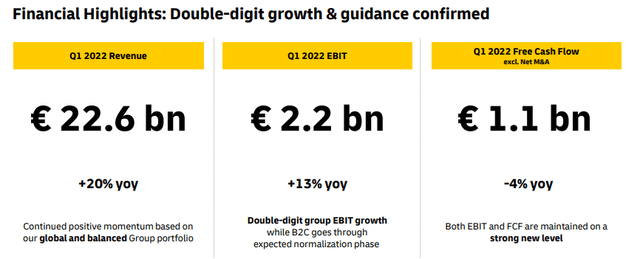

The current structure of the company can be simplified into a resilient, e-commerce-driven logistical company, with annual revenues not far south of €100B per year, as of the current quarterly run rate since 1Q22. From that revenue, the company earns an EBIT of €2.2B, or just south of 10% in terms of EBIT margin, and about 5% FCF margin.

The company has a broadly-structured portfolio including B2C, B2B, DHL Supply chain solutions, and the traditional/legacy Postal service. I view the mix here as very interesting because it blends very un-resilient segments that can be somewhat volatile (B2B Express, supply chain solutions) with extremely high-resilience sectors such as E-commerce related and legacy post.

Its position is that of the largest, most global logistical provider on earth – though FedEx (FDX) and UPS (UPS) might disagree with that assessment. Still, these companies lack some of the appeals that Deutsche Post has.

The company has worked for years to establish business processes that aren’t just resilient to GDP fluctuation and volatility but to inflation and entire economic cycles. Its segments – such as DHL Express, global forwarding/freight, Supply Chain, eCommerce, and Post & Parcel each address inflation through an appealing mix of surcharges, staff cost inflation addressed through GPI, labor productivity, digitization, clause protection in contracts, yield management and straight price increases – which the company is in fact very used to employing.

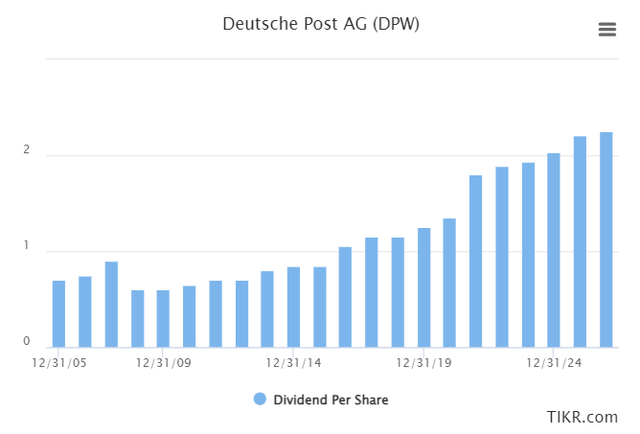

The company is appealingly-rated, with a BBB+ positive investment-grade rating. Furthermore, it has a very appealing dividend history with very few bumps – the only one back close to the financial recession. Since that time, it’s been a consistent history of increases, cut short not at all by the appearance and havoc of COVID-19.

Deutsche Post Dividend (S&P Global/TIKR)

So, this company offers Post and Parcel legacy, it works with DHL Express courier and parcel shipment services (owning different airlines), it’s in the Global Freight/forwarding business, operating a huge freight network, and also provides contract logistics and corporate information. That, on a high level, is a fairly complete logistics company in a way that even UPS and other peers have a hard time equaling.

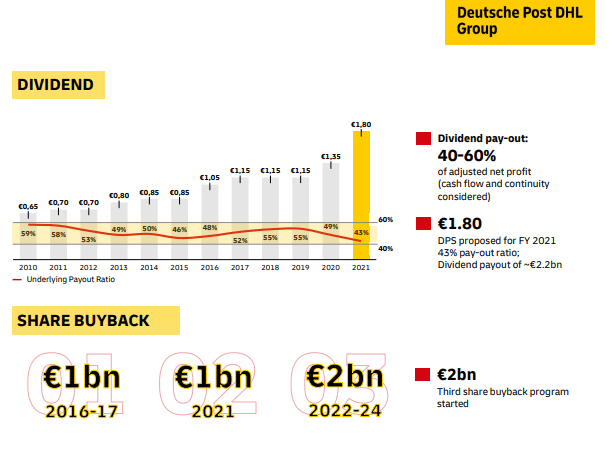

The company has an appealing use of company cash, split into growth investments and reinvestments in the company, shareholder returns through both buybacks and dividends (dividends before buybacks), and accreditive M&A as a third avenue. The latest such avenue is Hillebrand, for which the company paid approximately €1.4B and which is now booked as of 1Q22.

The group shows an upward trend – by that, I mean that the group ROCE is far higher, and trending higher, than the inflation-adjusted WACC of around 9% that I use for my calculations. Back in FY18, the company’s ROCE was 9% – today it’s 18%. It’s been stepping up for years, and I don’t see it dropping back down, as group ROCE is actually 25% if we exclude various accountings of goodwill.

Remember, ROCE is a metric that we use to assess a company’s actual profitability and capital efficiency. How well the dollars/euros that Deutsche post-DHL is making, are put to use. ROCE is especially useful in capital-intensive sectors including utilities, telcos, and, not coincidentally, logistical companies which typically work with both massive fleets of vehicles, planes, and other assets as well as real estate assets. The rising ROCE tells us that Deutsche Post is very good at increasing the amount of profit they can make on a per-dollar basis.

To me, ROCE trends are far more important than ROCE numbers for a single year. These trends show us that, despite what’s happening around the world, the company is still doing things “right”. This also goes for the company dividend and share buybacks. Take a look.

Deutsche Post DHL dividend (Deutsche Post DHL)

There isn’t much to dislike here – at all. With a BBB+ to A- rating target, a disciplined cash allocation policy, a legacy-backed set of operations some of which would notice only a blip even from a recession, and with the pricing power that a company of this size and scope enjoys, there are very few fundamental things that an investor can point to and say “that’s a serious risk”.

On a macro level, it’s likely that the fundamental upside is apparent for this, and similar companies continue. I expect an eventual return to pre-pandemic rates of sales for E-commerce, even if I don’t share the group’s optimistic growth rate expectations for the sector. However, I believe that adjacent sectors, including things like digitization, big data, logistics automation, API’s/analytics, and the like are likely to continue driving company growth here.

DHL is a major beneficiary of increases in global logistics – which are set to continue because it’s a product of the GDP, and population growth rate. This alone will ensure, to some degree, that demand for logistics increases. And DHL is a major company on this track that can and will benefit from these overall trends.

The company has increased its earnings, and it’s confident that profits will grow from these levels, rather than go back down. The company also has ESG and neutrality roadmaps that target 2030 targets for climate protection.

It is, to my mind, sufficient to point out that this company is a major beneficiary of these trends, and to then further point to the fact that this company is structurally and fundamentally sound.

The dividend is actually high. At a €1.8 per share dividend and a declined share price of €35/share, the company comes to a 5.02% yield for the native share of DPW. That means that the ADR-implied yield of around 2.7% is currently false.

So you’re getting a 5%+ yield from investing in one of the worlds biggest logistical companies, with revenues above €80B per year and a continued upside based on current trends.

Let’s look at some risks.

Deutsche Post – The risks

No company is without risks – and certainly not Deutsche Post. One thing i see often in the company’s forecast is the assumption of a return to a pre-pandemic e-commerce growth rate. I do not share this assumption. I believe e-commerce will continue to grow, but I believe it will grow at lower numbers, as this “tech craze” we’ve been seeing for years, to my mind, is grinding to a bit of an end or a halt. The stock market and the current trends, to my mind, are an accurate reflection of this.

Based on this, the company’s forecasts not materializing in this sector, including its current 2022E guidance, could impact numbers. Furthermore, at this point, it’s a tough exercise to start estimating the combined impacts of wage inflation (look at German wage increases in other sectors), fuel price inflation, and other input cost increases that eventually will eat their way into the company’s bottom line and per-share profits. I believe that the company will be one of the best at this, but there is only so much a company can do to offset this – and I believe that the company is being a tad optimistic here.

In fact, the company’s historical optimism is one of the risks as well. The company has a history in the past 10 years of overestimating, which leads to valuation increases, only to slightly disappoint (or more), which leads to major drawdowns – a higher beta than some other peers and other companies.

There’s also the fact that a not-inconsiderate amount of the company’s freight – 38% for global – is air freight. The current state of the airline industry and its issues haven’t spread far into logistics compared to commercial flights, but it’s still a major impact. There’s also the question as to future ESG considerations, as over 70% of the company’s emissions are tied to its air fleet. The company has done amazing things to its ground transport emissions through a mix of EV and improvements, down to 22% of company emissions. You might expect ocean to be the problem, but that’s not the case – only 7%.

The problem is air – and there are no easy solutions for this.

In the end, however, any of these risks mentioned are limited in their scope to what you get when comparing this player to any other. DHL is the #1 contract logistics player in the entire world. It’s expertly managing complex supply chains, and its arm for this generates a 10%+ EBITDA margin. All of this is backed by an extremely solid legacy network of post and parcel, that won’t go away anytime soon.

Detusche Post DHL IR (Detusche Post DHL IR)

Let’s move into valuation.

Deutsche Post DHL Valuation

The valuation for the company is fairly easy – I can tell you from the get-go that following the recent decline (and when I started buying), I consider this company to be significantly undervalued.

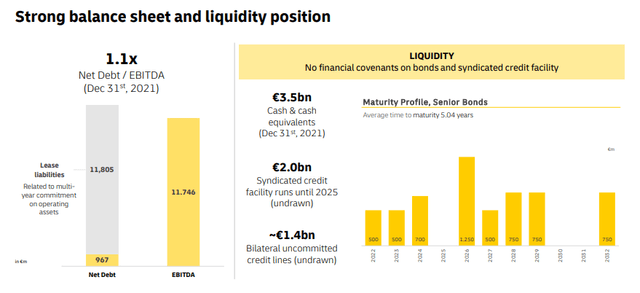

This is a product of the extremely strong fundamentals. Those extremely strong fundamentals include one of the strongest leverage ratios in the entire sector, a net debt/EBITDA of less than 1.2X.

Deutsche Post DHL Financials (Deutsche post DHL)

As you can see, there are no maturities of significance in the near term. Any of the maturities in the coming years could be paid off with the EBIT of less than half of one single quarter.

The largest appeal comes from the combined fact that the company is a superb investment, having generated 360% RoR in less than 14 years, at a CAGR of 12.2%, which is well above market averages. That also includes the latest decline in share price, where the company dropped from a native share price level of almost €60/share to where it now trades at €35.7

I bought my first position at €36.5, after being on the sidelines for many years.

Why did I do this?

Because at current valuations, the company trades at a sales multiple of less than 0.9X, revenue of less than 1X, and an EBITDA multiple of less than 6X. For P/E, we’re now below 10X from a conservative point of view with regard to forecasts, and the yield is almost double what it was a few years back. This would obviously be a concern if the company was expecting some sort of major decline in its revenues, profits, or some other adjacent issues that could impact the business. But this isn’t the case. I forecast the company at a conservative EBITDA/revenue growth rate of non-impacted GDP at 1-2% and my aforementioned WACC of 9%, with a risk-free rate updated to account for the 2022E rate increases at 3.5%. This brings me to a DCF range of no less than €45-€48/share, which implies an upside here.

Peer multiple comparisons are a joy to behold here. UPS trades at more than double the company’s current 0.7X revenue multiple, and close to a 15X P/E, compared to Deutsche Post DHL’s current 8.5X. FedEx, at 0.94X revenues and 10X P/E, is only slightly better. Even more specialty, smaller/niche companies in the sector such as C.H Robinson (CHRW) and DSV trade at multiples well above those we currently see applied to Deutsche Post. And this does not account for the simple fact that the yield of this company is 2-3X the yield we find in adjacent peers. This is not even mentioning the logistics giants which have no yield and trade at growth multiples, such as Ocado or Autostore.

The simple fact is, applying any sort of peer comparison to this company – and I see absolutely no reason to discount Deutsche post DHL in any way (feel free to tell me why you think so if this is the case), so any sort of lowering of the PT is not in the books for me.

I believe that this business should trade at least at 11-13X P/E of conservative GAAP – and that really is at least. That means, based on the 2021E as well as forecasts and even slight growth assumptions for the company going forward, that anything below €45/share is a no-go. If we accept S&P Global forecasts or FactSet forecasts of a modest 2-6% EPS growth, then that goes up well above €50/share.

S&P global targets are higher. 18 analysts give the company an average of €58, with a high of €74. This is obviously a bit too heavy – but the notion that they present, with 15 out of 18 analysts considering the company a “BUY” or “Outperform” is one I can get on board with. My own estimates call for a 2-4% EPS growth for the coming years, and I believe the combined appeal of reversion and yield safety will be what drives the company upward here.

I call Deutsche Post DHL a “BUY” and I give it a “BUY” at a €48/share target – and that’s going lowball.

Thesis

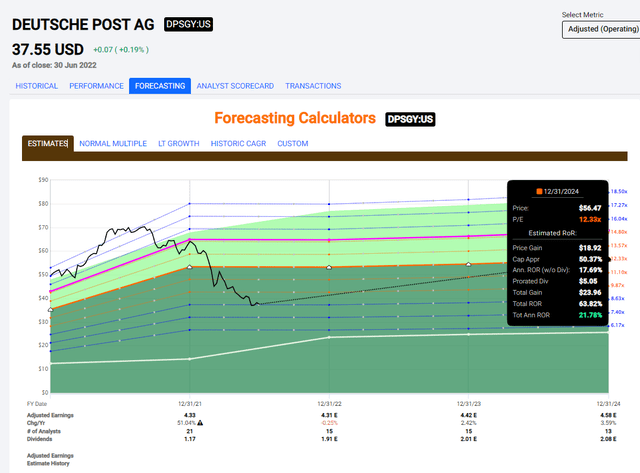

You can also look at the company’s ADR, called DPSGY, which goes some way to show how the company is currently trading in relation to its actual earnings, forecasts and current quarterly run rates.

Deutsche post DHL ADR upside (F.A.S.T graphs)

Even just considering a 12X forward upside, that RoR is still potentially over 20% – and that’s with the yield supposedly at 2.7%, even though native is at 5%+.

As always, I believe the native through IBKR or one of the brokers that accept EU stocks is the way to go here. Investing in Deutsche post DHL means exposure to the attractive EU logistics and legacy post/parcel market. This is not going anywhere, despite the current issues. The yield is well-covered, the company has already reported excellent run-rate 1Q22 results and delivered excellent guidance.

At below 9X P/E, you’re locking in the capital at a very low multiple, with a massive upside – and that’s what I’m all about.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment