photoschmidt/iStock Editorial via Getty Images

A few days ago, on March 09, 2022, the German logistics company Deutsche Post AG (OTCPK:DPSTF) reported annual results for fiscal 2021 and not only was this the best year ever by absolute numbers (highest revenue and highest earnings per share), but the company also reported the highest growth rates for revenue and earnings per share in a long time.

Despite these high growth rates, Deutsche Post constantly declined over the last few months and since the highs in late summer 2021 (around €60), the stock lost more than one third of its value and dipped briefly below €40 in the last few days and the stock is more or less trading at the same level as it was in December 2020, when my last article about Deutsche Post was published. Back then, I was rather neutral about the business, but with the improved fundamentals in the meantime, it certainly makes sense to look at this German mega cap again.

Annual Results

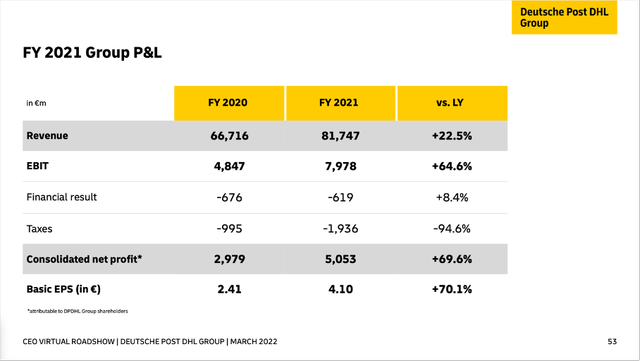

As already mentioned, Deutsche Post reported great results for fiscal 2021 and could generate €81,474 million in revenue. Compared to €66,716 million in revenue in fiscal 2020 this is an increase of 22.5% year-over-year. EBIT also increased from €4,847 million in fiscal 2020 to €7,978 million – resulting in 64.6% YoY growth and basic earnings per share increased even 70.1% from €2.41 in fiscal 2020 to €4.10 in fiscal 2021.

Deutsche Post could also increase its EBIT margin from 7.3% in fiscal 2020 to 9.8% in fiscal 2021 and net income margin also increased from 4.8% in fiscal 2020 to 6.6% in fiscal 2021. And finally, free cash flow increased from €2,535 million in fiscal 2020 to €4,092 million in fiscal 2021 – resulting in 61.4% year-over-year growth.

Growth

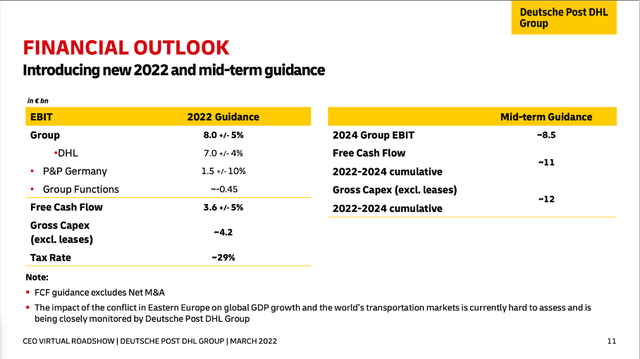

When looking at the guidance for fiscal 2022, Deutsche Post will have difficulties to grow this year after the great results in fiscal 2021. While Deutsche Post is expecting EBIT to be similar to fiscal 2021, free cash flow will be lower and only around €3.6 billion (fluctuating in a range from 5% lower to 5% higher).

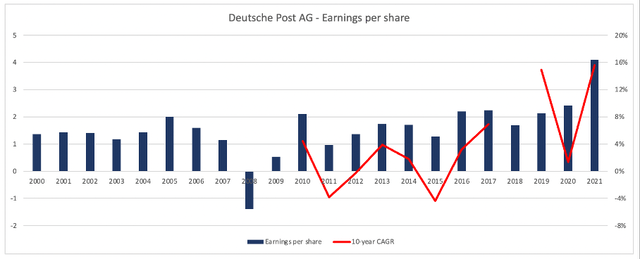

Aside from guidance for fiscal 2022, we can also look at the earnings per share of Deutsche Post in the last two decades. When looking at the years between 2000 and 2021, the company increased its earnings per share with a CAGR of 5.40%. However, the biggest part of growth came from fiscal 2021. When looking at the years between 2000 and 2020, EPS was only growing with a CAGR of 2.9%.

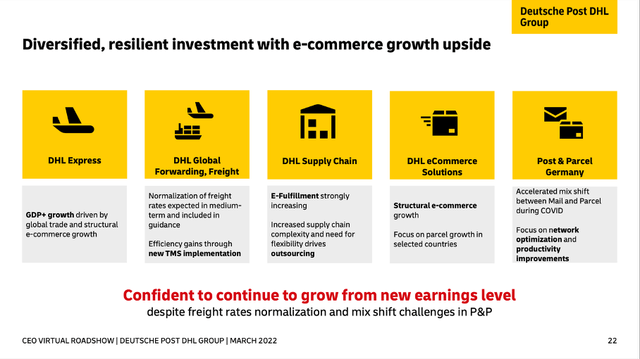

When looking at the past two decades, Deutsche Post could not really grow with a high pace and the earnings per share rather fluctuated than growing with a clear pace. But we see high growth rate since 2018 and Deutsche Post is quite optimistic that structural e-commerce growth will be a tailwind for DHL Express and DHL eCommerce Solutions. Additionally, e-fulfillment will increase in the years to come.

But even with different growth drivers in the years to come, we should not expect similar growth rates as in fiscal 2020 and fiscal 2021. And it is also not unrealistic, that growth rates will lag in the next few years as the increase in the last two years was an extreme outperformance and we could see a reversion to the mean. In case of Deutsche Post, I can imagine that the company will grow with similar rates again as before the pandemic (low-to-mid single digit growth). However, I can also imagine a scenario where e-commerce will grow with a much higher rate now (with the pandemic being an accelerator for e-commerce and the trend will last for several years to come).

When talking about growth and a growing e-commerce business, we also must keep in mind, that big e-commerce players like Amazon (AMZN) are also entering the logistics business and Deutsche Post might not profit so much from a growing e-commerce business when the big players are delivering on their own. It can also happen, that Amazon will take away business from Deutsche Post.

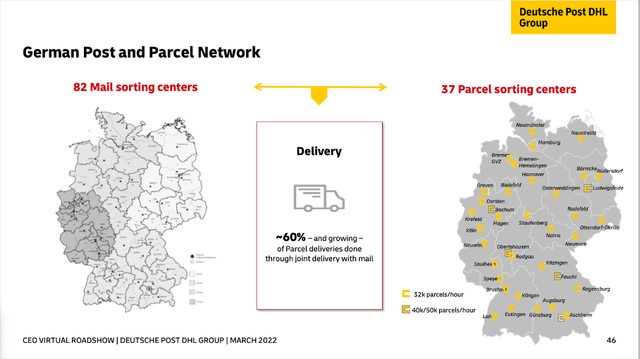

Stable Business

No matter what the growth rates will be and even if new competitors should try to enter the market, Deutsche Post is a very stable business and especially in Germany it will be difficult for new potential entrants to compete. In Germany, Deutsche Post has 82 mail sorting centers and 37 parcel sorting centers resulting in a dense network, which is making it difficult for new competitors to operate with the same efficiency. And while companies like Amazon have the financial strength to put a lot of pressure on other logistics companies, most other business (especially smaller companies) will have difficulties to compete with Deutsche Post.

In my last article about Deutsche Post I also pointed out, that the company is market leader in many different segments in Germany:

Additionally, Deutsche Post DHL is market leader in many segments. In 2018, the company was the biggest logistics company by revenue in Europe – followed by Maersk A/S, Deutsche Bahn and Kuehne + Nagel. In the German mail communication market, Deutsche Post has a market share of around 62% (according to the company’s own estimates). DHL also has a market share above 40% in parcel in Germany. At least in Germany, Deutsche Post DHL is a clear market leader which can lead to cost advantages for the business. However, this is also not the source of the economic moat.

Overall, we can describe Deutsche Post as a stable business, which should be able to defend itself against competitors.

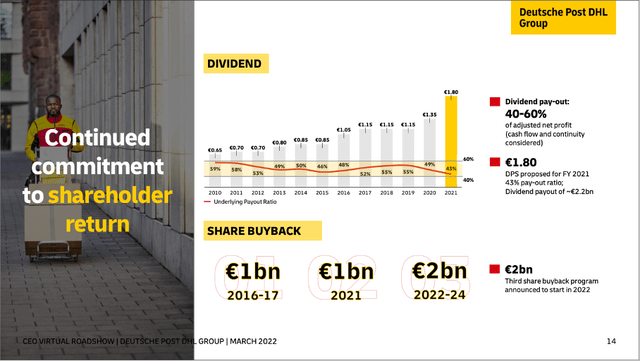

Dividend

Deutsche Post also increased its dividend from €1.35 for fiscal 2020 to a proposed dividend of €1.80 for fiscal 2021. This is resulting in an increase of 33% year-over-year and a dividend yield of 4.2% right now. When considering, that Deutsche Post is targeting a payout ratio between 40% and 60% of net profits, the dividend is at the lower end of that range as it is resulting in a payout ratio of 44%. The dividend will be paid on May 11, 2022.

Like most other German companies, Deutsche Post is trying to keep the dividend at least stable but does not increase the dividend every single year. However, with the rather low payout ratio in fiscal 2021, we can expect Deutsche Post to increase the dividend at least in small steps in the years to come.

And while the number of outstanding shares for Deutsche Post was more or less stable in the last few years (actually we saw a slight increase), Deutsche Post is planning to spend about €2 billion in the years between 2022 and 2024 on share buybacks. With a market capitalization of €53 billion right now, Deutsche Post can repurchase about 3.8% of the outstanding shares – assuming the stock price is staying at the current level and Deutsche Post will not dilute the number of shares in these years.

Balance Sheet

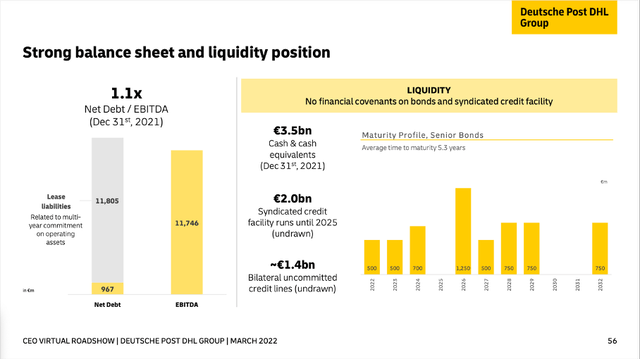

Deutsche Post also has a solid balance sheet. On December 31, 2021, the company had €3,283 million in current financial liabilities as well as €16,614 million in non-current financial liabilities on its balance sheet. Compared to a total equity of €19,499 million, this is resulting in a debt-equity ratio of 1.02, which is still acceptable. When comparing the total debt to the EBIT in the last fiscal year (€7,978 million), it would take about 2.5 years to repay the outstanding debt, which is also an acceptable ratio.

When looking at the asset side, Deutsche Post has €3,531 million in cash and cash equivalents as well as €3,088 million in current financial assets, which are also rather liquid assets. And when looking at the maturity profile of the senior bonds, the average time till maturity is 5.3 years and the highest amount Deutsche Post must repay in the next few years is €1,250 million in fiscal 2026.

Intrinsic Value Calculation

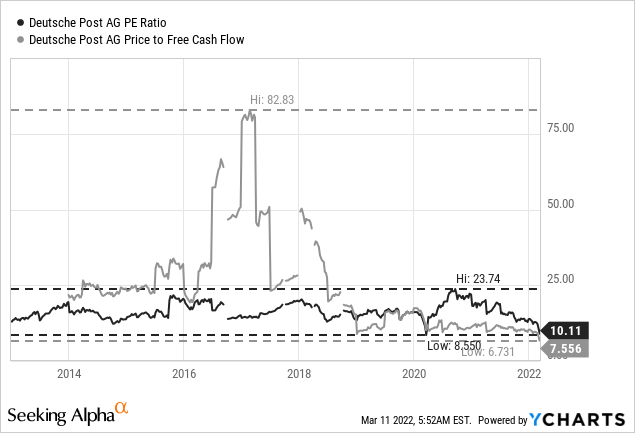

When looking at the P/E ratio, Deutsche Post seems to be extremely cheap right now. Taking the basic EPS of €4.10 for fiscal 2021, Deutsche Post is trading for 10.5 times fiscal 2021 earnings right now. Not only does a P/E ratio of 10 seem extremely cheap for any stable business, that is not declining, it is also the lowest P/E ratio Deutsche Post was trading for in the last few years (only during the crash in March 2020, the company was trading for a lower P/E ratio).

Aside from just looking at the price-earnings ratio, we can also use a discount cash flow calculation to determine an intrinsic value for Deutsche Post. As basis for our calculation, we can take a free cash flow of €3.6 billion as basis – according to the company’s own guidance. And let’s be cautious for growth in the years to come and assume only 3% growth annually. When calculating with 1,239 million outstanding shares and 10% discount rate, we get an intrinsic value of €41.51 for the stock making Deutsche Post fairly valued right now. When being a little more optimistic and assume 4% growth for the years to come, we get an intrinsic value of €48.53 for the stock.

Conclusion

Deutsche Post is a solid investment with a high dividend yield. Even when calculating with cautious assumptions for the years to come, the stock is fairly valued or slightly undervalued and we can expect an annual return around 10%. And finally, Deutsche Post could surprise and continue to grow with a higher pace than in the years before COVID-19.

Be the first to comment