jetcityimage/iStock Editorial via Getty Images

Designer Brands (NYSE:DBI) is one of the leading designers, manufacturers, and distributors of branded footwear and accessories in North America. It was founded in 1991 and was recently challenged by the pandemic, one of which was the disruption of its dividend payment. Nevertheless, I believe DBI is on track to give a dividend increase in the future due to its improving profitability.

DBI came back stronger in the recovery from the pandemic with its growing ROE and gross profit in comparison to its last 5 years of performance. The company managed to grow its revenue by an annual rate of over 4% over the last five years, outpacing most of its peers. I believe its main business is still expanding and I am optimistic that the company is on course to produce a better-than-expected performance.

I believe DBI might not be a timely investment in today’s slowing economy, but with its improving margin and liquidity, it unlocks value ahead of its potential dividend increase, making it a good buy at its dips.

Company Background

DBI operates under three segments: the US retail segment; the Canada retail segment; and the Brand portfolio segment. In all of their business segments, they both conduct physical and e-Commerce operations. After experiencing depressing figures due to the pandemic, the company has started to provide improving figures. Let’s start with the improving operating store count of 650 as of its Q1 2022, up from 648 last fiscal year. This resulted in a strong comparable sales growth of 15.3% and a two-year stacked comp of 67.5%.

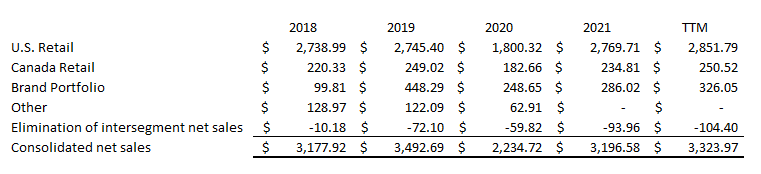

DBI: Improving Top Line (Source: Company Filings. Prepared by InvestOhTrader)

All of its operating segments have seen an improvement compared to pre-pandemic levels, as shown above. I believe with its transformation to be a leading brand builder from just being a retailer, DBI is successfully turning around towards sustainable growth.

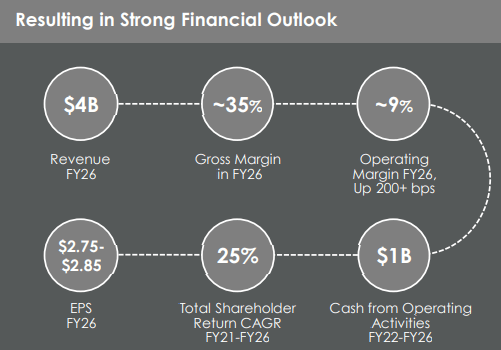

DBI: Strong Financial Outlook (Source: 2022 Investor Presentation)

With its transformative efforts and strong brand partnerships, as shown with its new prototype ‘Warehouse Reimagined’, I believe its outlook for FY26 is achievable. The company’s strengthened omni capabilities and customer experience contribute to the expansion of its VIP customer base, allowing it to maintain demand despite the slowing economy. Additionally, according to management, most of their customers are in the middle class, which supports the mentioned idea earlier.

…majority of our customer base has a household income over $100,000. So we haven’t felt perhaps some of the same pressures that others have from a customer. Source: Q1 2022 Earnings Call Transcript

After focusing on digitalization and e-Commerce operations since FY2019, DBI came back strongly in this recovery from the pandemic, and according to management, they are encountering strong growth in market share in the footwear industry.

We have gained significant market share in the first quarter. According to the NPD Group, DSW’s dollar growth outpaced the remaining total footwear market dollar growth by 15 percentage points for the first quarter. Additionally, DSW grew dollar sales faster than the remaining market in men’s, women’s and kids. We are particularly excited about the growth that we are seeing in our fashion assortment.

According to the NPD Group, DSW grew sales in fashion footwear 4x faster than the remaining market, resulting in market share gains. Source: Q1 2022 Earnings Call Transcript

Additionally, their long-term goal is to build a brand that inspires self-expression, which leverages the use of social media and helps the company promote brand awareness, achieving more efficient sales and marketing investment.

DBI: More efficient marketing expenditure (Source: Company Filings. Prepared by InvestOhTrader)

On top of this efficiency, management continues to invest in and improve their assortment strategy, which will contribute to achieving its 9% operating margin in FY2026.

Mixed FY2022 Outlook? No, It’s Getting Cheaper

DBI probably has a mixed outlook for its FY2022 in its Q1 2022, with a comparable sales growth rate to be in the mid-single digits compared to its previous guidance, which was to be in the high-single digits. On the other hand, management revised its diluted EPS forecast to $1.90–$2.00, up from $1.80–1.90. These flat growth figures may turn off some of its potential investors, especially looking at its diluted EPS last year of $2.0. DBI’s next fiscal year seems to be weak, especially looking at its P/E of 7.41x and forward P/E of 8.08x. However, with its $2.75-$2.85 diluted eps target in FY2026, up from its $1.01 normalized diluted EPS in FY2019, I believe DBI is undervalued as of this writing. This is especially true when we consider its trailing P/CF of 8.37x compared to its forward ratio of 5.36x. I will not be surprised to see DBI’s price challenge the street’s high range target of $22.

Buybacks & Dividend Catalyst

Covid-19 does not prohibit DBI from offering a good outlook for a 25% target total shareholder return from FY21 to FY26. This reassures investors that the company would continue to pay a growing dividend as its liquidity position improves, as noted below.

Our liquidity position, which includes cash and availability under our revolver is healthy, ending the quarter with $293 million versus $339.2 million last year. We had $306.9 million of debt at the end of the quarter versus $337.4 million last year, but our outstanding debt is now funded through our bank revolver, which carries substantially lower interest and less onerous covenants and restrictions than our term loan. Source: Q1 2022 Earnings Call Transcript

On top of this catalyst, DBI has also repurchased its own shares totaling 3.5 million shares as of May 27, 2022 with $312.2 million shares repurchase authorization in place.

Potential Change Of Structure

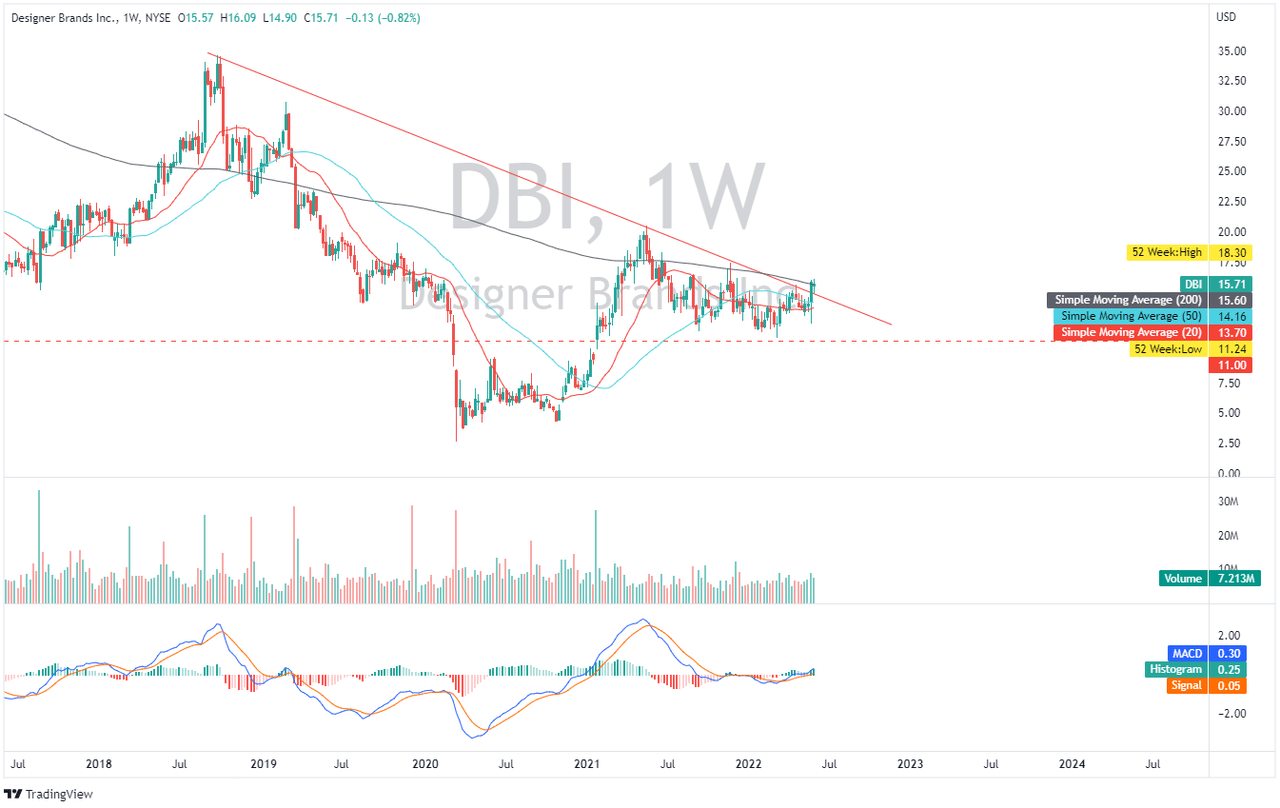

DBI: Weekly Chart (Source: TradingView.com)

Looking at DBI’s weekly chart, we can assume that there is a possibility of a change in market direction as the company successfully challenged its 20- and 50-day simple moving averages. However, as of this writing, its 200-day simple moving average is reacting as a significant resistance to monitor. I believe DBI will continue to break its 200-day simple moving average in confluence with the break of its multi-year trendline as shown in the chart above.

Looking at its MACD indicator, it has already crossed over its signal line, implying some bullish price action over the next few trading weeks. If price gets rejected at its 200-day simple moving average, I believe $11 is a strong support zone to monitor as well.

Key Takeaways

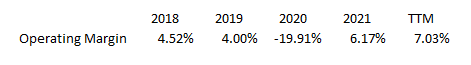

DBI: Improving Operating Margin (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

DBI’s top line growth snowballed into its improving operating margin, as shown in the image below. This helps DBI to produce an outstanding trailing net income of $163.6 million, a record over the last 10 fiscal years.

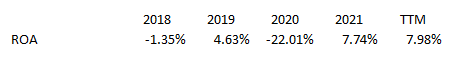

DBI: Improving ROA trend (Source: Company Filings. Prepared by InvestOhTrader)

Another value-adding catalyst is its improving profitability, which is clearly shown in its growing ROA. However, this figure remains below its peer, Caleres, Inc. (NYSE:CAL), which has an 8.65% trailing ROA.

Looking at its liquidity position, it shows a positive sentiment with its improving current ratio of 1.32x when compared to its last fiscal year of 1.20x. On top of its buybacks and dividend catalyst, DBI enjoys deleveraging, which helped its debt/EBITDA ratio of 3.42x improve compared to its 3.71x recorded last fiscal year. I believe DBI is undervalued and has a tolerable risk with a controlled Covid-19 situation in the North American region. This stock is a buy at today’s weakness.

Thank you for reading!

Be the first to comment