Galeanu Mihai/iStock via Getty Images

The WisdomTree Emerging Markets High Dividend ETF (NYSEARCA:DEM) offers a well-diversified and high yield option for investors looking for exposure to emerging markets without wanting too much exposure to China. With a distribution yield of 6.3% and a price/earnings ratio of just 6.2x, it is hard to find a well-diversified ETF trading at such low valuations.

The DEM ETF

The DEM tracks the performance of the WisdomTree Emerging Markets High Dividend Total Return Index, screening for the highest dividend-yielding stocks within the emerging markets. Included in its selection universe are dividend-paying companies over the prior annual cycle that meet minimum liquidity and size requirements. DEM selects the top 30% of firms ranked by dividend yield from the WisdomTree Emerging Markets Dividend Index. In addition, approximately 100 Chinese domestic listed companies by highest dividend yield that meet the index eligibility criteria will be selected for inclusion. Selected securities are then weighted based on dividends paid over the preceding annual cycle.

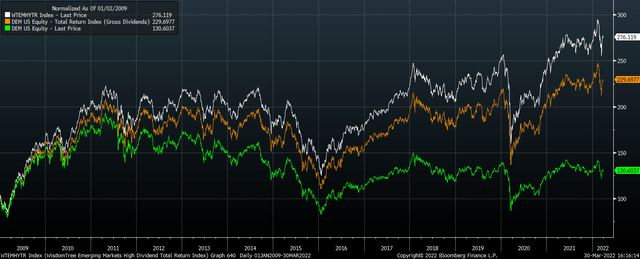

WisdomTree EM High Dividend Index, DEM, and DEM Total Return (Bloomberg)

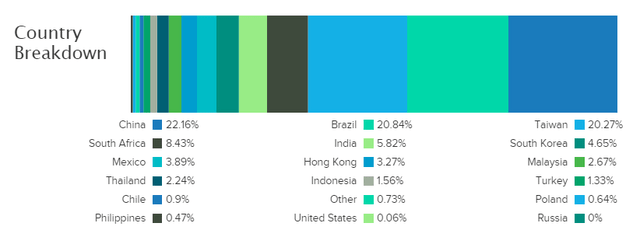

Like most high dividend emerging market indices, the fund has a high weighting of financials at almost 30%, due in large part to the inclusion of Chinese banks. However, the fund is very well diversified from a country perspective, with much less exposure to Asia than most EM ETFs. The fund is much more heavily weighted towards Latin America, for instance, with Brazilian stocks alone having a 21% weighting.

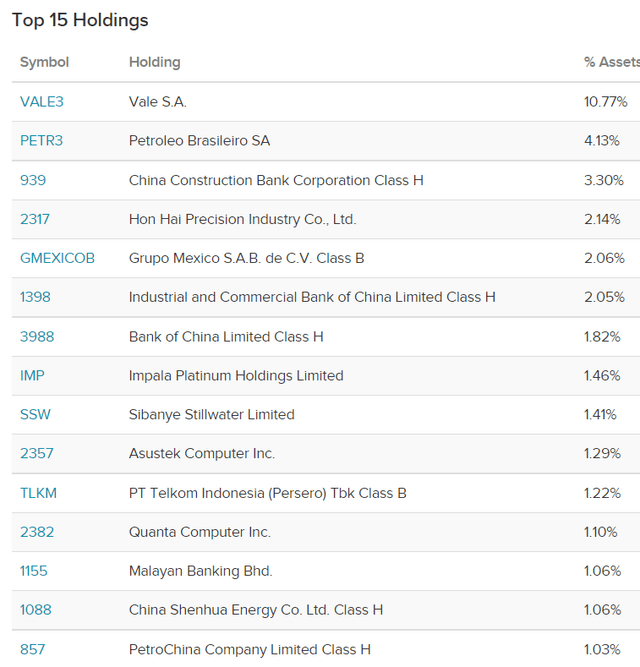

DEM Main Components (Etfdb.com)

Iron ore giant Vale (VALE), which currently pays a staggering 16% dividend yield, dominates the index with an 11% weighting. Apart from Vale, no other single stock has a weighting above 4%, and there are 483 companies in the index, significantly higher than most other EM ETFs. While the expense ratio is substantial at 0.63%, this pales in comparison to the fund’s dividend yield, which is currently an impressive 6.3%.

DEM Country Breakdown (Etfdb.com)

High Yield Reflects Abundance Of Cheap Stocks

One of the concerns I tend to have with high dividend indices is that they can often comprise of companies with extremely high dividend payout ratios rather than companies that are fundamentally cheap. This is emphatically not the case for the DEM. If we look at the underlying WisdomTree Emerging Markets High Dividend, it currently trades with a P/E ratio of just 5.9x, which is on par with the Covid crash lows. With the underlying index paying a dividend yield of 8.9%, this equates to a payout ratio of just over 50%, which is by no means excessive.

WisdomTree EM Dividend Index: PE, DY, and Dividend Payout Ratio (Bloomberg)

The next thing to consider is whether the low P/E ratio reflects a temporary rise in profit margins and returns on equity, which could reverse in the event of a fall in commodity prices or a recession that undermined banking sector profits. While it is true that measures of profitability do seem stretched at present, the index still trades at a huge discount to its EM peers in terms of its price/book and price/sales ratios. As the table below shows, the fund trades at a substantial discount to the MSCI Emerging Markets index on all major metrics.

DEM Valuation Discount Vs EM Benchmark. Bloomberg Data

| Dividend Yield | Price/Earnings | Price/Sales | Price/Book | |

| WisdomTree Emerging Markets High Dividend Index | 8.9 | 5.9 | 0.7 | 1.1 |

| MSCI Emerging Markets Index | 2.6 | 13.2 | 1.4 | 1.7 |

| WisdomTree % Discount | 71% | 56% | 50% | 39% |

Heavy Brazil Exposure Likely To Pay Dividends

The 21% weighting of Brazilian stocks in the DEM may be on the high side for many investors, particularly with two companies – Vale and Petrobras (PBR) – making up 15% on their own. However, as I argued in a recent article on Brazilian stocks (see ‘EWZ: Sticking With This Outperformer‘), even after the strong gains seen since the start of the year, they remain extremely cheap thanks to overblown political risk concerns. Vale trades at a 3.6x trailing P/E ratio, while Petrobras trades at 4.2x. Such low trailing P/E ratios in the past have reflected expectations of collapsing earnings due to commodity price crashes. However, with iron ore prices 70% up from their November lows and oil prices trading near record highs, earnings are likely to remain strong.

Chinese Banks Are Worth The Risk

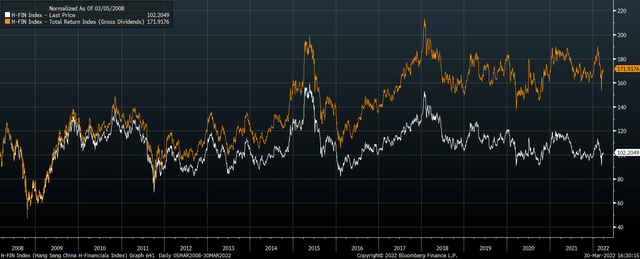

Chinese financials also make up almost 10% of the DEM, which again may seem high considering the legitimate concerns of Chinese corporate governance and the implosion of the real estate market, but my view is that at current valuations the reward is worth the risk. The Hang Seng Financials Index trades at a P/E ratio of just 5x and has a dividend yield of over 5% thanks to the strong fundamental performance of the Big 4 banks, all of which are in the DEM. Beijing’s announcement in mid-March that it will help calm local markets following the collapse in Chinese stocks not only signals that policymakers are willing to support the market, but it also highlights the degree of fear that existed at the market lows, which has often marked a sustainable bottom in Chinese stocks.

Hang-Seng Financials. Price Vs Total Return (Bloomberg)

Summary

The WisdomTree Emerging Markets High Dividend ETF is trading at extremely cheap valuations on every metric, which is reflected in the impressive 6.3% dividend yield. The high weighting of Brazilian resource stocks partly explains the fund’s valuation discount, with the sector trading at levels that imply investors are anticipating a collapse in earnings and dividends, but this appears unlikely given the recovery in commodity prices.

Be the first to comment