santirf/iStock Editorial via Getty Images

Earnings season is upon us. As usual, airlines will be some of the first companies to announce their 3Q results, with Delta Air Lines (NYSE:DAL) being perhaps the one to which I will be paying the closest attention.

Below, I discuss some of the hot topics that I believe will be front and center on October 13, when Delta releases its earnings report. Then, I explain why I consider DAL one of the best plays in the airline space today, even if I may not be the most bullish on the sector at large.

On the 3Q results

This will be one of the last quarters of easy comps for Delta and its peers, as the airline industry continues to recover after hitting the bottom of the well. Revenues of $13.75 billion are expected, which would represent a 50% YOY increase and a 9% jump (3% annualized) since the last comparable quarter before the start of the pandemic.

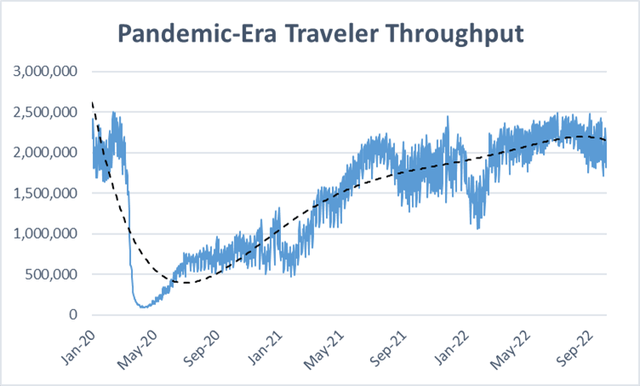

The key drivers of revenue should be fairly easy to anticipate. With summer demand very much back to pre-pandemic levels (see chart below), the number of passenger miles flown should be only limited by capacity, which in turn Delta has guided at 16% below 2019 levels. The drag to the top line caused by fewer passengers flown is likely to be fully offset by higher passenger revenue per unit (i.e., the revenue earned to fly one passenger one mile) that I expect to fall within a range of 15% to 20% above pre-pandemic levels.

DM Martins Research, data from tsa.gov

Any upside to these revenue projections is most likely to come from international travel, especially within the business vertical. Delta has been reporting a gradual recovery, especially in Latin America and Transatlantic routes. I imagine that the guidance provided last quarter must have been light on these assumptions, which sets Delta up for a potential top-line beat, assuming the company has been able to execute well in the summer months.

On EPS, Delta is expected to deliver $1.55, five times more than the comparable figure last year but 33% below 3Q in 2019. Fuel costs, substantially higher vs. pre-pandemic levels but well off the 2Q peaks, are likely to play a major role at and below the operating income line.

Looking forward, two interesting topics of conversation will be (1) the management team’s insights on travel demand in the face of decelerated economic growth, lingering inflation, and rising interest rates, and (2) any expected easing of capacity constraints and labor cost challenges.

On DAL stock

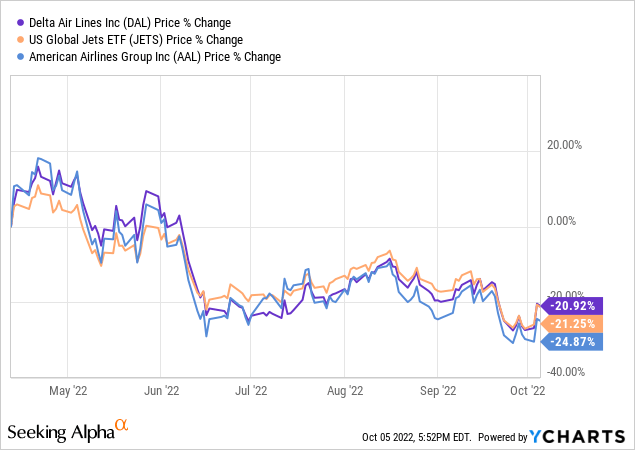

Earnings seasons tend to be a catalyst by default. There is no question that Delta’s 3Q results will be important for the airline’s shareholders and the investment narrative. However, the chart below helps to illustrate why understanding the macroeconomic (primarily) and the industry (mostly a corollary of the first) landscapes matters most, in my view. Note that:

- From arguably the highest- to the lowest-quality legacy US carriers, namely Delta and American (AAL), airline stocks of all kinds have been moving in lockstep since I published my most recent article on Delta. This is not a stock picker’s market, but one that has been reacting to forces that impact the airline industry at large.

- If one still wants to find an edge amid a period that has been highly uncertain for the economy and the airline space, quality has been the factor to bet on this year. For example, DAL has outperformed AAL over the past six months by about four percentage points.

Therefore, I suggest that any potential DAL investor should start from the top down. First, can restrictive monetary policy lead the US and the world to a deep recession in the next several months? This could be a worst-case scenario for cyclical stocks, in which case DAL and its peers should be avoided.

Second, can airlines weather (pun intended) the sector-specific challenges, especially labor shortages and rising costs? Can carriers allow capacity to catch up with demand in a restrictive labor environment? I am more optimistic on this front, given at least a couple of quarters, but risks exist here as well.

In the end, I maintain my approach to investing in the airline space. Generally, I find the sector fundamentals too unpredictable to see a compelling opportunity. I would only become a pound-the-table bull in the very early stages of the economic upcycle — and I do not think that we are there currently.

But were I to pick winners and losers, maybe to set up a long-short bet, I would favor DAL ahead of most of its peers. Relative safety (i.e., strong competitive position in the domestic market, robust international and business segments, solid balance sheet) seems like a better bet than more aggressive speculation in the current market environment.

Be the first to comment