Nate Hovee/iStock Editorial via Getty Images

First-quarter earnings season is upon us. It all starts with financial services companies and airlines reporting results and providing additional color on what to expect in the next few months.

Among the air carriers, I will be particularly interested in Delta Air Lines (NYSE:DAL), the most valuable company among the Big 3 legacy players and one of the best bets for investors looking for a quality play in an otherwise risky sector. The Atlanta-based airline is expected to release its earnings report on April 13, ahead of the opening bell.

Analysts expect Delta to report nearly $9 billion in revenues, more than twice the previous year’s number, as the industry recovers from the COVID-19 crisis. Further down the P&L, net loss per share of $1.27 should be impacted by substantially higher fuel costs in early 2022.

Pay attention to the narrative

There are a couple of important themes that I believe investors should keep an eye on during airline earnings season, and on Delta’s earnings day more specifically. The first should be generally bullish: the shift in consumer demand towards services and experiences, following the end of the pandemic-era lockdowns, from products and at-home offerings that were in vogue last year and through most of 2020.

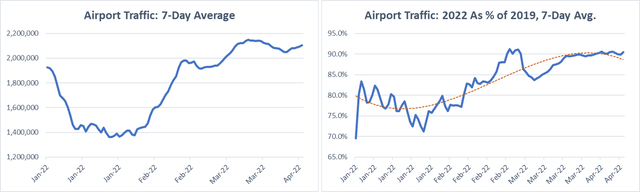

As the chart below depicts, airport traffic, as measured by TSA checkpoint travel numbers, has been increasing substantially lately. The effects from the COVID-19 crisis on traveler demand have all but worn off at this point: airport traffic in April 2022 has surpassed 90% of pre-pandemic levels, after Omicron pushed this ratio to the low 70% earlier in the year (see chart on the right).

I also expect Delta CEO Ed Bastian and team to report pricing strength, supported by the rapid increase in demand for air travel. In its most recent CPI report, the US Bureau of Labor Statistics disclosed a 13% YOY increase in airline fares in February that was the highest among all service ex-energy inflation subcategories. To be fair, pricing strength could be perceived as a positive for top-line resilience at most, but it will probably do little to offset margin pressures from jet fuel prices that have soared nearly 130% YOY.

Airport Traffic: 7-Day Average and 2022 As % of 2019 (DM Martins Research, data from TSA)

The second theme should be a bit more concerning for investors: the airlines’ ability to navigate recovering demand while facing labor shortages and increased operating costs. Recently, JetBlue (JBLU) and Alaska Air (ALK) announced sizable capacity reductions in the spring and summer weeks, with the latter blaming the shortage of pilots compared to what the company had previously forecasted for April.

All accounted for, on Delta’s earnings day, I would not be surprised to see a combination of:

- Capacity pressures in Q1 and similar expectations for the near future, driven by operational challenges (including winter weather) and personnel shortage.

- High occupancy rates and rich per-unit revenues driven by improved post-pandemic demand.

- Substantial margin constraints caused by the spike in crude oil prices and operational disruptions.

Why DAL over its peers?

I believe that anyone considering an investment in the airline sector today should first think through the sector-wide forces that are a mixed bag of positives (e.g., recovering demand, including from the battered business and international verticals) and negatives (e.g., high costs and capacity constraints). It is hard to be overly bullish on the space, in my view. Rather, I believe that uncertainty and volatility will play an important role in how airline stocks perform in the foreseeable future.

Due to the high risk of investing in the sector, especially now, I think that picking the highest quality assets makes the most sense. For this reason, I think that DAL is a good buy relative to its peers.

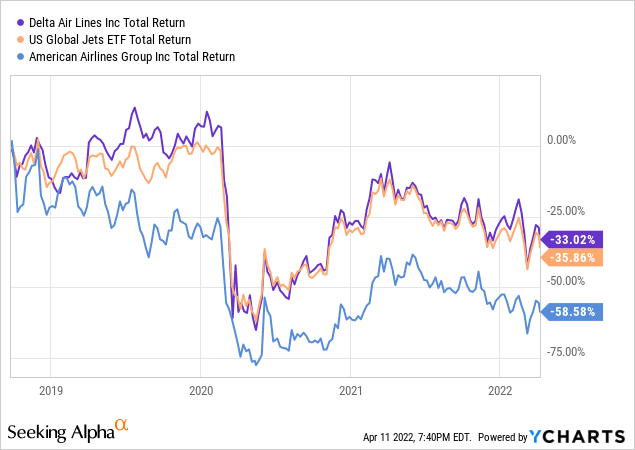

Back in September 2018, after my first broad study of the airline space, I chose Delta as the best major US airline to invest in. Over the following three and a half years, as the chart below depicts, DAL outperformed the airline peer group by just a bit and my least favorite legacy airline stock by a lot.

For the same reasons that I highlighted back then, including superior domestic routes and a robust balance sheet, I maintain my same opinion on DAL. While I remain cautious about the airline sector as a whole, I continue to think that Delta will prove to be a better investment over the long run relative to the rest of the pack.

Be the first to comment