James D. Morgan/Getty Images News

All roads may lead to Rome, but in the US, it seems that many flight connections instead go to Atlanta. Atlanta is of course the home of Delta Air Lines (NYSE:DAL), one of the better run airlines in America. Delta reports earnings this week and is one of the first companies to report for the quarter. DAL’s earnings release and conference call after will provide fresh insights into the state of the American consumer, the return of in-person work and business travel, and the ongoing effects of inflation. Traders will also be looking for insights into what the near future may bring. Will the Biden Administration finally drop the federal mask mandate for airlines? Is consumer spending beginning to slow? And will airlines (and Corporate America in general) be able to keep margins up in the face of rising costs of labor and commodities?

What To Look For in Delta Air Lines Earnings

- First up for traders interested in DAL stock is fuel costs. Airlines are a low-margin, high-turnover business, so they hate increases in fuel costs. There are various ways airlines try to deal with this, but the most common is hedging crude oil. At one point, Delta admitted to having lost $4 billion from hedging oil futures, but this probably overstates their overall losses. Economic theory says you generally can go long oil futures a few months out and get oil cheaper than if you buy it on the spot market, but airlines seem to have had issues translating this into actual profit over time. One of the reasons I believe this is–airlines buy jet fuel, not crude oil, so when the correlations don’t hold, they can get in huge trouble, as many airlines did when oil went negative in 2020.

- Delta has a somewhat novel strategy around fuel, which is that they bought a refinery about 10 years ago in an attempt to reduce their risk and increase their profit. This is a cool strategy, although it cost them a bunch of money during the pandemic. One reason it’s hard for them to make money is that the federal government forces them to buy biofuel credits, driving up their cost of doing business to subsidize corporate farmers in the Midwest, who in turn deforest wildlife habitats. It’s the “swamp” at its finest, but Delta and others are trying to lobby the government to stop some of this.

- To this point, government regulation around airlines needs a hard look. Vaccine mandates have led to labor shortages in all kinds of industries, while airlines are still operating under mask mandates after all 50 states have dropped them at least temporarily. I would venture a guess that mask mandates will be back every flu season for states and cities that are politically inclined, but it’s clear that the impact on the economy is not positive. Those in power will have to decide going forward how much risk they’re willing to accept from seasonal illnesses and how much they’re willing to restrict or distort economic activity to achieve their goals. The payoff from allowing the market to work is clear. After airlines were deregulated in the 1970s, paid fares dropped about 30% in inflation-adjusted terms over the next 20 years, and dropped even more for long-haul flights. Government protection is driving up the cost of everything from gasoline to Uber rides to insulin, and reform could bring costs back down. The most immediate item to watch is whether the Biden Administration drops the airline mask order for the summer– it’s currently extended through April 18th.

- On the demand side, Delta will be able to give guidance on how spring break travel was, how summer travel is expected to be, and on the state of business travel. The international terminal of the Dallas-Fort Worth airport was a little quiet when I was there a couple of weeks ago, but that was after Texas spring break ended. My guess is that it will be a little soft and that consumer spending on airlines is not going to be as good as analysts expect, capping the upside for airline stocks in general. Consumers got a ton of stimulus in 2021, and in 2022 they’re getting the opposite in the form of interest rate increases, surging fuel prices, and uncertainty over the war in Europe. Delta will report on the heels of the widely watched CPI report for March as well.

Portfolio Theory And Investing In Airlines

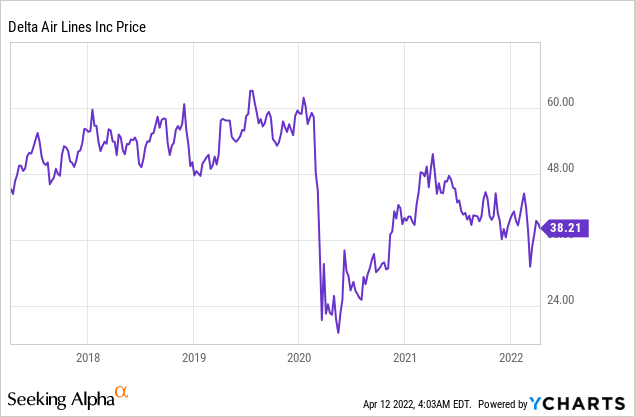

Delta is among the best-run airlines in the US. However, as an industry, airlines are not historically a great place to make equity investments. Airlines have high fixed expenses, high debt loads, and are highly cyclical. These are a toxic mix, and most airlines have credit ratings below investment grade. Delta once had investment-grade credit, but now is rated as “junk.”

Richard Branson on airlines.

If you want to be a millionaire, start with a billion dollars and launch a new airline.

Warren Buffett on airlines in 2007 (he would later buy stock in Delta and others, only to sell a few years later).

“The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines.

If you own airline stocks, I’d generally advise you to dump them for whatever they’re worth now before the debt they piled up during the pandemic is refinanced at higher interest rates. Delta’s balance sheet is here if you’re curious–note the huge debt sales from 2020 with no corresponding increase in assets. Even so, Delta is in far better shape than competitors like American Airlines (AAL).

For this reason, I’d recommend taking a look at Delta’s junk bonds, which will pay you back in a couple of years with a 4.25% annual return. Research shows that the credit of junk-rated companies performs far better than the common equity over time, and if things go south economically you’ll get paid out 100 cents on the dollar before shareholders get anything. This is almost always true for companies that are prone to lose money or are speculative in nature. This is also the basic idea behind a lot of relative value trades popular with hedge funds.

This doesn’t mean that Delta is a terrible business, but the history of airlines has shown that in recessions the ownership often changes from the shareholders of the company to the creditors.

Bottom Line

You should listen to what Delta has to say in their earnings conference call this week as it will help you get a deeper understanding of what the economy is likely to do in the next 6-12 months. If you own airline stocks (or god forbid, cruise stocks like Carnival Cruise (CCL)), I’d sell them and either get out entirely or swap them for their corresponding junk bonds. The risk-adjusted returns tend to be far better and the headaches less severe.

Be the first to comment