Over the past two weeks, it has become increasingly clear that the COVID-19 pandemic represents far more than just a temporary business headwind for the top U.S. airlines. Air travel demand has plummeted to a tiny fraction of previous levels. That will lead to deep losses for airlines across the board. Furthermore, leaders at American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL) don’t expect a quick recovery in demand.

Even if the federal government provides $25 billion to cover most of the commercial airline industry’s payroll costs for the next six months (as currently contemplated), airlines will face a challenging environment over the next few years. They are likely to exit 2020 with higher debt loads, making it essential for them to maximize their profitability and cash flow in the years ahead to fix their balance sheets. However, they will probably have to do so in the context of a slow demand recovery.

That means airlines must be prepared to shrink significantly in the medium-term (i.e. even after the pandemic peaks). That will be a painful step, but it will be far less painful for Delta than for either American or United.

Severe short-term pressure

Air travel demand has collapsed at an unprecedented rate over the past two weeks or so. Indeed, at an investor conference on March 10, airline executives discussed plans to cut capacity by perhaps 10%-20% in the second quarter in response to lower demand. Now, they have gone far beyond that.

Last week, Delta Air Lines announced that it will cut capacity by 70% for an indefinite period until demand bounces back. In a recent message to employees, CEO Ed Bastian said that revenue will plummet by about 80% ($10 billion) in the second quarter. The biggest declines are coming in the international market, but domestic demand has fallen dramatically, too.

(Delta is reducing its capacity by at least 70%. Image source: Delta Air Lines.)

Peers have similar outlooks. On March 15, United Airlines announced that it would cut capacity by 50% in April and May, and that it still expected load factors to fall to the 20%-30% range. (Typically, load factors exceed 80%.) Less than a week later, it expanded its April schedule cuts to 60% and predicted that even bigger reductions are coming in May. United warned that it would soon start furloughing staff in the absence of direct government support. Lastly, American Airlines has ended virtually all long-haul international flying and announced a preliminary 30% cut to its April domestic schedule, with additional reductions likely.

These cuts will mitigate losses, but won’t come close to ending them. For example, Delta has said it is burning through $50 million a day despite all of the self-help actions it has taken thus far. Federal payroll support will further reduce that cash burn, but won’t eliminate it: Delta spent $11.2 billion on salaries, wages, and benefits last year ($31 million/day).

All three legacy carriers are on track to end Q1 with between $7 billion and $8 billion of cash and credit line availability, giving them adequate short-term liquidity. However, they will exit 2020 with higher net debt than they had to start the year, making it extremely important for them to return to solid profitability as quickly as possible.

These airlines will need to shrink

Unfortunately, American, Delta, and United may have to rebuild their profitability in the context of continued demand weakness. First, nobody knows how long the COVID-19 pandemic will last. For example, Hong Kong successfully contained the threat at first, but a relaxation of restrictions earlier this month led to a new spike in cases. It’s possible that restrictions on movement will be necessary until a vaccine is available, which could be more than a year from now.

Second, the pandemic (and accompanying restrictions on economic activity) has decimated the U.S. economy. Even aggressive fiscal and monetary stimulus efforts may not be enough to spark a return to economic growth in the near term: it’s simply too early to know. That could weigh on travel demand well beyond the end of the pandemic.

(Image source: United Airlines)

(Image source: United Airlines)

Third, American Airlines, Delta Air Lines, and United Airlines rely far more on business travel than their smaller rivals. Last-minute bookings at high fares for business travel are a key unit revenue driver for the legacy carriers, enabling them to sustain massive route networks and make money despite high unit costs. To the extent that companies slash their travel budgets either to protect employees from COVID-19 or as part of broader budget cuts due to weak corporate earnings, it will disproportionately hurt these three carriers.

As a result, the legacy carriers need to consider significant changes to adapt to the environment they are likely to face over the next few years. American Airlines has already offered early retirement packages to employees with more than 15 years at the company to reduce headcount. Meanwhile, Delta CFO Paul Jacobson recently told employees that the carrier will come out of the pandemic “quite a bit smaller than when we went into it, and we’ll have the opportunity to grow,” according to The Points Guy.

Delta has lots of flexibility

Fortunately, Delta Air Lines’ fleet and route network should make it relatively easy to shrink, if that’s what business conditions warrant.

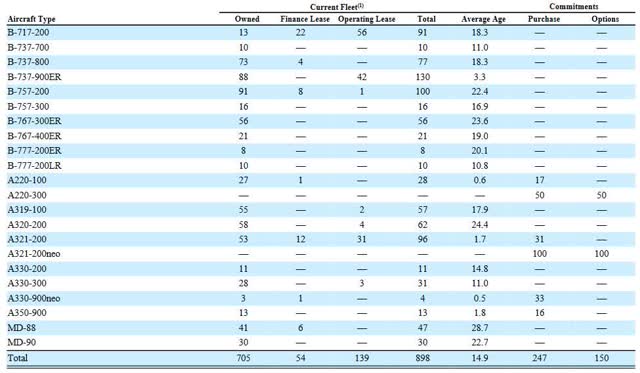

First, Delta Air Lines has one of the oldest fleets in the industry. At the beginning of 2020, its mainline fleet averaged 15 years of age. That included 47 MD-88s and 30 MD-90s, which the airline had planned to retire in late 2020 and 2022, respectively. Now, it is likely to permanently retire both fleets immediately.

Delta also has 100 Boeing (BA) 757-200s and 56 767-300s. The vast majority of those planes were delivered during the 1990s and are suitable for retirement. Delta’s 62 Airbus (OTCPK:EADSY) A320s are also close to retirement age for the most part, with an average age of nearly 25 years.

(Source: Delta Air Lines 2019 10-K SEC filing, p. 22)

(Source: Delta Air Lines 2019 10-K SEC filing, p. 22)

In the short term, Delta is parking more than 600 aircraft as it slashes capacity by 70%. Many of those planes will return to active service over the next year or two, but Delta Air Lines could permanently retire 100-200 planes from its mainline fleet of roughly 900 aircraft with minimal financial impact. Some of those may be replaced in the near term by new aircraft on order that can’t be deferred, but if business conditions warrant lower capacity for the next few years, Delta could wait to replace most of them.

Second, Delta Air Lines is better positioned than its top rivals to cut capacity while maintaining a strong route network. In recent years, it has added a new coastal hub (Boston) and built up several regional focus cities (Austin, Nashville, Raleigh-Durham, and San Jose, in addition to former hub market Cincinnati) to take advantage of strong local business demand in those markets. Some of those growth initiatives could be unwound if business demand recovers slowly over the next few years, with Delta funneling most of its traffic through its larger hubs.

Additionally, Delta is absolutely dominant in its core hubs (Atlanta, Detroit, Minneapolis-St. Paul, and Salt Lake City). That means it can make targeted reductions in those markets without risking long-term market share loss (which would be very costly, as scale is critical to the profitability of airline hubs).

In short, with lots of older aircraft and plenty of non-core routes that can be cut while maintaining a strong connecting network, Delta Air Lines is relatively well positioned for a world with lower air travel demand.

Why American and United are worse off

American Airlines and United Airlines are not so fortunate. American Airlines’ biggest problem is a lack of fleet flexibility. Following a massive aircraft replacement program over the past decade, American’s fleet had an average age of 11 years at the end of 2019. While the airline may speed up plans to phase out several fleet types (the E190, A330-300, and 767), those three models together account for just 5% of its mainline fleet.

Furthermore, all of American’s aircraft spending over the past decade has driven up the carrier’s aircraft rent and interest expense. Together, those two line items totaled $2.4 billion last year, compared to $724 million for Delta (a similar-sized airline). That’s a substantial level of fixed costs in an environment where shrinking may be necessary.

(Image source: American Airlines)

(Image source: American Airlines)

American Airlines also has lower market share in certain of its hubs, like Chicago and Phoenix. In Chicago, its ability to make medium-term capacity cuts depends on what United Airlines does; the two carriers have competing hubs at O’Hare International Airport. On the other hand, this crisis could prod American to close its Phoenix hub, which is highly duplicative of the carrier’s much larger and more profitable Dallas-Fort Worth hub.

United Airlines is closer to Delta in terms of fleet flexibility; its average fleet age surpassed 15 years at the end of 2019. Additionally, it spent just over $1 billion on aircraft rent and interest expense last year.

On the other hand, United has even less room to cut its network than American. Virtually all of its capacity moves through its seven main hubs, and it faces market share battles in several of them (Chicago, Denver, and Los Angeles). Bolstering its route network by adding flights and improving connectivity has been the key to United’s turnaround strategy in recent years. Thus, United may struggle to maintain its competitiveness against Delta and American (which have larger hubs) if it is necessary to offer less capacity over the next few years.

Despite a furious 40% rally on Tuesday and Wednesday combined, Delta Air Lines stock ended Wednesday at $31.10: down a little more than 50% from its 52-week high. That has knocked $20 billion off its market cap. With short-term government payroll grants likely to limit its 2020 cash burn and ample flexibility in its business to respond to changing market conditions, Delta Air Lines is an intriguing turnaround play for long-term investors: far more so than American or United.

If you enjoyed this article, please scroll up and click the follow button to receive updates on my latest research covering the airline, auto, retail, and real estate industries.

Disclosure: I am/we are long DAL, AAL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment