Justin Sullivan

Dell Technologies Inc. (NYSE:DELL) doesn’t quite get the same type of attention as other tech leaders, but probably should. The company has a number one market share position in several critical IT infrastructure categories like external enterprise storage, servers, and personal computers. The attraction here is a positive long-term growth outlook capturing high-level themes like cloud adoption and the shift towards software-defined storage. Ahead of the upcoming quarterly report, we take a look at the themes to watch and offer our take on where shares are headed next.

We last covered DELL with an article back in March citing macro headwinds and tough pandemic-era comps as adding uncertainties. Indeed, shares are down around 12% since amid the broader market volatility. A lot has happened over the period warranting an update. First, the last quarterly report in May came in stronger than expected, which helped to improve the outlook. Fast-forward and this Q2 earnings report will be the chance for management to set the record straight on whether Dell remains resilient despite global growth concerns. Either way, there’s potential here for a big move in Dell stock.

DELL Q2 Earnings Preview

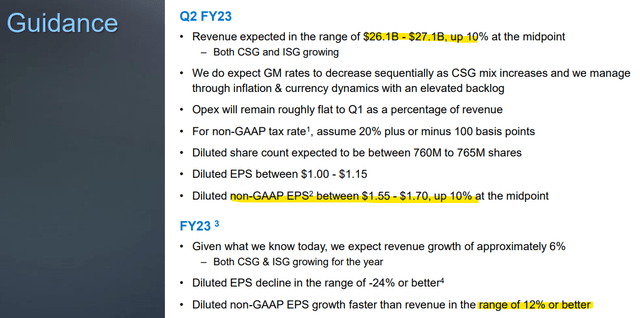

Dell is set to report its fiscal 2023 Q2 earnings on Thursday, August 25th, after the market close. The current consensus EPS of $1.64 and revenue estimate at $26.5 billion are nearly at the midpoint guidance Dell management offered with the Q1 report back in May.

Keep in mind that the forecast for sales and the normalized EPS to both climb by approximately 10% from last year excludes the contribution of VMware in the period last year which Dell spun off in November 2021. The core client solutions group (CSG) and infrastructure solutions group (ISG) segments are expected to maintain the underlying growth momentum observed in recent quarters.

One of the themes from Q1 was strong margins with record profitability. The company has been gaining market share in areas like PCs while growing its storage and server business above industry rates, which was impressive considering the headline-making inflationary cost pressures and supply chain challenges. Even with macro concerns of a slowing global economy, the understanding is that an elevated backlog of orders and strong pricing trends provide some confidence in the underlying runway.

The Q2 data from Dell will be important as a bellwether for the broader PC industry and enterprise side of tech. Reports from other tech players like Intel Corp. (INTC) and even Advanced Micro Devices, Inc. (AMD) already confirmed a slowdown in PC sales, although the weakness is concentrated in gaming and consumer products against an exceptionally strong 2021.

On the other hand, the strength of DELL comes down to its diversification into areas that could be described as less cyclical with greater exposure to the enterprise side of the hardware. More encouraging Q2 trends from cloud-computing leaders like Microsoft Corp. (MSFT) with its “Azure” segment and Amazon.com, Inc. (AMZN) through AWS better tie into Dell’s storage and networking solutions.

The gross margin will be another key monitoring point as management already said it expects a sequential decrease compared to the 22.7% non-GAAP result in Q1 citing a shifting sales mix along with inflation and FX headwinds. Still, this is one area we believe DELL could end up outperforming on these points considering indications inflation has cooled off since May, particularly through lower energy costs easing transportation cost pressures. The ability of DELL to capture some savings from lower commodity prices in manufacturing or even with discounting by suppliers could open the door for DELL to approach the upper end of the earnings target.

Is DELL A Good Long-Term Investment?

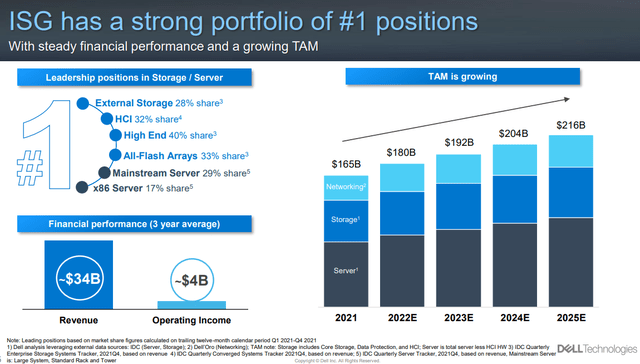

Getting into the granularities of quarterly reports has its place, but it’s important not to lose track of the big picture and long-term outlook. We mentioned the company’s leadership position. On the PC side, Dell has the number one market share with desktops in North America, but we note that more than 70% of the business is related to commercial end-users.

This is important as commercial is recognized as more stable compared to the consumer and gaming side. Companies continue to invest in technology and Dell is a major part of that requirement worldwide. With storage and server systems, the market is growing with DELL benefiting from its name recognition and reputation for quality. The point here is to say that beyond this quarter, or even this year, Dell is well positioned to continue innovating and capturing new business.

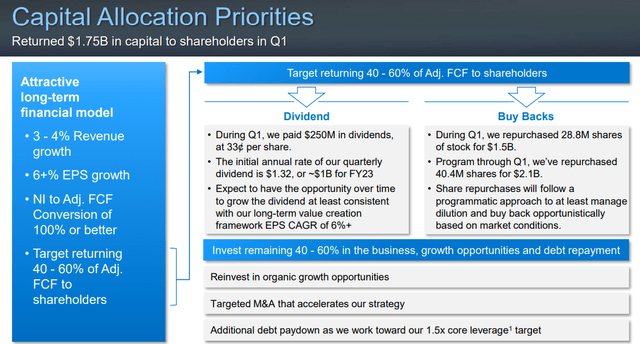

From a high-level perspective, DELL checks off all the boxes for what we would consider a high-quality stock between steady growth, recurring profitability, positive free cash flow, along with a solid balance sheet. Dell expects to generate revenue growth between 3-4% per year over the long run while a target for EPS climbing in the mid-single digits reflects a gradual shift into a new high-tech business that can add to margins.

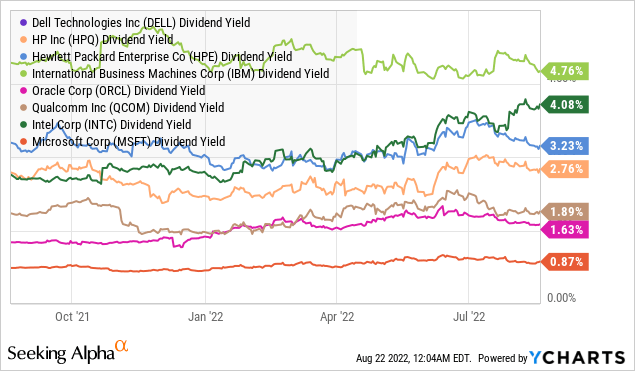

The company is also moving forward with a robust capital allocation plan that includes a new quarterly dividend, initiated earlier this year, and regular buybacks. Returning 40-60% of adjusted free cash flow to shareholders, the current quarterly dividend rate of $0.33 per share yields nearly 3% on a forward basis. We expect Dell to evolve into a dividend growth name, with annual increases at least in line with earnings.

When comparing DELL’s dividend to other tech leaders and IT infrastructure names, the rate is not necessarily the highest yield available. We could make the argument that DELL is fundamentally stronger than some high-yield names like Intel Corp. with a 4.1% yield and International Business Machines Corp. (IBM) at 4.8% given its stronger growth in recent periods.

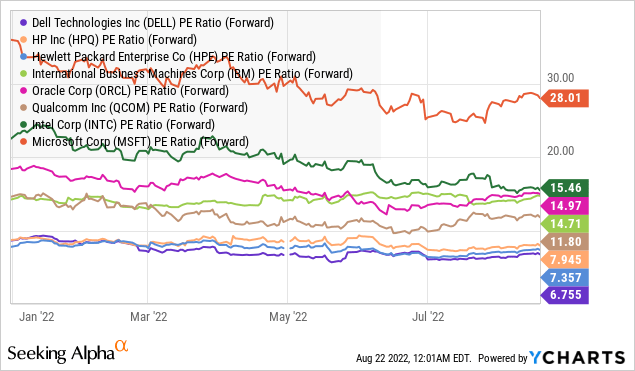

Where DELL stands out is through its valuation, which is at a discount to tech sector peers. Considering its consensus full-year EPS estimate at $7.06, shares are trading at a forward P/E of just 6.8x. This compares to HP Inc. (HPQ) and Hewlett Packard Enterprise Co. (HPE) closer to 7.5x. DELL also screens attractively through other metrics like its enterprise value to EBITDA multiple at 5.6x. To be clear, each of these companies has its differences, but we make the case that DELL is a good tech “value stock”.

DELL Stock Price Forecast

We’re looking for this upcoming earnings report to set the tone for the trading action in shares of DELL for the rest of the year. The stock is currently down around 22% from its Q1 high and otherwise stuck in a relatively tight trading range of around $45.00 over the last few months.

A strong report confirming the company has been able to maintain its operating and financial momentum, combined with some positive guidance, could be enough to mark a breakout above ~$52.00 as the start of a new trend higher. On the downside, a weak report based on more concerning softening demand conditions could also open the door for shares to retest their cycle lower around $40.00.

The bullish case here can also benefit from what has been an improving macro setup over the last few weeks. Indeed, the broader market has rallied on some better-than-expected macro data like cooling inflation and a resilient labor market that point to more positive sentiment towards risk assets. By this measure, we believe DELL should be able to head higher going forward.

Final Thoughts

This is a tricky earnings report to trade DELL considering the mixed signals among other tech stocks between chip names missing estimates and correcting lower, while other large-cap leaders have been able to buck the trend with a stronger performance. Forced to make a decision, we’ll take the over with a bullish call on the stock with a belief that DELL will ultimately be trading higher over the next few months.

We rate DELL as a buy with a price target of $57.50 for the year ahead, representing an 8x forward P/E on the current consensus fiscal 2023 EPS. While the target implies a modest 20% upside in the share price, the attraction here is the company’s quality profile with a sense that shares are simply undervalued. Longer-term, the ability of DELL to drive margins higher can support even more upside for the stock.

Be the first to comment