MicroStockHub

Introduction

When 2022 started, the very painful Covid-19 era was coming to a close for the shareholders of Delek US Holdings (NYSE:DK) with their dividends likely to be reinstated imminently following their first quarter results, as my previous article highlighted. Thankfully, they did not disappoint with their dividends reinstated and when looking ahead, it seems that more is coming, which stands to push their dividends well past their current low 3.30% yield, as discussed within this follow-up analysis.

Executive Summary & Ratings

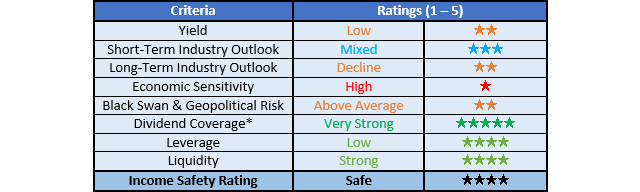

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings, as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

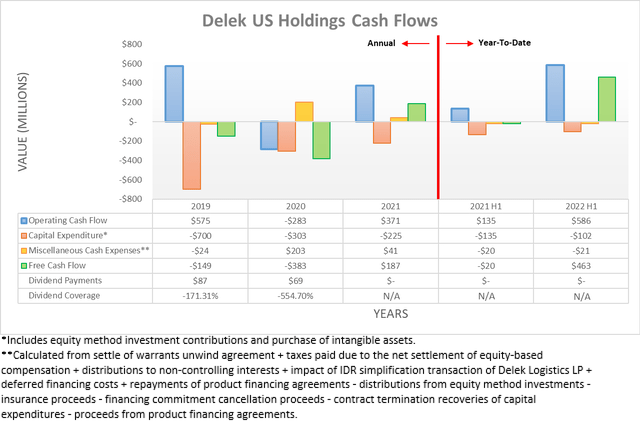

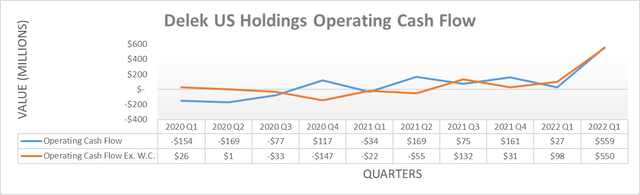

After seeing a recovery beginning late 2021 and the first quarter of 2022, their cash flow performance during the second quarter far surpassed anything ever seen before with their operating cash flow for the first half of $586m easily beating any full-year result since at least 2019, despite only being literally half the time. In fact, if zooming into their results for the second quarter in isolation, it sees operating cash flow of $559m, and thus they effectively saw an entire year of cash generated within only one quarter. Importantly, this was not merely the product of working capital movements with their underlying results that exclude such movements posting a very similar result, as the graph included below displays.

Even after removing their temporary working capital movements, which were minimal during the second quarter of 2022, it still sees their underlying operating cash flow at $550m and thus way ahead of anything since the downturn started in 2020, thereby well and truly marking the end of the very painful Covid-19 era. Obviously, it would be quite foolhardy to expect this booming cash flow performance to continue indefinitely into the future, especially given the risks of a recession looming and given the inherently volatile nature of their industry, it is impossible to ascertain exactly where it will land for any particular quarter. At least their shareholders can now enjoy meaningful cash returns with their dividends reinstated, which helps ease the discomfort of investing in this volatile industry.

Even though it was clearly communicated during their first quarter of 2022 conference call, as per my previously linked article, it was still positive to see more than a token dividend with their new quarterly rate of $0.20 per share representing nearly two-thirds of their former rate of $0.31 per share that were suspended in 2020. Apart from reinstating their quarterly dividends, they also rolled out a $400m share buyback program, which equals around 23% of their shares given their current market capitalization of approximately $1.7b.

Whilst I am not normally a fan of share buybacks, at least they did not completely neglect their dividends and thus going forwards, it will be interesting to review the pace these are completed and most importantly, whether the lower share count translates into comparable dividend growth on a per-share basis. Even without reducing their share count, it should be possible to see their quarterly dividends reclaim their previous level of $0.31 per share because given their latest outstanding share count of 71,035,056, they would only cost $88m per annum.

At the moment, their booming cash flow performance would easily allow for very strong dividend coverage given their free cash flow of $463m during the first half of 2022, but even during more business-as-usual operating conditions, it should still be possible. Even if they were to only see circa $500m operating cash flow for the entire year, such as during 2019, these dividend payments would not even amount to one-fifth of their cash inflows, thereby providing ample scope to fund them via free cash flow, depending upon their future capital expenditure.

Obviously, their future capital expenditure leaves a question mark but whilst 2019 saw $700m invested, it has subsequently decreased significantly each year with 2020 and 2021 only seeing $303m and $225m respectively. When looking at their long-term capital allocation strategy, it sees only $112.5m per annum of sustaining capital expenditure at the midpoint, as per slide fifteen of their May 2022 investor presentation. Meanwhile, this same guidance does not necessarily state their growth in capital expenditure, but it does highlight very high internal rate of return targets of 15% to as high as 50%, which I suspect will keep their overall capital expenditure modest on average, as they appear to be focused on value over size or volume.

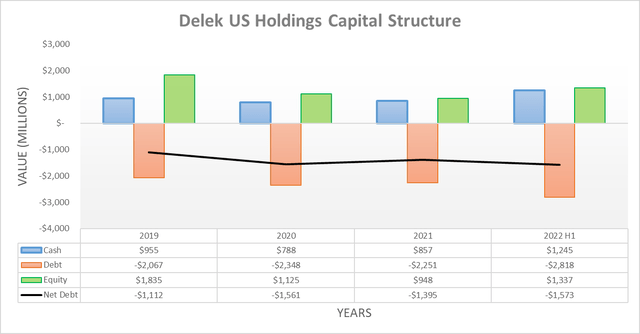

Thanks to their extremely strong cash flow performance during the second quarter of 2022, they were able to fund their 3Bear Energy acquisition without imposing too great of a cost upon their capital structure. Even though this acquisition ultimately cost $621.7m, their net debt ended the second quarter at $1.573b and thus close to their previous level of $1.359b following the first quarter. As a result, their net debt did not spike as was feared when conducting the previous analysis and thus obviously, neither did their leverage. Since their net debt is only slightly higher and very likely to slide lower during the third quarter given these operating conditions, it would be redundant to reassess their leverage in detail, or their liquidity because their cash balance of $1.245b remains plump.

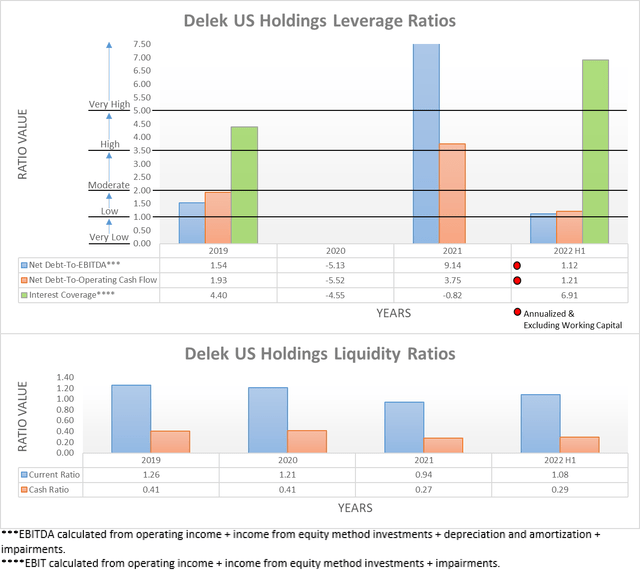

The two relevant graphs have still been included below to provide context for any new readers, which show that their respective net debt-to-EBITDA and net debt-to-operating cash flow at 1.12 and 1.21 dropped into the low territory of between 1.01 and 2.00 after the second quarter of 2022. Whereas their previous respective results of 2.70 and 3.46 following the first quarter were within the moderate territory of between 2.01 and 3.50. Meanwhile, their strong liquidity also saw its respective current and cash ratios improve across these same two periods of time to 1.08 and 0.29 versus their previous respective results of 0.97 and 0.20. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

The end of the very painful Covid-19 era is well and truly here, with their dividends reinstated and well on their way back to their former levels before the pandemic. Thankfully, they sport a healthy financial position with low leverage and strong liquidity, which helps provide support to see the remaining gap closed in the coming years. Since their share price of circa $25 is still around 25% lower than its level before the Covid-19 pandemic of circa $32.50 despite these booming operating conditions, I believe that maintaining my buy rating is appropriate because their prospects to provide more dividend growth should help it recover more of its former value.

Notes: Unless specified otherwise, all figures in this article were taken from Delek US Holdings’ SEC filings, all calculated figures were performed by the author.

Be the first to comment