Robert Way/iStock Editorial via Getty Images

DBS logo (DBS)

Investment thesis

Three months ago, I upgraded DBS Group (OTCPK:DBSDY) (OTCPK:DBSDF), South East Asia’s largest bank, from a hold to a buy on the expectations of higher net interest rate income starting to kick in.

The bank has just published its First Half and Q2 2022 results, and we shall dissect their results together with its business development

Mid-Year 2022 Financial results

The net profit for Q2 was SGD 1.8 billion, which was similar to Q1 net profit. The difference was just SGD 14 million.

One geographical area that saw lower net profit was their bank in Hong Kong. It came down from SGD 617 million in the FH last year compared to SGD 593 million FH this year.

EPS for the group in the First Half of 2022 was SGD 2.80, just eight cents lower than the year before.

Their return on equity was up from 13.1% in Q1 to 13.4% in Q2.

The dividend was kept at SGD 0.36 per share for the quarter, which based on the present share price gives investors a yield of 4.5%.

A yield that is acceptable but not great.

In 2020, fixed income, such as Singapore’s 10-year treasury notes offered less than 1%, and you would get an equity risk premium of 3.5%. However, now that the yield on the 10-year notes has gone up to 3.5%, you get an ERP of just 1%.

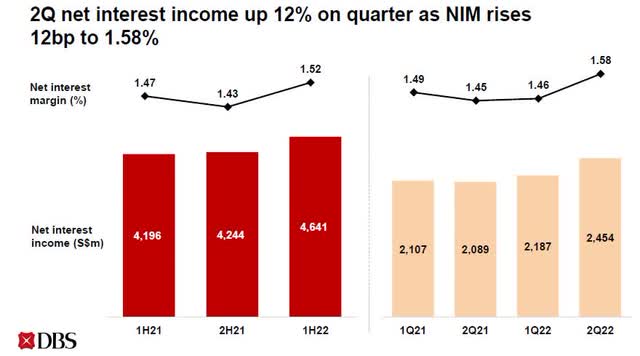

As expected, the NIM trend started to go up. It improved considerably from 1.46% to 1.58% Q-o-Q. Management of the bank expects that it will continue to go up and should end this year at around 2%.

NIM trend is up (DBS FH 2022 CFO presentation)

Net interest income increased from SGD 2.19 billion in Q1 to SGD $2.45 billion in Q2 on the back of loan and deposit growth and the higher NIM.

The Group’s results got negatively affected by a 14% lower fee income in Q2. It ended at SGD 768 million. This was mainly a result of wealth management fees dropping 17% as the equity market conditions kept customer’s activities at low levels. However, Wealth Management’s AUM actually increased by an additional SGD 10 billion, so one can reasonably expect that at some point their customers will increase trading activities at a point where confidence starts to improve.

The decline was somewhat offset by higher fee income from credit cards which was up 9%, as traveling for Singaporeans started to pick up.

- Estimated Credit Losses and Non-Performing Loans

Asset quality for the bank’s loan book is stable, with the NPL ratio being 1.3% over the last six months.

When we look at ECL, we want to focus on stage 3, which is the credit that has been due the longest and falls within the highest risk of losses. Over the first half of 2022, it was SGD 235 million, which was up from SGD 135 million in the second half of 2021.

This amount needs to be looked at in the context of the fact that the bank holds total allowance reserves of SGD $6.69 billion.

Their mortgage book in Singapore is large. It stands at SGD 196 billion.

With a rising interest rate, it will gradually impact borrowers once loans are repriced, and immediately for new loans that get created. The bank has run different stress test models to assess what will happen if the interest rates on these mortgages were to reach 6 to 7%. Based on the lender’s present income streams and the loan to value of the property, the bank is comfortable with what they see.

They will become more concerned if we see a spike in unemployment.

Singapore’s latest figure on the official seasonally adjusted resident unemployment rate has declined to 3.0%, the lowest rate since end-2018. The total employment is still 2.5% below the pre-pandemic level – mainly because Singapore lost 15% of its non-resident workforce since December 2019.

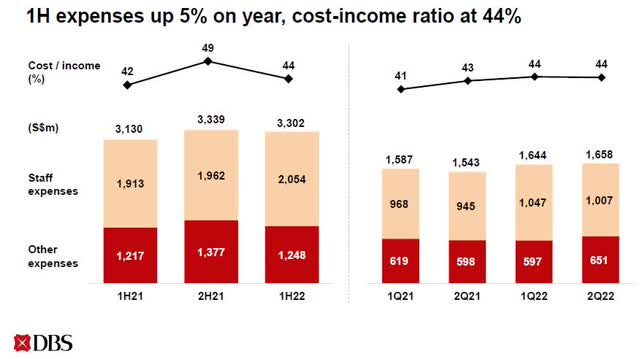

The bank’s cost-to-income ratio has increased steadily. Some of this should be expected as inflation has pushed up salaries and the acquisitions they have made in the last twelve months also require the bank to spend on the integration of this.

Higher costs (DBS CFO FH 2022 presentation)

However, I would also expect the bank to reign in the costs as their rival HSBC (HSBC) is doing with improved efficiency from technology and a smaller real estate footprint.

Business development

On the topic of HSBC, in a recent opinion article by Bloomberg, the author suggested that in the event HSBC were to spin their Asia business into a separately listed unit, DBS could effectively challenge their position.

I believe the likelihood of HSBC being split up is very small. There are few truly global banks left, and there are many multinational organizations that benefit from HSBC’s large footprint and size.

The author also stated that some reason for this was that DBS had the advantage of a strong Singapore market. In particular, the real estate market. Hong Kong, on the other hand, he argued, is seeing a much weaker sentiment.

This fear of both DBS and HSBC’s exposure to real estate in China is in my opinion overblown. Both lenders are very conservative in choosing who they lend to. DBS’s CEO Piyush Gupta informed analysts that their exposure to commercial real estate in China was SGD 16 billion with the bulk of this to State-owned companies such as CapitaLand (OTCPK:CLILF) and their affiliates. Those companies have good balance sheets and long WALE.

Hong Kong’s real estate market might be weaker, but last week the large real estate developers like Sun Hung Kai (OTCPK:SUHJY), and Henderson Land (OTCPK:HLDCY), came out with new developments for sale, and most units got snapped in one day, so there must be willing buyers out there.

At the end of January this year, DBS agreed with Citigroup (C) to purchase their Taiwan Consumer bank operation. Integration is taking place and the deal should be completed and start to take effect from Q3 of 2023 the bank communicated during the Q&A session of their latest presentation to analysts that they expect it will add another SGD 800 million to the top line and roughly SGD 250 million to the net profit for the group.

If their estimates are right, it gives the bank a very good return on its investment. The purchase price was SGD 956 million plus the net assets held in the bank. On top of this comes their cost of integration, but it should easily give them a ROTE above their average 13.4%

Conclusion

The bank is certainly on a good track to potentially beat the full-year profit from last year, as I had placed my bet on in my article three months ago.

The share price is presently SGD 32,70, which means that the market is pricing in the extra income that will come from the positive NIM trend.

Despite this, even their CEO sees potential for dark clouds and the outcome of geopolitical events and whether inflation can be curtailed as quickly as the central bank would like to see is questionable. When people ask the question of whether we are heading for a recession, we are usually already in one.

Asia should do well for now. And Singapore in particular is technically not in a recession with its GDP growing roughly 4% last quarter, but the island nation is also very dependent on the economy of its large trade partners like China, the U.S., and Europe.

DBS Group’s NAV per share is SGD 20.78 and has been shrinking over the last couple of quarters. If we look at the share price of SGD 32.70, the P/NAV is not cheap at 1.57.

I am not sure if the share price reflects this potential risk.

Therefore, as much as I do not like to change my stance too often, I do see the need to change it from a buy to hold in view of the uncertainties.

Be the first to comment