Horst Gerlach/E+ via Getty Images

DBGR Has a Well-Diversified Portfolio of Large-Cap Stocks

Deutsche X-trackers MSCI Germany Hedged Equity ETF (NYSEARCA:DBGR) invests directly and through derivatives in stocks of companies operating across diversified sectors in public equity markets of Germany. At present, it holds almost 60 stocks, mostly large-cap growth and value stocks. Almost 78 percent of this fund is invested in large-caps. The fund benchmarks itself with the MSCI Germany US Dollar Hedged Index and fully replicates it. The Underlying Index is designed to track the performance of the German equity market while mitigating exposure to fluctuations between the value of the U.S. dollar and euro.

Xtrackers MSCI Germany Hedged Equity ETF was launched and is managed by DBX Advisors LLC. DBGR also uses derivatives such as forwards to create its portfolio. Initially, I thought that the exchange-traded fund (“ETF”) of the largest German firms would be full of companies operating in automobile, manufacturing, energy and utilities. However, the majority of funds have been invested in businesses that are involved with technology and finance. 55 percent of the funds are invested in stocks of companies involved in financial activities, healthcare technology, technology services, electronics technology, and communications.

DBGR Has Invested in Stocks of Globally Known German Companies

DBGR’s top 20 investment positions account for 76 percent of its total funds, including 5 percent investment in U.S. dollars. These stocks are some of the best-known global brands and decide the direction of DBGR’s portfolio. The best thing about its top holdings is that these companies are well diversified. The list includes technology & communication giants like the world’s leading enterprise resource planning software vendor SAP SE (SAP), technology conglomerate Siemens Aktiengesellschaft (OTCPK:SIEGY), science and technology Merck KGaA (MRK), healthcare technology firm Siemens Healthineers AG (OTCPK:SEMHF), semiconductor manufacturing giant Infineon Technologies AG (OTCQX:IFNNY), and Europe’s largest telecommunication service provider Deutsche Telekom AG (OTCQX:DTEGY).

Similarly, there are globally known automobile manufacturers like Bayerische Motoren Werke Aktiengesellschaft (OTCPK:BMWYY), Volkswagen AG (OTCPK:VWAGY), and Mercedes-Benz Group AG (OTCPK:MBGAF). Investments in the financial sector included investment banking behemoth Deutsche Bank Aktiengesellschaft (DB), one of the world’s largest insurers and financial services group Allianz SE (OTCPK:ALIZF), capital market operator Deutsche Börse AG (DB1.DE), and one of the world’s leading reinsurers Munich Reinsurance Company (MUV2.TI).

The list is completed by pharmaceutical giant Bayer Aktiengesellschaft (OTCPK:BAYZF), energy supplier RWE AG (RWE.DE), logistics and supply chain management firm Deutsche Post AG (OTCPK:DPSGY), world’s largest chemical producer BASF SE (OTCQX:BASFY), world’s second-largest sportswear & sports apparel manufacturer adidas AG (OTCQX:ADDYY), one of the world’s largest investor-owned electric utility service provider E.ON SE (OTCPK:EONGY), and Germany’s leading residential real estate company Vonovia SE (OTCPK:VNNVF).

DBGR’s Price and Dividend Performance is Disappointing

Xtrackers MSCI Germany Hedged Equity ETF pays semi-annual dividends and generated a low yield (almost 2 percent on an average) for the past 5 years. Prior to that the yield was significantly higher, primarily due to consistent strong payout. The payout has been reduced during the past 5 years. At the same time, DBGR’s market price has become more volatile. While the fund traded around $25 in the initial years, the price has moved within a range of $20 to $33 during the past 5 years. Lack of strong yield and price volatility surely takes this fund outside the purview of income-seeking investors.

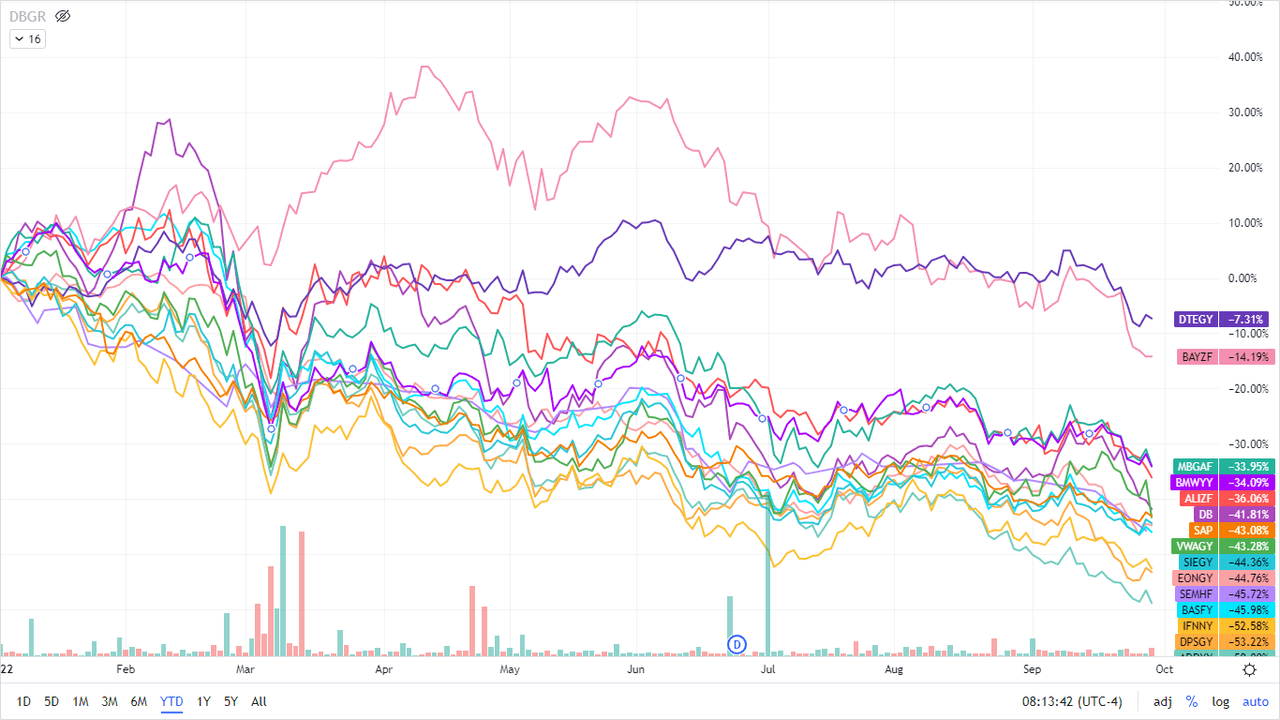

1-year price growth (Seeking Alpha)

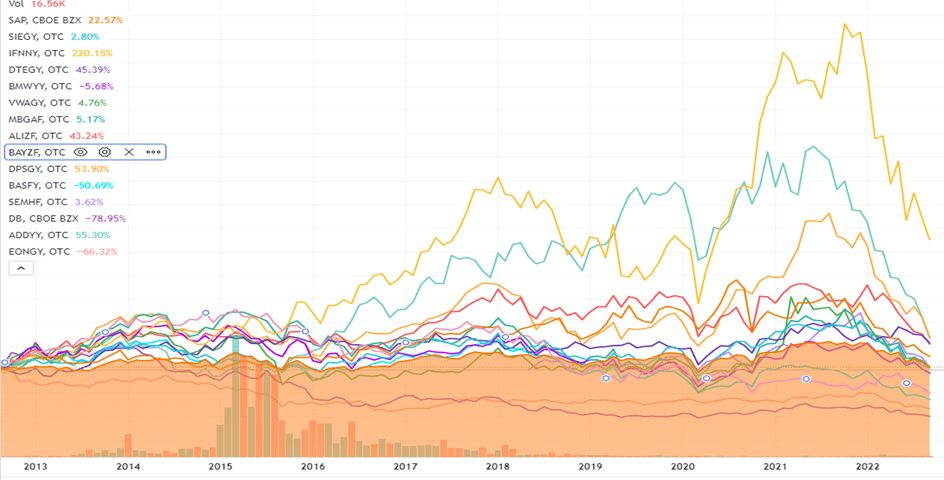

The price performance of its top stocks has been disappointing, too. I obtained the data of 15 of these 20 stocks that are listed in the U.S. market. During the past 1 year, all the stocks suffered price loss ranging from 15 percent to 60 percent. Over the past 5 years, only 2 stocks (SEMHF and VWAGY) posted positive price growth, which is also marginal. Although the figures are much better over the past 10 years, only 6 stocks – IFNNY, ADDYY, DPSGY, DTEGY, ALIZF, and SAP – have been able to record a price growth in excess of 5.2 percent. Such poor price growth does not benefit investors. Xtrackers MSCI Germany Hedged Equity ETF thus becomes unattractive to investors, despite investing in globally well-known German companies.

10-year price growth (Seeking Alpha)

Covid-19 Pandemic and Russia’s Invasion Jeopardized German Economy

Although Germany was quite successful in protecting its citizens from the jaws of the Covid-19 pandemic, the crisis created supply chain bottlenecks that hampered manufacturing and services sectors. At the beginning of this year, the nation started opening its economy after it emerged from a severe winter wave of the Delta variant of Covid-19 virus. However, Russia’s invasion of Ukraine on February 24 changed everything and made things worse, as the European Union responded with economic sanctions against Russia and Germany in particular suspended the approval of the Nord Stream 2 gas pipeline and also committed to increasing its military spending by an additional €151.5 billion over the next five years.

In order to support the livelihood of its people and its industries, the German government announced support measures, including relief to vulnerable households and liquidity support to firms. These measures helped offset some of the spillover effects from the war. However, the consumer price inflation (in September 2022) reached 10 percent, primarily due to rising energy prices. Prices of other goods and services also shot up, due to indirect effects of energy price hikes as well as recovery in consumer demand. Since the start of the Covid-19 pandemic, hourly wages rose by almost 3.3 percent annually, which led to increase in output prices and ultimately a rise in consumer prices. All these macroeconomic divergences severely impacted the German economy and lowered the expectations of future growth.

A report published by the Germany country team of the International Monetary Fund (IMF) European department titled “Germany Faces Weaker Growth Amid Energy Concerns,” mentioned that:

“After growth of 2.9 percent in 2021, we expect economic growth to slow sharply to 1.2 percent in 2022 owing to elevated energy import prices and weak consumer confidence. We expect supply bottlenecks to persist even into 2023. These bottlenecks, combined with the usual delayed pass through of wholesale to retail gas prices, drives down our expectations of growth to just 0.8 percent in 2023. These growth rates for 2022 and 2023 are, respectively, 0.9 and 1.9 percentage points below those that we projected in April’s World Economic Outlook.”

Investment Thesis

Soaring energy prices and consumer inflation lowered consumer confidence, and foreign demand for Germany’s exports has weakened. The IMF has issued its expectations regarding inflation, where it predicted a 7.7 percent inflation in 2022 and 4.8 percent in 2023. The 2023 guidelines are based on the assumption of stable energy prices due to the end of the Ukraine crisis, which again is uncertain, and the impacts are difficult to predict. IMF’s inflation expectations (of Germany) over the next 5 years remain anchored near the European Central Bank’s (ECB’s) target of 2 percent.

Not surprisingly, DBGR’s investments in stocks of the most well-known German companies failed to deliver results. Most of these companies had disappointing price performance. Their price-performance was unsatisfactory even before the Covid-19 pandemic. But, the twin shock of the pandemic and Russia’s invasion of Ukraine made things worse. The Germany-focused fund paid semi-annual dividends and has reduced its pay-out during the past 5 years. The average yield of almost 2 percent over this period will most likely fail to attract investors. I don’t expect Xtrackers MSCI Germany Hedged Equity ETF to generate a strong return in the coming quarters.

Be the first to comment