ArtistGNDphotography/E+ via Getty Images

A Quick Take On Dave

Dave (NASDAQ:DAVE) recently reported its 1st Quarter 2022 financial and operational results on May 11, highlighting increased revenue, gross profit and growth of its member base.

The company provides financial services via its mobile-centric app of the same name.

While demand for Dave’s offerings may indeed increase as an economic slowdown or recession occurs, it appears too early to tell how well the firm will be able to produce improved financial results in the near term.

DAVE may be a stock to put on a watch list, but for now I’m on Hold for it.

Dave Overview

West Hollywood-based Dave was founded in 2015 to develop a suite of online personal financial management services for its members.

The firm is headed by founder and CEO Jason Wilk, who previously founded WriteyBoard, AllScreen and 1DaySports.com.

The company’s primary offerings include:

-

Extra Cash – cash advance

-

Side Hustle – connections to local, flexible jobs

-

Dave Banking – digital checking and demand deposit account

The firm has been backed by billionaire Mark Cuban and went public in a SPAC merger deal with VPC Impact Acquisition (VPCB) at an equity value of around $4 billion. The deal closed in January 2022.

Dave acquires customers through a variety of online means, including search engine marketing and online partners.

The company recently received $100 million in an investment from noted cryptocurrency exchange FTX US, where FTX will serve as the exclusive partner for crypto assets to be introduced on the Dave platform.

Dave’s Market & Competition

According to a 2020 market research report by Allied Market Research, the market for mobile banking was an estimated $715 million in 2018 and is expected to reach $1.8 billion by 2026.

This represents a forecast CAGR (Compound Annual Growth Rate) of 12.2% from 2019 to 2026.

The main drivers for this expected growth are increasing adoption of smartphones for banking and financial services and improved innovation by financial service providers.

Also, this report is limited to mobile banking, so the markets for lending or cash advances and other services would be in addition to these figures.

While the North America region accounted for significant market share, the Asia Pacific region is expected to produce the highest CAGR by region, at 16.0% from 2019 to 2026.

Other major market participants or competitors include:

- Chime

- Deserve

- Even

- B9

- Varo Bank

- Credit Sesame

- MoneyLion

- Steady

- Braviant

- Empower Finance

Dave’s Recent Financial Performance

-

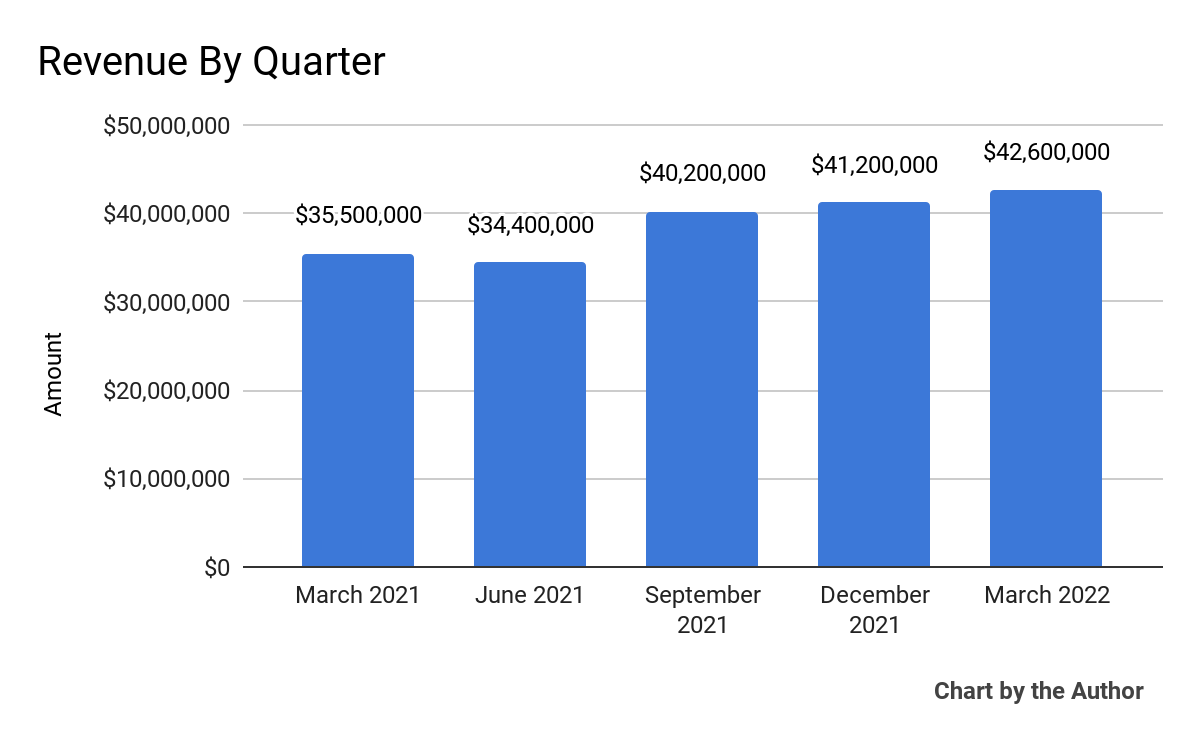

Total revenue by quarter has grown moderately in the three most recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

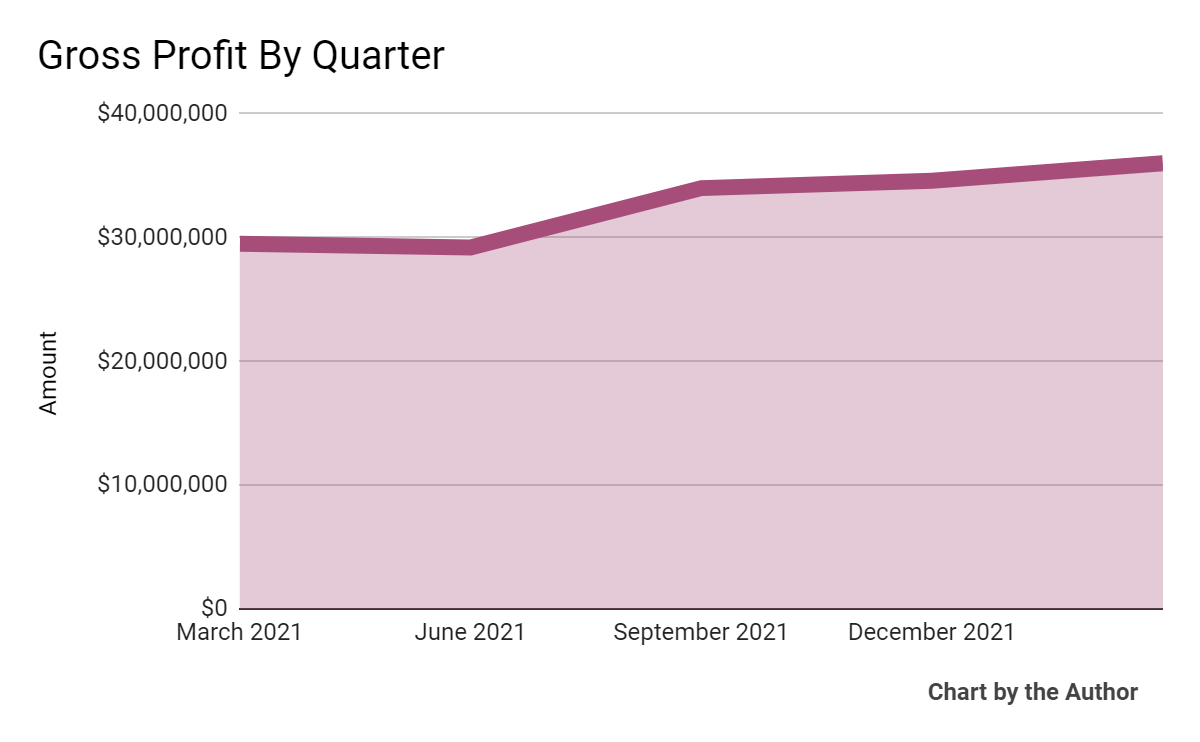

Gross profit by quarter has risen but recently plateaued:

5 Quarter Gross Profit (Seeking Alpha)

-

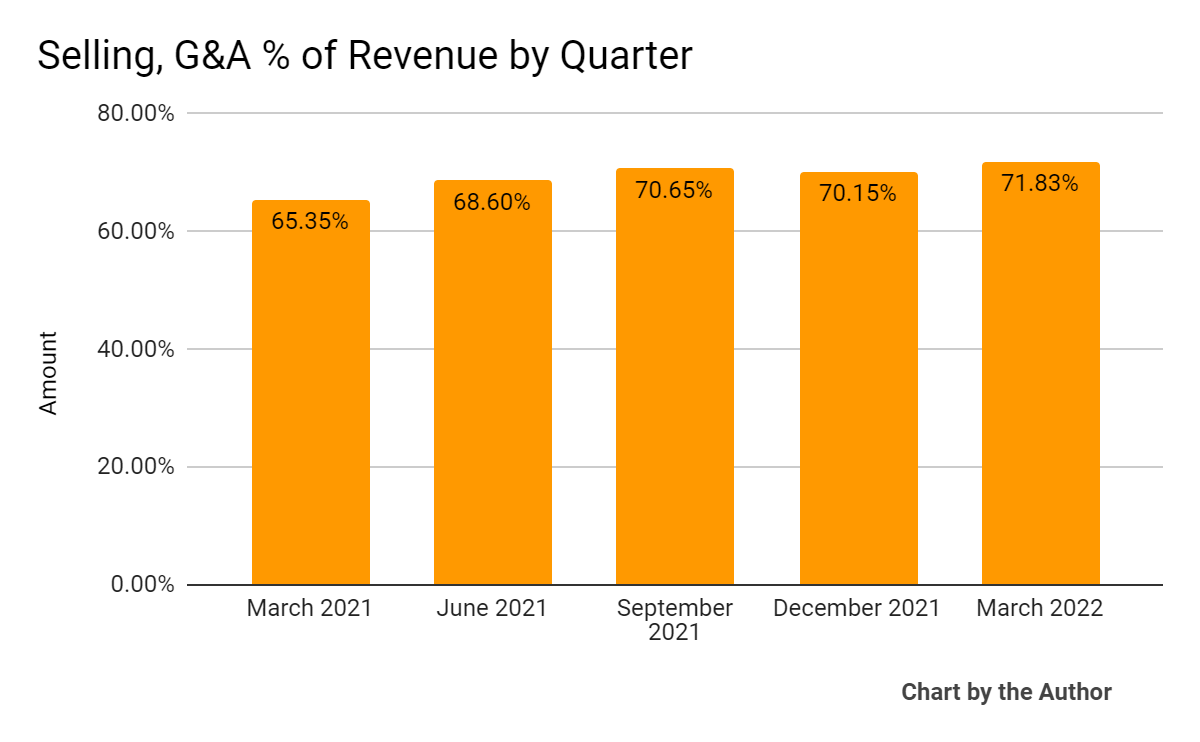

Selling, G&A expenses as a percentage of total revenue by quarter have been in a rising trend, indicating the firm is getting less efficient at generating revenue over time:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

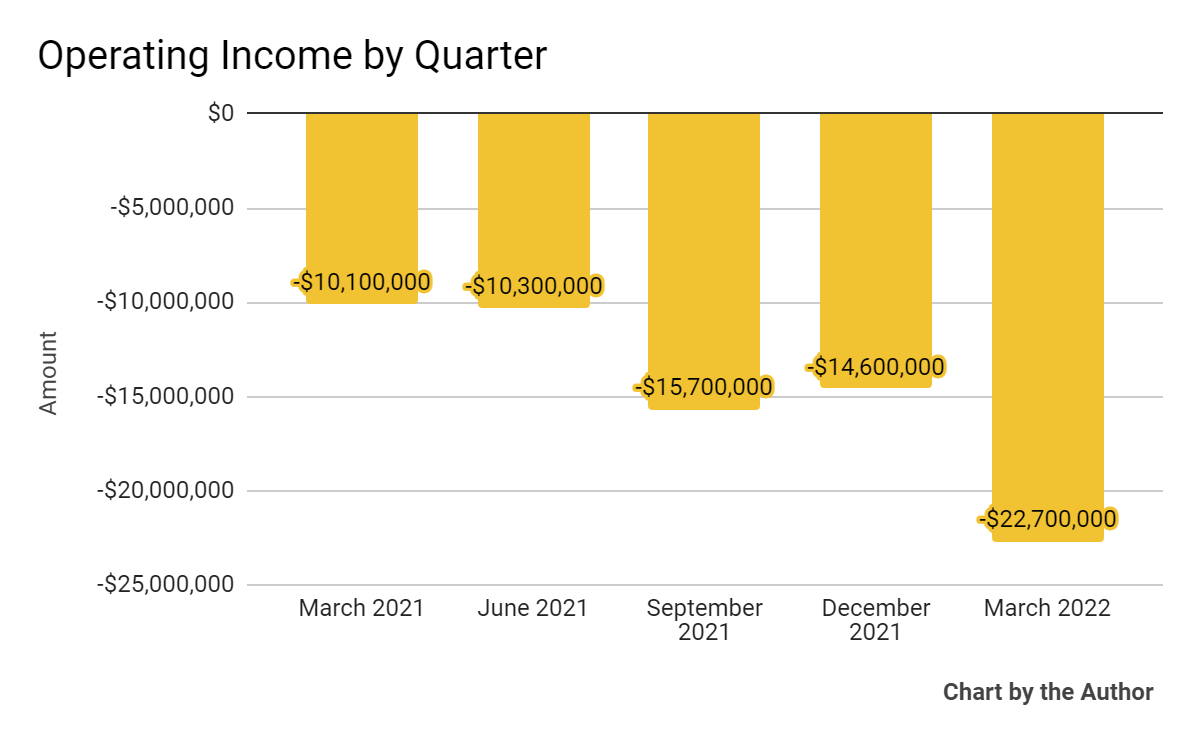

Operating losses by quarter have worsened considerably in the past three quarters:

5 Quarter Operating Income (Seeking Alpha)

-

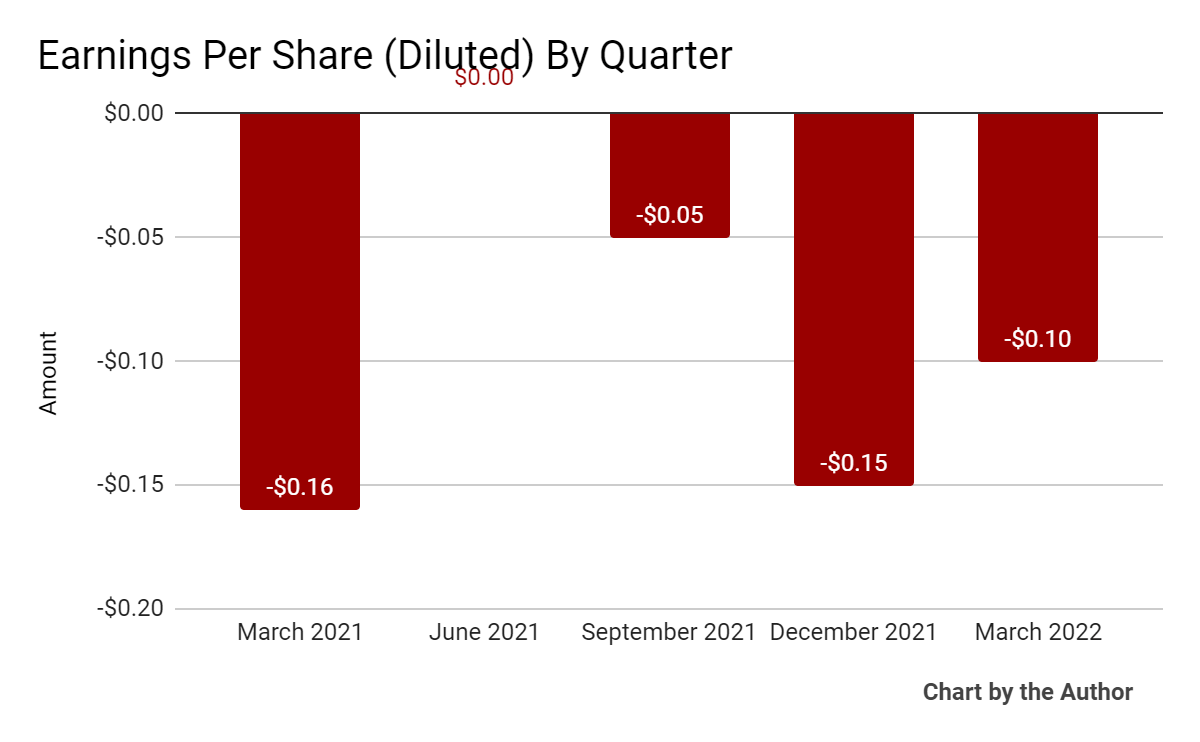

Earnings per share (Diluted) have remained mostly negative in the past 5 quarter period:

5 Quarter Earnings Per Share (Seeking Alpha)

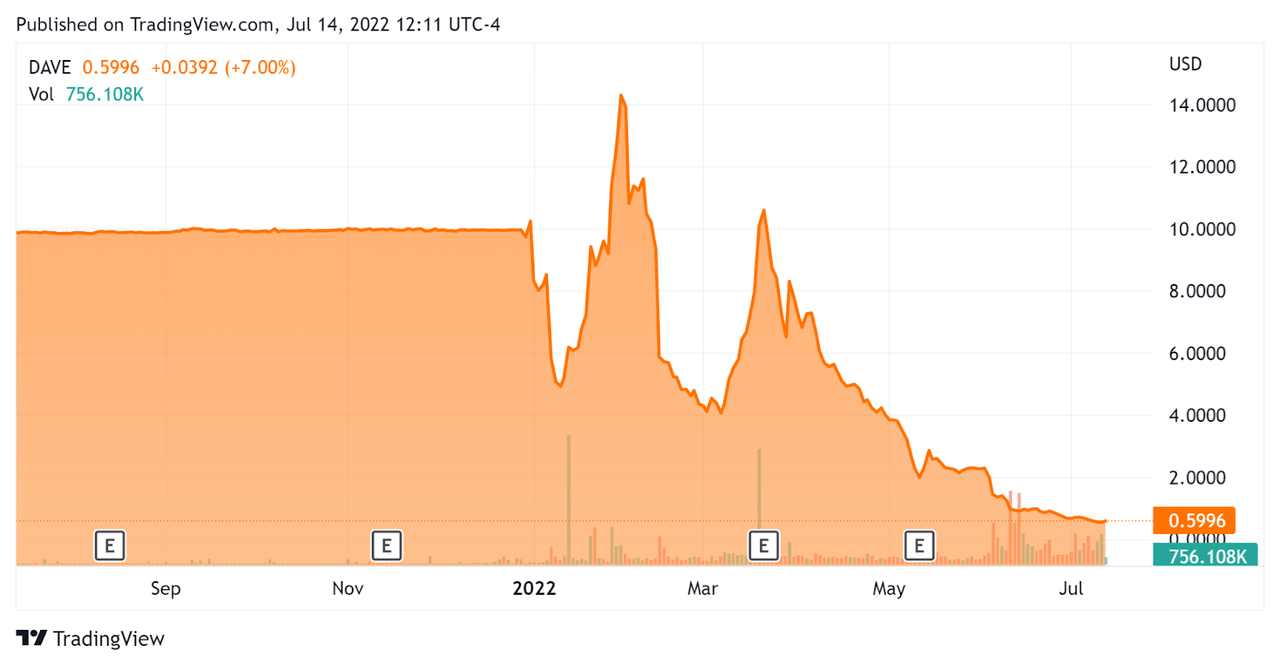

In the past 12 months, since its SPAC merger, DAVE’s stock price has dropped 93.9 percent vs. the U.S. S&P 500 index’ drop of around 13.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Dave

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$65,030,000 |

|

Market Capitalization |

$209,480,000 |

|

Enterprise Value / Sales [TTM] |

0.40 |

|

Price / Sales [TTM] |

0.55 |

|

Revenue Growth Rate [TTM] |

24.84% |

|

Operating Cash Flow [TTM] |

-$80,800,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.30 |

(Source – Seeking Alpha)

Commentary On Dave

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the addition of 340,000 net new members, finishing the quarter with 6.4 million members.

Notably, the company had 1.45 million of its members (22.7%) make at least one ‘funding, spending, ExtraCash or subscription transaction’ during the quarter.

Founder and CEO Jason Wilk said that he believes that reduced fiscal stimulus and tighter financial conditions support the firm’s value proposition to users who may have greater need for its services in a more challenging economic environment.

So, the company plans to add features and capabilities to its service offerings, especially ExtraCash, which management is seeing increasing user engagement with and usage.

As to its financial results, topline revenue and gross profit continued their moderate growth trajectory, but GAAP operating losses worsened markedly during the quarter and continued a deteriorating trend over the last three quarters.

The company expensed significantly higher provisions for unrecoverable advances during the quarter, due in part to higher transaction volumes.

The firm’s margin results declined 700 basis points versus Q4 2021, due to ‘the timing of higher origination volumes, requiring additional allowances for unrecoverable advances rather than changes in our overall credit performance.’

Notably, there was no mention of crypto initiatives in the earnings call prepared remarks or Q&A section.

For the balance sheet, the company finished the quarter with $302.3 million of cash and marketable securities, which gives the firm considerable capital to advance its growth initiatives over the next few years.

Looking ahead, management reiterated its 2022 guidance due in part to what it believes are more favorable macro environment conditions for user demand for its offerings.

Regarding valuation, the market is valuing the firm at an EV/Revenue multiple of only 0.4x despite topline revenue growth of nearly 25%.

The primary risk to the company’s outlook is uncertainty around its unrecoverable advance write-offs during an economic downturn.

A potential upside catalyst would be a soft economic downturn which could increase demand for its services.

Another potential upside is quick integration of crypto offerings from its deal with FTX US combined with a cyclical bull market for crypto perhaps in 2023, however, the timing and extent of crypto market demand is anyone’s guess

While demand for Dave’s offerings may indeed increase as an economic slowdown or recession occurs, it appears too early to tell how well the firm will be able to produce improved financial results in the near term.

DAVE may be a stock to put on a watch list, but for now I’m on Hold for it.

Be the first to comment