Just_Super

Investment Thesis

Datadog (NASDAQ:DDOG) is an Application Performance Monitoring platform. Datadog has seen its valuation come down significantly in 2022. Consequently, I argue that much of its downside is now already priced in.

The one blemish in the bull case is that its non-GAAP profit margins are likely to compress slightly in the back half of 2022.

Nevertheless, there’s a lot to like about this company. Hence, I’m upgrading Datadog to a buy rating. Here’s why:

My Background With Datadog

In my January article, I noted the following:

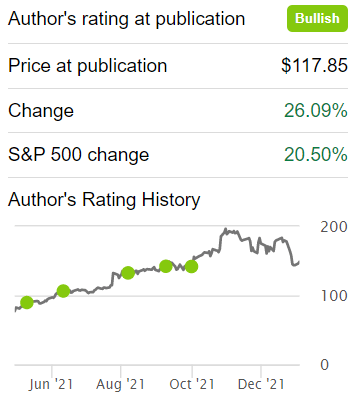

Author’s coverage

I had been an unwavering bull of Datadog throughout the whole of 2021. Then, in January 2022 I changed my mind. When I wrote Crowded Trade, I stated that:

I declare that for new investors coming to the stock, paying 33x this year’s revenues is probably starting to price in a lot of its future prospects

At that point, I reasoned that I could no longer be bullish on Datadog. At the time, I was concerned that investors were pricing too much optimism.

Author’s coverage

With the stock today trading at nearly a 30% discount to January, I believe that the odds are now once again favorable. This is why it’s time to get bullish on this name.

Datadog’s Revenue Growth Rates Remain Very Strong

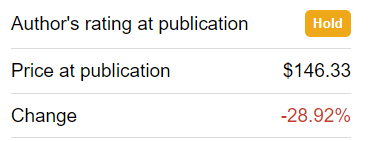

DDOG revenue growth rates

Datadog is a growth story. But not just any premium growth story. It’s a business that consistently impresses with its high sustainable topline growth.

What’s more, it’s the sort of company that simply does not offer investors much in the way of negative surprises.

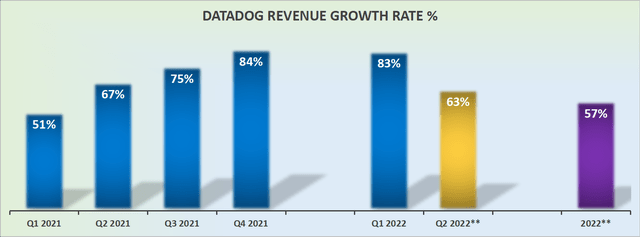

DDOG revenue surprises

As you can see above from past quarterly results, Datadog has a history of beating analysts’ estimates.

Datadog’s Near-Term Prospects

Datadog is a data and analytics platform. It’s recognized by Gartner as a leader in Application Performance Monitoring. At its core, Datadog automates monitoring.

Datadog provides analytics to customers, and the ability to derive insights from data. Datadog’s other key products include observability, data logs, and user experience monitoring. The latter products are its very high growth areas.

Essentially, Datadog is able to gather vast amounts of data from different sources and perform analytics on this data to gain performance insights.

Moving on, the one aspect where Datadog shines is its land-and-expand strategy. Indeed, consider the two following aspects:

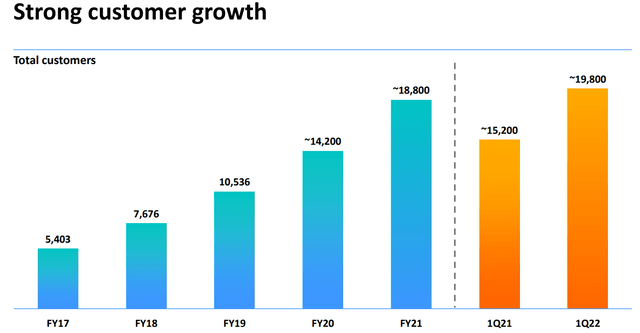

Datadog presentation

In the first instance, as you can see above, Datadog’s total customers continue to steadily grow over time. As of Q1 2022, its total customers were up 30% y/y.

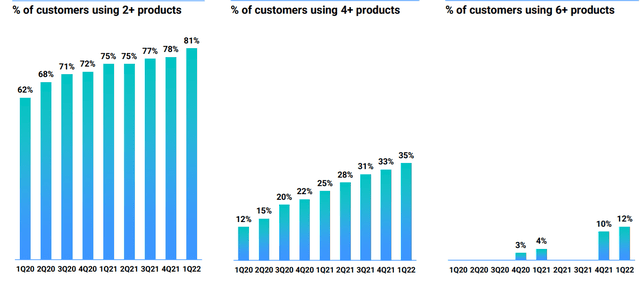

Datadog presentation

Secondly, as you can see above, not only are more and more customers using 2 of Datadog’s products but there are now 12% of its customers using more than 6 of its products. In fact, recall that this time last year only 4% of its customers were using more than 6 of Datadog’s products.

Accordingly, there’s no denying that customers are positively resonating with Datadog’s product portfolio.

Very Strong Profit Margins

Yet another aspect where Datadog shines strongly is its profitability profile.

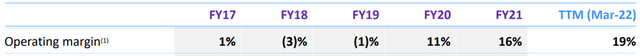

Datadog presentation

As you can see above, over time Datadog’s profitability profile has consistently improved. As it stands right now, Datadog’s guidance points to finishing 2022 with non-GAAP operating margins of 16%. This is level with 2021.

On the one hand, investors would like to see its margins continue moving higher.

And the fact that for its trailing twelve months Datadog’s non-GAAP operating margins reached 19% and now looking ahead, its guide points to 16% for 2022, implies that management believes that margins will compress in the second half of 2022.

That being said, we should keep in mind that at this stage in its business, Datadog is not focused on maximizing profitability. That’s not where this “story” is.

DDOG Stock Valuation – Priced at 20x Sales

Datadog has never been a cheap stock. It’s a business that’s growing rapidly, with non-GAAP profitability margins improving over time. What’s more, it’s a business that is well-positioned for the massive digital transformation that is underway.

With all that in mind, one should not expect the stock to ever trade in the bargain basement.

Consequently, I believe that 20x forward sales for Datadog is a very fair entry point for new shareholders.

The Bottom Line

As the rest of tech falls out of favor on recession fears, I’m not convinced that Datadog’s share price sell-off is justified. This is a business that is seeing a strong increase in customer adoption, combined with a strong increase in revenue growth rates.

I believe that paying 20x for a very high-quality business is an attractive multiple. Particularly when that company is still growing at more than 50% CAGR.

Be the first to comment