SimonSkafar/E+ via Getty Images

Introduction to Darling Ingredients

While yesterday I discussed a speculative, but well-contracted, biofuel producer, Gevo (GEVO), today I will offer insights into a far less speculative and far more investable company, Darling Ingredients (NYSE:DAR). Darling offers an investment into a wide range of sustainable industries such as biofuel production, waste recycling techniques, and even animal feedstock production. Essentially, the company works to provide more cyclicality and renewability to processes that can be developed with biological processes.

Established in the late 1800s, Darling is a story about how well-established companies often have a better chance to leverage new technologies rather than high-cost startups. As the company began with food and feed production decades ago, they were able to slowly R&D their current portfolio of sustainable subsidiaries. I will discuss these below.

DarPro Solutions: “Responsible Handling of Inedible Meat By-Products”

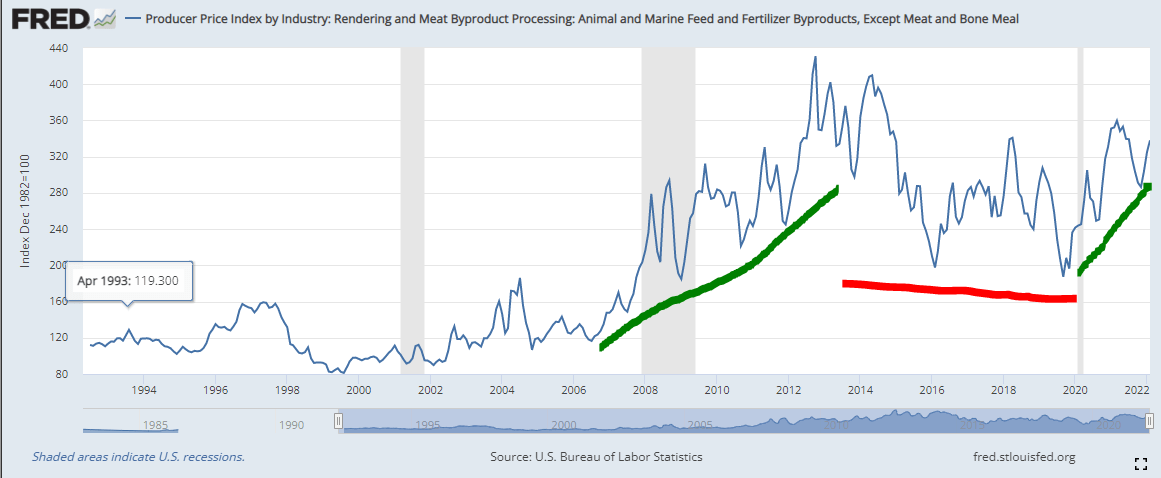

This segment allows for waste reduction in the meat production industry as Darling collects waste to turn into a variety of end products, rather than a huge amount of waste meat decomposing and releasing carbon in landfills. In fact, this industry is quite important, and if these so-called renderers did not exist we would run out of landfill space within 4 years. As the largest revenue segment for the company at ~40%, it is important to consider the outlook in this segment. Considering that rendered products are a commodity, they are influenced by the same cycles as other products.

St Louis Fed

If renderers earn less money from rendered byproducts and dead animals, they will pay less for such materials. In the past, renderers paid for dead animals. Now most charge a fee to pick them up. In its 2002 study on the cost of livestock mortalities, Sparks assumed that so long as MBM could be sold for feed, the average per-head cost of disposing of dead cattle and calves might be $8.25 per head; if MBM is banned from animal feed, the cost could rise to $24.11 per head. Sparks estimated the per-head costs for other disposal methods at $9.33 for incineration, $10.63 for burial, and $30.34 for composting.

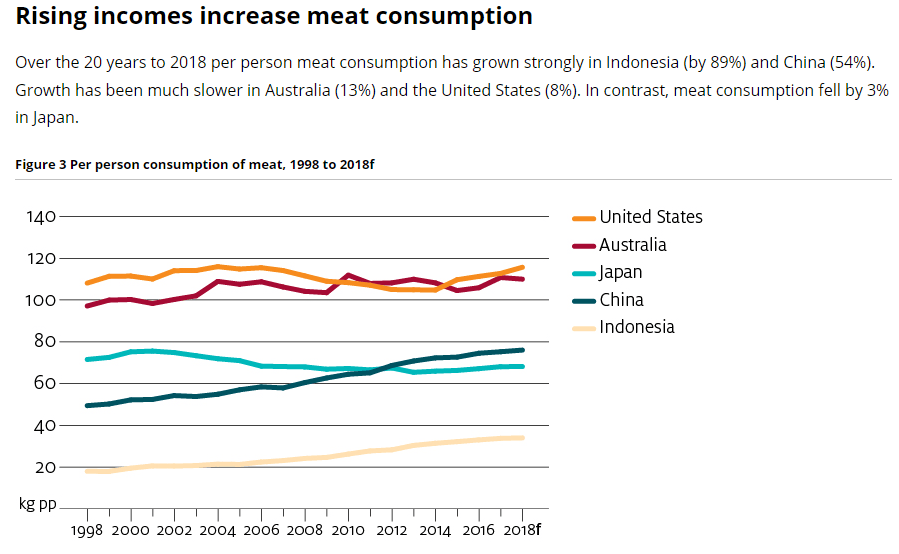

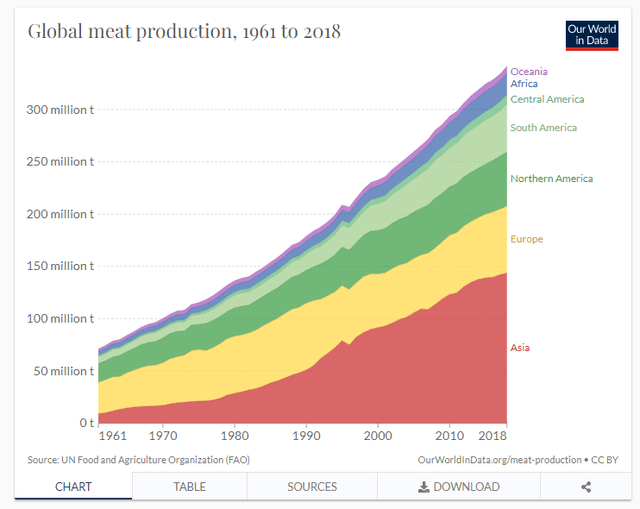

Due to the relationship with meat processors and farmers, there is a skew in balance towards renderers being able to control prices as the costs for alternatives are often far better. As such, this plays favorably for Darling, and I expect this segment to survive any economic effects, even a recession. Considering that meat consumption is only forecasted to increase with time, even in consideration of the negative environmental and health effects, I consider Darling to be in an extremely safe position for their major revenue segment.

Diamond Green Diesel (Joint Venture 50-50 with Valero (VLO)): “North America’s Largest Renewable Diesel Production Facility”

Combining Darlings expertise in the breakdown of animal fats, used cooking oils, and inedible corn oil with Valero’s expertise in hydrocarbon refining, this joint venture is a significant producer of Renewable Diesel. The venture has already been on commercial scale for a few years with increases in production rising from 160 million gallons per year to the current 400 million per year for 2021/22. Further, the JV has announced the approval of a new plant in Port Arthur, Texas that will increase total annual production to over 1.0 billion gallons per year. The project is slated to begin operations in 2023.

Due to the fact that their current facilities are operational and growing at a quick pace, I see little risk to the downside in regards to their large facility, albeit watch for construction delays may present entry points. As an important indicator of growth, DGD’s predicted 1.2 billion gallons of production pales in comparison to the 44.6 billion usage of diesel for 2020. Therefore, the only hindrance to growth is the number and output of production sites.

Impact from this segment is seen as a straight boost to EBITDA, and averages approximately $2.00 in EBITDA per gallon sold. This led Darling to obtain $383 million in EBITDA for FY 2021, an increase of 13.7% YoY. Considerations include increased gallons sold (up 28.5% YoY) but lower EBITDA per gallon (down 11.5%) due to CAPEX and higher feedstock prices for the most part. With prices for fuels remaining elevated in 2022, I expect continued margin growth and sales of products to support the overall growth.

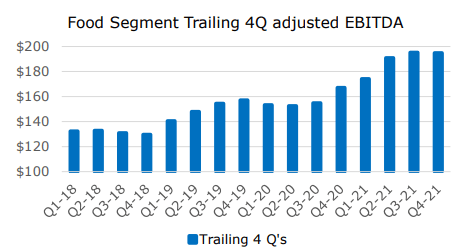

Animal Food, Feed, and Nutrients

Similarly to the rendering services provided, Darling also has applications in taking waste bakery residues and other by-products and turning them into high-quality end products. While some of this has use in producing products such as renewable fuels, collagen, and more, much of the waste is turned into animal feed. End uses include pet food (dry and wet), fish feed for aquaculture, and compound feed for livestock. Darling has the advantage of marketing a high quality, but cost-effective and sustainable product offering to support revenues into the future. However, as their main established segment, there is far lower growth than the other novel segments. 2021 full year revenues and EBITDA were up only 6.72% and 16.8% respectively.

I find solace in the fact that this segment operates in an essential capacity and growth is almost certain worldwide. This is thanks to the fact that Darling is already established around the world, and this offers safety in the face of commodity risks. The same philosophy of increased meat consumption world-wide offers a positive feedback loop for Darling to leverage. Higher overall consumption requires more meat processing which allows for increased waste collection that in turn creates feed products for higher numbers of livestock. However, I would look to Darling to expand to those developing regions to take part in the growth process and allow for sustainable practices in those regions.

Darling Ingredients Australian DAWE

Strong Financial Foundation

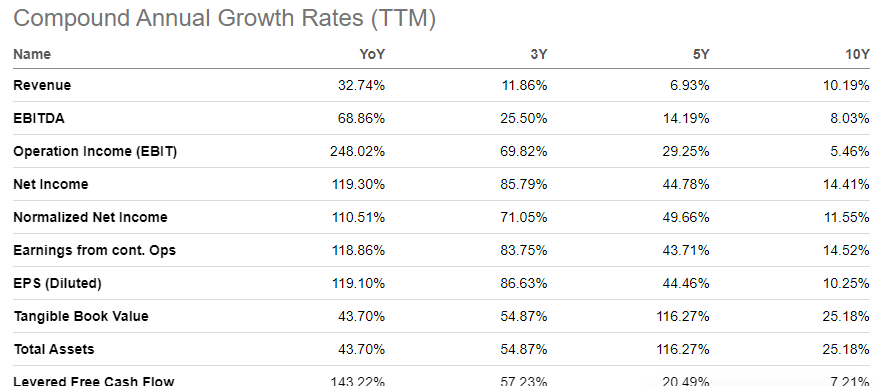

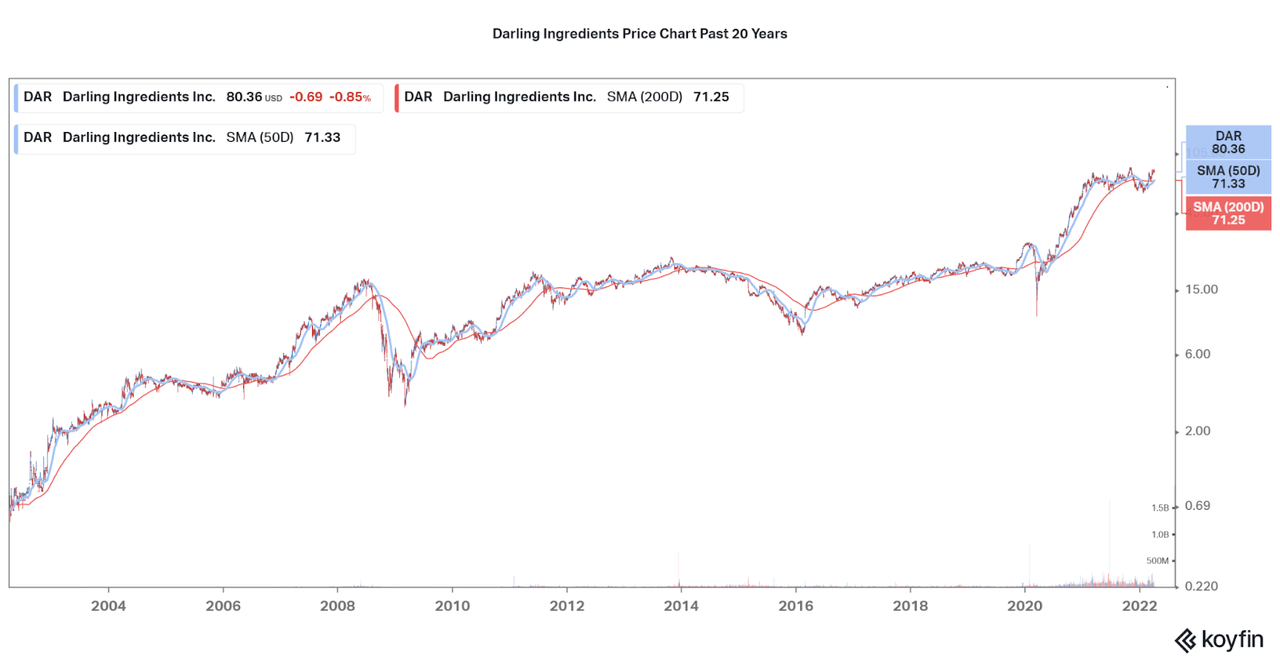

As we can see, the company has well-established revenue segments, and sees a mix between stable and high growth. This balance has contributed to the company’s favorable long-term performance, and I see little that would shift the company from this path. Taking a look at the CAGR growth chart highlights a very favorable trajectory even considering the company’s diversity of revenues and the inherent cyclicality of segments. While the 10 year chart fails to consider the 2008-10 period, I provide a longer-term chart below that highlights the overall stability of the decade and more trajectory.

Seeking Alpha Koyfin

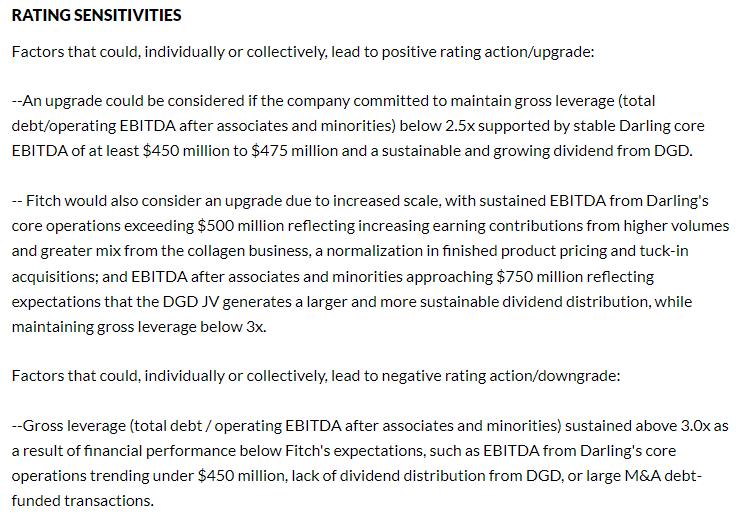

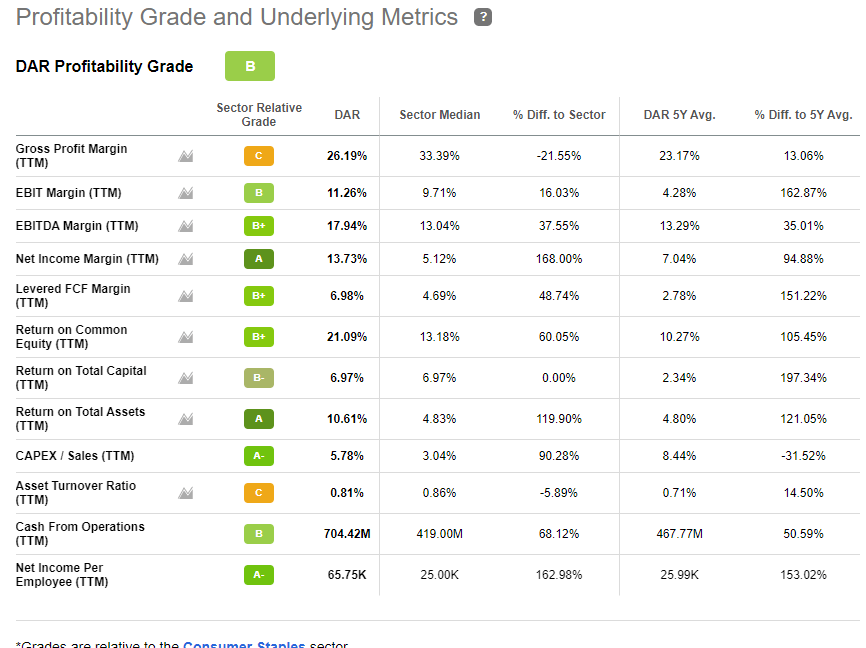

Along with growth, the company has also established a rock-solid capital foundation tied together with high profits margins, ample liquidity, and falling debt. While cash flows have remained essentially 0 for the past decade, the company has seen strong net income growth and reduced overall share count. Leverage has decreased over the years, but the company does make good use of their $1.0 billion revolving credit facility. Fitch ranks the company at BB+ and has a stable outlook.

Fitch Ratings Seeking Alpha

Valuation

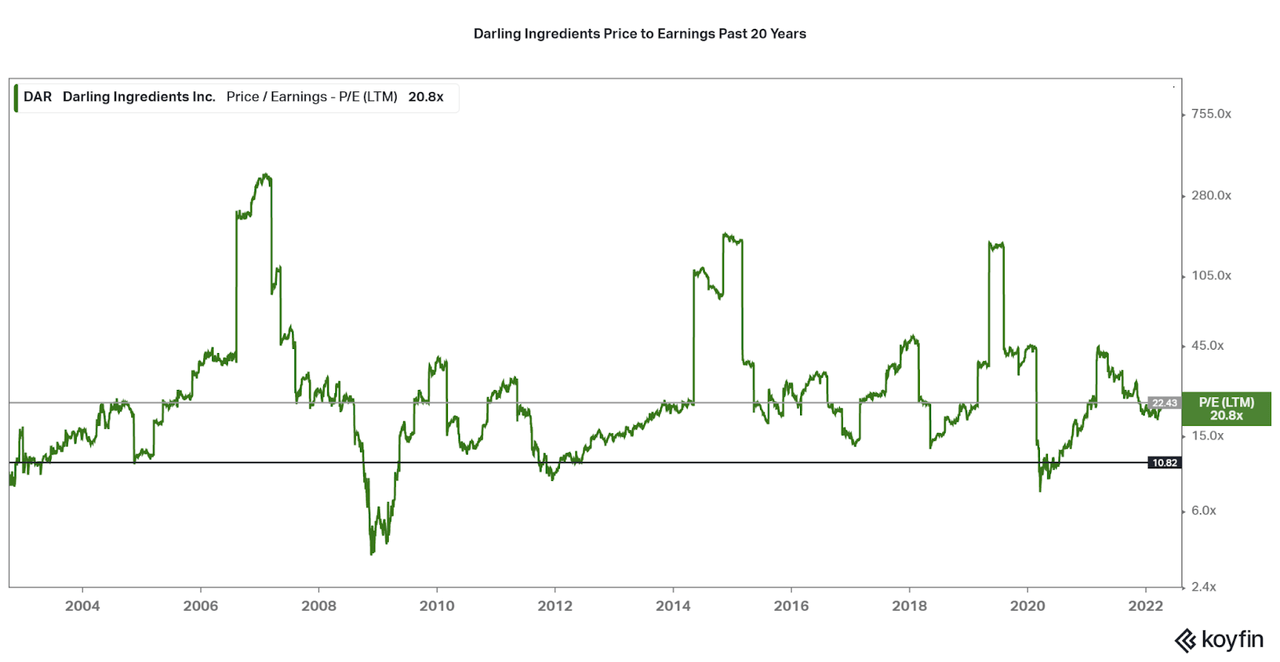

While one can see that Darling offers many positive factors to the investment, one may think that there must be a catch with the current valuation. However, I would like to say that is not true, and that the company is in fact at quite a fair valuation, if not undervalued. The company currently trades at a 30% discount to their five-year average P/E ratio, but performance is currently far above average. As such, one can consider that there is significant room to grow from this position. Looking at the P/E chart over the past years indicates that the company has cycles, and the share price is approaching a low point. I would also not use Seeking Alpha’s valuation metrics for this company as peers in the agricultural product and consumer staples industries are far different and incompatible with some metrics. However, the current 20 P/E ratio is favorable for any sector these days. Considering I recommend recurring investments, I suppose it would also be time to establish an initial position after you conclude your due diligence.

Koyfin

Conclusion

I find that Darling Ingredients offers a combination of safety and growth, a rare sight in the sustainable technologies industries. This is thanks to their slow development of novel technologies at a sustainable clip over their long history, and this offers investors a much better scenario. While cyclicality may be a long horizon issue to ponder, I find that the underlying growth potential of the biodiesel segment to be a stronger influence.

Combined with the stable financial foundation and positive shareholder catalysts, such as share buybacks, I believe DAR is a solid investment to consider for any investor. While they do not currently offer a dividend, they are fully capable of doing so, and I would suspect the company to initiate one after the large biodiesel plant to begin operations and provide significant EBITDA flows. Until then, it may not be a problem accumulating a small position.

Thanks for reading, let me know what you think in the comments.

Be the first to comment