NicoElNino/iStock via Getty Images

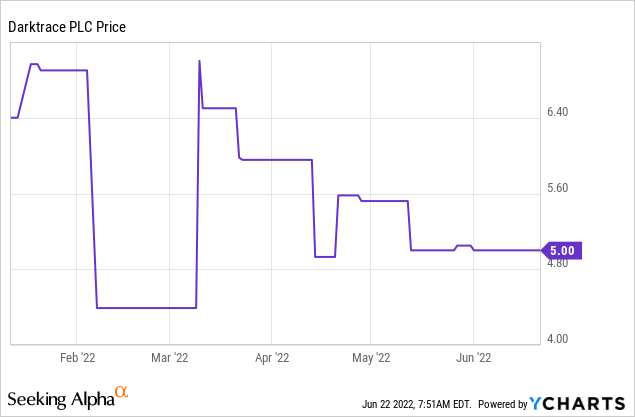

Cybersecurity attacks are on the rise, from the Colonial pipeline attack to Email hacks and Data Breaches. Our increased connectivity has expanded the attack surface for potential bad actors. In 2021, the world saw a 105% surge in ransomware cyberattacks, which were designed to cripple businesses until money was paid (“ransom”). Thus, it’s no surprise, the global cybersecurity market is forecasted to grow at a rapid 13.4% compounded annual growth rate (‘CAGR’) between 2022 and 2029, reaching $376 billion by the end of the period. As investors, it makes sense to invest into companies which are poised to ride growing trends. Darktrace (LSE:DARK) (OTCPK:DRKTF), is a leading cybersecurity company which specializes in Artificial Intelligence (‘AI’). They IPO’d on the London Stock Exchange just last year and have been growing their revenue and customer base rapidly. The company even recently raised their Annual Recurring Revenue (‘ARR’) guidance for the full year 2022. The stock price has recently pulled back, due to the market rotation from technology/growth stocks to value stocks, driven by inflation and rising interest rates. This now presents an opportunity as the stock is undervalued intrinsically and relative to competitors in the industry. Let’s dive into the business model, financials and valuation for the juicy details.

Secure Business Model

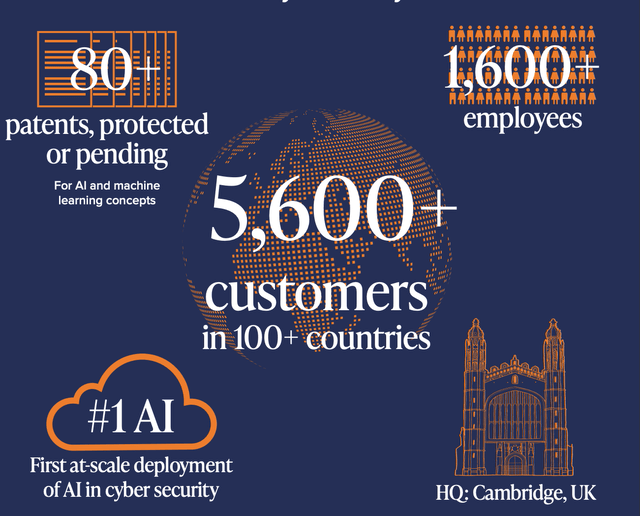

Darktrace was founded by Cyber Defense experts at the University of Cambridge and British Intelligence agencies in 2013. Today, they are a global leader in Cybersecurity AI (Artificial Intelligence) and offer real-time threat protection. The technology learns the “pattern of life” for every user and device in order to spot anomalies in the system. This helps to understand and bolster the “Cyber Immune System” of a company. Today they employ over 1,600 people in 44 global offices and provide cybersecurity protection to over 5,600 customers across multiple industries. The company has over 80 patents (protected or pending) for various machine learning and AI concepts, this offers a competitive advantage against new systems being developed.

Cybersecurity Darktrace (Investor Report)

Darktrace’s business model focuses on a “try before you buy” approach in which they install the platform on clients’ systems during a free trial period, so they can see the “proof of value” for themselves. This is a low friction method of selling and has resulted in high conversions for the business. Next, the company “upsells” multiple products/modules to the customers and as of June 2021, 62.2% of customers had three or more products, and 39.2% had four or more products, from their ten product platforms. Finally, the business focuses on retaining these customers, and they have a record 103% Net ARR Retention rate.

Growing Financials

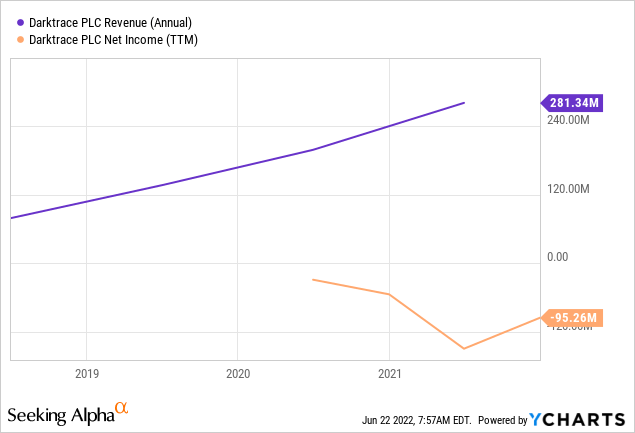

Darktrace generated revenue of $109.8 million for what they call Q3 2022, this was up a meteoric 50.1% year over year. They added 359 net new customers to bring the total customer base to 6,890, this is growth of 37.3% year over year and came from the acquisition of Cybersprint in March 2022. Net Annual Recurring Revenue (‘ARR’) was $462.6 million, up a rapid 46.3% year over year, with 1.4% related to the Cybersprint Acquisition. They have recently raised their guidance for ARR and now expect growth of ~40.0%, up from 38.5% previously forecasted.

Note: The Chart below shows Revenue for the FY2021, which for this company ended on 29th June 2021.

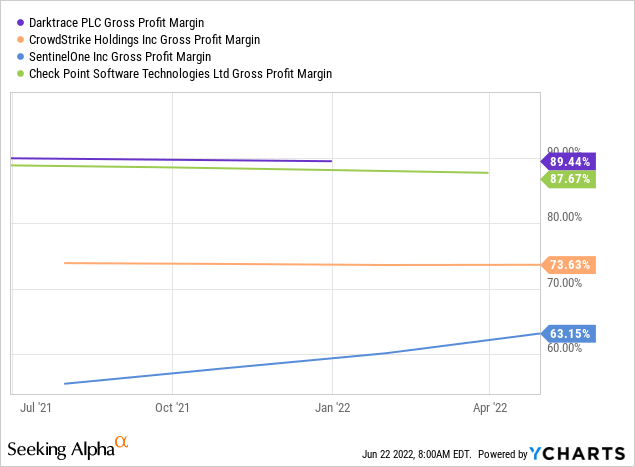

The company operates with a super high gross margin of 89.9%, which is one of the highest levels in the industry. I have added CrowdStrike (CRWD), SentinelOne (S) and Check Point Software Technologies (CHKP) as a comparison.

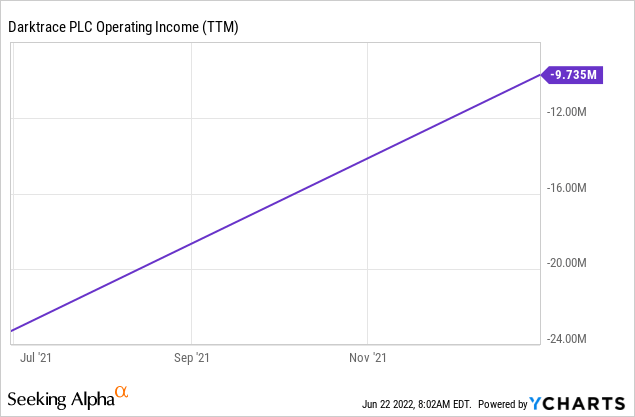

The company operates at a small loss of -$9.7 million in the trailing 12 months, mainly due to large investments into R&D ($34 million), Sales and Marketing.

Darktrace has a fortress balance sheet with $342 million in cash and cash equivalents and $33 million in total debt.

Valuation

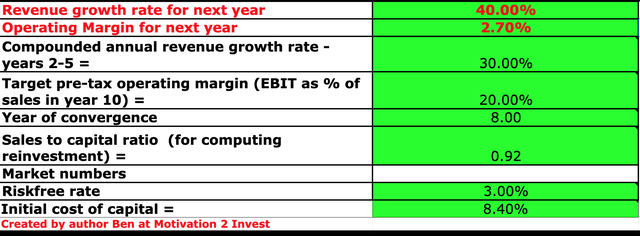

In order to value Darktrace, I have plugged the latest financial data into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 40% revenue growth for next year in line with the company’s own estimates and conservatively estimated 30% revenue growth for the next 2 to 5 years.

Darktrace Stock (Created by Author Ben at Motivation 2 Invest)

As a software business, I have forecasted their operating margin to increase to 20% as the company reaches greater scale and can maintain its R&D investments. This is a conservative estimate given the average operating margin for the software industry is ~25%.

Darktrace (created by author Ben at Motivation 2 Invest)

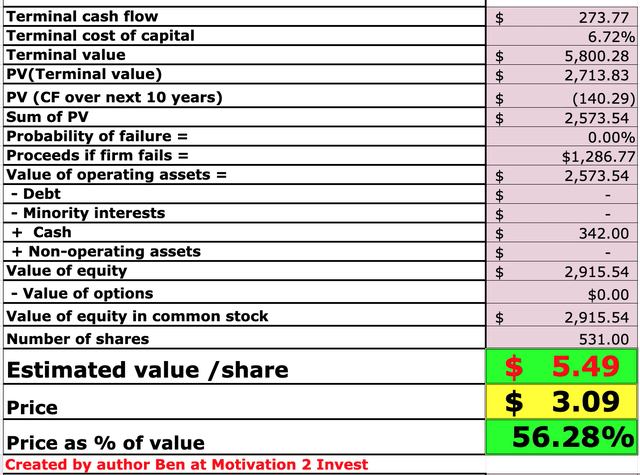

Note: The above share price result is in Great British Pounds (£), however, all other financials are in dollars, so ignore the dollar sign at the result.

Given these factors, I get a fair value of £5.49 per share, the stock is currently trading at £3.09 on the London Stock Exchange, (LSE:DARK) and is thus undervalued by ~44%, which gives a significant margin of safety.

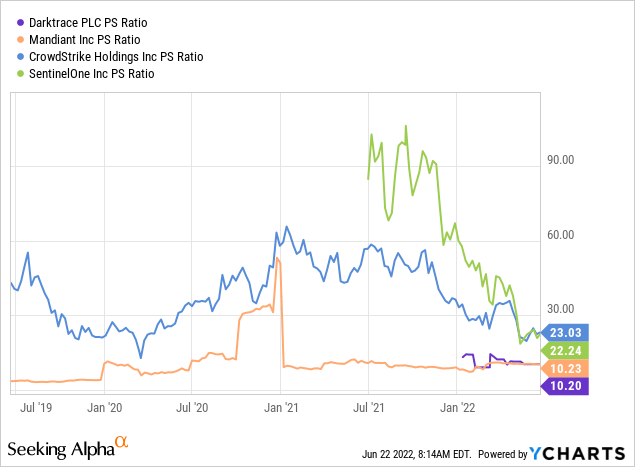

Relative to industry peers, Darktrace is trading at a Price to Sales ratio = 10.2, which is lower than historic levels and most peers in the industry. For example, CrowdStrike trades at a Price to Sales ratio = 23 and Sentinel One trades at a Price to Sales Ratio = 22.

Risks

Competition

The cybersecurity market is expected to be worth $376 billion by 2029. A large Total addressable market attracts a lot of competition. There are many companies in the industry, that offer similar solutions. For example, CrowdStrike offers endpoint protection and threat intelligence driven also by AI models.

Patents Hard to Enforce

As mentioned prior, Darktrace has over 80 patents (protected or pending) for various machine learning and AI concepts. This is great, however, it is also very difficult to detect and enforce breaches. As most cybersecurity companies protect their algorithms and software (for obvious reasons) and thus finding if an element was copied or just duplicated independently is extremely difficult.

Small Market Capitalization

The company has a relatively small market cap of “just” £2.16 Billion, thus greater volatility should be expected.

Rising Interest Rates

The High Inflation and Rising Interest rate environment, devalues growth stocks more than mature cash flow generating value stocks. Thus, until inflation subdues the stock may stay depressed.

Final Thoughts

Darktrace is a tremendous company and a true leader in Cybersecurity AI solutions. Their heritage at the University of Cambridge and with British Intelligence agencies gives the company immense credibility in a world of AI buzzwords. The patent protection acts as a competitive advantage and their “try before you buy technique” means low friction adoption is possible. The stock is currently undervalued relative to their historic price-to-sales ratio and intrinsically and thus this could be a great buy for the long term.

Be the first to comment