Love Employee/iStock via Getty Images

Investment summary

Markets pundits have shifted away from paying premium multiples for the promise of cash flows out into the future and are instead focused on bottom-line fundamentals in FY22. DarioHealth Corp. (NASDAQ:DRIO) epitomizes the current state of affairs, a small-cap growth player that looks set to compound top-line growth over the coming years. However, the market is agnostic to these factors in FY22, and this might be why DRIO trades 55% down this YTD.

In that vein, we identify that DRIO’s market and operational strengths look to be offset by valuation and the allure of cash flows priced out into the future. Whilst we like the growth story, we’ve shied away from rewarding top-line growth and are positioning towards earnings quality and fundamental momentum instead. We feel the stock is overvalued and price DRIO at $3.28 on a neutral rating.

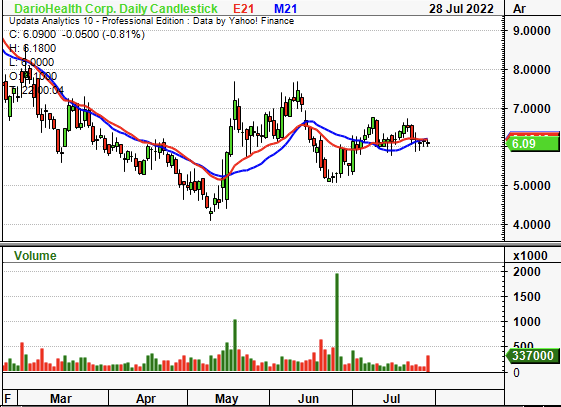

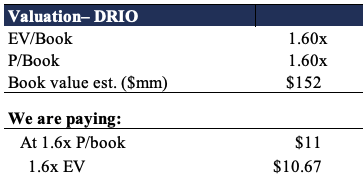

Exhibit 1. DRIO 6-month price action

Data: Updata

Key Risks

Firstly, there are a number of risks to this investment thesis. Should the market in fact reward DRIO for its sales growth, then its share price could in fact appreciate. It could also deliver an exceptionally strong earnings result in the coming month or so, thereby increasing investor attraction. Moreover, updates around the Sanofi (SNY) agreement could prove to be an upside risk to the thesis. There are also inherent risks in investing in smaller-stage life-sciences companies, and this must be factored in also.

DRIO’s Q1 results show bedrock is forming

First quarter earnings illustrated the company continues to make sequential top-bottom improvements down the P&L. Revenue was $8 million, up 124% YoY and a 34% sequential gain from Q4 FY21. It also signed 14 new accounts, and this included 2 new health plans. In fact, DRIO notes it actually prefers health plans as it provides a far higher revenue margin per account. At the end of Q1, the company had 61 accounts on book, and 80% of these have launched.

As a result, it is set to recognize $40 million in ARR when all these accounts are fully implemented. DRIO also kept a ~35% enrolment rate for the new accounts it launched. However, it did have to drive up inventory purchase in response to the uptick in new accounts to be launched. It paid for this upfront and probably best as it anticipates to book revenue in these coming periods from the 2 newest health plans that were signed during the quarter. In total, with the new contracts signed this year, it now has 61 contracts on a goal towards 100. On this, contract value is currently ~$42 million, and the majority of the off-cycle, employer health plan and provider agreements are expected to book sales this year.

One key trend-shift that occurred last quarter was drift in revenue from business to business (“B2B”) from business to consumer (“B2C”). For the first time, B2B has exceeded B2C revenue in Q1. Hence, management is moving budget to B2B, after operating expenses narrowed to ~$15 million from $16.4 million sequentially. It anticipates this trend to continue as it wants to capture additional upside from the higher margin B2B as capital allocation is pulled away from the B2C segment.

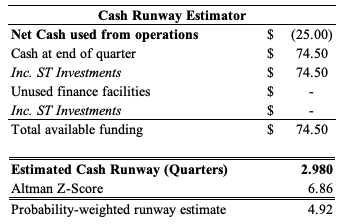

As a result, consensus has DRIO to print $34 million at the top in FY22, stretching up to $48 million in FY23 and $74 million in FY24. We are aligned with this view, and see the company delivering a loss on FCF of $42 million this year. This we envision to generate a loss on invested capital of 42%, narrowing to -30% in FY23. One factor to consider is DRIO’s cash burn. Management correctly noted it would run hot last quarter, due to the large inventory purchase. Whilst it’s not a trend, on a current position basis, we estimate it could be a risk looking ahead. In the table below, the composite suggests that there could be ~5 periods of available cash at the current burn rate. This is something we’d advocate to keep a close eye on to see what management’s strategy is to unlock further liquidity. Ideally, the intention is to see sales come through as FCF to cover the same.

Exhibit 2. With the current rate of burn we look to examine DRIO’s liquidity management in the upcoming earnings call

Data: HB Insights Estimates

Sanofi Collaboration, clinical trial momentum

Back in March the company signed an agreement with Sanofi to commercialize its digital therapeutics portfolio. The deal is for 5 years and valued at $30 million and is advantageous to DRIO in several ways. Firstly, it enables DRIO to spread the execution risk and allow Sanofi to do the heavy lifting, using its deeply entrenched sales, distribution and marketing channels as sales leverage.

At the income level, the structure could potentially allow DRIO to retain more EBIT with the lower operating cost tied to these revenues. We’ve seen this in other collaborations, particularly in licensing and/or royalty structures. The single platform covers a breadth of medical markets ranging from hypertension, diabetes and weight management – each with exciting economics. As some insight into the deal, DRIO CEO Erez Raphael said on the press release:

“Dario’s proven digital therapeutic solutions and innovative technologies provide the perfect complement to Sanofi’s scientific expertise, market access and scale, creating a foundation for long-term success in support of Sanofi’s goal of expanding into digital health therapies for chronic conditions.“

DRIO will receive funding in 5 tranches, with the first $8 million tranche set for release year. However, in terms of total ARR and contract value, DRIO is “negotiating” per the earnings call. Moreover, the deal adds a layer of validation to DRIO’s business model, as Sanofi would have done extensive and rigorous due diligence on DRIO prior to any agreed investment.

Finally, it secured a partnership with Solera Health to offer a solution for hypertension. It hopes to leverage its hypertension platform towards Solera’s hypertension users and close gaps in current standards of hypertension care. We await further news on this in the upcoming earnings call.

Market factors

We also examined how much of the consensus’ psychology is currently baked into the stock price. As seen in the Exhibit below, DRIO has strengthened against the medical devices and health care equipment sector since May of this year. This has occurred whilst the stock has caught a bid. More importantly in our eyes, however, is that its covariance structure has shifted downwards across the same time, suggesting the upside is idiosyncratic in nature rather than sector beta.

As investors have exhausted the beta-driven trade of FY20/21′ it is now idiosyncratic premia that are being rewarded in FY22, and hence we look to names that are strengthening against the sector. This is important for reasons of equity positioning, position sizing and forming a view looking ahead. We estimate there is still more of the consensus view to be baked into DRIO (that view being a period of upside).

Exhibit 3. Strengthening against the sector whilst covariance downshifting is a sign of idiosyncratic premia to harvest, we estimate

Valuation

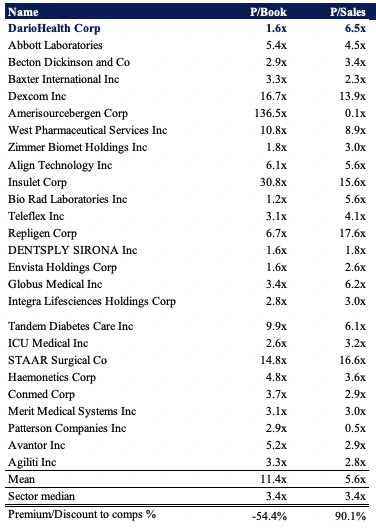

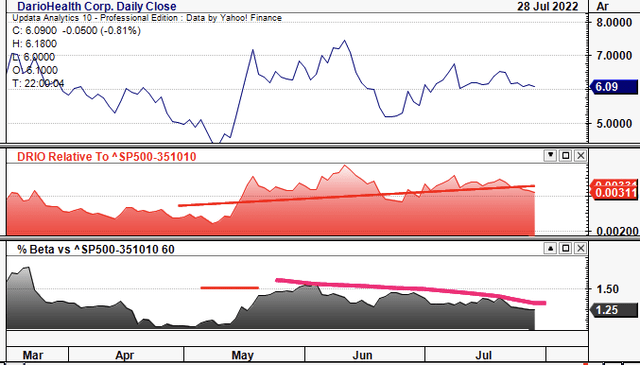

Assigning a concrete valuation is difficult due to lack of forecasted profitability. The predictability of future cash flows is also a challenge due to the macro environment and shifting costs of capital. Alas, on relative terms, shares are trading at ~1.6x book and 6.5x sales, 54% discount and 90% premium to the GICS industry median, as seen below.

Exhibit 4. Multiples and comps

Data: HB Insights

Hence on more tangible measures of corporate value, we estimate that paying 1.6x book value would see us actually pay $11 for DRIO, suggesting the stock is potentially overvalued by 83% as seen in Exhibit 5. Hence, until we see evidence of more tangible value creation for shareholders, we price DRIO at $3.28.

Exhibit 5.

Data: HB Insights Estimates

In short

DRIO is at a potential turning point in FY22 and looks set to deliver a period of earnings growth in the years ahead. However, investor appetites have changed this year, having shifted from growth stories promising cash flows into the future, onto bottom-line, realized fundamentals instead. Hence, it becomes a question of how willing an investor is to speculate on DRIO’s execution on its growth vision looking ahead.

Recent catalysts add weight to its capacity to do so, especially the vote of confidence from Sanofi. Market pundits are also rewarding the stock on what appears to be idiosyncratic-like premia in FY22. Nevertheless, as it stands, we see the stock as overvalued and price it at $3.28. On this basis, we rate neutral.

Be the first to comment