shaunl/E+ via Getty Images

A year ago, Danaos Corporation’s (NYSE:DAC) stock price was about $50. By the end of March 2022, DAC passed $100; however, by 11 April 2022, retreated to below $90. Based on my analysis and calculations, DAC is still a buy. Danaos’ charter backlog of $2.8 billion with an average charter duration of 4 years, will ensure strong cash flows for the company. I estimate a fair value of $17 per share for DAC. According to Seeking Alpha ratings (Wall Street price target), Danaos has an average price target of $125.

2021 financial results

In its fourth-quarter and full-year 2021 financial results, Danaos Corporation reported a 4Q 2021 net income of $166 million, or $8.05 per diluted share, compared with a 4Q 2020 net income of $43 million, or $2.07 per diluted share. The company’s full-year 2021 net income increased by 586% to $1053 million from $154 million in 2020. Danaos reported a 2021 earnings per diluted share of $51.15, compared to 2020 earnings per diluted share of $6.45, up 693%. Danaos paid a dividend of $0.75 per share for the fourth quarter of 2021. In the fourth quarter of 2021, DAC’s operating revenues increased by 80% (YoY) to $215 million. Also, the company’s operating revenues climbed from $462 million in 2020 to $690 million in 2021. On the other hand, the company’s operating expenses increased from $67 million in 4Q 2020 to $99 million in 4Q 2021, up 48%. DAC reported 2021 operating expenses of $332 million, compared with 2020 operating expenses of 263 million, up 26%.

John Coustas, the CEO, said that the amount of media coverage on the positive dynamics in the container market represents DAC’s market view. “We foresaw the ongoing disruption in the supply chains and tightening of the container market through 2022 many quarters ago. Our outlook directed our growth and chartering strategy, both of which have maximized our returns,” the CEO commented. Another important thing for Danaos in 2021 was that the company’s investment in ZIM Integrated (ZIM) shares went beyond the expectations, making it possible for the company to report a 2021 net income of more than $1 billion.

Danaos expects its chartering policy will generate strong cash flows in 2022. The company’s $2.8 billion contracted revenue with an average charter duration of 4 years brings shareholders certainty about the future. Relying on the significant cash flows, the company increased its quarterly dividend by 50% to 75 cents per share and has started considering a share buyback. John Coustas said that the element of counterparty risk that dominated the previous decade has completely disappeared, and long-term chartering, which is DAC’s policy, has become a norm. “The future is bright, and Danaos is well-positioned to benefit from it and continue to reward its shareholders,” the CEO said.

DAC’s revenues: Past and future

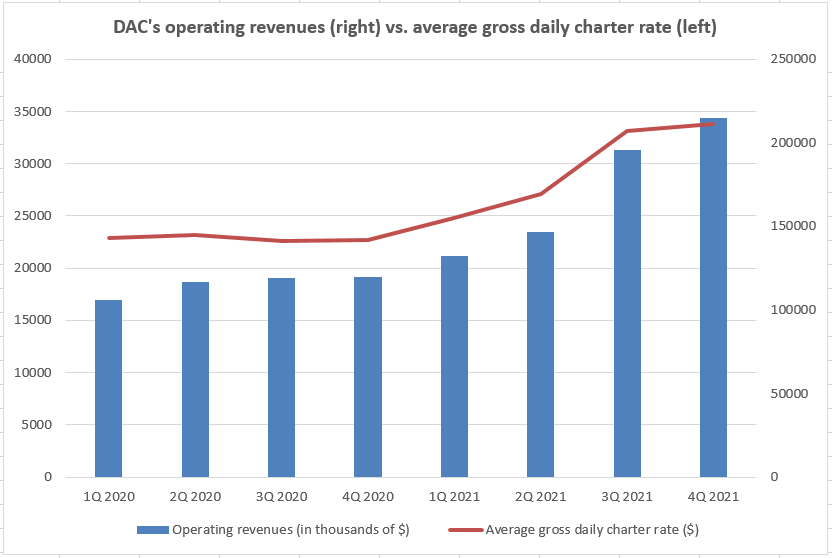

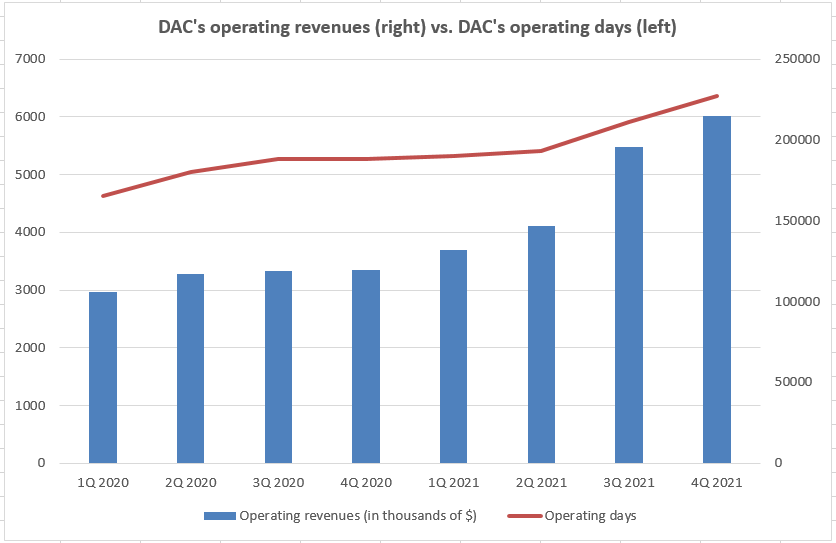

About 40 percent of the increase in DAC’s operating revenues in 2021 relates to higher charter rates (see Figure 1). Moreover, 25 percent of the increase in DAC’s operating revenues in 2021 relates to newly acquired vessels (see Figure 2). In January 2022, Danaos agreed to sell two old vessels for a gross consideration of $130 million, expected to be delivered in November 2022. What is going next?

Figure 1 – DAC’s operating revenues vs. average gross daily charter rate

Author

Figure 2 – DAC’s operating revenues vs. DAC’s operating days

Author

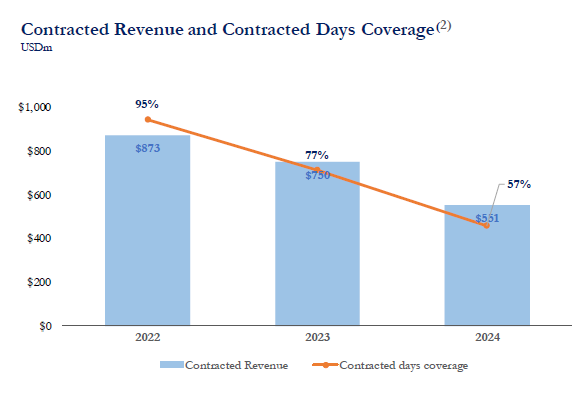

Figure 3 shows that Danaos’ contracted revenue in 2022 will be $873 million (with 95% contracted days coverage). Also, it shows that with a contracted days coverage of 75% in 2023, the company’s contracted revenue will be $750 million, and with a contracted days coverage of 57%, DAC’s contracted revenue will be $551 million. My calculations show that if the company’s contracted days coverage in 2023 and 2024 increases to 95%, the company’s contracted revenue in 2023 and 2024 will be about $925 million and $918 million, respectively. With current charter rates for 2022, the company’s contracted revenue for 2022 (with 77% contracted days coverage) and 2023 (with 57% contracted days coverage) will have been $708 million and $523 million, respectively. Thus, based on Danaos’ contracts, chartering rates are increasing in the next few years.

Figure 3 – DAC’s contracted revenue and contracted days coverage

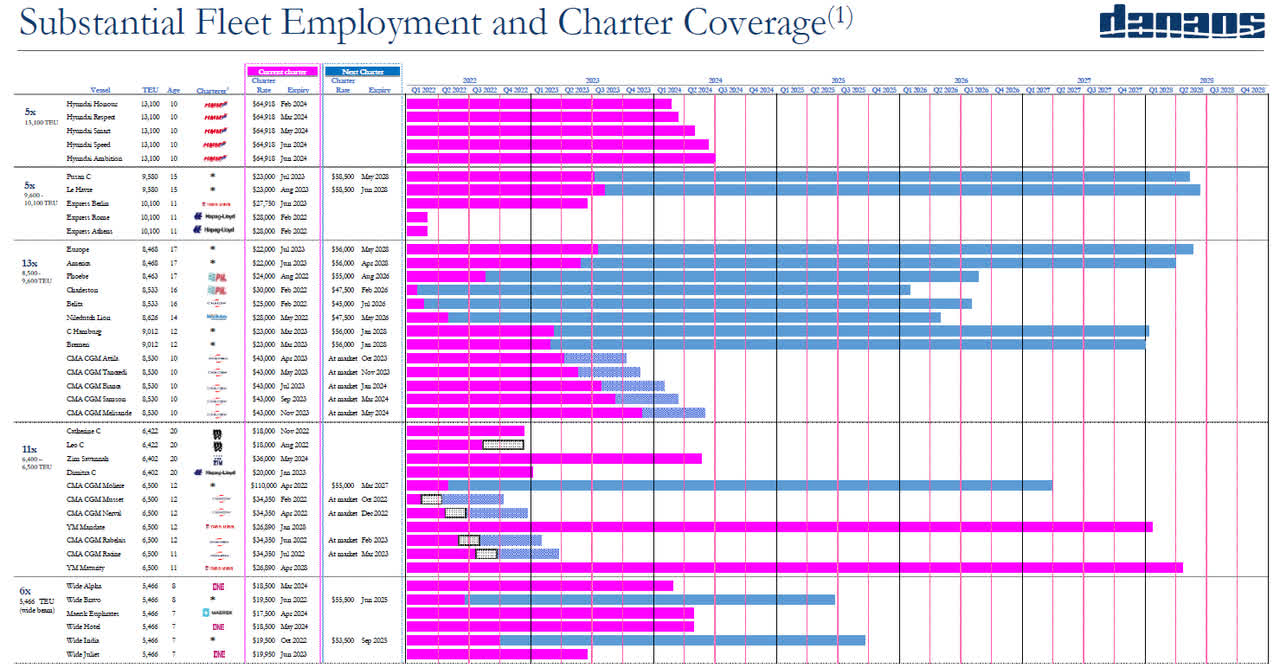

DAC’s 2021 investor presentation

Figure 4 shows that for two of DAC’s 9500 TEU vessels, which are 15 years old, charter rates until mid-2023 are $23000. However, charter rates for these two vessels from mid-2023 to 2028 are $58500. Also, for 8 of the company’s vessels (8500 TEU to 9500 TEU vessels), charter rates until mid-2023 are around $22000 to $30000. However, from mid-2023 to 2028, charter rates for these vessels are between $45000 to $56000. Thus, the company’s expectation about its bright future is not only based on its projections about the market condition.

Figure 4 – DAC’s fleet employment

DAC’s 2021 investor presentation

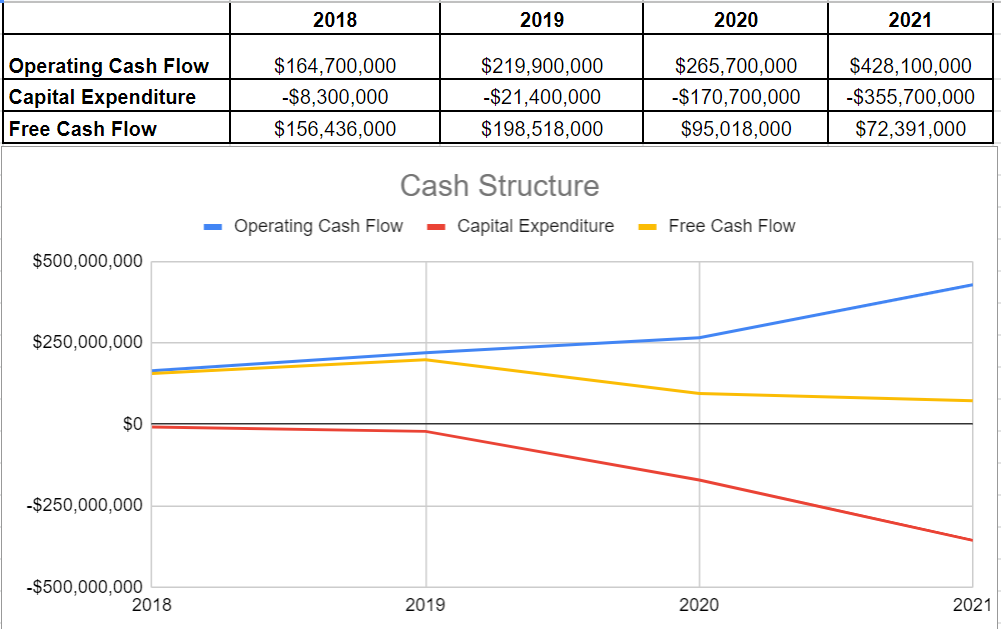

Performance

Analyzing the company’s operating conditions indicate that DAC’s operating cash flow surged amazingly from $275.7million at the end of 2020 to $428.1 million at the end of 2021. This amount is about double its result of $219.9 million in 2019 before the COVID-19 pandemic started. On the other hand, DAC’s capital expenditure saw a massive increase from $170.7 million in 2020 to $355.7 million in 2021. Ultimately, the company’s free cash flow declined by 23%, from $95.01 million in 2020 to $72.39 million in 2021 (see Figure 5).

Figure 5 – DAC’s cash structure

Author

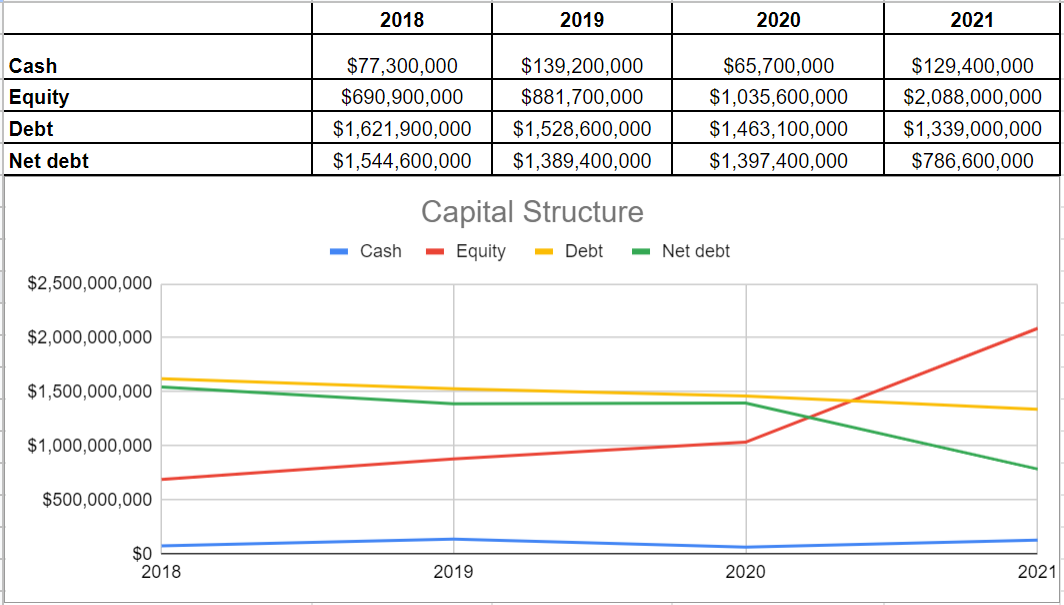

The company’s capital structure shows that DAC’s debt shrank to 1.339 billion in 2021 from its previous level of 1.463 billion, down 8%. Also, its net debt declined severely to $786.6 million in 2021 from $1397.4 million at the end of 2020. DAC’s net debt at the end of 2021 was far lower than its level of $1397.4 million at the end of 2019. The company’s equity and cash levels increased by over 100% and 80%, respectively. DAC’s cash generation surged to $129.4 million at the end of 2021 from its level of $65.7 million in 2020, which shows that the company is recovering its cash structure. The equity level surged to $2088 million in 2021 from its previous level of $1035.6 million at the end of 2020. Thus, the company’s debt is well beneath its equity level, which leads to better leverage conditions (see Figure 6).

Figure 6 – DAC’s capital structure

Author

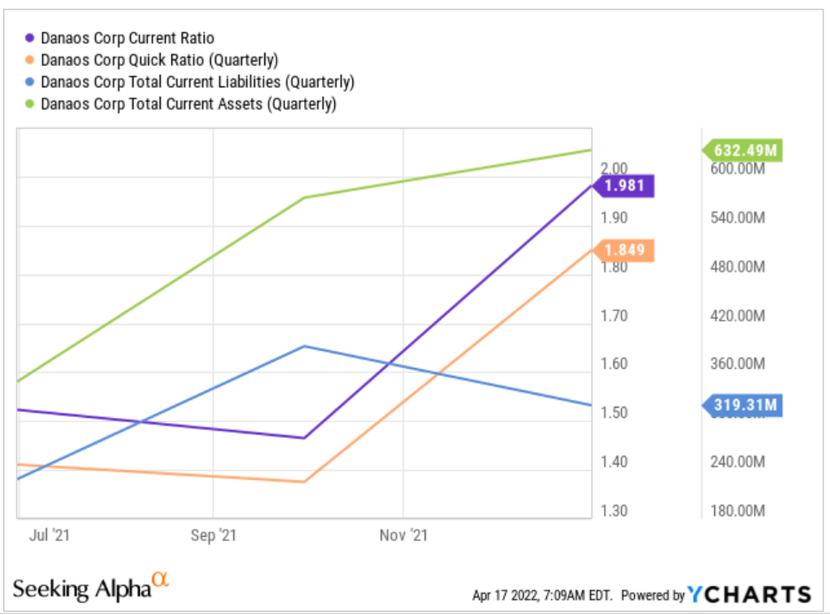

In the last quarter of 2021, DAC’s current and cash ratios have increased to 1.98x and 1.84x, respectively. Combined with lower debt and stronger financial performance during 2021, these liquidity ratios indicate that DAC’s liquidity is strong, thereby making their financial position healthy and hence well-positioned to boost their future dividends. Looking ahead, the company’s capital structure and increasing cash generation ensure that there is less probability of liquidity issues (see Figure 7).

Figure 7 – DAC’s current and cash ratios

YCharts

Valuation

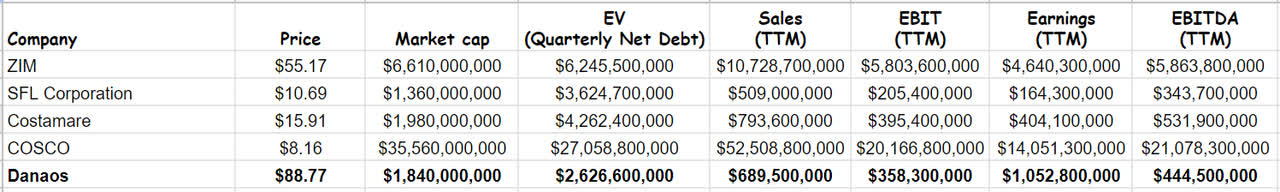

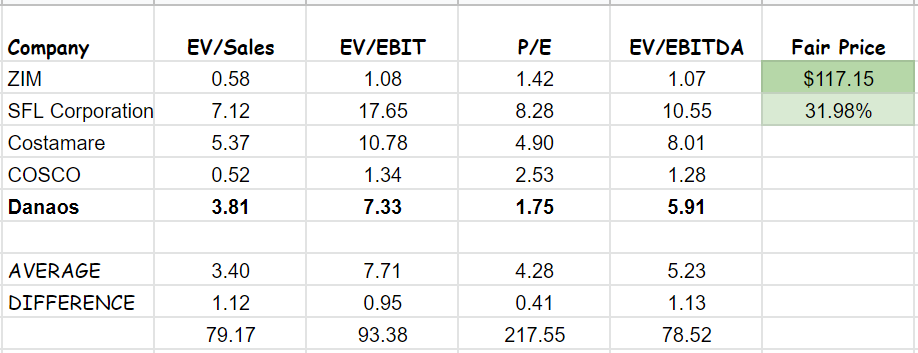

Using Comparable Company Analysis (CCA), I evaluated that DAC stock is attractive and undervalued. Comparing Danaos Corporation with other peer competitors – ZIM Integrated, SFL Corporation (SFL), and Costamare (CMRE) – and using the CCA method, I estimate that the stock’s fair value is about $117. To choose the peer group, I considered containership leaders in the shipping industry. Data was gathered from the most recent quarterly and TTM data.

Table 1 – DAC’s financial data vs. peers

Author (based on Seeking Alpha data)

Getting down to the nitty-gritty of DAC’s valuation ratios and comparing them with other peers represent that DAC is fundamentally one of the best investments in the shipping industry. The company’s P/E ratio is 59% lower than the group’s average of 4.28x. It is a sign of being undervalued, and the stock’s fair value is higher than its market price. Also, the company’s EV/EBIT amount is 7.33x, which is in line with the peers’ average of 7.71x. Danaos Corporation has about 32% upside potential (see Table 2).

Table 2 – DAC stock valuation

Author’s calculations

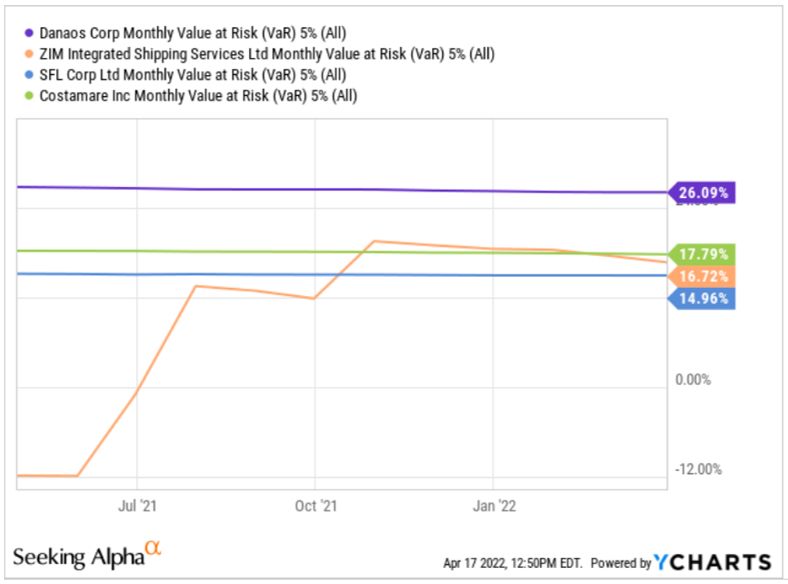

Risk

Danaos corporation’s variable at risk (VAR) measurement is higher than the peers’ average. VAR is a measurement that shows total potential loss through a specific period. Therefore, it could be a risk to be considered (see Figure 8).

Figure 8 – DAC’s variable at risk amount vs. peers

YCharts

Also, 22% of DAC’s charter backlog belongs to CMA CGM, one of the largest container transportation and shipping companies in the world, headquartered in France. With 20 vessels on-time charter, Danaos is one of the largest ship providers for the CMA CGM group. Danaos has been providing the group with vessels for more than 15 years. If anything happens for CMA CGM, or if things between Danaos and CMA CGM get complicated, the management will face a big problem.

Summary

Using the CCA method and the last quarterly data, I estimate that Danaos Corporation is worth around $117 per share, a 32% upside potential. Due to its strong financial performance during 2021 and some liquidity ratios, I investigate that there is less probability of liquidity issues. Therefore, its financial position is healthy and hence well-positioned to boost future dividends. In a word, DAC stock is a Buy at prices around $90.

Be the first to comment