mphillips007/iStock via Getty Images

When it comes to investing, one of the most valuable traits is patience. Just because you believe an investment opportunity is appealing does not mean that it will move in the direction that you want even if you are correct in your assessment. Sometimes, shares can underperform the broader market for an extended timeframe, perhaps even significantly so. Other times, some downward revision and expectations is warranted based on a company’s changing fundamental condition. One example that encapsulates both of these ideas involves Daktronics (NASDAQ:DAKT), an enterprise that designs and produces electronic scoreboards, programmable display systems, and large video screen displays for a variety of venues. Recently, revenue growth achieved by the company has been impressive. But even with that growth in revenue, profits and cash flows have taken a step back. It’s unclear exactly what the future of the enterprise would look like. But it’s also true that, so long as financial performance reverts back to where it was previously, shares are cheap enough to warrant some nice upside potential.

Signs of near-term pain

Back in early August of this year, I wrote my first article discussing whether or not it might make sense to invest in Daktronics. Instead of finding the enterprise by searching for interesting businesses in interesting fields, this one was suggested to me by somebody else. I first fell in love with the concept of the company because it does operate a unique business model where it focuses on the aforementioned types of displays. This is the kind of niche enterprise that I tend to find myself drawn to. But it wasn’t just the business model that intrigued me. Over the prior few years, financial performance had been stuck in a fairly narrow range. Although that was slightly problematic, it also meant that the future would likely be fairly similar to the recent past. Predictability can be a good thing when it comes to investing. On top of that though, shares of the company were also trading on the cheap. All combined, this led me to rate the business a ‘buy’ to reflect my view that shares should outperform the broader market moving forward. Thus far, things have not gone exactly as planned. While the S&P 500 is down 1.1%, shares of Daktronics have generated a loss of 8.9%.

Since the publication of that article, we have only seen data for one additional quarter come into existence. That involves the first quarter of the company’s 2023 fiscal year. During that time, sales came in really strong, hitting $171.9 million. That’s 18.8% higher than the $144.7 million the company generated the same time last year. The great thing for investors is that this year-over-year growth came about as a result of strength and each one of its sales categories. On a percentage basis, the greatest mover involved the transportation category of sales, with revenue jumping 55.6% from $12.6 million to $19.5 million. Next in line, we have the high school park and recreation category, with revenue jumping by 28.4%. This was followed closely by 22.4% from the commercial space. Live events and international sales came in on the low end, rising 7.6% and 5%, respectively.

In all, management said that the fulfillment of orders in the company’s backlog, combined with continued strong orders, positively affected its operations. However, they did say that there were some troubles brewing. Material supply shortages and labor challenges created an increase in lead times and were extending the timing of converting some orders to sales in the near term. While this suggests that sales might otherwise have been higher, it also is a problem that management said is almost certain to persist throughout the rest of the 2023 fiscal year. Despite this pain though, orders for the company are still strong. During the latest quarter, they totaled $170.2 million, down only 6.3% from the $181.7 million generated at the same time last year. Overall backlog for the company it’s still pretty strong, having totaled $469.1 million as of the end of the latest quarter. By comparison, backlog the same time last year was $285.3 million, while at the end of the final quarter of 2022 it stood at $471.6 million.

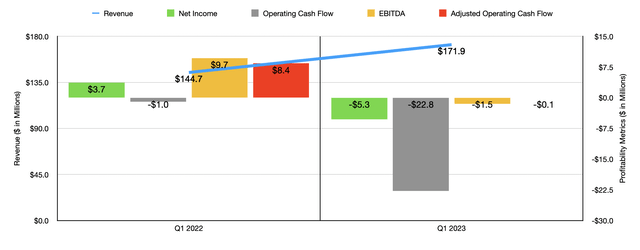

While it’s great to see revenue rise, the company did see some weakness on its bottom line. Net income fell from $3.7 million in the first quarter of 2022 to negative $5.3 million the same time this year. Higher selling expenses to the tune of 22.3%, as well as greater expenses related to materials, freight, and personnel-related costs, all negatively affected the company’s profitability. Its gross profit margin, for instance, fell from 22.2% to only 15%. Naturally, other profitability metrics followed suit. Operating cash flow went from negative $1 million to negative $22.8 million. If we adjust for changes in working capital, it would have gone from $8.4 million to nearly $0.1 million in the red. Meanwhile, EBITDA shrank from $9.7 million to negative $1.5 million.

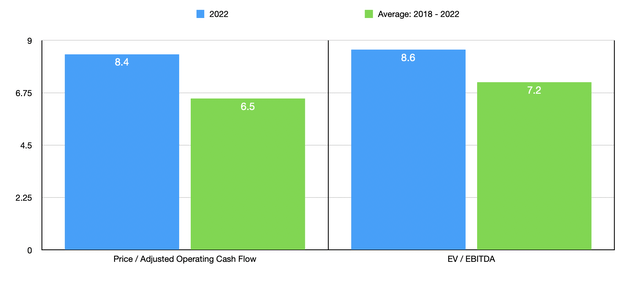

Truth be told, we have no idea what to expect for the rest of the 2023 fiscal year. If we were to instead value the company based on 2022 results, we would end up with it trading at a price to adjusted operating cash flow multiple of 8.4 and at an EV to EBITDA multiple of 8.6. In my last article, I also averaged out the company’s financial results between 2018 and 2022 because of the narrow range those figures traded in. In that case, those multiples would have been 6.5 and 7.2, respectively. There’s no doubt that this year would be more challenging than most of those. But if the past is any indication of the future, results will eventually revert back to what they were in prior years. So even in the near term, it’s difficult to imagine shares getting so pricey that the stock would be considered overvalued. Also as part of my analysis, I decided to value the company compared to five similar firms. On a price to operating cash flow basis, these companies range from a low of 17.2 to a high of 506.9. And using the EV to EBITDA approach, the range was from 10.1 to 159.9. In both scenarios, Daktronics was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Daktronics | 8.4 | 8.6 |

| Luna Innovations (LUNA) | 506.9 | 89.7 |

| Iteris (ITI) | 48.2 | 103.0 |

| Identiv (INVE) | 97.5 | 159.9 |

| National Instruments Corp. (NATI) | 114.0 | 21.5 |

| OSI Systems (OSIS) | 17.2 | 10.1 |

Takeaway

In the long run, I fully suspect that Daktronics will fare well for itself. Having said that, it’s clear that recent financial data has been a bit painful. Higher costs have been problematic and the supply chain issues that caused much of that pain could persist for some time. At the end of the day though, I am a value-oriented investor who values the long run. So while I could understand some investors walking away from the business for now and waiting to come back at some point in the near future, I still feel comfortable enough rating it a ‘buy’ even though my expectations regarding upside are less promising than they were before.

Be the first to comment